How Google Makes Money from Android: Business Model Explained

Android is a widely successful mobile operating system. It competes shoulder to shoulder with iOS, mainly in English speaking countries and dominates in non-English speaking ones. Android is open source, and Google mostly does not charge any licensing fee for it. So why Google spends billions of dollars each year for its development? How does Google make money from Android? Is Android profitable for Google?

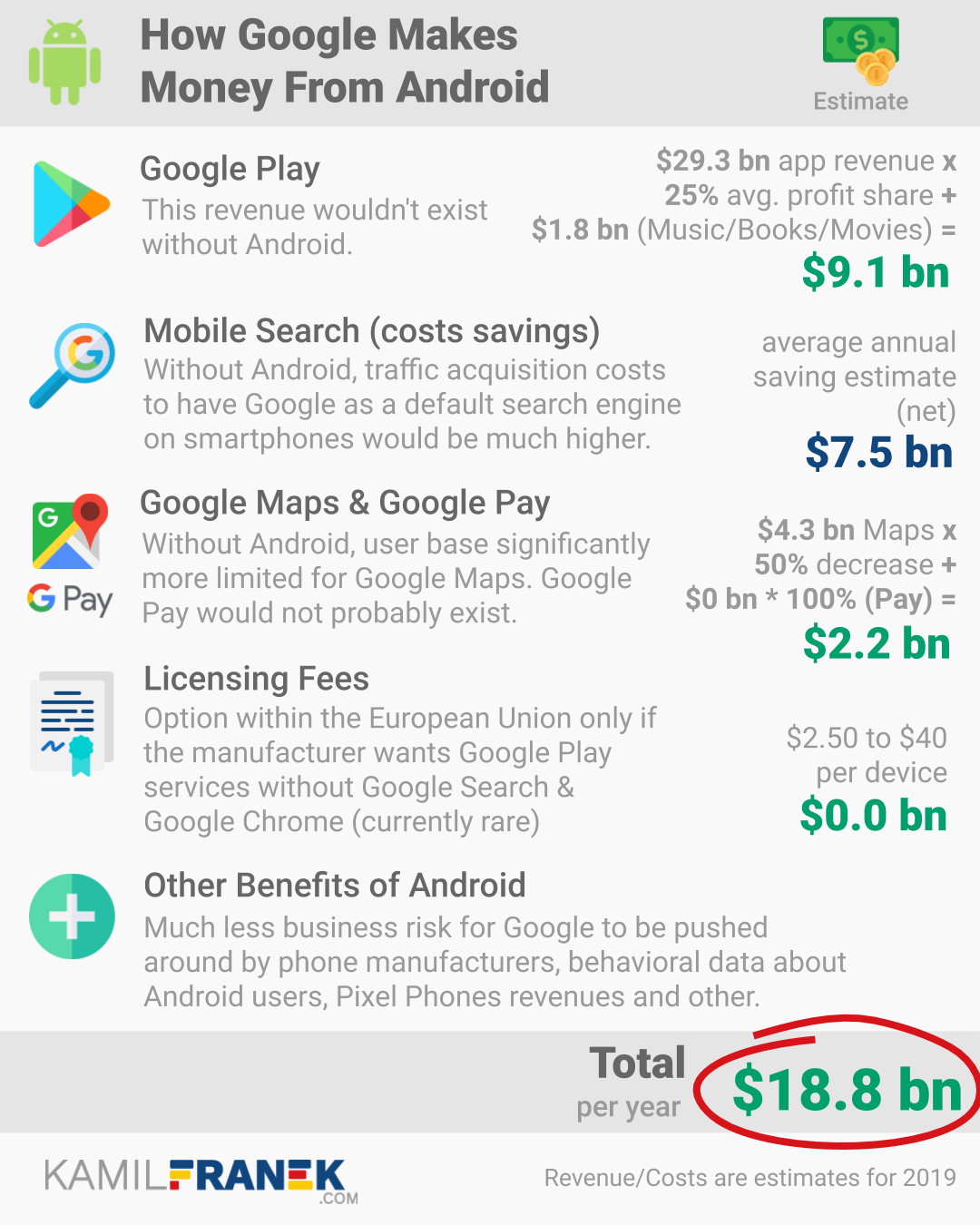

There are three main ways how Google makes money from Android ($19bn a year) :

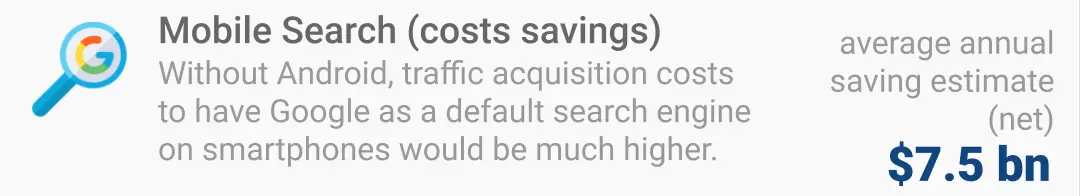

- Play Store: revenue would not exist without Android ($9.1bn)

- Search: without Android, Google would need to pay more to phone manufactures for keeping it as a default search engine ($7.5bn)

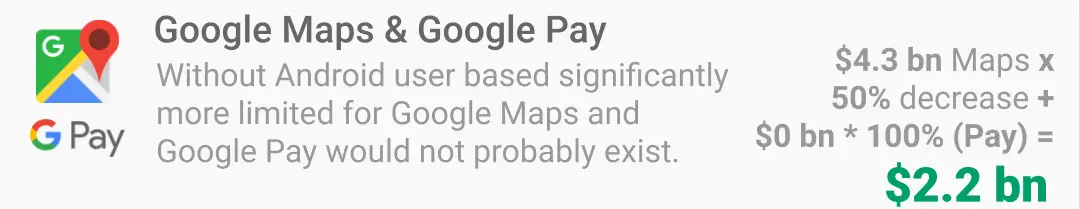

- Maps: part of the revenue is dependant on Android ($2.2bn)

As you can see, even though Google does not make money from Android directly through licensing, it earns a sizable part of Google’s (Alphabet’s) revenue from Android. In the rest of this article, I will breakdown different Android revenue streams and walk your throug its business model. I will also show you that the Android that most consumers use is far from “open source,” and Google keeps a very tight grip around it.

⚙️Android How You Know It Is Not Open Source

You have probably heard that Android is Open Source, and any phone manufacturer can use it for free.

Well, it is not totally accurate, because it depends on which kind of Android we are talking about. The only Android that is free & open source is the “bare” Android system without Play store and other core Google services.

