Who Owns Shell: The Largest Shareholders Overview

Shell plc (LSE: SHEL) is one of the worlds’s largest oil and gas companies. It is active in exploration, production, refining, and distribution. Let’s look at who owns Shell and who controls it.

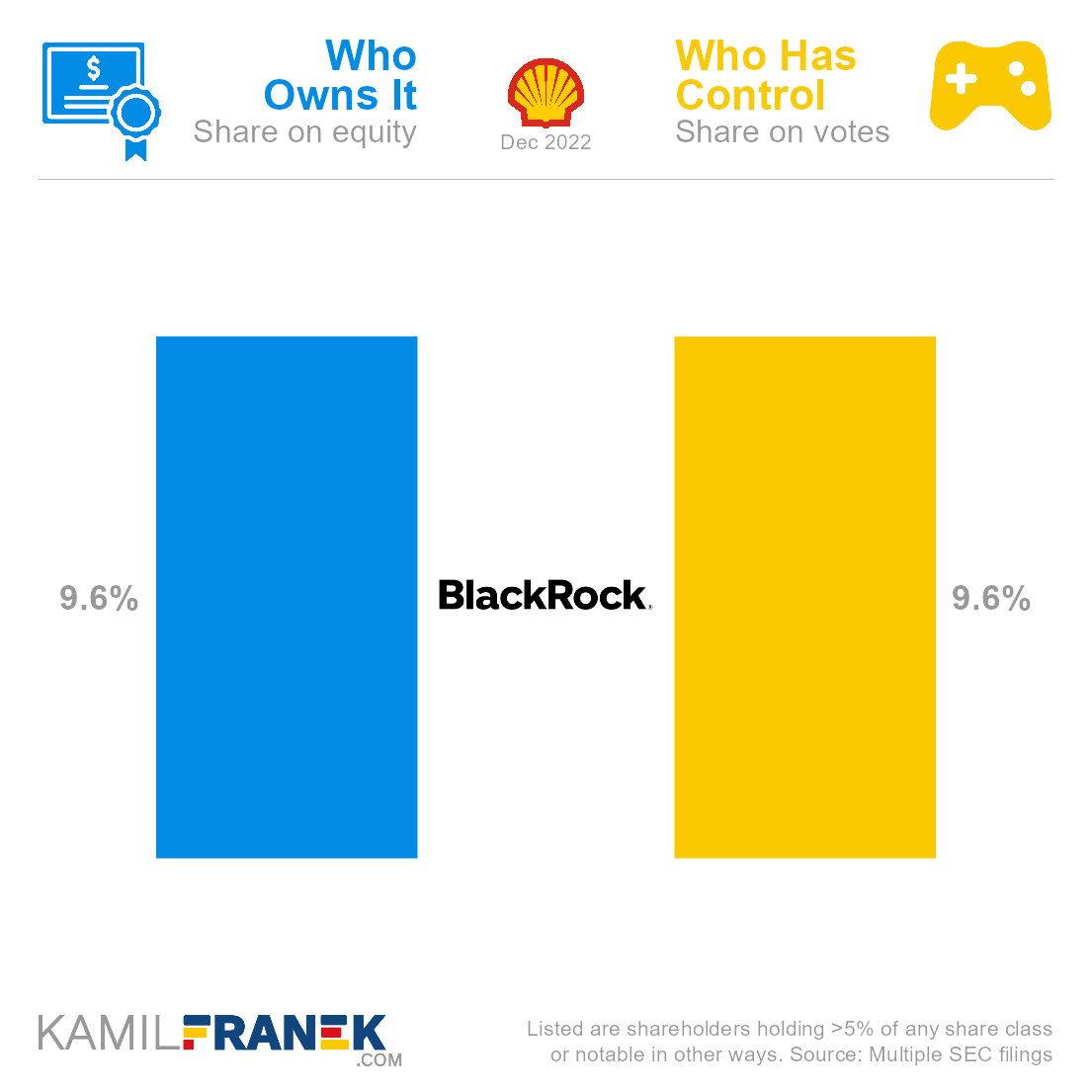

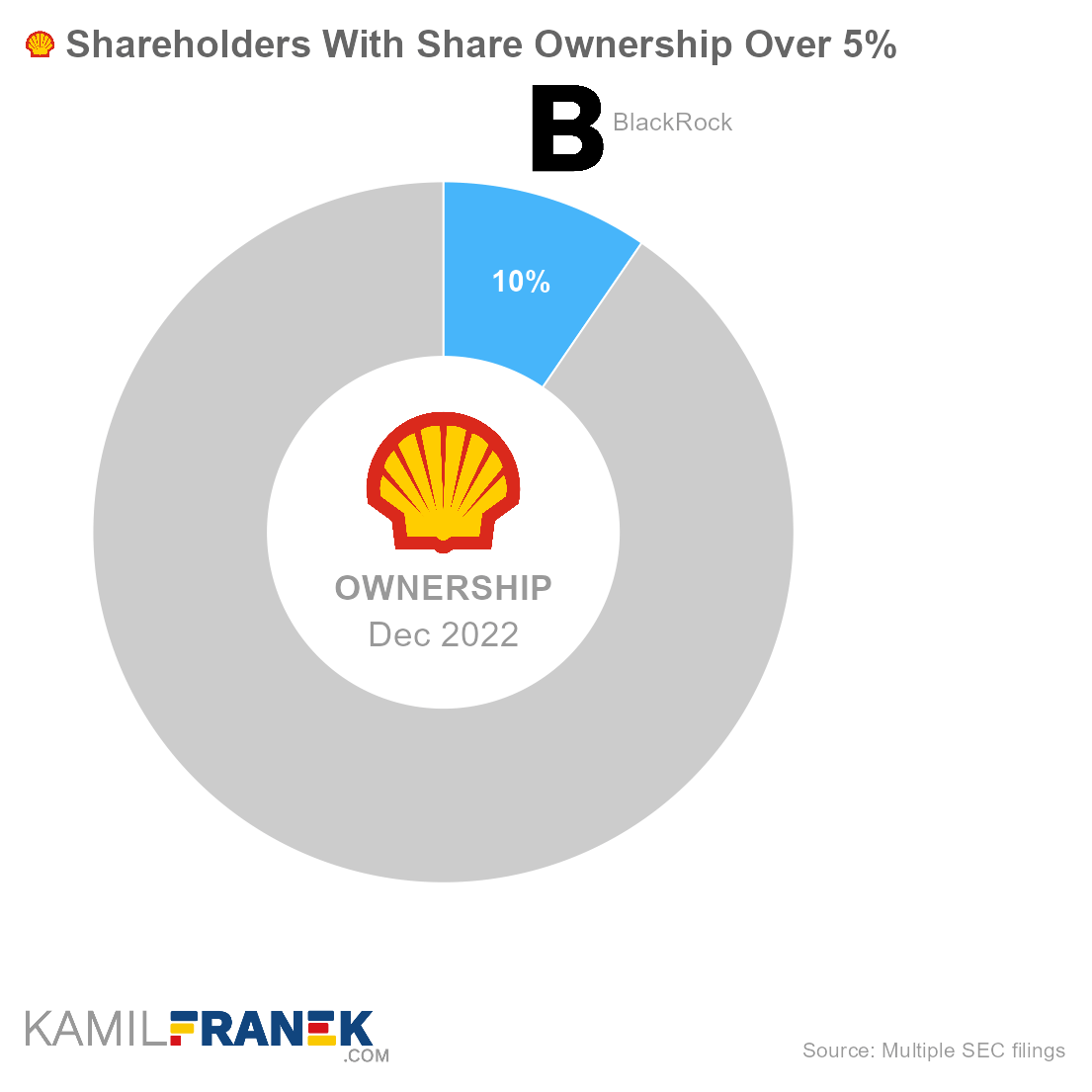

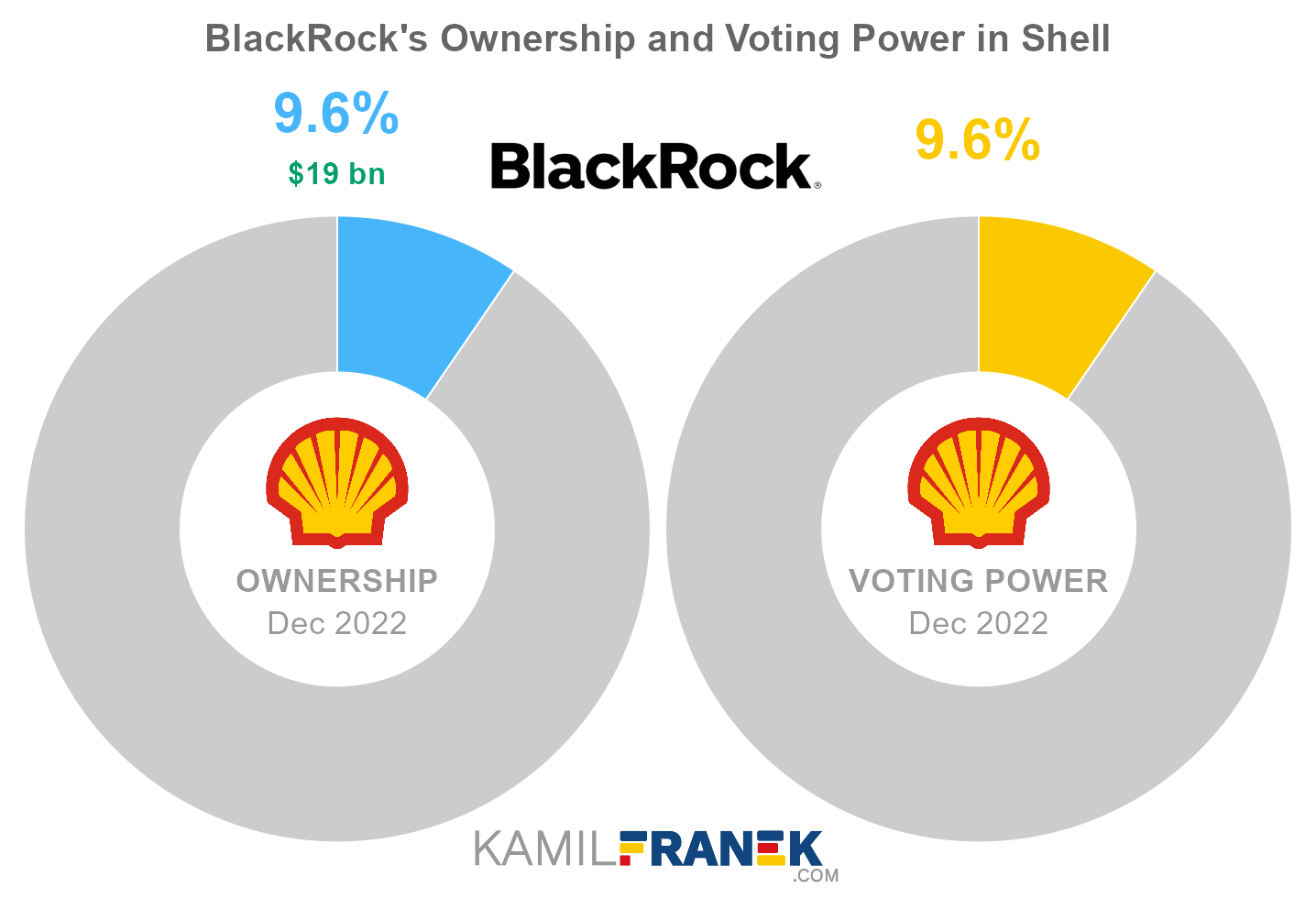

Shell’s largest shareholder is asset manager giant BlackRock, which owns a 9.6% share. Shell ownership is quite dispersed, and no other shareholder owned more than 5% as of December 2022.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| BlackRock | 9.6% | 9.6% | |

