Who Owns Ferrari: The Largest Shareholders Overview

Ferrari N.V. (RACE) is a Dutch holding company that owns Ferrari S.p.A, an iconic company that makes money predominantly from manufacturing and selling its luxury cars. Let’s look at who owns Ferrari and controls it.

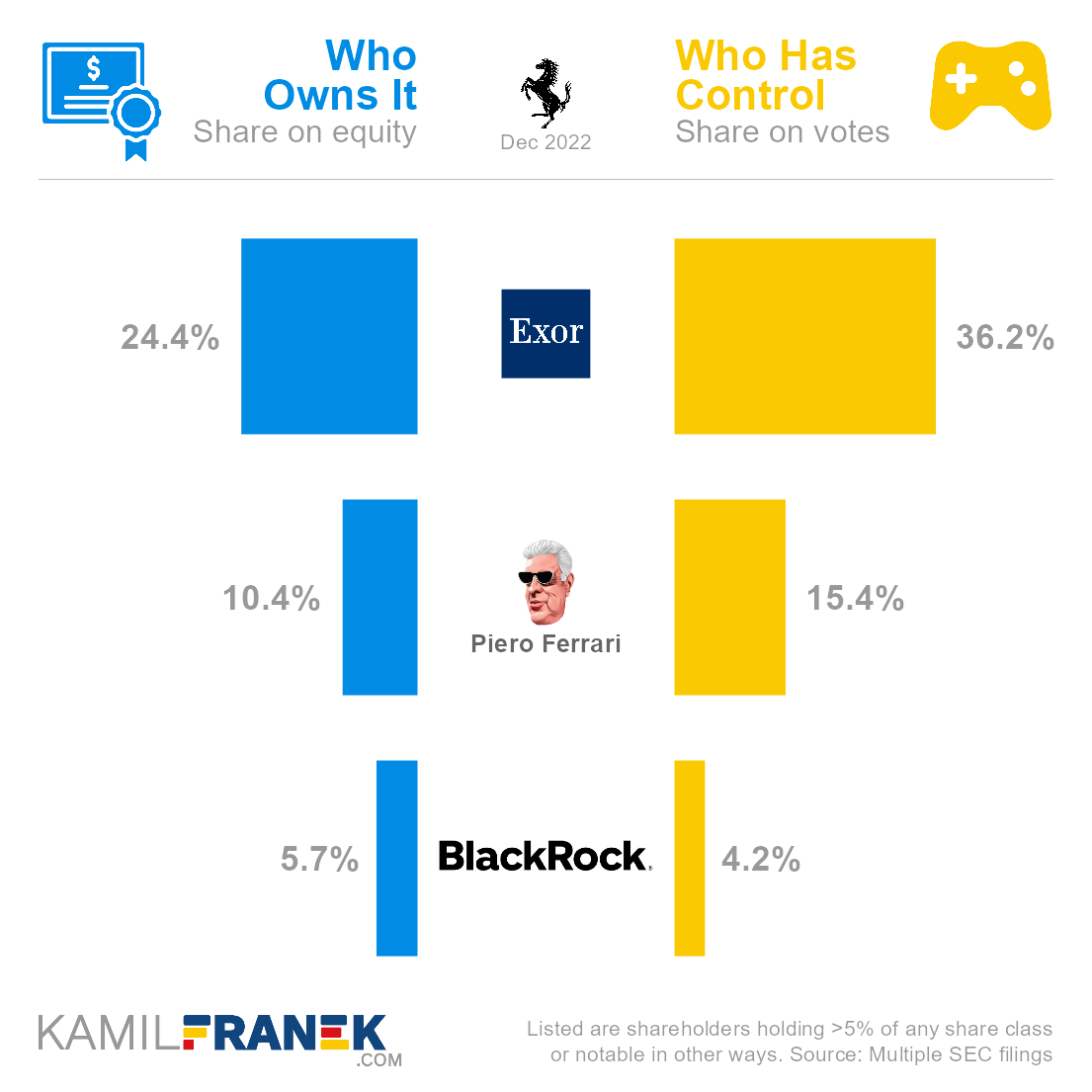

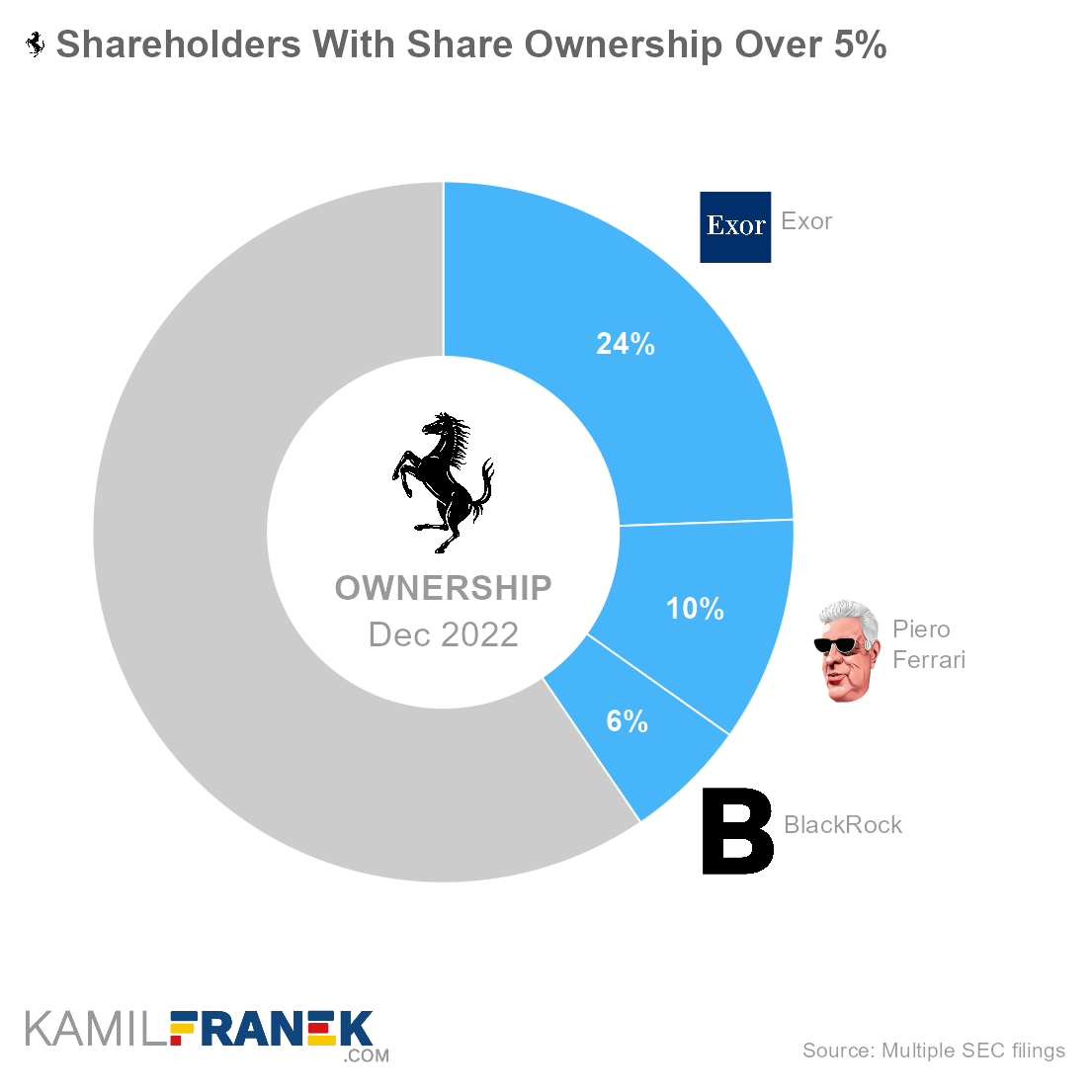

Ferrari’s largest shareholders are Exor, controlled by the Agnelli family, which owns a 24.4% share, followed by Piero Ferrari, who owns a 10.4% share. Thanks to special “voting shares,” Exor and Piero Ferrari together hold 51.6% of voting power and control Ferrari.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Exor | 24.4% | 36.2% | |

| Piero Ferrari | 10.4% | 15.4% | |

| BlackRock | 5.7% | 4.2% | |

| Other | 59.5% | 44.1% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Ferrari and who controls it. I will show you who Ferrari’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Tesla, Volkswagen, Alphabet(Google), L’Oréal, or Xiaomi.

📃 Who Owns Ferrari?

Ferrari is owned by its shareholders. The largest ones are Exor, controlled by the Agnelli family, which owns 24.4% of the company, followed by Piero Ferrari, with a 10.4% ownership share, and BlackRock (5.7%). Thanks to “special voting” shares, Exor and Piero Ferrari control Ferrari.

