How Google Pay Earns Money: Business Model Explanation

Google Pay adoption is growing strongly, but the question that bugged me for some time was how exactly Google Pay earns money for Google (Alphabet), and how much revenue it makes. This article is a result of a more in-depth look at current and future Google Pay business model.

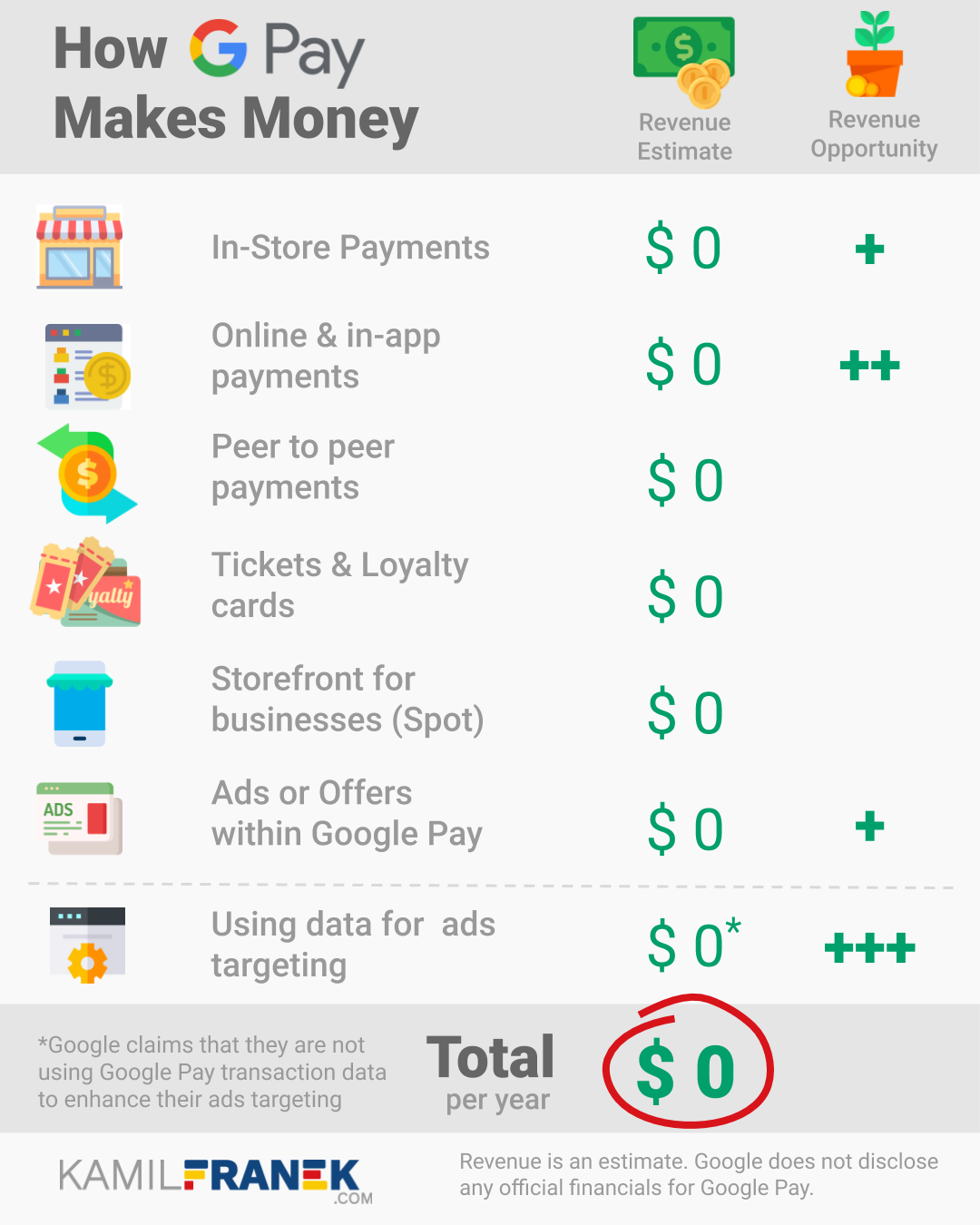

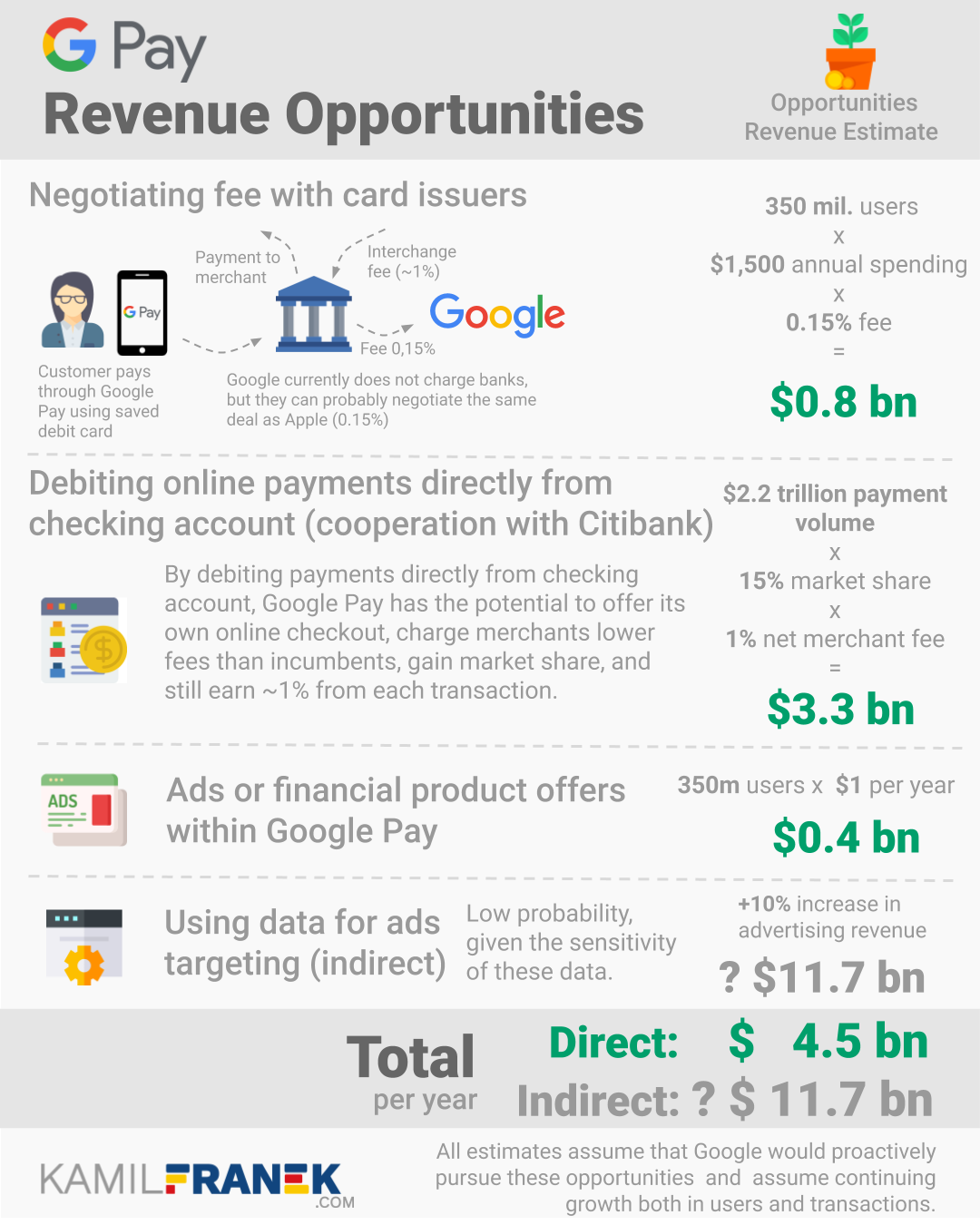

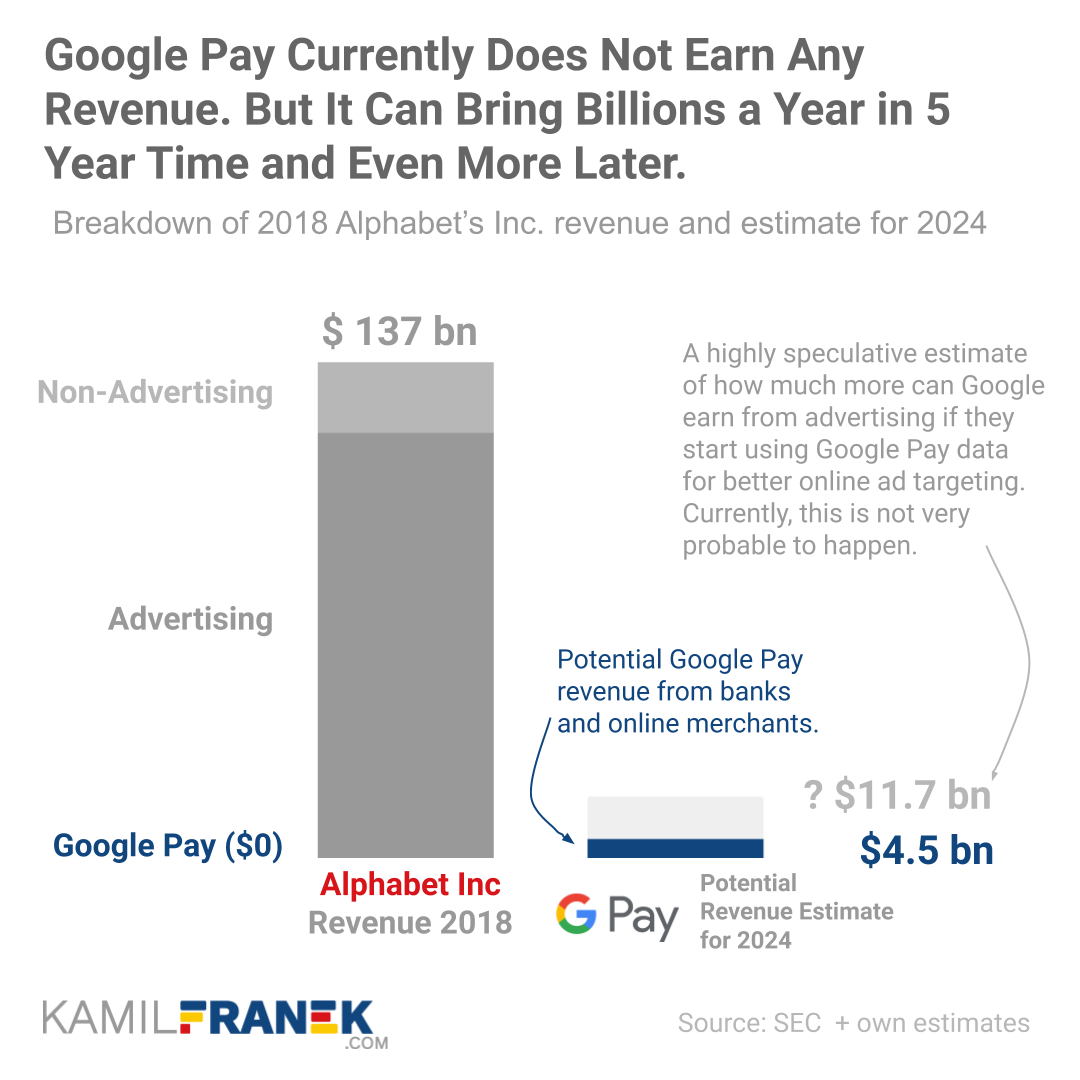

Google Pay currently does not earn any money for Google (Alphabet Inc). However, Google Pay has several revenue-making opportunities that can, after several years, make an estimated $4.5 billion a year. This revenue might be both from transaction fees from banks or merchants (~$4.1bn) and also from ads and product offers within Google Pay (~$0.4bn).

As you can see in the infographic above, Google is not focusing on monetizing Google Pay right now. However, Google is working hard on Google Pay adoption. That can be seen in announced partnership with Citibank and new functionalities that is Google continuously adding to the service.

The fact that Google does not make any money from Google Pay right now does not mean that it is going to be like that forever. Based on previous Google projects like, for example, Google Maps or Google Suite, we know that Google can continue developing products even for a decade before it starts making money from them. That’s how they do stuff, and with their scale, they can afford it.

If Google continues to grow Google Pay user base, there are some significant revenue earning opportunities that can be tapped in several years from now. The infographic below offers a summary of those opportunities with revenue estimates for each of them.

In the rest of the article, I will look in more detail into business models for each of them and will also offer a rough revenue estimate. I will also try to explain why I think we might be heading for some “fintech” disruption after all.

🔵 How Can Google Pay Earn Money from In-store Proximity Payments

A quick overview of how in-store proximity payments work

Google Pay (similar to competing services like Apple Pay and Samsung Pay) offers simplification of payments in stores with contactless terminals.

