Who Owns Zoom: The Largest Shareholders Overview

Zoom Video Communications, Inc. (ZM) makes money mainly by selling subscriptions for its Zoom communication platform to businesses. Zoom also offers paid plans for individuals and free plans with limited functionality. Its business experienced rapid growth during the COVID-19 pandemic. Let’s look at who owns Zoom and who controls it.

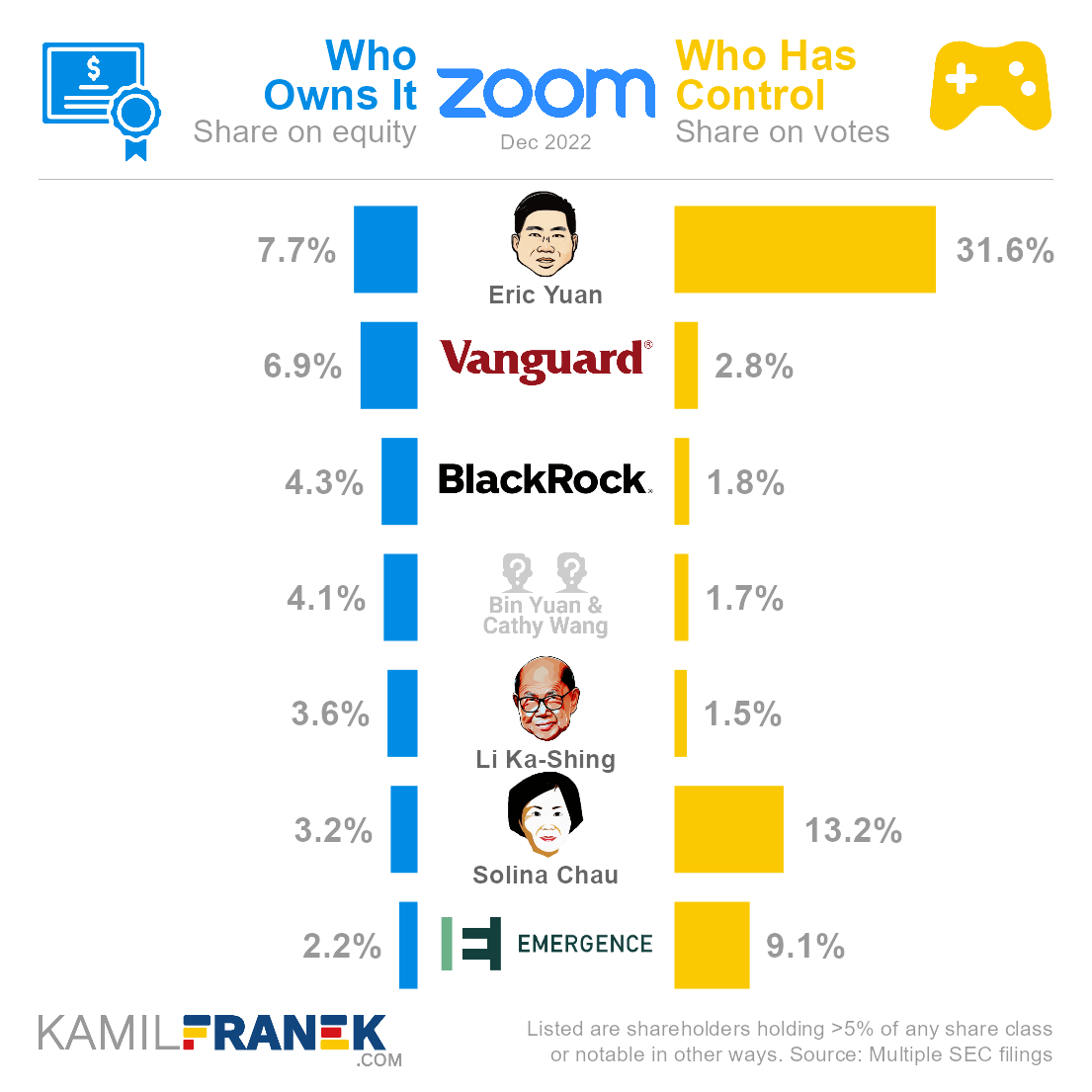

Zoom’s largest shareholders are its founder Eric Yuan, who owns a 7.7% share, followed by Vanguard (6.9%), BlackRock (4.3%), and Bin Yuan and Cathy Wang (4.1%). However, thanks to “super-voting” shares, Eric Yuan holds 31.6% of all votes and, together with Emergence and Solina Chau, control Zoom.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Eric Yuan | 7.7% | 31.6% | |