The largest owner of Ferrari is the holding company Exor, which owns 24.4% of Ferrari. Exor N.V. is controlled by the Agnelli family, descendants of Giovanni Agnelli, founder of Fiat.

- They control Exor N.V. through Giovanni Angelli B.V., which owns 52% of Exor and holds 85% of its voting rights.

The second largest Ferrari owner is the son of Ferrari founder Enzo Ferrari, Piero Ferrari, who owns a 10.4% ownership stake.

A sizable owner is also asset manager BlackRock, which owns 5.7% of the company.

Exor N.V. (controlled by the Agnelli family) and Piero Ferrari are not just independent shareholders minding their own business. They signed a shareholder agreement and are coordinating their positions before the shareholder meetings.

Exor N.V. and Piero Ferrari also agreed that if any of them wants to sell their stake in the future, Exor will have the right to buy it if they match the third-party offer, and Piero Ferrari has the right to the first offer.

Next to holding regular common shares of Ferrari, Exor and Piero Ferrari also hold special voting shares that give them control over Ferrari.

Ferrari N.V. is a Dutch registered holding company that is traded in New York (ticker: RACE) and Milan and owns 100% of Ferrari S.p.A., which makes and sells famous Ferrari cars and holds stakes in other subsidiaries. Ferrari S.p.A has headquarters in Maranello, Italy.

Ferrari was previously owned by Fiat but was spun off from Fiat Chrysler Automobiles in 2015.

Ferrari was founded in 1939 by Enzo Ferrari and has been a publicly listed company since it was listed on NYSE in 2015 (Ticker: RACE).

Ferrari N.V. is registered in the Netherlands, but its headquarters are in Maranello, Italy.

🎮 Who Controls Ferrari (RACE)?