You can safely save your credit card information into the Google Pay app, and when paying in the store, there is no need to have it even with you. You can tap your phone with NFC technology on the terminal, and that’s it. For higher amounts, unlocking the phone is required.

You can even link your Google Pay to PayPal account, although only in selected countries.

Google also claims that payment through Google Pay is more secure because, during the payment, your credit card number is not exchanged. Google will generate a new “token” number for each transaction.

How much money Google Pay makes from in-store proximity payments

When it comes to earning money, Google is not earning any revenue from in-store transactions at all. It is charging neither customers nor banks.

It is interesting because Apple that launched its Apple Pay service sooner was able to negotiate a fee from each transaction in the US. More precisely 0.15% from credit card and 0.5% from a debit card.

If the reason behind Google’s decision to offer this service free was that it would mean faster adoption between banks, then it did not work. Apple Pay growth does not seem to be affected at all. So now it looks like a missed business opportunity.

Apple turned out to be a winner here. As usual for Apple, they were able to negotiate a very good deal for themselves and still left some interchange income for the banks.

However, in some European countries where the interchange income of banks is lower thanks to regulation, Apple is charging fees that extract nearly all interchange income from banks. Banks still quickly adopt Apple Pay, probably for fear of missing out.

How might Google Pay earn money from in-store payments in the future (+ revenue potential estimate)

Google will probably not want to charge banks a fee from each transaction for some time. That is their way of doing things. First, they offer free service and then try to make income from it only after it is well established on the market.

But let’s say that Google decides to monetize this service five years from now. How much money can they earn from it? Is this an interesting business model for them? What is the size of this revenue opportunity?

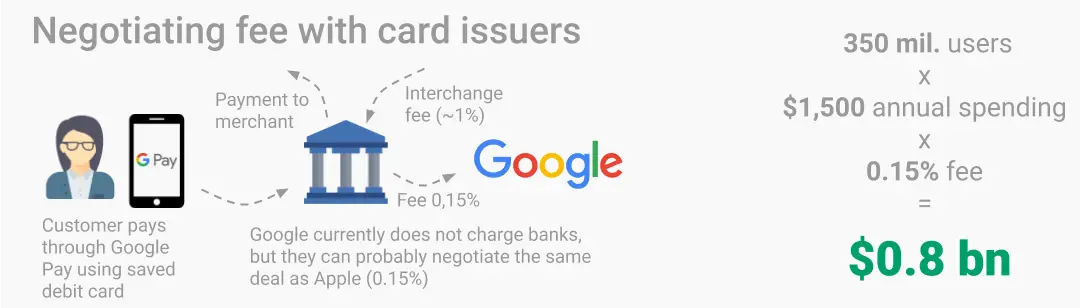

I’ve put together my rough estimate, and it turns out that in-store payments alone can add $0.8 billion a year to Google’s revenue. That’s not bad. This number is based on the following facts & assumptions:

- Google will be able to negotiate a similar deal with banks as Apple did (0,15% from each transaction)

- They will grow their user base to 350 million users worldwide, which is roughly double their current estimated user base.

- The average spending per user will stay and $1500. (This is based on current average and might turn out to grow higher than that)

- 350 million x $1500 x 0.15% = $0.8 billion

🔴 How Can Google Pay Make Money From Web & In-app Payments

Web and in-app payments using Google Pay are potentially even more helpful to users than in-store payments. It allows customers to check out and to pay online very seamlessly.

There is no need for retyping your credit card number each type you want to buy something. Paying online should be as easy as buying an app in the google play store.

Google Pay, and also its main competitor in in-store payments Apple Pay, are tiny players in online transaction markets. Google’s market share is just 0,5%. The dominant market player is PayPal, with over half of the sites offering a PayPal payment option. And because this market is growing by more than 20% each year, PayPal is doing quite well.

Problem with web payments is that it is much harder to enter. It is not enough to persuade Android smartphone users to use this service. You need to persuade e-commerce sites, application-developers, and payment gateways to support it.

How much money Google Pay earns from web & in-app payments

Currently, Google is not charging any money for this service. It is free for business owners to implement on their website and in apps. The business owners still have to pay fees to their payment processor, so Google does not have much space here to charge fees on top of that. The transaction still goes through a card network.

Similarly to in-store payments, Google is not charging card-issuing banks any fee for online transactions. That might be an opportunity, but given Google Pay’s market share, the opportunity is minuscule.