| Other | 90.4% | 90.4% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Shell and who controls it. I will show you who Shell’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Microsoft, Alphabet(Google), Lenovo, Lockheed Martin, L’Oréal, or Kahoot!.

📃 Who Owns Shell?

Shell is owned by its shareholders. The largest one is asset manager giant BlackRock, which owns 9.6% of the company. No other shareholder owns more than 5% of Shell.

No shareholder has dominant ownership in the company. Shell’s ownership is dispersed, and the largest owners are asset managers who invest money on behalf of their clients.

Shell was founded in 1833 by Marcus Samuel, and is listed on London Stock Exchange under the ticker: LSE: SHEL.

- The beginnings of Shell can be traced back to 1833 when Marcus Samuel decided to expand his existing business by importing shells from the Far East. After Marcus Samuel’s death, the business was managed by his sons. They grew it by starting to transport oil and renamed the company Shell Transport and Trading Company.

- It is not known if Samuel’s family descendants still hold a stake in Shell, but Samuel’s family members were directors of Shell for generations, although not anymore.

- Shell stocks are publicly traded on several exchanges.

- It has a primary listing on London Stock Exchange (Ticker: SHEL)

- The secondary listing is in Amsterdam ERONEXT (Ticker: SHELL).

- The company is also traded in New York’s NYSE through American Depositary Shares (Ticker: SHEL), where each share represents two (2) ordinary shares.