Only a few manufacturers use “bare” Android, and there is a good reason most manufacturers do not use it. Consumers simply do not like it. Not having access to Google Play App Store is a deal-breaker for most of them.

One example worth mentioning is Amazon’s Fire Phone that was based on “bare” Android, and one of the reasons it failed was that it did not allow access to Play Marketplace. But Amazon was not able to use “bare” Android as it is. It was forced to create its own app store and replace many Google apps with its own. Amazon put a lot of energy into it, but it simply did not work out, and Fire Phone does not exist anymore.

Another manufacturer that was forced to use bare Android recently is Huawei. For them, it was not a choice but merely an unwanted result of China vs. US trade war. Below you will find a great video from MKBHD where he very well explains issues Huawei faces by being forced to use bare Android.

So If we disregard this “bare” Android version than we can clearly say that Android is not open source but proprietary Google’s software. To use it, the manufacturer does not need to pay anything, but they need to comply with many of Google’s conditions to be able to use the full version of Android with Play and other Google’s apps.

Conditions that phone manufacturers need to comply with to get a free license to install Android with Play:

- The manufacturer needs to include all other apps like YouTube, Gmail, Maps Photo, and mainly Search and Chrome.

- They need to make Google Search default

- Manufacturers have to push Google apps to a prominent place on the home screen

- and also, a manufacturer that wants to use Android phones with Google Play cannot use other modified versions of bare Android on different devices.

Since 2019, some of the conditions are not relevant anymore in the European Union as a result of the EU antitrust case against Google. Phone manufacturers can offer “forked” Android versions without fear that Google would not prolong their licenses for devices that use the Google Play store.

They can also use the Play Store & Play Services without installing Search and Chrome. To do that, however, they need to pay the licensing fee to google that was announced to be somewhere between $10 and $40 depending on screen resolution.** In some countries, licenses for lower-end phones can go as low as $2.50.

🔵How Android Makes Money through Google Play

Revenue coming from Google Play is, according to my estimate, the biggest piece of Android’s business model in terms of revenue. If Android did not exist, then there wouldn’t probably be any app store owned by Google and any related revenue. Therefore we can associate 100% of Play revenue with Android.

Lets’ have a look at different ways how Google Play makes money for Google (Alphabet) and estimate the connected revenue in more detail.

Google Play Store purchases and in-app payments

Google Play is a distribution channel for Android apps that Google operates. It contains mostly apps from third-party developers. Most of them are free, but some of them are paid.

Since Google is business and not non-profit, it charges a fee for providing this easy distribution channel and payment processing to app developers. It charges them 30% of the amount consumers pay for the apps or as an in-app payment. For regular subscription-based payments, it charges 30% for the first-year subscription consumer pays and 15% from all subsequent years.

Based on Sensor Tower,total spend on Play App Store is estimated to be $29.3bn in 2019.

Google’s revenue from the distribution of Music, Video, and Books.

Apart from the app store, Google provides several different apps like Play Movies & TV, Play Music, and Play Book, which allows users to stream or download digital content from other publishers. For example, Google currently has 15 million subscribers for its music-streaming service.

These apps are part of “must-have” apps that phone manufacturers have to include on every Android phone if they want to install Google Play on it. Therefore it gives these apps prominence against other similar digital content services that are not readily pre-installed on the android phones, and consumers need to download it first to be able to use it.

It is hard to imagine that Google would offer these types of apps if Google did not own Android, so again I estimate that all of the revenue from these apps would not exist without Android.

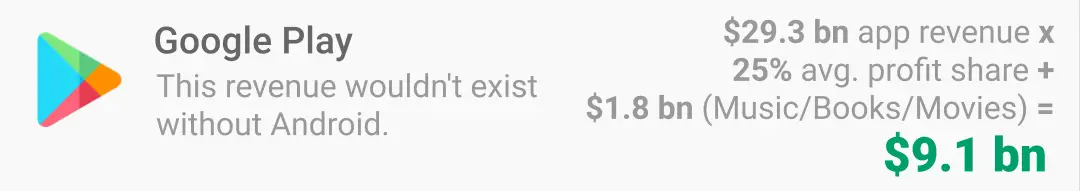

Estimate of Google Play related revenue

Let’s try to translate it into numbers. To estimate Google Play revenue, we, unfortunately, cannot rely on Google’s official financial results because Google does not disclose its results in such detail.

If you want an overview of Alphabet Inc’s financial results, which is a holding company of Google LLC. I’ve put together step by step walkthrough of Google’s (Alphabet’s) financial statements in one of my previous articles.

If you look at Google’s annual income statement, you will see that in 2018 Google’s (Alphabet’s) revenue was $137bn. Most of it was advertising related but $19.9bn was “other income” that included revenue from Google Play, Google Cloud and also Hardware Sales.

Unfortunately, Google does not tell us how much from those $19.9bn is revenue from Google Play. But if we put together some market data about total app spend from Google Play and already mentioned 15% to 30% profit share of Google, we can easily estimate this ourselves.

Estimate of Google Play Revenue for 2019:

- $29.3bn estimate of Google Play App Spend in 2019 by SensorTower.com

- x 25% estimated revenue share of Google

- + $1.8 bn estimated revenue from digital content (Video/Music/Books)

- = $9.1 bn Google Play revenue

Google Play Apps spend vs. Apple’s App Store spend

Although this is not entirely must know for estimating Google Play revenue, I would like to point out one fact about Android App spend vs. Apple App Store spend.

Even though the estimated number of active Android phones is multiple of iPhones, spend on the Apple App store is significantly higher than Google Play Spend. As I mentioned earlier Google Play app spent in 2019 is estimated to be $29.3bn compared to $54.2bn spend on Apple’s App Store.

Different factors come into play here. iPhones compared to Android phones do not offer many “budget” options and therefore have, on average higher purchased price. These customers are far likelier to spend more on digital content too. The second factor is geographical. Android has a dominant market share in low-income regions (Asia, Africa, South America), where consumer purchase power is far lower than in developed countries.

🔴How Google’s Android Makes Money through Mobile Search

Google makes the most money from advertising, and a large part of advertising revenue is from mobile advertising. By following this pattern, it might look at first that Google is making the most money from Android through mobile search-related advertising too and that we can just look up how much money Google earns from mobile search, and we would get the amount that is earned by Android.

However, that would be the wrong approach, and in this part of the article I will try to persuade you that Google would still be able to earn most of its revenue from mobile search even without Android and impact on mobile advertising revenue would not be catastrophic. Android is crucial for Google, but the core reason is not advertising income.