Why is a partnership with Citibank potential game-changing opportunity for Google and for massive disruption of the online payments market?

If I did not know about Citibank + Google partnership, I would evaluate the potential of Google Pay in web and in-app payments as pretty bleak. I would not expect too much revenue coming from that.

Similar to in-store payments, Google should be able to get some cut from interchange fees from card issuers. However, web payments are a market dominated by PayPal and credit/debit card companies, and I currently don’t see any plan of how Google can increase its minuscule market share in this segment.

In my opinion, Google and Citibank partnership changed all of that. Google announced that it is going to partner with Citibank on checking account offer that will be accessible through Google Pay. That opens new options for Google Pay business model where it can succeed in online payments and take some market share from PayPal.

Currently not much was announced about this partnership, so I will quickly recap what we know about it:

- The offer of checking account should be available in 2020 (probably in the US only)

- there is no info if there will be any fees connected to that (My guess would be it will be free)

- So far, the banking industry partners are Citibank and Standford Federal Credit Union. Google is opened to add more banks in the future.

- Google won’t hide partner brands behind its own brand. It will be openly branded as a Citibank checking account.

- Google talked about providing useful insight and budgeting as added value for their users

“We’re exploring how we can partner with banks and credit unions in the US to offer smart checking accounts through Google Pay, helping their customers benefit from useful insights and budgeting tools while keeping their money in an FDIC or NCUA-insured account.

–Craig Ewer, Google’s spokesman, as reported by Reuters

So what new possibilities this cooperation opens for Google Pay and online payments?:

-

Google announced by this that they are going to make make a fintech app that will try to make sense of people’s finances. Not only card payments but also their income end other payments going through checking account. That is not good news for multiple fintech companies that were focusing on the same thing.

-

Not sure if Google already has put a team in place for this. If not, we can expect the announcement of some fintech acquisition/acquihire soon.

-

That can be a big opportunity how to shake up the whole online payment system and weaken MasterCard & VISA power over it. VISA/Mastercard will probably continue to have clout over in-store payments. Google Pay + Citibank can offer online payments that will deduct funds directly from a customer’s checking account and deposit it to checking account of an online shop through some rapid payment channel.

-

I should add that online payments linked directly to checking accounts are not anything new. This service is also offered by PayPal and by some banks. What is different here is that if both Google+Citibank and potentially also Apple + Goldman later enter this business, things can start moving pretty quickly. The beauty of Google Pay and other similar services might be that they offer ease of use and lower costs for both sides of a transaction.

OK, but as you can remember, I mentioned the main problem with Google Pay becoming dominant in online payments is that it needs the cooperation of e-commerce site operators. And let’s face it, B2B business never was a strength of Google.

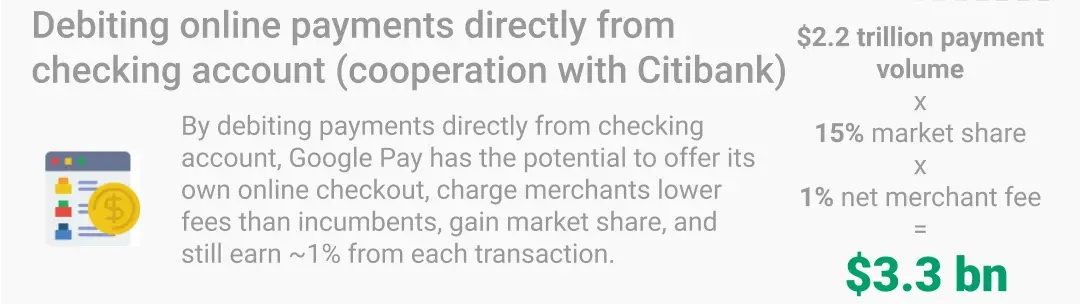

With Visa nad Mastercard out of the way, Google & Citibank can put together an offer for e-commerce businesses that will significantly decrease their cost of online payment acceptance. By undercutting PayPal in price, Google Pay can steal a piece of the market share from PayPal and also card networks.

Since Paypal will have to react to this new business model, and Apple Pay is also expected to join the fight, I assume that Google can gain around 15% market share for Google Pay.

Visa & Mastercard are also not waiting for anything and are also offering ways how to save your card and avoid entering card detail every time.

I should also mention that the US central bank (Fed) announced that it plans to launch a new rapid payment scheme between banks called FedNow. It is expected to be launch in 2024, which would mean another simplification of the whole process.