| Vanguard | 6.9% | 2.8% | |

| BlackRock | 4.3% | 1.8% | |

| Bin Yuan and Cathy Wang | 4.1% | 1.7% | |

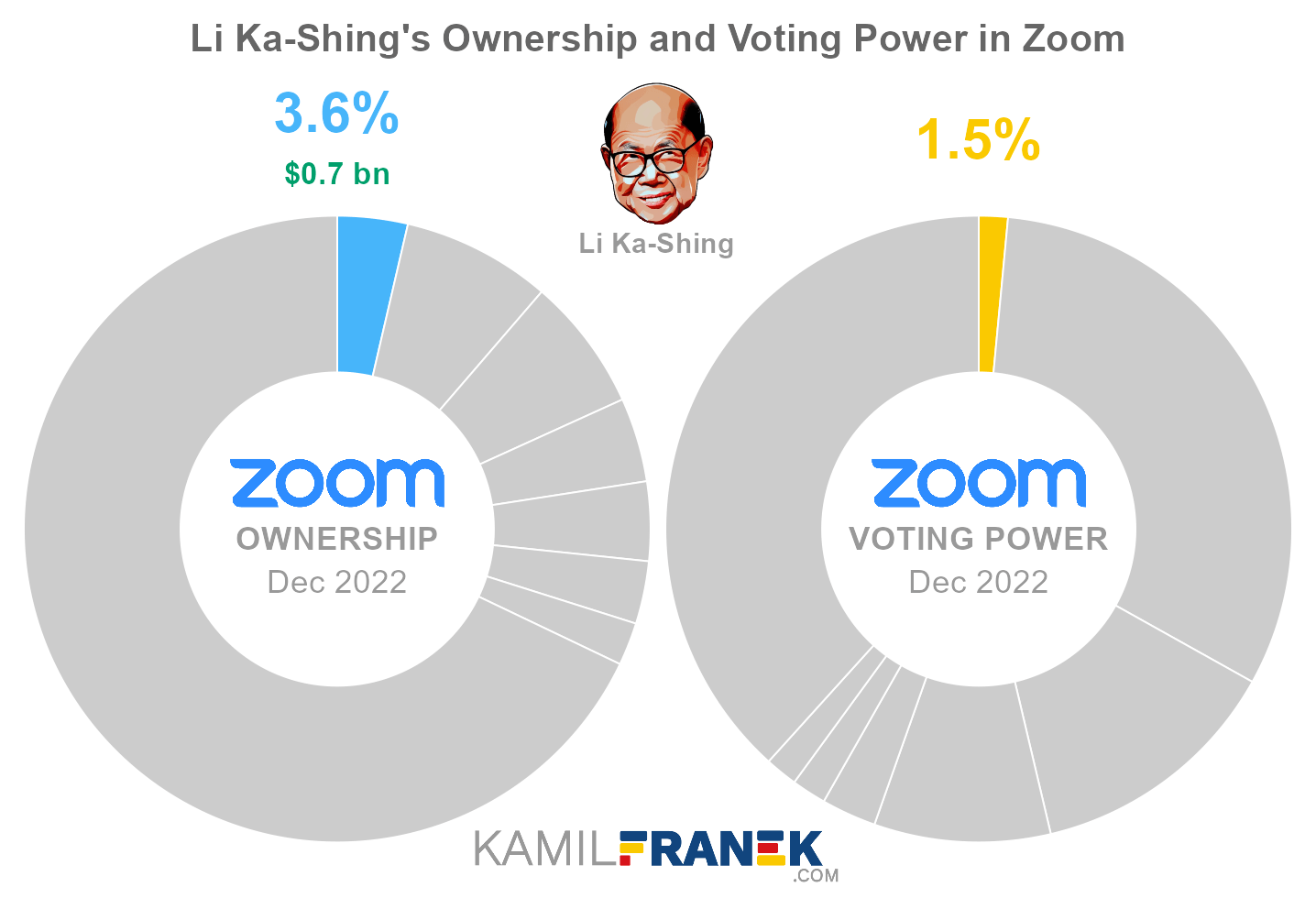

| Li Ka-Shing | 3.6% | 1.5% | |

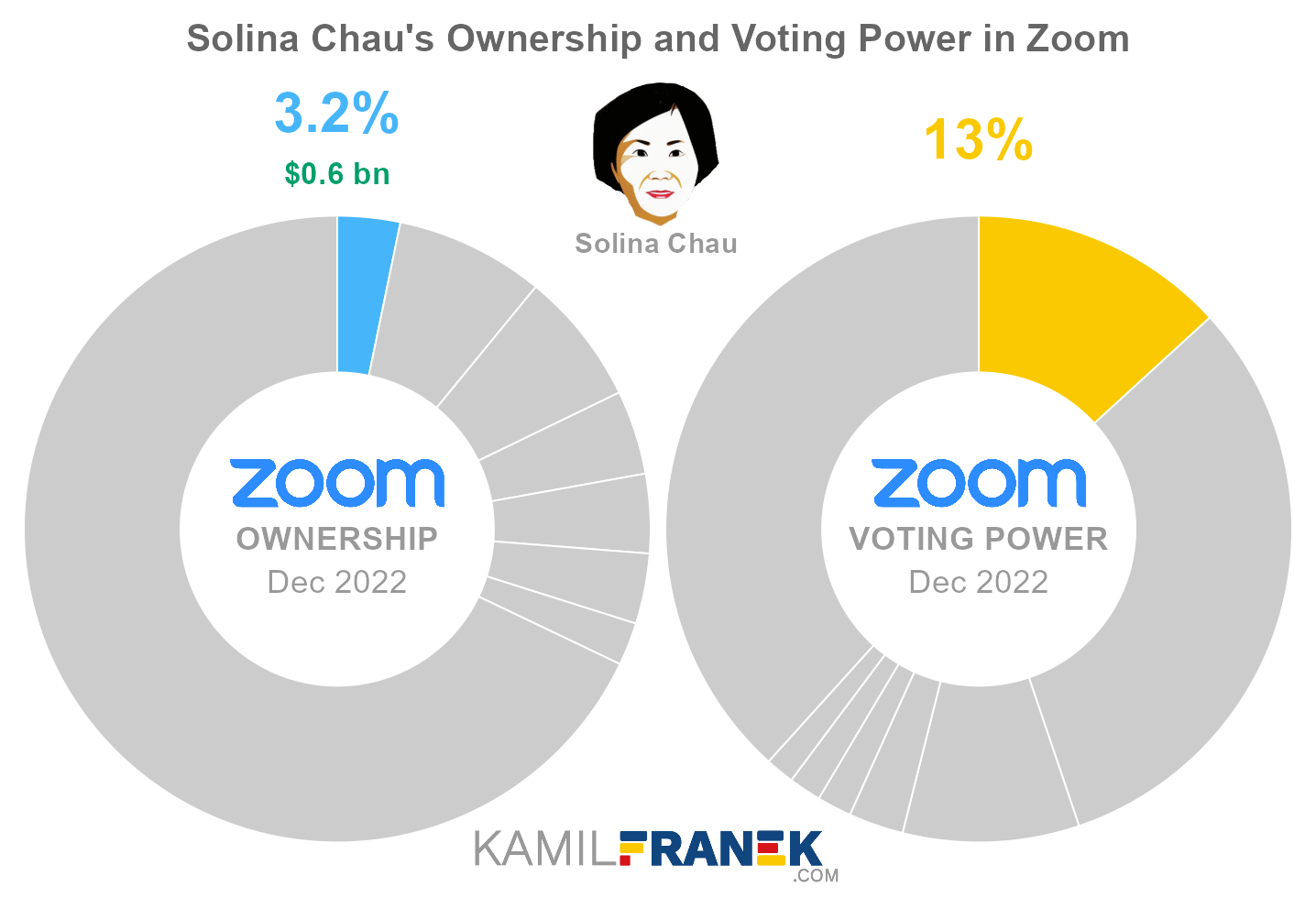

| Solina Chau | 3.2% | 13.2% | |

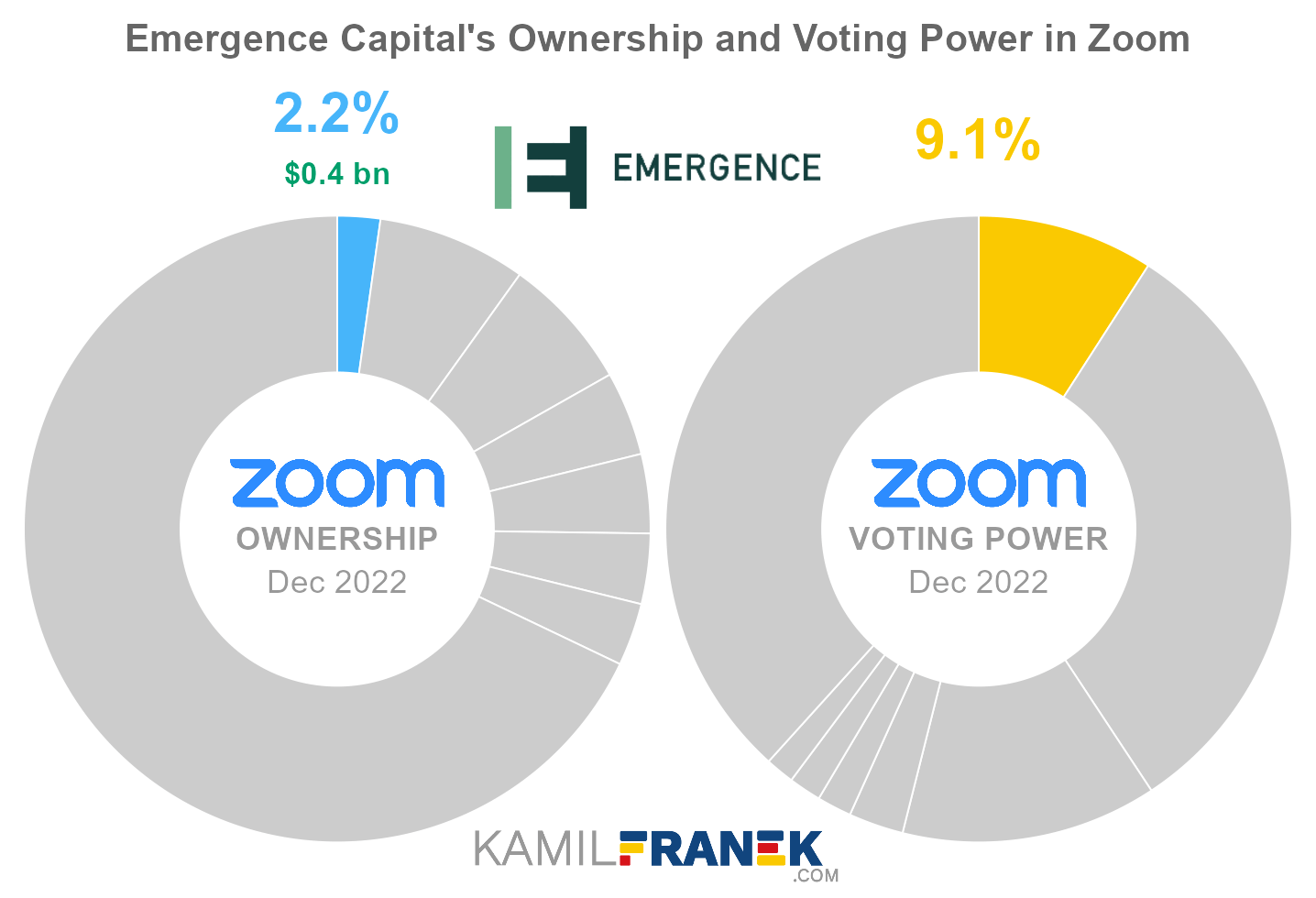

| Emergence Capital | 2.2% | 9.1% | |

| Other | 67.9% | 38.3% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Zoom and who controls it. I will show you who