The first problem with associating Google’s mobile revenue with Android’s revenue is simply that mobile search advertising revenue is not coming only from Android phones but also iPhones. And even if we concentrated solely on mobile advertising revenue coming from Android users, we just cannot assume that this income would just disappear without Android.

Currently, Google (Alphabet) has to pay billions of dollars each year to Apple to keep Google as default search engine and it is reasonable to assume that if Google did no own Android, it would be able to reach similar profit-sharing agreement with other manufacturers as it managed to do with Apple.

Another reason why I quite optimistic that Google’s position in Google search would not be significantly hit without Android is that currently Google is the top search engine out there in terms of quality of results. The quality of the product is so good that consumers would prefer it anyway. And if consumers will like it, hardware manufacturers will prefer it too, especially if they will also be paid for it.

An excellent example of how consumers prefer Google Search is Google Search on Windows computers. Google dominated Search from windows computer even though it did not own Windows, and it did so even before it introduced its Chrome Browser.

The fact is that Google already pays profit share from advertising revenue also to other phone manufacturers like for example Samsung for the exclusive use of Google Search on its devices. Even though Google owns Android, it still has to pay profit share to Samsung, which dilutes the difference between Android and iPhones from Google’s point of view. It seems that only smartphone that Google can be sure that it does not need to pay profit-sharing from is the smartphone Google produces itself, which is Pixel. Unfortunately, Pixel does not have such s significant market share currently.

Approach to estimate Android’s value for Google’s mobile advertising revenue

In the previous part, I explained why I think that mobile advertising revenue would be only slightly affected if Android did not exist or wasn’t owned by Google (Alphabet). Let’s now look for the best way how to estimate the value Android has for Google’s (Alphabet’s) mobile advertising.

One approach would be to estimate Google’s advertising revenue from Android phones, assuming Google would just let it disappear without making any changes ( e.g., higher profit sharing for manufacturers). In that case, we might estimate impact by applying some reasonable decrease (10% to 30%) on a mobile search revenue and that would be the revenue that Android is responsible for.

The problem with this is that it is unrealistic. If Android for some reason stopped being owned by Google, Google would not stay still and let the revenue drop, Google would try to stop this possible revenue decrease by making deals with phone manufacturers and probably offering them higher profit share.

Therefore, Impact of Android on mobile search advertising revenue would be better estimated as an increase in traffic acquisition costs than as a revenue decrease.

How much Google pays to Apple and Samsung each year to use Google Search as default

So my approach will be to estimate the value of Android from mobile search advertising by determining how much more money Google would have to pay to smartphone manufacturers if Google would not have the advantage of owning Android. My estimate is that this increase can be anywhere between 50% to 150%, and I will further work with mid-value of 100% increase in traffic acquisition cost that Google pays to phone manufacturers that currently use Android, which is presently mainly Samsung.

To get to some specific numbers, we have to know how much Google is paying to Android phone manufacturers based on current profit-sharing agreements. We can either look at estimates done by various analysts that are flying around in financial news articles and also look at what we can find about it in Alphabet’s (Google’s) annual report.

Estimates of Google traffic acquisition cost toward device manufacturers from outside analysts cited in other articles (with link to the source)

| (in billions $) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Apple | 1.0 | ? | ? | 3.0 | 9 | 12 |

| Samsung | ? | ? | ? | 3.5 | ? | ? |

| Other | ? | ? | ? | ? | ? | ? |

Total traffic acquisition costs for Google own sites from Google’s annual report

| (in billions $) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019* |

|---|---|---|---|---|---|---|

| TAC to distribution partners | -3.6 | -4.1 | -5.9 | -9.0 | -12.6 | -14.5 |

*2019 is estimated based on Q1-Q3 results

Note that the total traffic acquisition costs (TAC) include not only costs for mobile but also other channels. But we know from Google’s annual reports that mobile has higher traffic acquisition costs than desktop search, so we can assume that most of the cost is connected with mobile search.

By comparing estimated and the total numbers, we can see that since 2018, the numbers do not add up.

For example, in 2017, conventional estimates are that Google paid $3bn to Apple and another $3.5 billion to Samsung. It is $6.5bn just for these two device manufacturers. Total from Google’s annual report for 2017 is $9bn, which means that if the estimates are correct, then there is another $2.5bn of traffic acquisition cost paid to different partners. So far, so good.

The issue arises when you try to do a similar sense check from 2018 and 2019. We don’t have estimates from analysts about how much Google paid to Samsung in 2018 and 2019, but since it is a profit-sharing agreement, it would have to go up too because of an increase in mobile traffic. The problem is that if you take this into account and also that there are probably also other partners that google pays traffic acquisition cost to, the total of analyst’s estimates is higher tan total from Alphabets annual report.

How is it possible? There might be different explanation but my view is that estimates for 2018 and 2019 for Apple are unrealistically high. Especially jump between 2018 and 2017 is too steep to believe it is true. I simply don’t buy that those numbers are right and for my purposes I adjusted 2018 and 2019 estimates downward to make sure that total ties to official Google’s figures and its growth. It’s not perfect but better than what is currently available from other sources.

Adjusted Estimates for traffic acquisition cost to device manufacturers.

| (in billions $) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Apple | 1.0 | ? | ? | 3.0 | 5.0 | 6.0 |

| Samsung | ? | ? | ? | 3.5 | 5.2 | 6.3 |

| Other | ? | ? | ? | 2.5 | 2.4 | 2.2 |

Now we simply have to add 2019 number for Samsung ($6.3bn), and my estimate of how much from Other row is Android-related ($1.2bn). The result is estimated cost of $7.5bn that Google will pay to Android phone manufacturers in 2019.

My estimate was that Google would be able to keep mobile advertising revenue even if Android did not exist, but it would mean paying twice as much in traffic acquisition cost. That means that by owning Android, Google saved $7.5bn in 2019 and this number will only go up in future years.

⚪How Much Revenue Android Makes from Google Maps

Google Maps is estimated to earn $4.3bn a year mainly from advertising and expectation is that Google will push monetization of this service in the coming years, and revenue will grow significantly.

Google Maps have 1 billion monthly active users and it is evident that if Google did not own Android number of these app users would probably be significantly lower. Just take into account that Google Maps is one of the apps that Google pushes down on Android phone manufacturers by packaging it together with Google Play Store. Device makers, therefore, have to preinstall in on their phones and even show it on one of the home screens.