How might Google Pay earn money in the future from web & in-app payments leveraging a partnership with Citibank (+ revenue potential estimate)

I admit that so far, this is just a speculation. Nothing was confirmed yet. But the truth is that without shake-up like this, I don’t see Google Pay being able to take market share from PayPal anytime soon. I see this as an opening in the market. If Google will be able to pursue it successfully is unsure.

So if it happens, how much money it can make for Google?

First, we have to make some estimates of how much can Google earn from each transaction if they (together with Citibank) start offering online checkout services. I know from Paypal’s financial results that their average transaction fee is 2.5% from the amount. If we deduct their transaction costs, we will get to 1.5% net revenue.

If Google and Citibank offer more aggressive pricing around 1.5% for direct checking account transactions and motivate users to use it instead of cards, I think Google can claim around 1% for itself, leaving 0.5% for Citibank to cover the cost of infrastructure around it. In a few years, the price for online merchants can go as low as 1%, because of competition.

It means that Google can earn far more from direct debit online payments than what would possible deal with card issuers earned.

If Google will decide to push this option, my rough estimate for annual revenue in five years is around $3.3 bn. That assumes the following:

- Google will be able to “steal” 15% market share from PayPal or other providers of online checkouts.

- the market will double in 5 years, which is in line with current growth rates (confirmed by revenue growth of PayPal)

- Google will be able to earn 1% from each transaction.

Let’s now put the numbers above together: 2,200 bn (addressable market) x 15% Market Share x 1% = $3.3 bn a year.

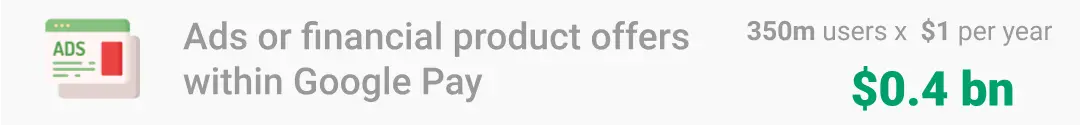

⚪ How Can Google Pay Earn Money from Ads and Financial Product Offers within Google Pay

Advertising is how Google primarily makes money, and Google is good at it. Therefore it makes sense to consider also advertising as a way how Google Pay can earn money.

And I am not talking about using Google Pay data in ads targeting outside Google Pay here (that is an improbable “nuclear” option I will consider later). I am talking only about offering ads, or specific product offers in cooperation with Citibank or other Google’s financial industry partners.

Google should be able to make at least $1 per user a year. That is not much, but this considers that time users will spend directly in the app won’t be so long. Financial products would definitely earn a lot per click, but because users would not use the app actively so often, I assume only $1 per user per year.

To have some benchmarks, you can check charts & data in my article about Google Maps, where I compared annual revenue per customer for multiple social media sites.

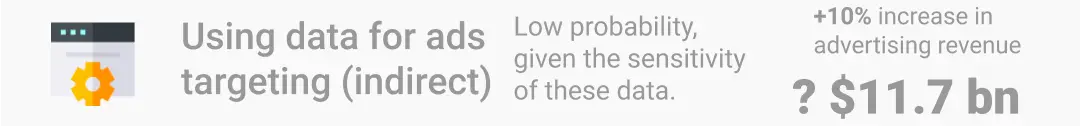

🔵 How Can Google Pay Make Money by Using Google Pay Data for Google Ads Targeting

Another option that is not, in my opinion, very probable, is that Google can earn money from Google Pay if it uses users’ data about their financial transactions. Google can then use it for ads targeting in Google Search, Youtube, and other webpages that show Google’s ads.

That would be, of course, Holy Grail of ads targeting. But given the sensitivity of these data and possible backlash from users, politicians, and also regulators that might step in, I don’t think that is is a very feasible option.

I also have no clue how I would estimate revenue from it. Google earns 117 billion a year from ads, and this increase in ad targeting efficiency could have a massive impact on revenue. If we assume a 10% revenue increase, that could earn $11.7 billion more every year.

So I would say potential is enormous here, but if Google would do it, it could become such a significant public and political issue that they might even lose money in the end.

Based on what Google’s representatives said in several interviews, it looks that Google is not considering this option. Good to know.

⚫ Other Google Pay Services That Probably Won’t Earn Much Revenue

P2P payments

Google Pay peer to peer payments can earn money, but I don’t see it as something that Google will be able to monetize in the next five years. Bank payments within one country are usually free.