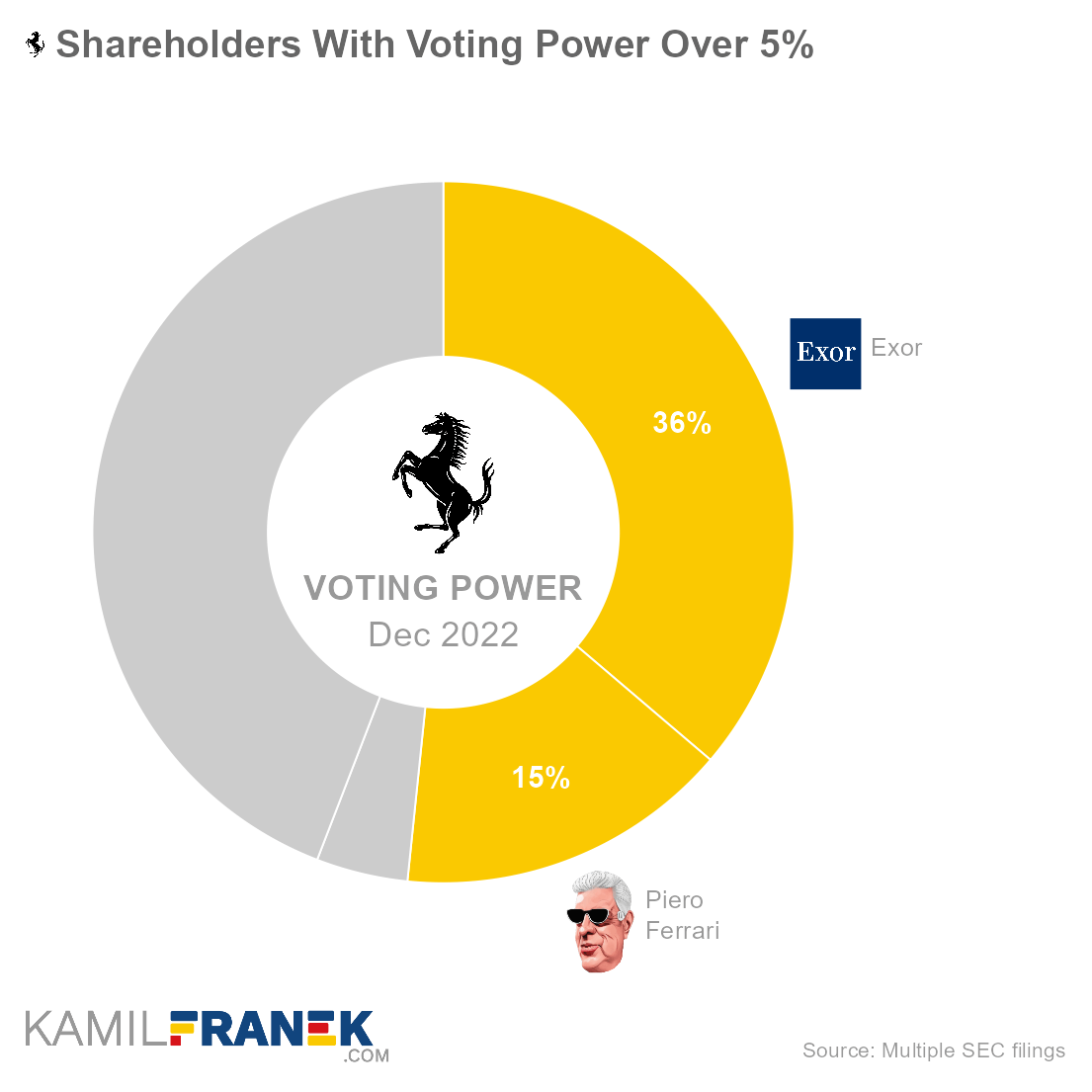

Ferrari’s shareholders with the largest voting power are Exor, which holds 36.2% of all votes, followed by Piero Ferrari, with 15.4% voting power, and BlackRock (4.2%).

As you can see, the size of voting power is not equal to ownership. The reason why certain shareholders have outsized voting power compared to their ownership stake is that Ferrari N.V. has two types of outstanding shares.

- Common Shares: These are regular shares traded in New York and Milan and have one vote per share.

- Special Voting Shares: These shares can be held only by the shareholders that held Ferrari N.V. common shares for at least three years. They have negligible economic rights but give their holder an extra vote per share.

Ferrari’s shareholder with the largest voting power is holding company Exor, which holds 36.2% of all votes. Exor owns 24.4% of Ferrari, but its voting power is boosted by special voting shares they own.

- Exor is controlled by the Agnelli family. The head of the family seems to be John Elkann, the heir of Giovanni Agnelli, his grandfather.

- John Elkann is CEO and chairman of Exor N.V. and represents the interests of Exor on Ferrari’s board of directors as chairman.

Ferrari’s shareholder with the second-largest voting power is Piero Ferrari, who holds 15.4% of all votes. Piero Ferrari owns just 10.4% of the Ferrari, but its voting power is the result of special voting shares.

- Piero Ferrari is also a member of Ferrari’s board.

Together, Exor N.V., and Piero Ferrari, own 35% of Ferrari. And because both Piero and Exor own special voting shares, they together control Ferrari with 52% voting power.

Currently, special voting shares are held only by Exor N.V. and Piero Ferrari, giving them double the votes they would otherwise have. Therefore they together control the company.

Also, Piero Ferrari and Exor N.V. has signed a shareholder agreement and are consulting their positions before shareholder meetings. They also have agreements that if Piero decides to sell, Exor N.V. has the right to match the offer, and if Exor decides to sell its stake, Piero Ferrari has the right to make the first offer.

To sum up, Exor and Piero Ferrari, when acting together, are in charge, except on matters where two-thirds of shareholder votes are needed.

What could shake up their tight control of Ferrari is if another shareholder, for example, BlackRock, holds its shares for more than three years and asks the company to assign them special voting shares too. If that happens, Exor and Piero Ferrari will have less than 50% of the votes, which would probably force them to buy more shares on the market to get the company back under their control.

Ferrari ‘s important insiders are mainly CEO Benedetto Vitna, chairman of the board John Elkann (who represents the Agnelli family), and other board members and executives.

- Ferrari’s board has ten (10) members.

- Nobody from the board of directors or executive officers, except Piero Ferrari, holds more than 0.05% of Ferrari’s shares.