My estimate is that without Android number of users could drop by 50%. Since annual revenue from Google Maps is estimated $4.3bn a year than it means that Google Maps revenue that Google is earning thanks to Android is $2.15bn in 2019 and this number will grow in future years.

If you want to dig deeper into how Google Maps makes money for Google, check out my article that will walk you through how Google Maps works and how it earns $4.3bn a year.

⚫How Much Money Android Makes from Google Pay

Google Pay is one of the apps that is hard to imagine that would exist if Google did not own Android. Therefore my estimate is that all revenue from Google Pay can be treated as Android-related revenue.

How much money would Google loose if Google Pay did not exist? Answer for 2019 is $0 because currently, Google Pay does not earn any money. But in several years, this might not be true anymore, and Google Pay will probably make billions each year.

I wrote article specifically about how google pay earns money, where I also included my own estimates of how much revenue can this app generate for Google in future. If you are interested in Google Pay revenue-making potential, I recommend you to check it out.

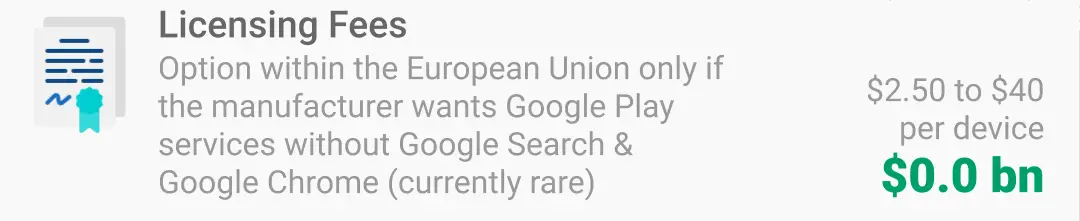

🔵How Android Makes Money from Licensing Fees

Another income stream of how Google can make money from Android is from licensing fees. This is a new income stream that did not exist until 2018. And it was not Google’s choice to introduce it.

As I explained earlier, before 2018, Android, with all its main features, was hard to consider Open Source. It was only a theoretical option if manufactures used its bare version. But even the proprietary Android version with Google Play Store was free if manufacturers meet different conditions required by Google.

European Union fine of €4.3bn in 2018 (for abusing the market dominance of its Android operating system to extend the reach of Google’s search engine) change that and Google was forced to introduce new option for manufacturers that allow them to license Google Play and other apps without Chrome and Google Search. However, if they chose this option, they have to pay a licensing fee to Google.

In the following video, EU Commissioner Margrethe Vestager announces €4.34bn fine for Google and offers a clear explanation of Google’s illegal practices and what specifically Google needs to change to avoid penalty payments.

Licensing fees would differ for different phones based on its screen resolution, which is a way how to make it dependent on price. Based on some reports, it would range between 40$ for most pricey phones to $10 for phones with low screen resolution. For lower-end phone in selected countries, it might be even as low as $2.5.

The introduction of this new licensing option was not the only way how Google complied with the EU findings. One of the issues the EU found was also that Google forbids manufacturers that want to use a version of Android with Google Play to offer any other “forked” versions of bare Android. This will no longer be required.

Google has also already announce results of the first EU auction to add three third-party search engine choice as part of Android setup screen. Which is another step in how to comply with EU findings.

So far all these changes are available only for devices sold within European Union (or more precisely European Economic Area). So customers outside the EU won’t benefit from these new choices.

It is probably too early to evaluate if these new licensing options will see some significant adoption by manufacturers. But so far we did no see any considerable adoption by major manufactures and therefore even total revenue that Android generates thanks to new licensing option is immaterial.

The first phone that was introduced under new licensing options was a phone from French smartphone maker Wiko. But until this new option gets picked up by some more prominent smartphone manufacturers it will remain immaterial.

As I mentioned earlier, new licensing option that Google offered is not very popular among device manufacture so far, and therefore my estimate of revenue coming from this new income stream is $0.0bn.

Interestingly, theoretical maximum Android revenue from licensing fees Google might generate if all manufacturers would offer Android with Google Play without Google Search is around $7.7bn (2.2bn phones * 10$ licensing fee per device / 2.87 average device lifetime) which is another approach how to estimate value of Android for mobile search advertising, and it is very similar to my estimate of $7.5bn traffic acquisition cost increase.

🔴Other Ways How Google Makes Money or Benefit from Android

In this article, I so far mentioned different business models through wich Android generates revenue for Google. Some of them, like Google Play, would probably don’t even exist if Google did not own Android, and some of them would exist, but Android revenue might be negatively impacted (Mobile Search, Google Maps).

There are many other benefits that Android brings to Google. Some of them are hard to translate into actual numbers, but that does not mean they are not crucial for Google.

List of Other Benefits

- Android significantly reduces Google’s business risk and gives them the power to influence smartphone markets and offerings. Without Android, Google would be too dependant on manufacturers and would have a much weaker negotiation position to include Google Search and other Google’s services their devices. It is always better to be in direct control of users’ “entry point” to the internet. Android with Google Chrome Browser helps to do that.

- Behavioral Data is another crucial benefit Google gains from Android. If you want to use an Android phone, it requires you to have Google Account and be signed in, and although you can find some workarounds to avoid that, they significantly limit users’ experience. Therefore when most of people use Android, they are signed in to Google, and Google has access to invaluable data about their behavior. Constant sign-in on Android phones also helps Google target the ads without relying on traditional cookies.

- Google uses Android to push its free app like Chrome, Photos, Drive, Duo, and YouTube. Without Android reach of these apps would be far more limited.

- Google earns money from in-app advertising in Android apps, and even though this income stream would probably exist even without Android, it definitely helps a lot to be the owner of the platform and be able to influence its development priorities.