Shell plc is incorporated in the United Kingdom, and its headquarters are in London (UK).

- Shell plc headquarters in London is a change from Shell’s weird corporate setup until 2021. Until then, Shell, or more precisely, Royal Dutch Shell company, had its headquarters and tax residency in the Netherlands and a registered office in Britain.

- As a result of this change, the company dropped “Royal Dutch” from its name, and the official name is just Shell plc.

- The company quoted “many factors” as a reason for this move. Some of those might be a 15% dividend withholding tax in the Netherlands and a recent court ruling that would force Shell to cut its carbon emission faster might have the effect, although the company denies that this was a reason.

🎮 Who Controls Shell (LSE: SHEL)?

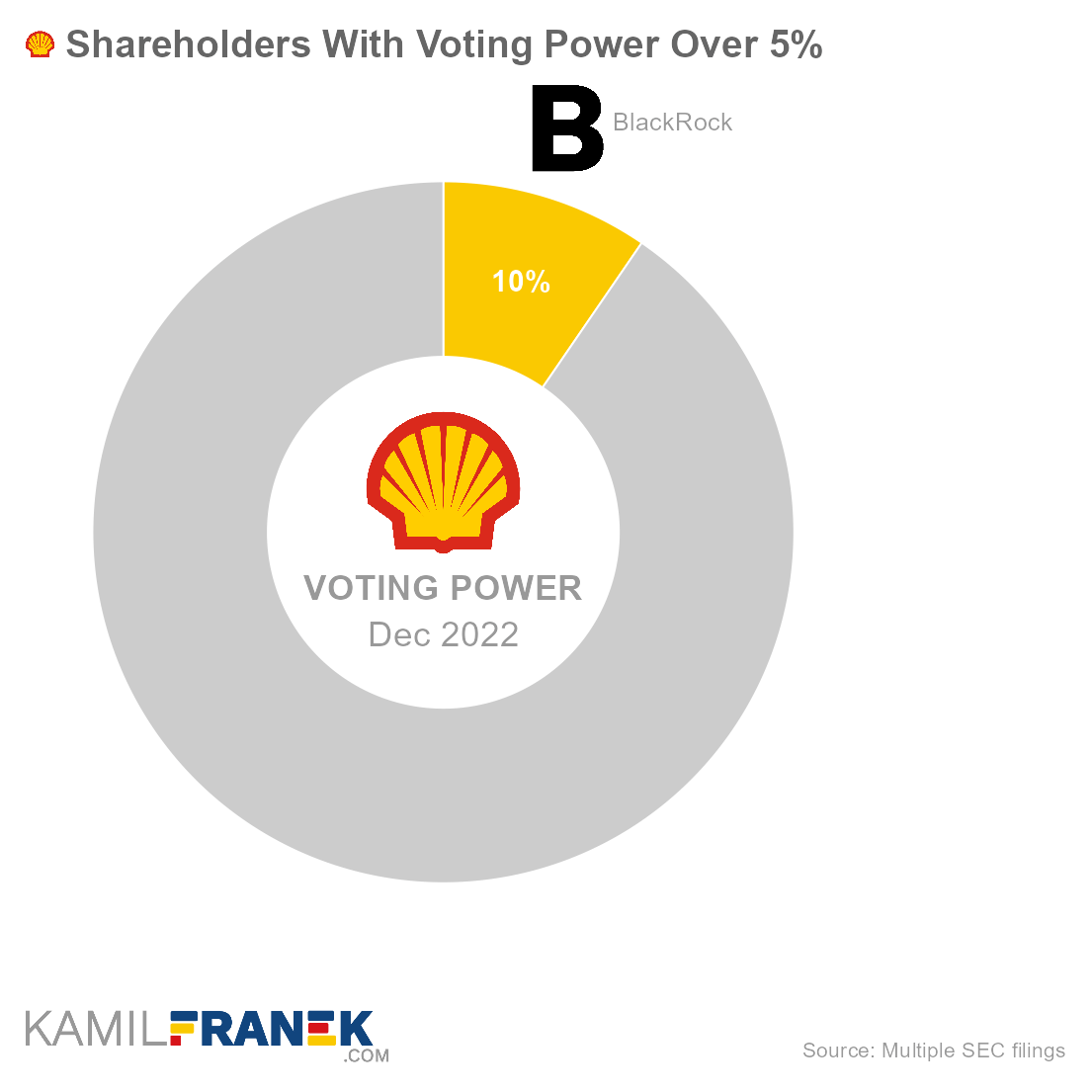

Shell’s shareholder with the largest voting power is asset manager giant BlackRock, which holds 9.6% of all votes. No other shareholder controls over 5% of Shell.