🗳️ Breakdown of Ferrari’s Outstanding Shares and Votes by Top Shareholders

Ferrari N.V. had a total of 182 million outstanding shares as of December 2022. The following table shows how many shares each Ferrari’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Exor | 44 | 44 | 24.4% | |

| Piero Ferrari | 19 | 19 | 10.4% | |

| BlackRock | 10 | 10 | 5.7% | |

| Other | 108 | 108 | 59.5% | |

| Total (# millions) | 182 | 182 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 245 million votes distributed among shareholders of Ferrari N.V.. The table below shows the total number of votes for each large shareholder.

|

|

|||||

| In millions of votes as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Exor | 44 | 44 | 89 | 36.2% | |

| Piero Ferrari | 19 | 19 | 38 | 15.4% | |

| BlackRock | 10 | - | 10 | 4.2% | |

| Other | 108 | 0 | 108 | 44.1% | |

| Total (# millions) | 182 | 63 | 245 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

💵 Breakdown of Ferrari’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Ferrari N.V. worth.

However, keep in mind that a stake in Ferrari could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Exor | $9.5 | $9.5 | 24.4% | |

| Piero Ferrari | $4.0 | $4.0 | 10.4% | |

| BlackRock | $2.2 | $2.2 | 5.7% | |

| Other | $23.2 | $23.2 | 59.5% | |

| Total ($ billions) | $39.0 | $39.0 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Ferrari shareholder individually.

📒 Who Are Ferrari’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Ferrari N.V. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Ferrari worth.