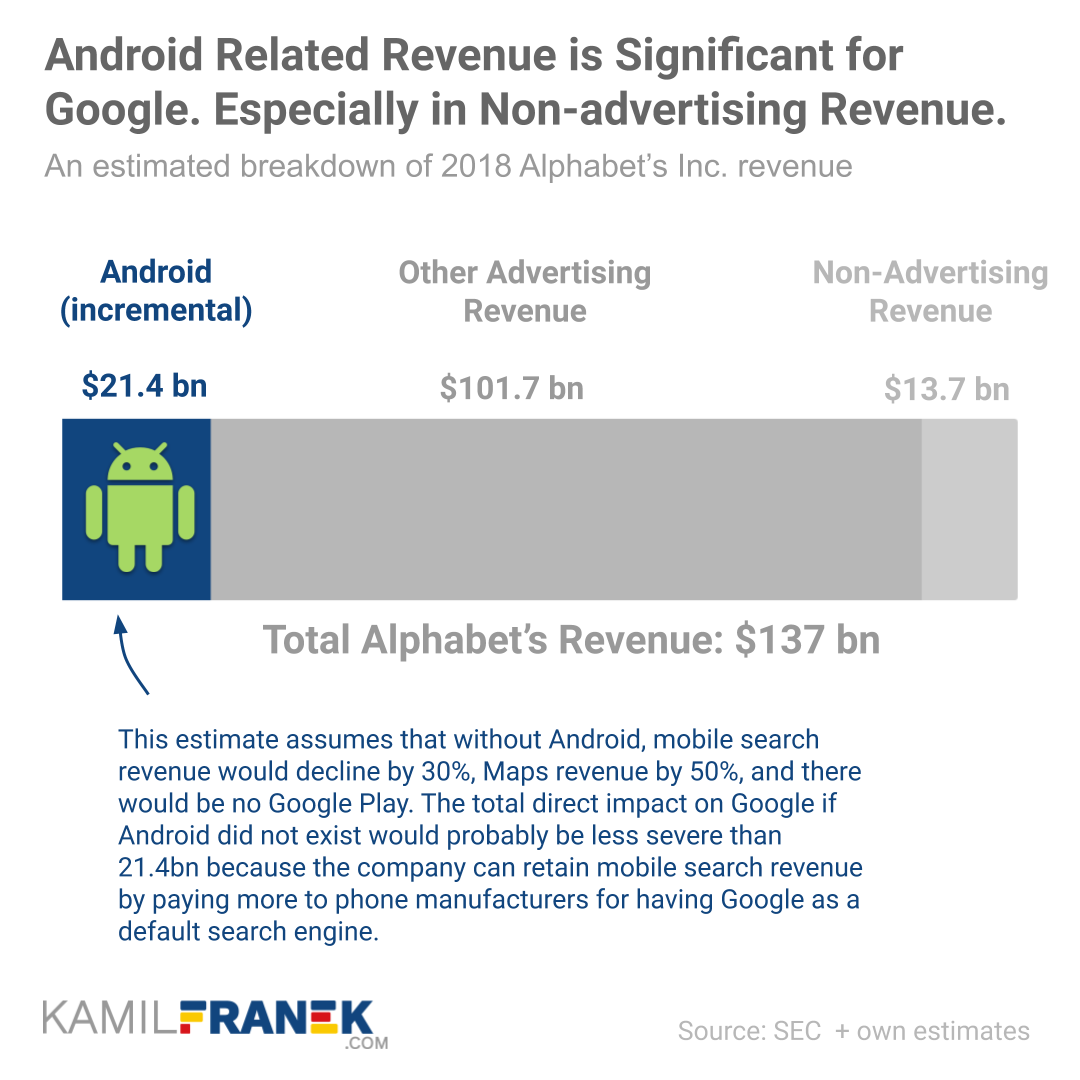

⚖️ How Much Revenue Android Makes Compared to Total Alphabet Inc. Revenue

Based on estimates I did in this article, the revenue of Alphabet Inc (Google) without Android would probably be lower by $11.3bn and its traffic acquisition cost higher by $7.5bn. When we compare it to total revenue of $137bn of Alphabet Inc in 2018 we can see that Android is crucial for Google.

To allow better comparison with total revenues in 2018 in the following chart, I transformed all numbers to 2018 values, and instead of traffic acquisition cost-saving for Google Mobile Search transformed into revenue (assuming 50% incremental profit margin).

If you want to explore Google Financials further a recommend my article reviewing their recent annual report.