Shell has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of Shell plc is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients. None of them control the company individually, but together they have a big influence.

Shell’s dispersed ownership creates conflicts of interest between Shell’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

Shell’s insiders that have influence over the company are CEO Wael Sawan, chairman of the board Andrew Mackenzie, and other board members and executives.

- Shell’s board has a 12-member board of directors.

- Nobody from the board of directors or executive officers holds more than 0.05% of Shell’s shares.

Until the beginning of 2022, the company had two classes of shares, Class A and Class B, although they both had the same rights. The difference was in the tax treatment of dividends. Class A shares were subject to Dutch withholding tax, but Class B shares were not.

🗳️ Breakdown of Shell’s Outstanding Shares and Votes by Top Shareholders

Shell plc had a total of 6,971 million outstanding shares as of December 2022. The following table shows how many shares each Shell’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| BlackRock | 667 | 667 | 9.6% | |

| Other | 6,304 | 6,304 | 90.4% | |

| Total (# millions) | 6,971 | 6,971 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 6,971 million votes distributed among shareholders of Shell plc. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| BlackRock | 667 | 667 | 9.6% | |

| Other | 6,304 | 6,304 | 90.4% | |

| Total (# millions) | 6,971 | 6,971 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Shell’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Shell plc worth.

However, keep in mind that a stake in Shell could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| BlackRock | $18.7 | $18.7 | 9.6% | |

| Other | $176.8 | $176.8 | 90.4% | |

| Total ($ billions) | $195.5 | $195.5 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Shell shareholder individually.

📒 Who Are Shell’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Shell plc one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Shell worth.

#1 BlackRock (9.6%)

BlackRock is the largest shareholder of Shell, owning 9.6% of its shares. As of December 2022, the market value of BlackRock’s stake in Shell was $18.7 billion.

BlackRock owned 667 million shares in Shell and controlled 667 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

🧱 Who and When Founded Shell

The beginnings of Shell can be traced back to 1833 when Marcus Samuel decided to expand his existing business by importing shells from the Far East. So if you wonder why the company is called Shell, this is why.

After Marcus Samuel’s death, the business was managed by his sons Marcus and Samuel. They grew it by starting to transport oil and renamed the company Shell Transport and Trading Company.

Current Shell plc is a result of the 1907 merger of Royal Dutch Petroleum Company (Netherlands) and The Shell Transport and Trading Company (UK).

It is not known if Samuel’s family descendants still hold a stake in Shell, but they were Shell company directors for generations.

📅 Shell’s History Timeline

These are selected events from Shell’s history:

- 1833: Marcus Samuel decided to expand his London business of selling antiques by importing by selling shells from the Far East. This laid foundation of an import-export business that would ultimately become Shell plc.

- 1870: Marcus Samuel dies, and his sons Marcus and Samuel take over his business

- 1880s: Marcus and Samuel expanded their business to oil exporting and commissioned a fleet of steams to carry oil.

- 1897: Marcus and Samuel renamed their company the Shell Transport and Trading Company and launched their first refinery.

-

1907: The Shell Transport and Trading Company (UK) merged with Royal Dutch Petroleum Company (Netherlands). The decision was driven by the need to compete with Standard Oil. However, companies maintained their legal existence but operated as a single unit.

-

2005: “Partnership” structure between Royal Dutch Petroleum and Shell Transport and Trading was finally reorganized, and Shell unified its corporate structure under a single new holding company, Royal Dutch Shell plc. - Company original shares were delisted from the stock exchanges, and Class A and Class B shares of a unified company were issued. They had the same rights but different tax treatment of dividends.

- 2015: Royal Dutch Shell announced the acquisition of BP Group, completed in 2016.

- 2022: Company merged the A and B shares into one class, renamed to Shell plc. and moved its headquarters to London.

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Kahoot!: The Largest Shareholders Overview

Overview of who owns Kahoot! and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Netflix: The Largest Shareholders Overview

Overview of who owns Netflix and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lenovo: The Largest Shareholders Overview

Visual overview of who owns Lenovo and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lockheed Martin: The Largest Shareholders Overview

Overview of who owns Lockheed Martin and who controls it. With a list of the largest shareholders and how much is each of their stake worth..

Other Resources

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.