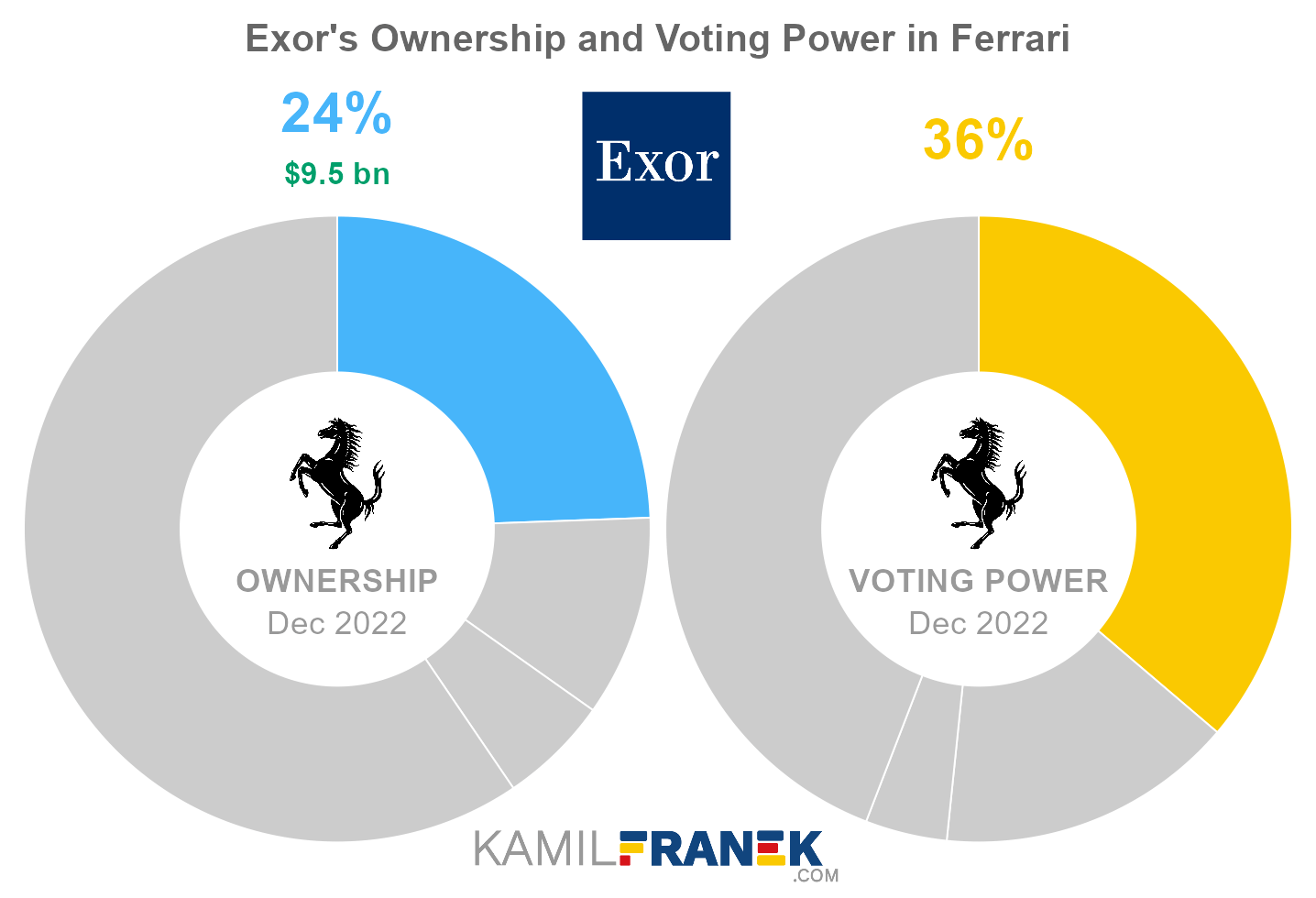

#1 Exor (24.4%)

Exor is the largest shareholder of Ferrari, owning 24.4% of its shares. However, Exor controls 36.2% of all votes thanks to owning special voting shares. As of December 2022, the market value of Exor’s stake in Ferrari was $9.5 billion.

Exor owned 44 million shares in Ferrari and controlled 89 million shareholder votes as of December 2022.

Exor N.V is a publicly traded holding company that owns significant stakes in companies like Ferrari, PartnerRE, Stellantis, CNH Industrial, Juventus, Iveco Group, and also The Economist Group. Exor also invested in several smaller startups.

Exor N.V. is controlled by the Agnelli family, who are descendants of Giovanni Agnelli, founder of Fiat. Thir control it through another dutch company Giovanni Agnelli B.V.

This control is evident from the company’s list of directors. Jonh Ellkan, chairman and CEO, is the grandson of Fiat founder Giovanni Agnelli and is his chosen heir. Board of Exor also includes his sister Ginevra Elkann and relatives Andrea Agnelli and Alessandro Nasi.

Exor is controlled by the family through company Giovanni Agnelli B.V. which owns 52% of the company and holds 85% of outstanding voting thanks to special voting shares.