Zoom’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Roblox, Netflix, Twitter, Microsoft, or Spotify.

📃 Who Owns Zoom?

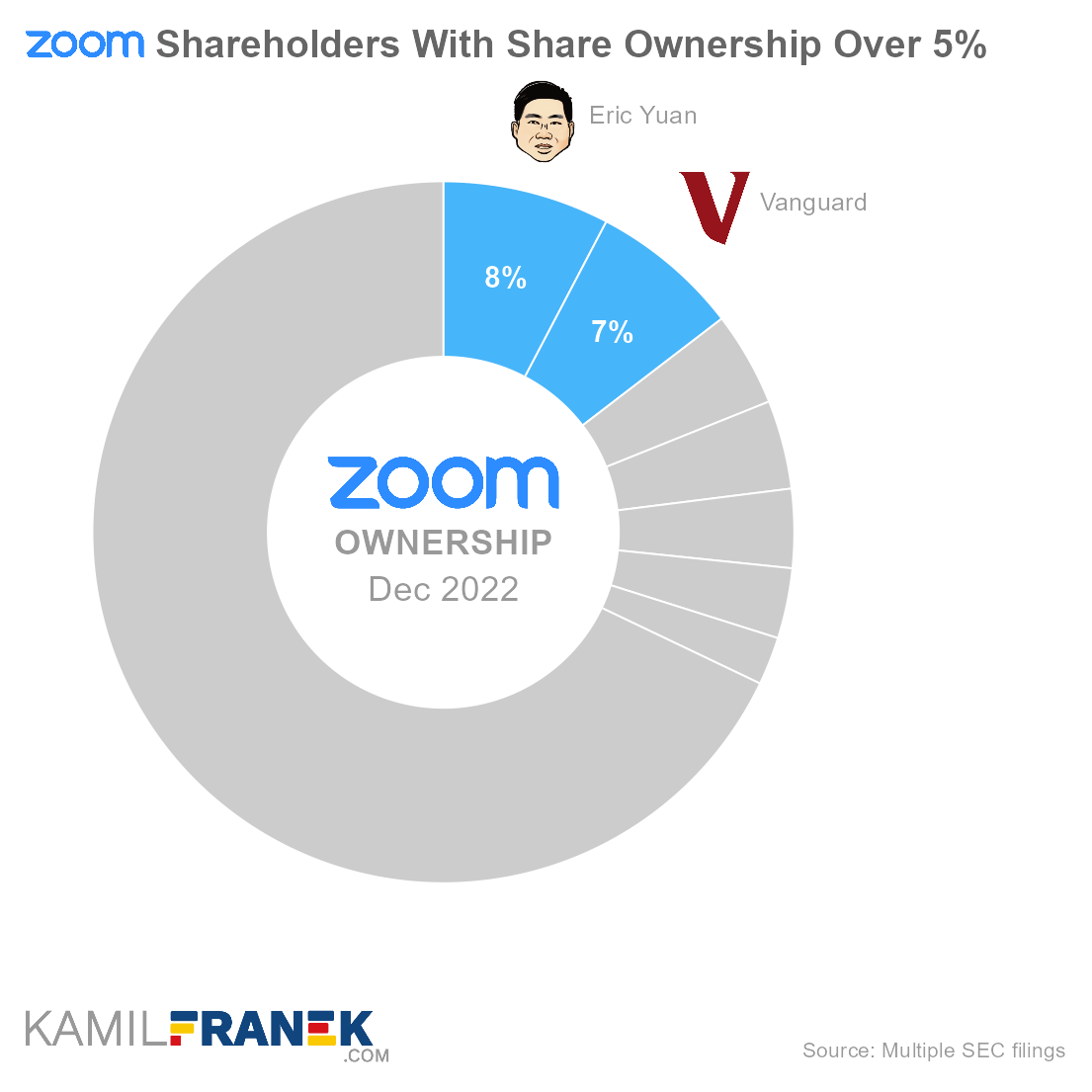

Zoom is owned by its shareholders. The largest ones are founder and CEO Eric Yuan, who owns 7.7% of the company, followed by Vanguard (6.9%), BlackRock (4.3%), and Bin Yuan and Cathy Wang (4.1%). The notable owners are also Li Ka-Shing (3.6%), Solina Chau (3.2%), and Emergence Capital (2.2%).