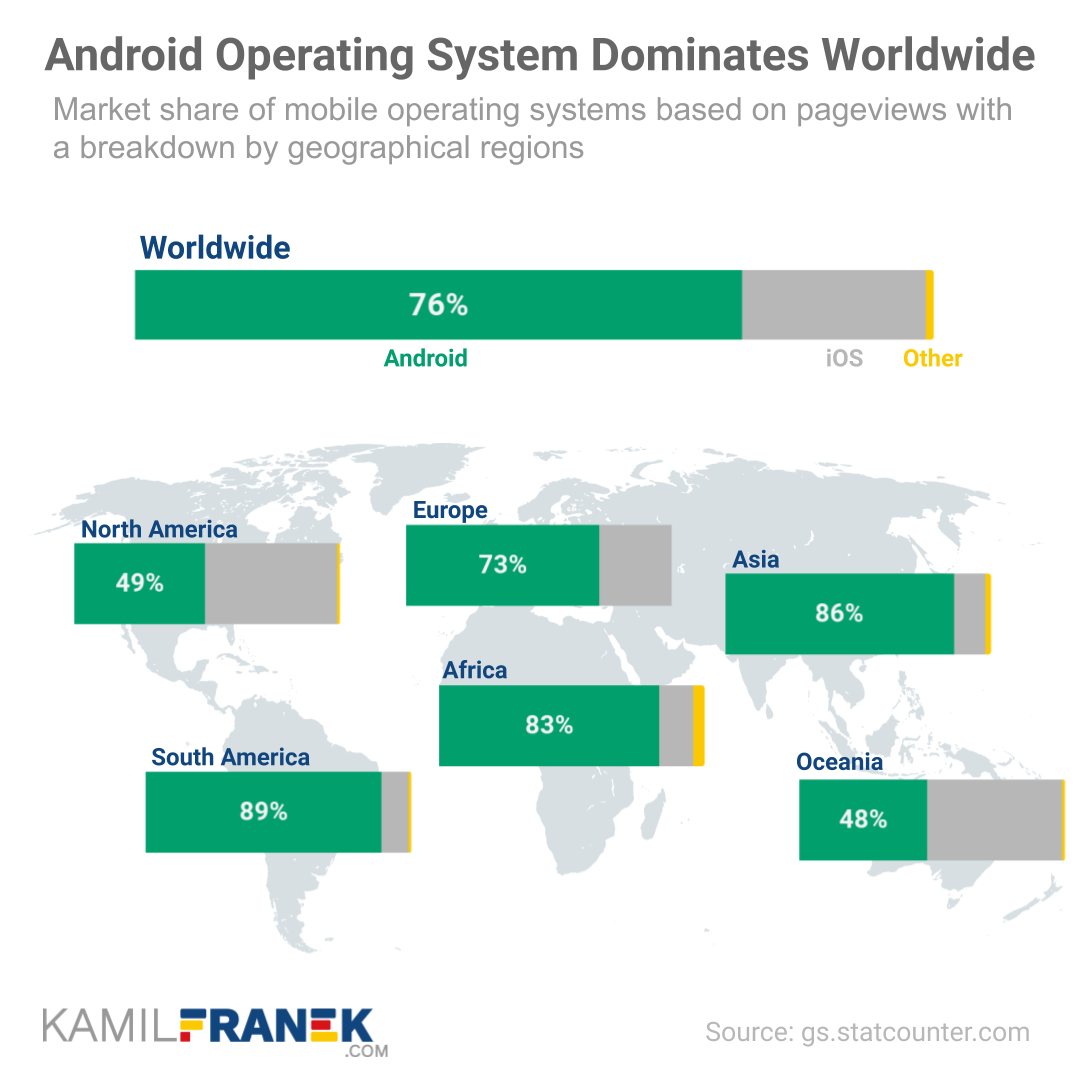

📊 Android Market Share Overview vs. Competitors

To Understand the Android position on the market, let me share with you several numbers and charts showing the Android market share from different points of view.

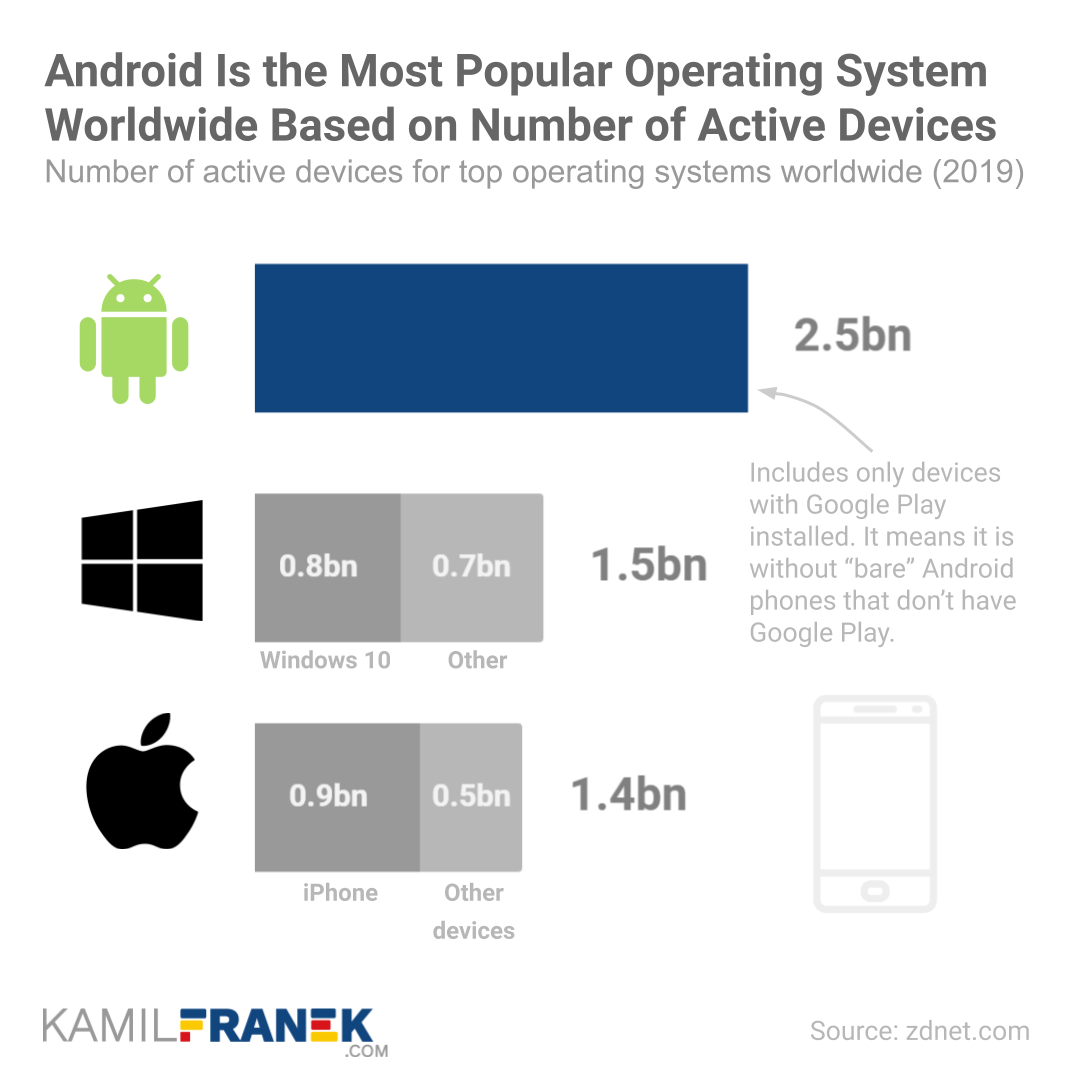

Firstly, let’s have a look at a comparison of active install devices by the operating system, which tells us how many active devices with a given operating system are out there. Android with 2.5bn active devices dominates not only on smartphones but on any platform. Windows with dominant position within OS for desktops is in second place overall with 1.5bn active devices. Apple which uses its own operating system is on third place with 1.4bn of active devices.

Unfortunately, I did not find data split that would tell us exactly how much of 2.5bn of Android devices are smartphones, so we cannot directly compare Android smartphones with iPhones. But since we know Android is much less successful on tablets and other smart android based devices, I guess that the number of non-smartphone devices would not be lower than 0.5bn for Apple.

This would give us around 2.1-2.2bn estimated active android smartphones vs. 0.9bn active iPhones. Which would mean 70% market share of Android on active smartphones worldwide.

The problem is that these numbers do not include devices with a bare Android system that do not have Google Play. Those are popular mainly in Asia.