Possibility to monetize P2P might be if Google & Citibank will offer currency conversion and cross-border payments. But so far, it is not on the table.

Tickets and Loyalty/Reward cards

One of the functions of Google Pay is the possibility to add not only payment cards but also various Loyalty or Reward cards. This way, you can use the discounts they offer without having them physically with you.

Google also has an option (on tab Passes) with some partners to store plane tickets and event tickets. The number of partners they have so far is quite limited. I don’t think this is a significant revenue opportunity for the foreseeable future.

Another option Google Pay offers for merchants is the ability to send location-based reminders to customers to let them enroll or sign in to their loyalty program when they’re in your store. They can also enroll by just “tapping” your phone, which will trigger the enrollment process within the Google Pay app.

It looks that these offers are only available for “early adopters,” probably not a big revenue maker, but can help with user experience.

Anyway, although there might be some small monetization opportunities, they will probably be connected with localized promo offers, which I’ve already covered earlier.

SPOT platform by Google Pay

Spot is a new addition to Google Pay functionalities. To my knowledge, it is currently available only in India, which became a testing ground for Google Pay development.

Google, unlike in other countries, is the leader in mobile payments there and reported 67 million users.

Google started in India in 2017 with the service called Tez that they later rebranded to Google Pay. Google Pay in India functions differently. Transactions are not channeled through debit/credit card networks but through UPI (Unified Payment Interface), which is an instant real-time payment system between banks working 24x7. Only recently, Google added also the option of payments through saved credit and debit cards.

But let’s get back to “Spot.” It is is a simple mini e-commerce platform within Google Pay, and users can order products and pay directly there, without waiting in line. It tries to combine the physical and digital world.

This offer is so far limited to just a few partners but confirms that Google is working on a way how to make it easier for businesses to accept payments. It is another data point that suggests that they might be preparing to fight for a market share with Paypal. And if you look at how India’s UPI works, It might be the approach that Google might pursue in the US or some other big countries in cooperation with Citibank.

⚖️ How Much Revenue Google Pay Makes (and Could Make) Compared to Total Alphabet Inc. Revenue

Based on my estimates, Google Pay can bring $4.5bn a year in 5 years. It is a sizable business, even though it looks small compared to the total of $137 billion of Google’s (Alphabet’s) revenue. And the best part is that even after five years, the revenue will continue to grow quickly.

In terms of profitability after other expenses, I am not expecting high profit margins in the first five years. To make this change successful, Google will have to provide incentives and bonuses to facilitate quick user adoption. Both on the side of customers and also online merchants. They will be facing other players doing the same thing, which can become costly.

Luckily, Google does not need to worry about the infrastructure of payment processing, because this heavy-lifting will be handled by Citibank or some other partners that Google might add to Google Pay.

Established large banks probably won’t trip over themselves to offer a checking account in cooperation with Google Pay because this would mean losing direct relations ship with the clients and threatening their interchange income. However, It will be very attractive for smaller players in retail banking that want to grow and get access to cheap funding.

CitiBank in the US fits this profile. For Citibank, this is an opportunity to grow, and even though they can’t expect too much profit from providing just the transaction business through Google Pay, they can make up for it by offering banking products to those customers and lowering their funding costs.