The largest owner of Zoom is its founder, CEO, and chairman of the board Eric Yuan, which owns 7.7% of the company. He and several other pre-IPO shareholders hold super-voting Class B shares, giving them outsized voting power.

- He owns most of his shares through 2018 Yuan and Zhang Revocable Trust, for which Mr. Yuan and his spouse serve as cotrustees.

The second and third largest Zoom owners are asset managers Vanguard and BlackRock. They are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies.

The list of Zoom shareholders also includes Bin Yuan & Cathy Wang because they are trustees of a trust that owns a sizable amount of Zoom’s shares. I don’t know who exactly Bin Yuan is, but based on SEC filings, he is an immediate family member of Zoom’s founder Eric Yuan. Bill Yuan also appears in Zooms SEC fillings before the IPO as a shareholder, although with a much smaller stake.

- Ownership stake under Bin Yuan & Cathy Wang is probably connected to Eric Yuan’s stock transfer from 2021, where he gifted a sizable part of his Zoom stake to somebody else.

- During this transaction, Eric Yuan’s B Class shares were converted into ordinary shares. So by doing this, Eric Yuan weakened his control over Zoom. This is surprising because transfer among family members does not need to trigger conversion to ordinary shares according to the company’s certificate of incorporation.

- In 2022, the ownership of Bin Yuan & Cathy Wang sizably decreased.

A sizable owner is also Li Ka-Shing, Hong Kong’s richest man., who owns 4.3% of the company.

- He significantly reduced his position compared to the end of 2021, together with other early shareholders.

The other two sizable shareholders, especially when it come to super-voting shares, is Solina Chau ( 3.2% ownership and 13.2% voting power) and Emergence Capital ( 2.2% ownership, 9.1% voting power) They do not own over 5% stake but are important owners of Class B super-voting shares.

- Emergence Capital is a venture capital firm that invested in Zoom in 2015. Their stake before the IPO was significant, nearly 13%.

- Solina Chau, Li Ka-Shing’s close friend and business partner, owned in 2021 a smaller stake but of super-voting shares. That made Solina Chau the second largest shareholder according to voting power.

- Ms. Chau, in the older 2019 SEC filing, disclaimed having beneficiary ownership of Zoom despite being the sole shareholder of company Puccini World Limited which owns the stake in Zoom. This disclaimer did not appear in more recent fillings anymore.

- Neither Ms. Chau nor Emergence Capital filed an updated 13GA report in 2023, values I included are based on previous year submissions, assuming they did not fill the report because there was no change in their ownership.

Compared to the end of the previous year, you won’t find T. Rowe Price on the list of largest shareholders because they drastically reduced their ownership during 2022.

Zoom was founded in 2011 by Eric Yuan, who was the former vice president for Cisco Webex. Zoom has been a publicly listed company since its initial public offering on NASDAQ in 2019 (Ticker: ZM).

- Right before the IPO, the largest shareholders, next to Eric Yuan with 19.9% share, were Emergence Capital Partners (12.6%), Sequoia Capital (11.4%), and Digital Mobile Venture (8.8%).

Zoom Video Communications, Inc. is incorporated in the State of Delaware (US), but its headquarters are in San Jose, California (US).

🎮 Who Controls Zoom (ZM)?

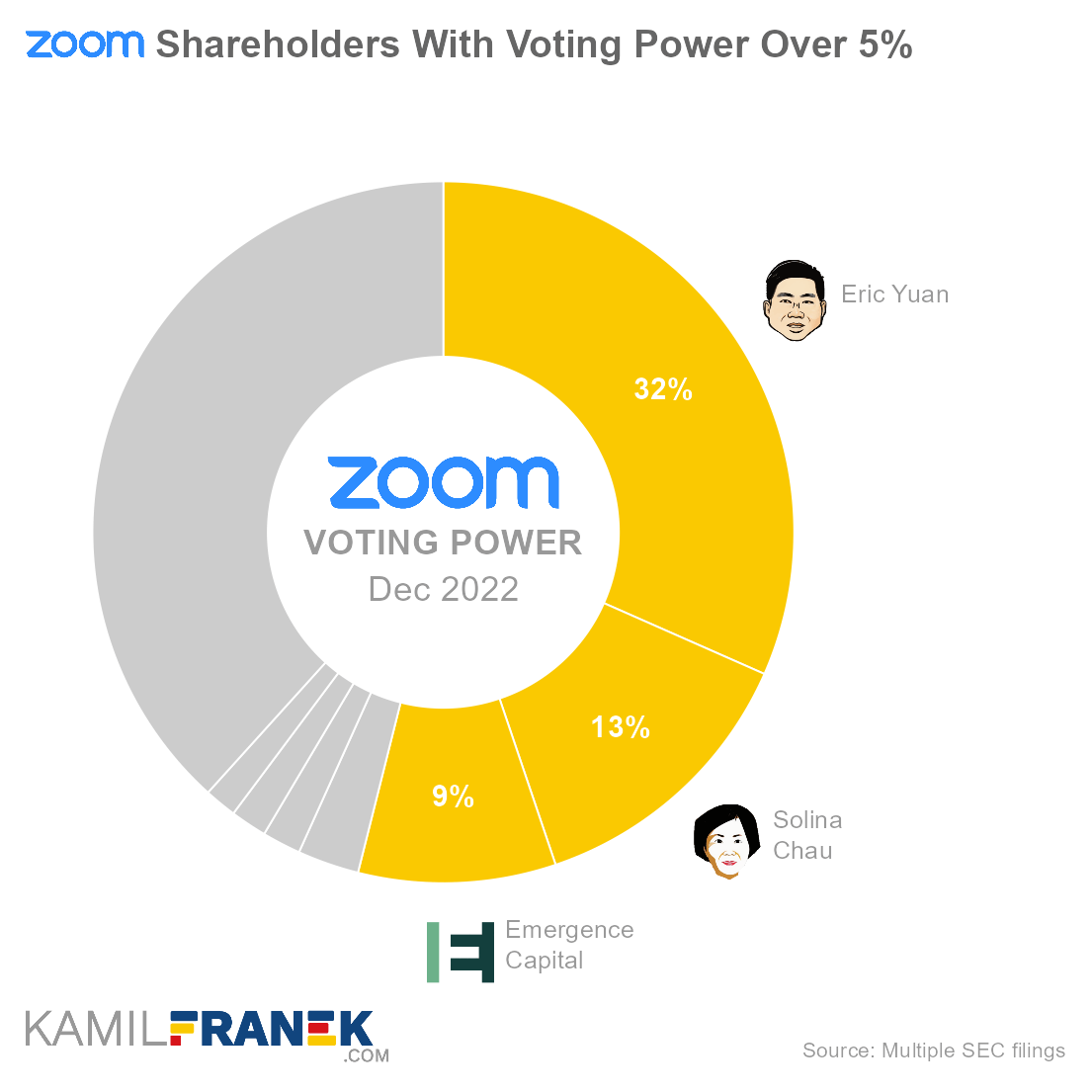

Zoom’s shareholders with the largest voting power are founder and CEO Eric Yuan, who holds 31.6% of all votes, followed by Solina Chau , with 13.2% voting power, and venture capital firm Emergence Capital, with 9.1% voting power. Together, the largest three shareholders control Zoom.