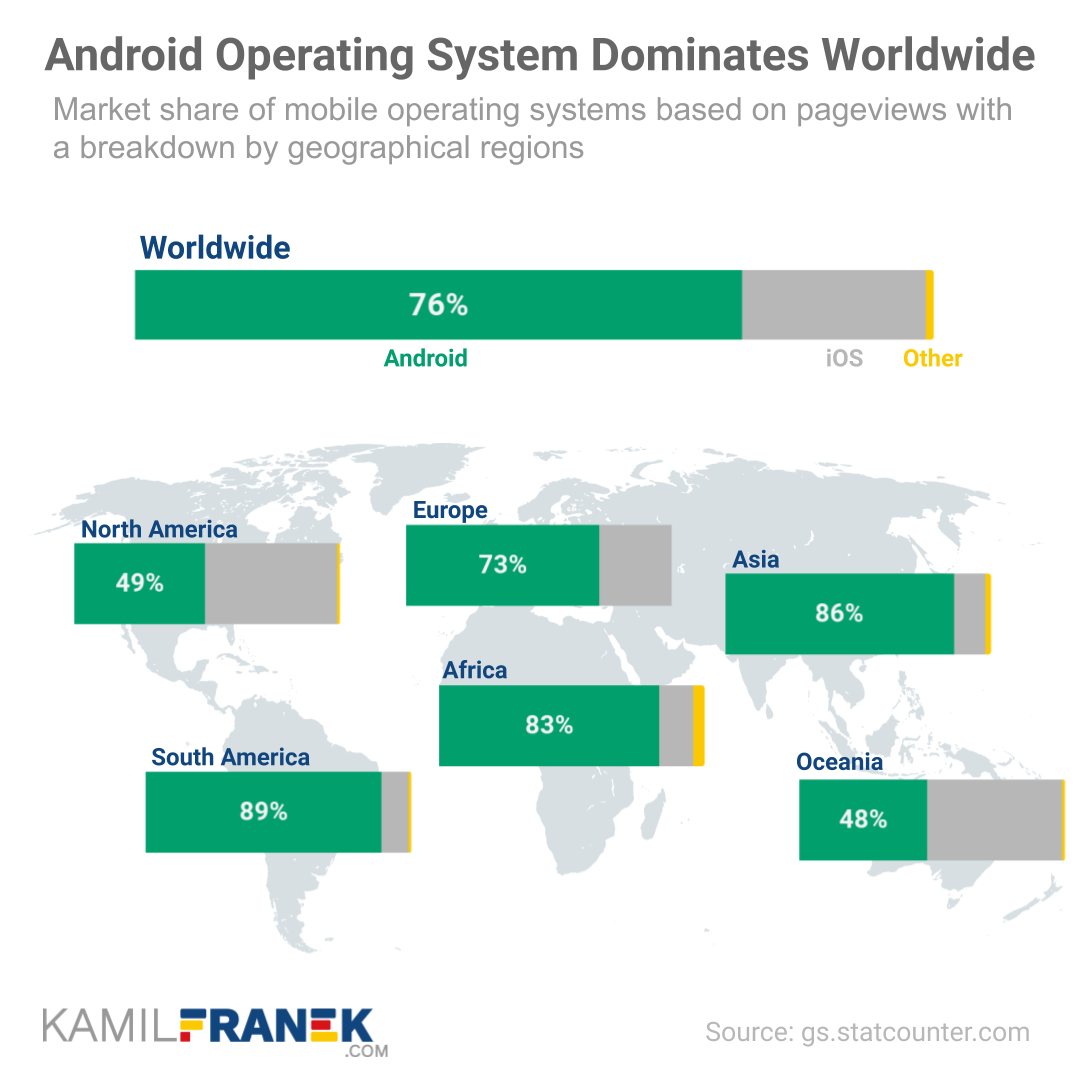

Fortunately, we have another way how to compare the market share of Android vs. iOS on mobile phones by comparing pageviews originated from different devices. This approach gives us Android worldwide market share of 76%

This approach also gives us a much more granular look at market share by different regions and even countries.

As you can see from the chart with an overview of market share around the world above, Android is dominant around the world except mainly in English speaking regions of North America and Oceania. And the same is true also when we look at individual English speaking countries (UK, Ireland). That might be just false causality because English speaking countries are usually richer ones. Still, cultural differences might be helping it too since some rich countries are also dominated by Android (like Germany or France).