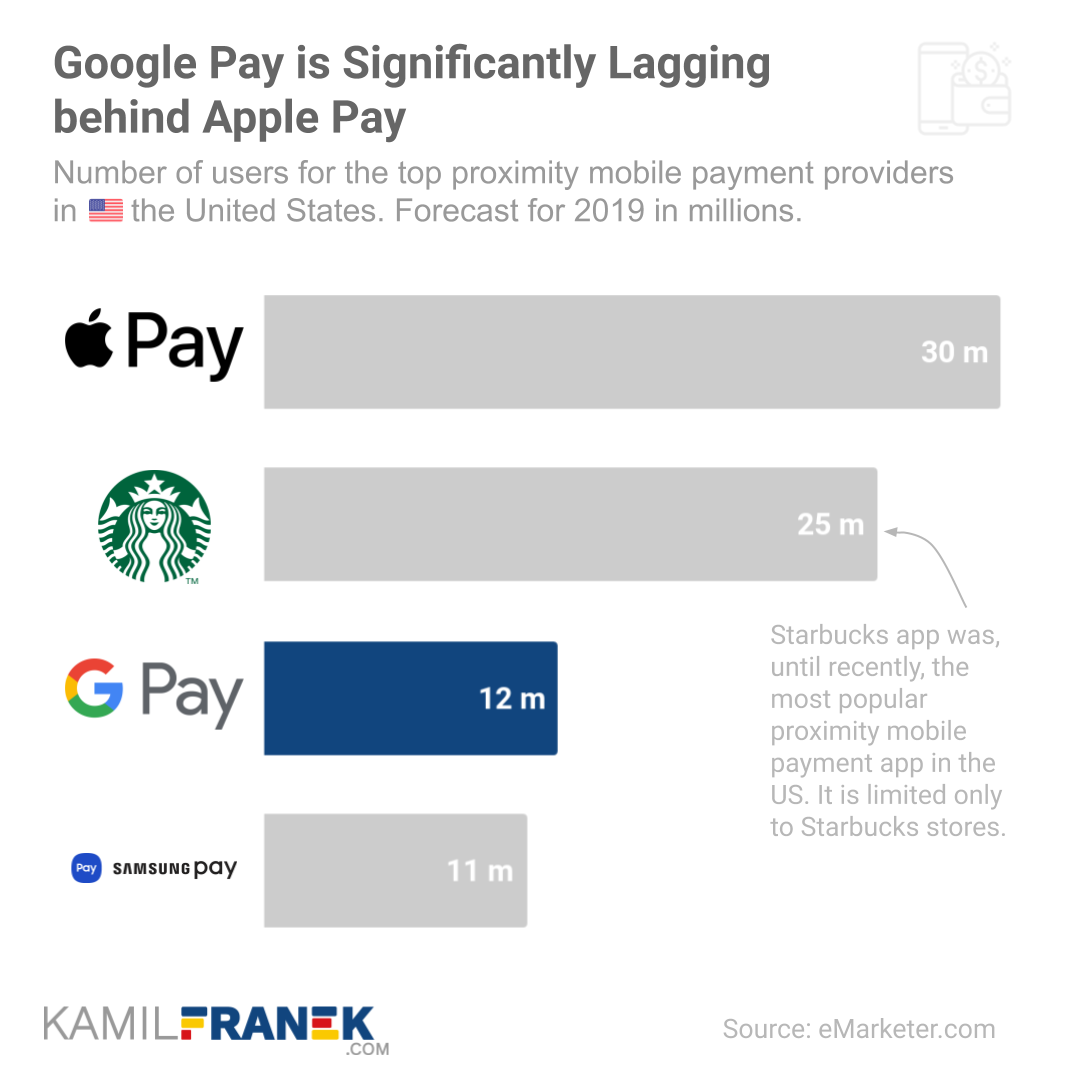

🧑📊 How Many Users Does Google Pay Have and How It Compares to Competitors

Before I wrap this article, let me share with you an overview of the competitive landscape in proximity payments in the United States.

As you can see in the chart, Apple Pay is killing it. One reason is the fact that the Android world is split between Google and Samsung Pay. If we put those services together, market share would be in line with Apple’s share on mobile devices in the US. Unlike in the rest of the world, Apple devices have a slightly bigger market share than Android in the US.

The advantage of Apple is that it has a monopoly in the iPhone market. It does not allow third-parties to access the NFC chip on iPhones. Because of this, Apple is being accused of uncompetitive behavior.

But that is not the whole story. Even though Android is the dominant software mobile platform outside the US, Google Pay is still not winning worldwide. Outside of the US, Google Pay is also lagging, so Google has a lot of catching up to do. Based on eMarketer number of mobile proximity payment users worldwide will cross 1 billion in 2020.

Hard to say what is the reason for such a weak adoption of Google Pay, but it might be a more proactive way in which Apple is pushing Apple Pay. Google chose to follow it’s traditional launch strategy of launching the product and waiting to see what happens.

If you look at India, where Google chose a more proactive approach, they are dominating it against tough local competition. Apple Pay is not present in India since the presence of iPhones is not very high there.

So what do you think? Will Google Pay, together with others, disrupt the online payments industry? Let me know by commenting on some of my LinkedIn or Twitter posts.

📚 Resources & Links

- Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth. - Google Pay Product Page :Google’s official site about the product and functions.

- PayPal Annual Report 2018 (10-K)

- Alphabet/Google’s Annual Report 2018 (10-K)

Disclaimer: Although I use third party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.