As you can see above, the size of voting power is not equal to ownership. The reason why Eric Yuan and other shareholders have outsized voting power compared to their ownership stake is that Zoom Video Communications, Inc. has two classes of outstanding shares, with different rights.

- Class A shares: These are regular shares publicly traded under the ZM ticker and have one vote per share.

- Class B shares: Owned by shareholders like founder Eric Yuan, Solina Chau, or Emergence Capital. They have ten(10) votes per share instead of one, giving those shareholders outsized voting power in Zoom.

Zoom’s shareholder with the largest voting power is founder and CEO Eric Yuan, who holds 31.6% of all votes. Eric Yuan owns “just” 7.7% of Zoom, and his voting power is boosted by super-voting shares.

- His voting power and the voting power of other Class B shareholders increased because the number of Class B shares outstanding decreased.

Currently, Eric Yuan is not fully controlling a majority of votes in Zoom, but with his voting power and position of CEO and Chairman, he is the person in charge. As you can see in the case of Tesla, you don’t have to own a majority stake to sway the decisions your way.

Additionally, assuming that Eric Yuan has the support of Solina Chau and Emergence Capital and his relatives who own Zoom shares, they together hold the majority of voting power and fully control the company.

Zoom bylaws also make it difficult to easily replace the board by using a classified board system where directors are split into three groups (classes). In each ear, only one group is up for reelection for a three-year term.

But the power of super-voting Class B shares that gives some Zoom shareholders outsize voting power is not forever. Class B shares will lose their super-voting power and automatically convert to Class A shares 15 years after IPO, which means in 2034. Until then, few early shareholders will control Zoom without owning the majority of equity.

Class B shares can cease to exist also earlier than 2034 in the following situations:

- If current CEO Eric Yuan leaves the company or cannot do his job properly thanks to illness or death. In that case, class B shares will transform into normal ones after six months.

- If current Class B shareholders sell their shares, they will lose their super-voting power and turn into Class A shares.

- If holders of Class B shares agree, they can get rid of their supper-voting power earlier.

Above mentioned 15 years limit on super-voting shares is not something specific to Zoom. For example, Roblox has similar rules applied to the super-voting shares.

Other Zoom insiders that have influence over the company (except CEO) are other board members and executives. However, because of Eric Yuan’s voting power, it is clear that he is the one holding the reigns of the company.

- Zoom has a 10-member board of directors.

- Nobody from the board of directors or executive officers holds more than 0.05% of Zoom ‘s shares except Santiago Subotovsky, who is the company’s director and partner of early shareholder Emergence Capital.

🗳️ Breakdown of Zoom’s Outstanding Shares and Votes by Top Shareholders

Zoom Video Communications, Inc. had a total of 293 million outstanding shares as of December 2022. The following table shows how many shares each Zoom’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Eric Yuan | - | 23 | 23 | 7.7% | |

| Vanguard | 20 | - | 20 | 6.9% | |

| BlackRock | 13 | - | 13 | 4.3% | |

| Bin Yuan and Cathy Wang | 12 | - | 12 | 4.1% | |

| Li Ka-Shing | 11 | - | 11 | 3.6% | |

| Solina Chau | 0 | 9 | 9 | 3.2% | |

| Emergence Capital | - | 6 | 6 | 2.2% | |

| Other | 191 | 8 | 199 | 67.9% | |

| Total (# millions) | 246 | 47 | 293 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

There were 713 million votes distributed among shareholders of Zoom Video Communications, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

|||||

| In millions of votes as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Eric Yuan | - | 225 | 225 | 31.6% | |

| Solina Chau | 0 | 94 | 94 | 13.2% | |

| Emergence Capital | - | 65 | 65 | 9.1% | |

| Vanguard | 20 | - | 20 | 2.8% | |

| BlackRock | 13 | - | 13 | 1.8% | |

| Bin Yuan and Cathy Wang | 12 | - | 12 | 1.7% | |

| Li Ka-Shing | 11 | - | 11 | 1.5% | |

| Other | 191 | 82 | 273 | 38.3% | |

| Total (# millions) | 246 | 467 | 713 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Owning class B shares with ten(10) votes per share gives some shareholders larger voting power compared to shareholders who own regular shares that are publicly traded.

💵 Breakdown of Zoom’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Zoom Video Communications, Inc. worth.

However, keep in mind that a stake in Zoom could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Eric Yuan | - | $1.5 | $1.5 | 7.7% | |

| Vanguard | $1.4 | - | $1.4 | 6.9% | |

| BlackRock | $0.9 | - | $0.9 | 4.3% | |

| Bin Yuan and Cathy Wang | $0.8 | - | $0.8 | 4.1% | |

| Li Ka-Shing | $0.7 | - | $0.7 | 3.6% | |

| Solina Chau | $0.0 | $0.6 | $0.6 | 3.2% | |

| Emergence Capital | - | $0.4 | $0.4 | 2.2% | |

| Other | $12.9 | $0.6 | $13.5 | 67.9% | |

| Total ($ billions) | $16.7 | $3.2 | $19.9 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Let’s now look at each Zoom shareholder individually.

📒 Who Are Zoom’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Zoom Video Communications, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Zoom worth.