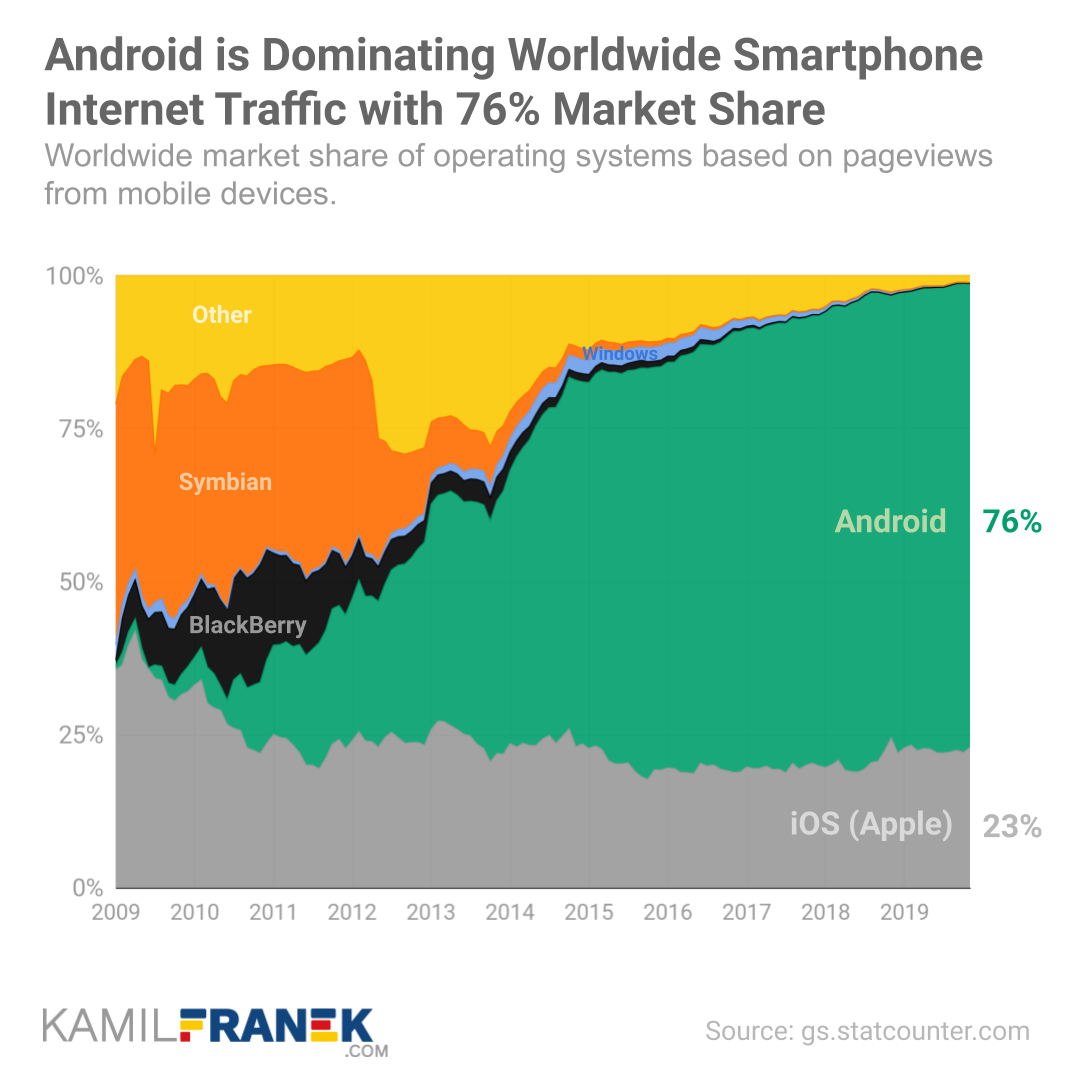

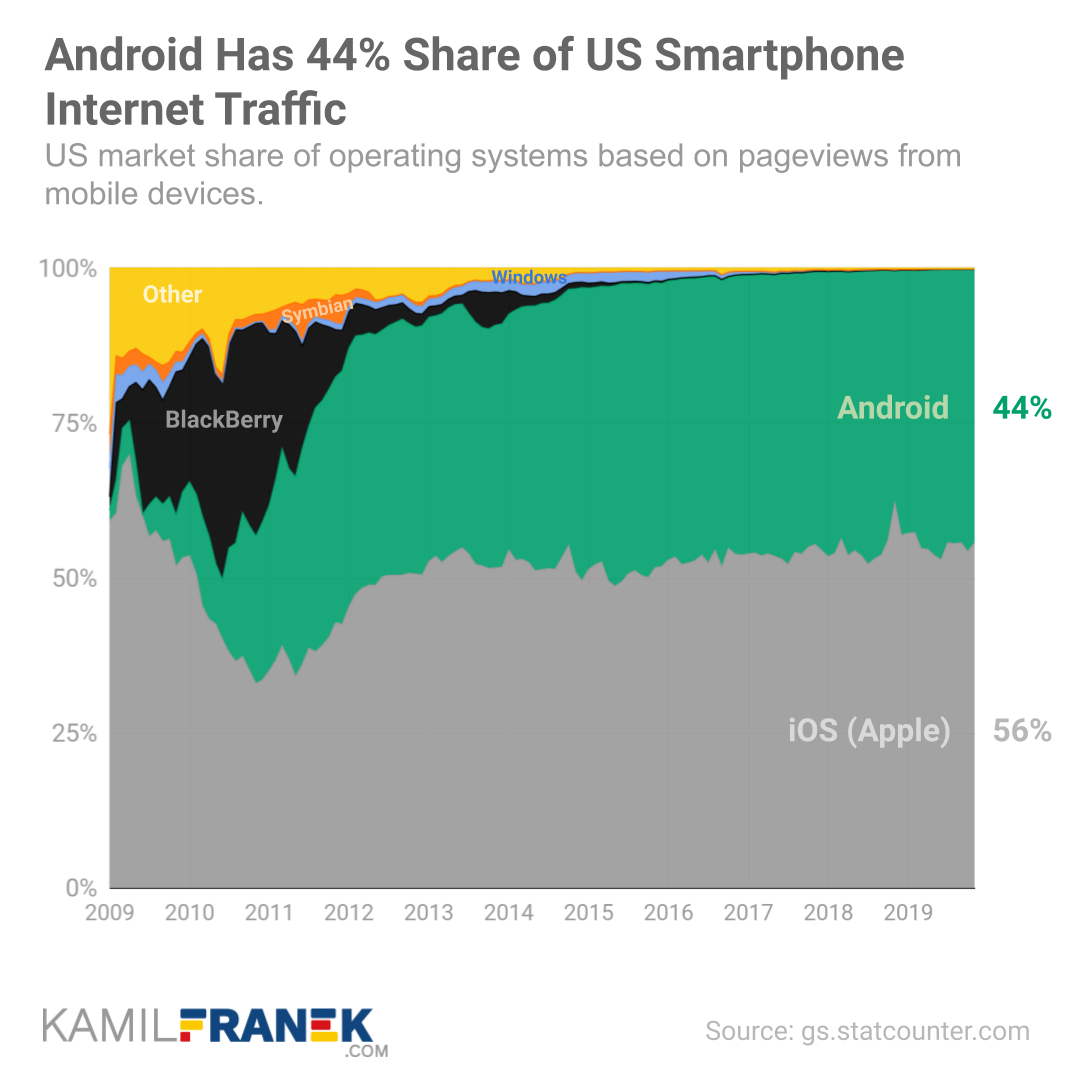

Android did not get to its dominant position overnight. It took Android a decade to get to is current position worldwide, as you can see from the following chart.

The chart below shows the same development in the US market. You can see that although Apple’s market share (based on page views) is higher in the US, Android achieved its position quicker in the US than worldwide. You can also see that Android growth was not so much at Apple’s expense but mainly at the expense of alternative OS like Blackberry, Windows Mobile & Symbian.

📅 Timeline of Important Events Related to Android and Its Business Models

| Year | Month | Event |

|---|---|---|

| 2005 | July | Google acquired Android for $50 million |

| 2007 | June | Apple launched the first iPhone |

| 2008 | The first Android OS version 1.0 was introduced | |

| 2008 | Oct | The first-ever Android smartphone T-Mobile G1 hit the market |

| 2013 | June | Apple made Bing the default search engine for Siri but not for the Safari browser on the iPhone |

| 2017 | Google replaced Bing as the source of web search results for Siri by Google | |

| 2018 | Jul | EU fined Google €4.34bn for anti-competitive practices related to Android |

| 2018 | Oct | Google offered a new licensing option of devices sold within the EU as a reaction to EU investigation of its illegal practices that resulted in €4.34bn fine. |

| 2019 | Dec | Google launched its “Chat” service that is iMessage alternative for Android users. |

| 2020 | March | Android users in EU will get a choice of 4 search services as part of Android setup. |

📚 Resources & Links

- Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth. - Alphabet/Google’s Annual Report 2018 (10-K)

- Example of older Google’s MADA Agreement: Agreement that phone manufacturers are required to sing to be able to use Google Play and that forced them to include in prominent manner also other Google’s services.

- Overview of consumers spending in Mobile Apps in 2019 (SensorTower)

Disclaimer: Although I use third party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.