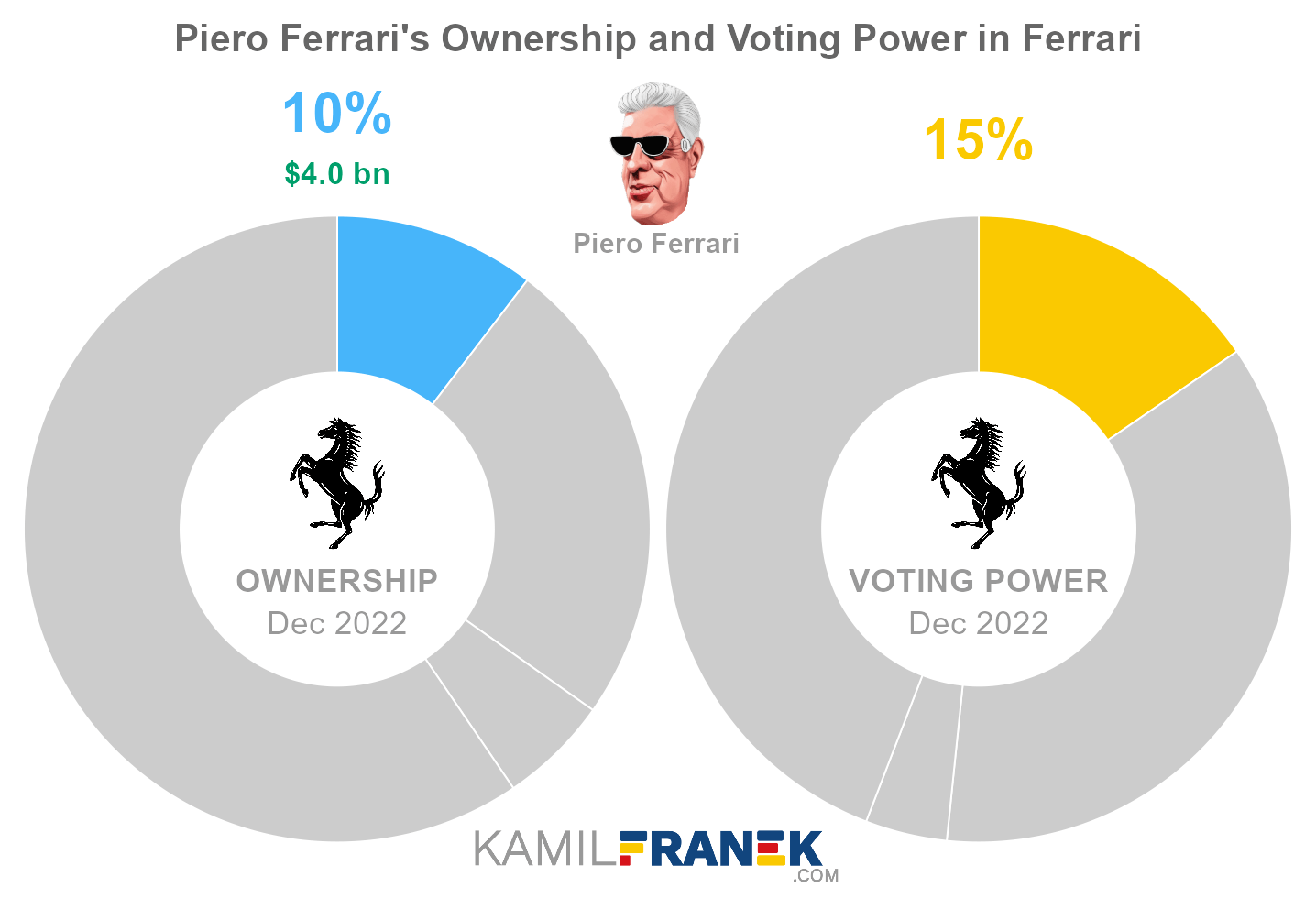

#2 Piero Ferrari (10.4%)

Piero Ferrari is the second-largest shareholder of Ferrari, owning 10.4% of its shares. However, Piero Ferrari controls 15.4% of all votes thanks to owning special voting shares. As of December 2022, the market value of Piero Ferrari’s stake in Ferrari was $4.0 billion.

Piero Ferrari owned 19 million shares in Ferrari and controlled 38 million shareholder votes as of December 2022.

Piero Lardi Ferrari is the son of Enzo Ferrari, Ferrari’s founder. After Enzo’s death, Piero became a sole heir of a 10% stake in the Ferrari company.