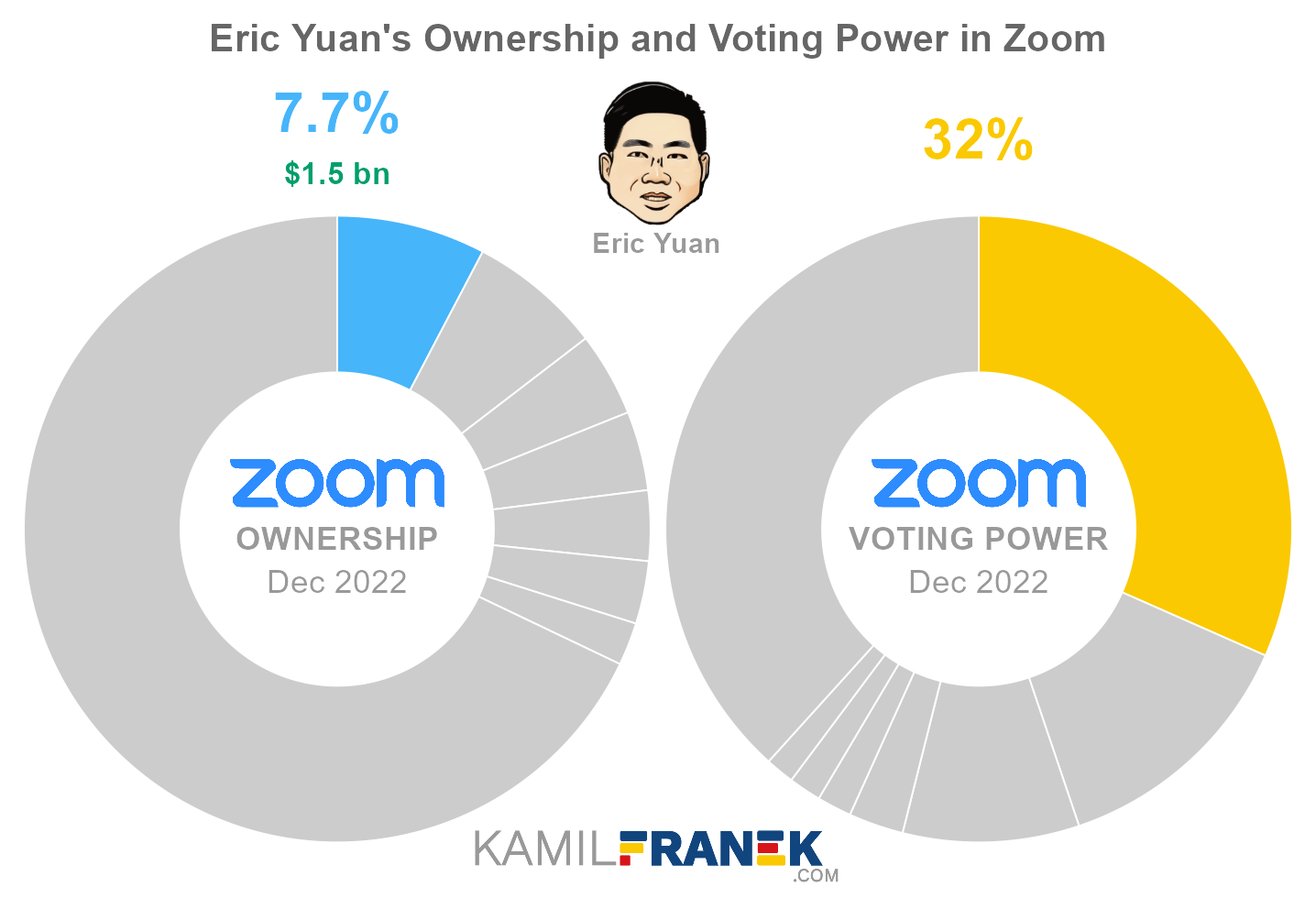

#1 Eric Yuan (7.7%)

Eric Yuan is the largest shareholder of Zoom, owning 7.7% of its shares. However, Eric Yuan controls 31.6% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Eric Yuan’s stake in Zoom was $1.5 billion.

Eric Yuan owned 23 million shares in Zoom and controlled 225 million shareholder votes as of December 2022.

Erik Yuan is a founder, major shareholder, and CEO of Zoom Video Communications Inc. He was born and raised in China, but in 1997 moved to the US and, since 2007, has been a United States citizen.

After moving to the US, Yuan worked for a startup called WebEx, where he was one of the early hires. The company was later acquired by Cisco, and Yuan became vice president of engineering there.

When his idea of a smartphone-friendly video conferencing system got rejected at Cisco, he founded his own company Zoom Video Communications in 2011.

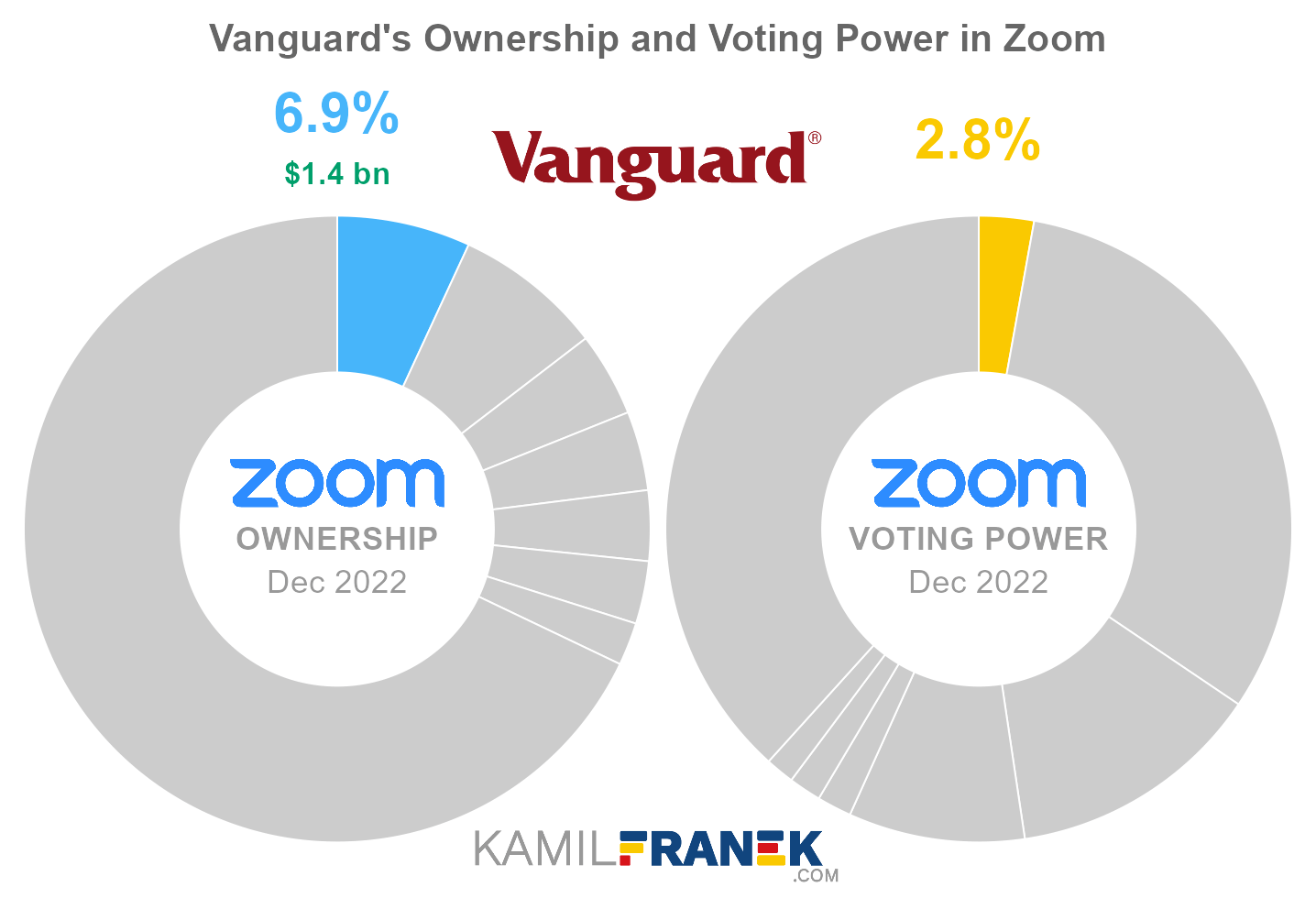

#2 Vanguard (6.9%)

Vanguard is the second-largest shareholder of Zoom, owning 6.9% of its shares. However, because other shareholders hold super-voting shares, Vanguard’s voting power is only 2.8%. As of December 2022, the market value of Vanguard’s stake in Zoom was $1.4 billion.

Vanguard owned 20 million shares in Zoom and controlled 20 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

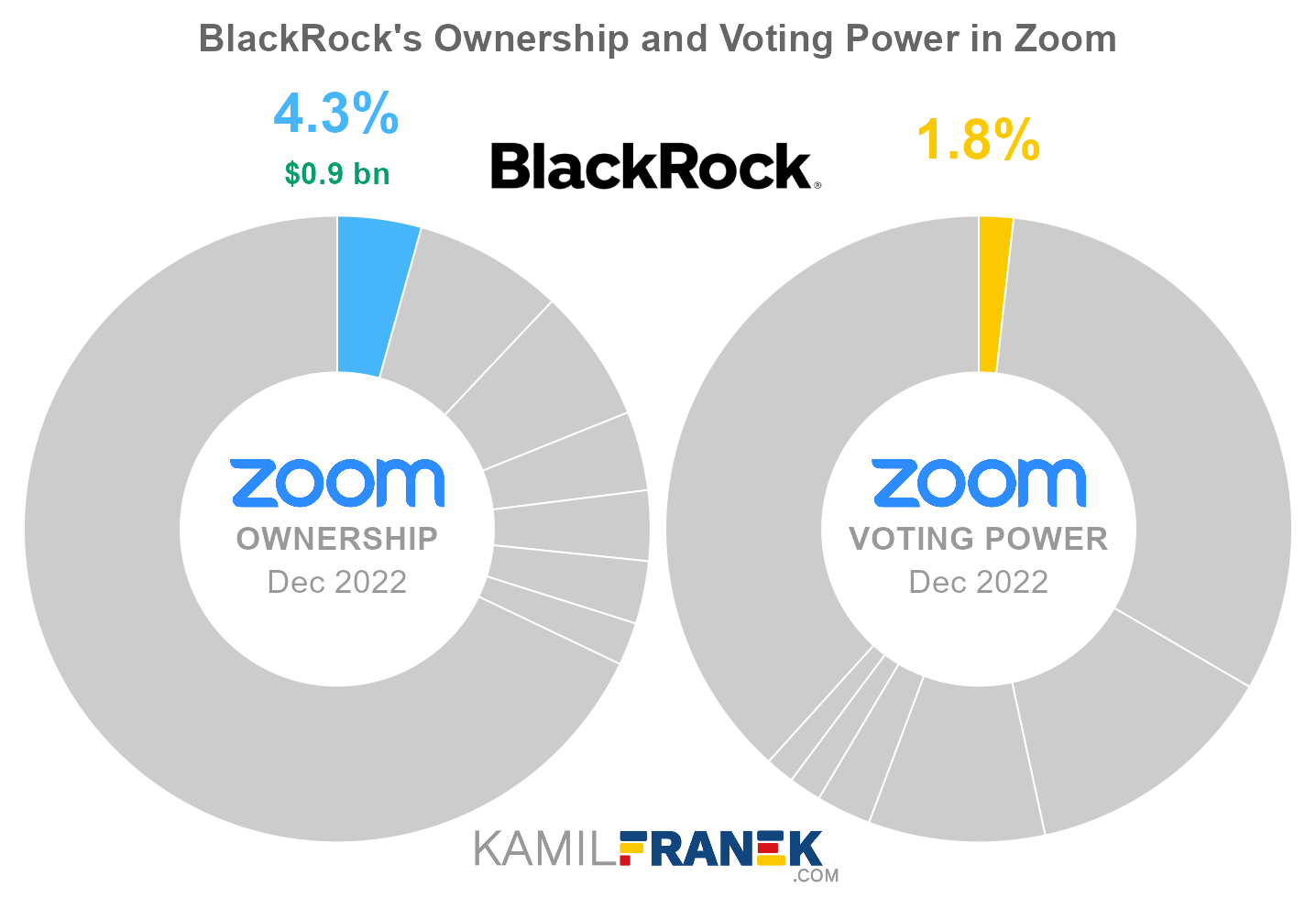

#3 BlackRock (4.3%)

BlackRock is the third-largest shareholder of Zoom, owning 4.3% of its shares. However, because other shareholders hold super-voting shares, BlackRock’s voting power is only 1.8%. As of December 2022, the market value of BlackRock’s stake in Zoom was $0.9 billion.

BlackRock owned 13 million shares in Zoom and controlled 13 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