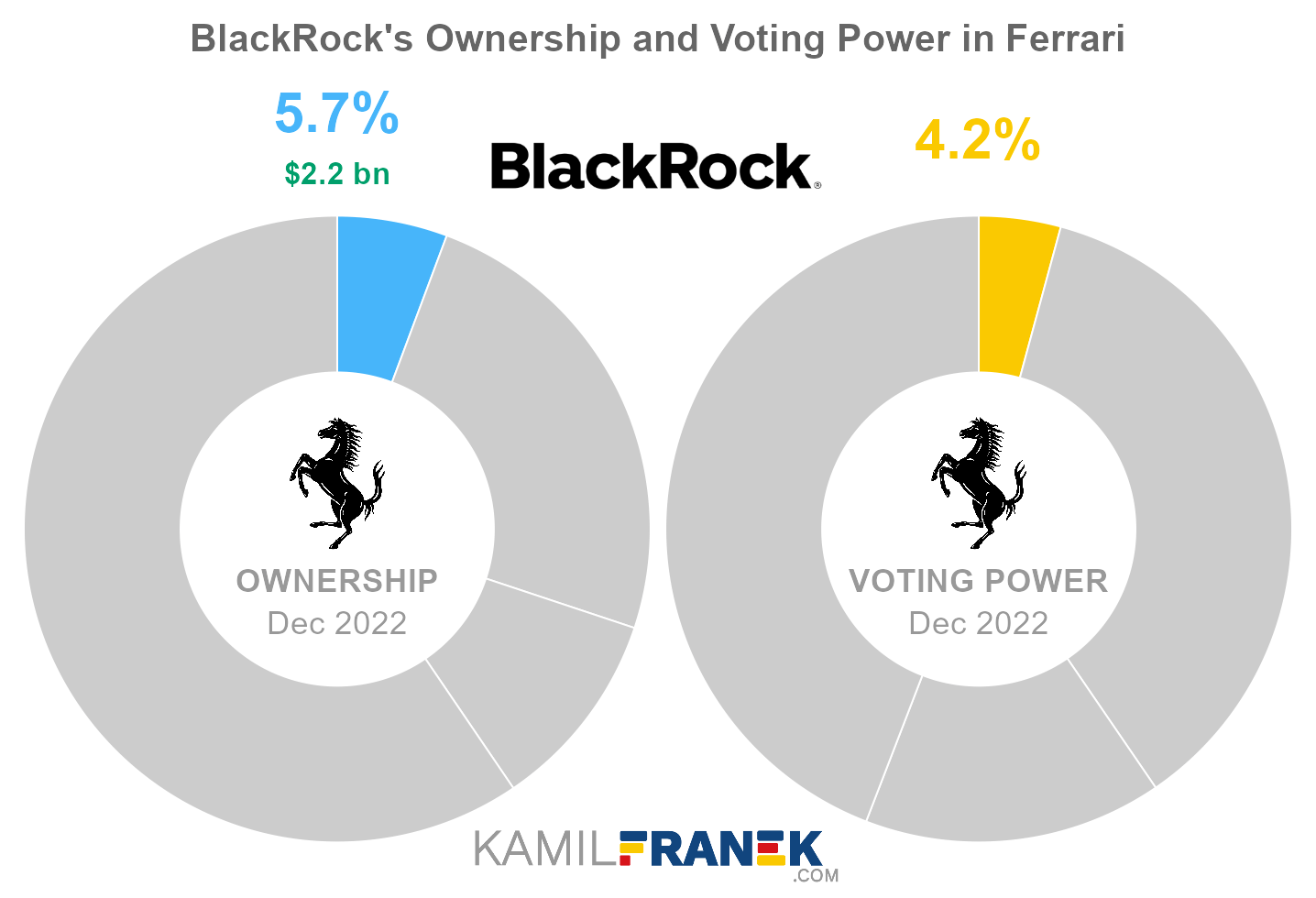

#3 BlackRock (5.7%)

BlackRock is the third-largest shareholder of Ferrari, owning 5.7% of its shares. However, because other shareholders hold super-voting shares, BlackRock’s voting power is only 4.2%. As of December 2022, the market value of BlackRock’s stake in Ferrari was $2.2 billion.

BlackRock owned 10 million shares in Ferrari and controlled 10 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

❔ Does Fiat Still Owns Ferrari?

Fiat acquired 90% of Ferrari in the 1960s, and Ferrari has been part of Fiat since that. However, soon after Fiat merged with Chrysler to form Fiat Chrysler Automobiles (FCA), they spun Ferrari into a separate public company in 2016. Ferrari is an independent company now.

Even though Ferrari is a public company, the Agnelli family, descendants of Fiat’s founding father Giovanni Agnelli, still own a significant stake in Ferrari through a company Exor, which they control.

Together Piere Ferrari, son of Ferrari’s founder, the Agnelli family, is controlling the majority of voting power in Ferrari through special voting shares they held, even though Piero Ferrari and Exor own “only” 35% of Ferrari’s capital.

🧱 Who and When Founded Ferrari?

Ferrari, a luxury sports car manufacturer, was founded in 1939 in Italy by Enzo Ferrari, father of the current second-largest shareholder, Piero Ferrari.

The first car was produced in 1940, but the first Ferrari-branded car was not produced until 1947.

📅 Ferrari’s History Timeline

These are selected events from Ferrari’s history:

- 1939: Ferrari was founded by Enzo Ferrari

- 1940: The first car produced (Tipo 815)

- 1947: The first Ferrari car produced (125 S)

- 1956: Enzo Ferrari’s firstborn son Alfredo died

- 1963: Ferrari withdrew from negotiations with Ford to sell his company

- 1965: Fiat acquired a small stake in Ferrari as it offered more flexibility

- 1969: Fiat acquired a 50% stake in Ferrari, which brought more money for investments into new models.

- 1988: Fiat increased its ownership to 90% of Ferrari, and Enzo retained a 10% stake.

- 1988: Enzo Ferrari passed away at the age of 90

- 2014: Fiat and Chrysler merged into Fiat Chrysler Automobiles (FCA)

- 2015: FCA sold 10% of Ferrari through a direct listing on the New York stock exchange, reducing its stake to 80%; Piero Ferrari owned 10%.

- 2016: Ferrari is spun off from FCA and becomes a separate company. Each FCA shareholder got one Ferrari share for each 10 FCA shares

- 2021: Benedetto Vigna becomes new CEO of Ferrari

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Coca-Cola: The Largest Shareholders Overview

Overview of who owns the Coca-Cola Company and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Xiaomi: The Largest Shareholders Overview

Overview of who owns Xiaomi and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Ferrari’s Annual Financials Statements (K-10)

- Ferrari’s Proxy Statement

- Ferrari’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.