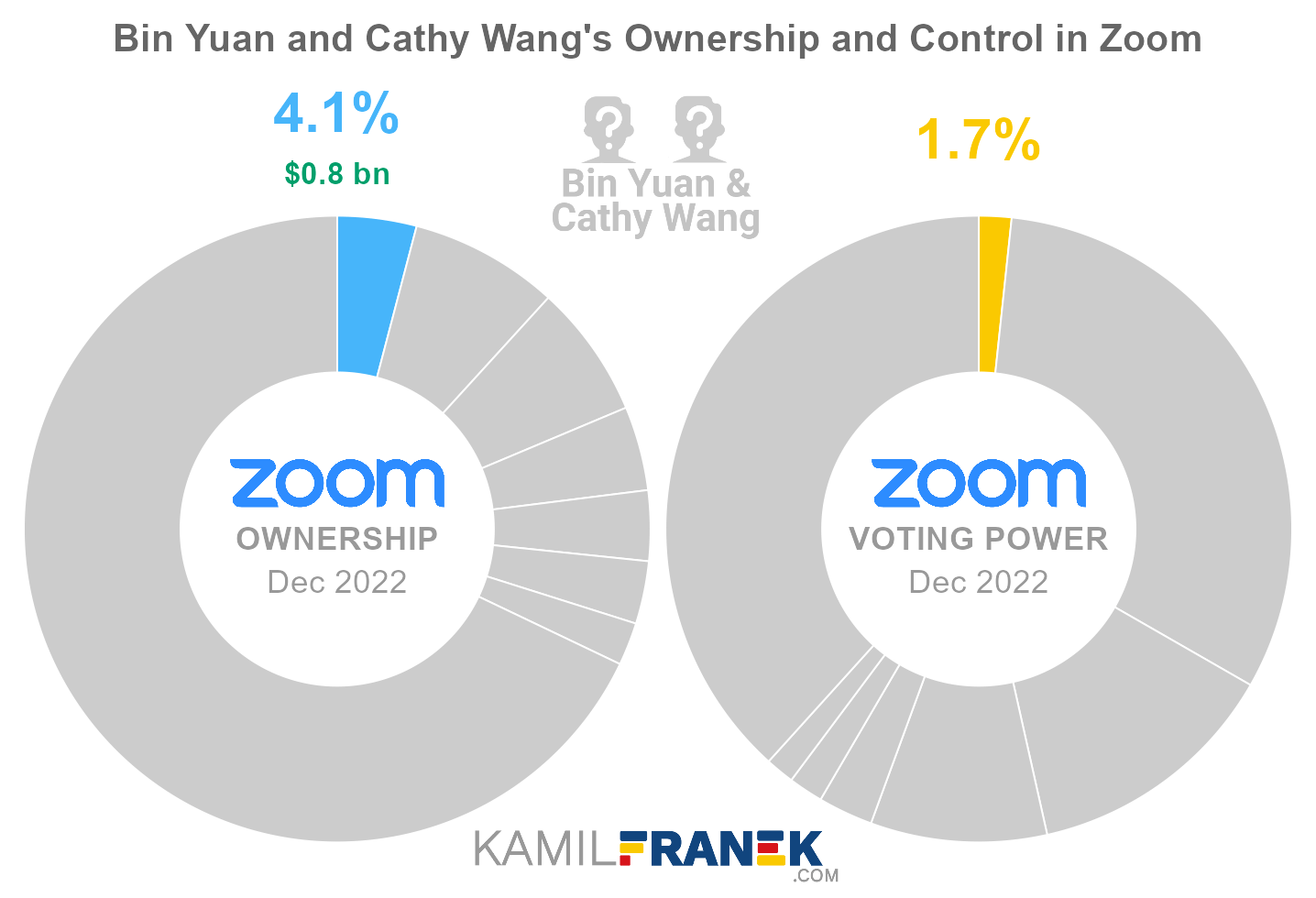

#4 Bin Yuan and Cathy Wang (4.1%)

Bin Yuan and Cathy Wang own 4.1% of Zoom’s shares. However, because other shareholders hold super-voting shares, Bin Yuan and Cathy Wang’s voting power is only 1.7%. As of December 2022, the market value of Bin Yuan and Cathy Wang’s stake in Zoom was $0.8 billion.

Bin Yuan and Cathy Wang owned 12 million shares in Zoom and controlled 12 million shareholder votes as of December 2022.

Unfortunately, there is not much that could be said about “Bin Yuan And Cathy Wang.” They are trustees of a trust that owns a stake in Zoom Video Communications, and Bin Yuan is an immediate family member of CEO Eric S. Yuan.

#5 Li Ka-Shing (3.6%)

Li Ka-Shing owns 3.6% of Zoom’s shares. However, because other shareholders hold super-voting shares, Li Ka-Shing’s voting power is only 1.5%. As of December 2022, the market value of Li Ka-Shing’s stake in Zoom was $0.7 billion.

Li Ka-Shing owned 11 million shares in Zoom and controlled 11 million shareholder votes as of December 2022.

Li Ka-shing is a business tycoon and the most wealthy billionaire in Hong Kong, where he is based. Hi is currently in his 90-ties and stepped down from active management of his conglomerate, but he still serves as an adviser and major shareholder.

His conglomerate ranges across many industries, including real estate, operating container ports, telecommunication, and retail. He was also an early investor in Facebook, Spotify, and Zoom.

He is a very generous philanthropist and pledged to donate a third of his wealth to his foundation. His foundation is considered to be the second largest private foundation in the world after Bill & Melinda Gates Foundation.

#6 Solina Chau (3.2%)

Solina Chau owns 3.2% of Zoom’s shares. However, Solina Chau controls 13.2% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Solina Chau’s stake in Zoom was $0.6 billion.

Solina Chau owned 9 million shares in Zoom and controlled 94 million shareholder votes as of December 2022.

Solina Chau is a Hong Kong based businesswoman. She is a close friend and business partner of Li Ka-Shing, Hong Kong’s richest man.

She owns a stake in Chinese tech company TOM Online and is also the founder of Horizons Ventures, which invested in a lot of US tech companies.

#7 Emergence Capital (2.2%)

Emergence Capital owns 2.2% of Zoom’s shares. However, Emergence Capital controls 9.1% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Emergence Capital’s stake in Zoom was $0.4 billion.

Emergence Capital owned 6 million shares in Zoom and controlled 65 million shareholder votes as of December 2022.

Emergence Capital is a venture capital firm that invests in companies in their early stage. One of their marquee investment is Zoom, where they invested in 2015 and still are partially invested in the company.

❔ Does Microsoft Own Zoom?

Microsoft does not own Zoom, and it is a separate publicly traded company. To my knowledge, Microsoft does have a stake in the company, although it is hard to know for sure since stakes under 5% do not require disclosure.

Of course, it is possible that Microsoft considered acquiring Zoom before, and there was even some unconfirmed rumor that Microsoft tried to acquire Zoom several times over the years, but founder Eric Yuan was not interested.

It is definitely a possibility that such acquisition attempts happened but take this info with a grain of salt.

❔Is Zoom a Chinese Company?

Zoom Video Communications, Inc. (Zoom) is not a Chinese company. It is US based company incorporated in Delaware in 2011. Zoom’s founder and top shareholder Eric Yuan is of Chinese origin, but he moved to the US in 1997 and, since 2007, has been a US citizen.

However, Zoom got under a lot of heat from US lawmakers about its Chinese links when it turned out Zoom fulfilled some Chinese government requests to block several meetings.

- The company defended those moves as a need to apply local laws and regulations based on the countries where the participants are.

- Adding to the concerns above is also the fact that Zoom has an engineering team in China, and several prominent financial backers are Hongkong based.

📅 Zoom’s History Timeline

These are selected events from Zoom’s history:

- 2011: Zoom was founded by Eric Yuan, who previously worked as vice president for Cisco Webex.

- 2019: Zoom’s initial public offering (IPO)

📚 Recommended Articles & Other Resources

Who Owns Starbucks: The Largest Shareholders Overview

Overview of who owns the Starbucks Corporation and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Twitter: The Largest Shareholders Overview

Overview of who owns Twitter and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Roblox: The Largest Shareholders Overview

Overview of who owns Roblox Corporation and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Netflix: The Largest Shareholders Overview

Overview of who owns Netflix and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Zoom’s Annual Financials Statements (K-10)

- Zoom’s Proxy Statement

- Zoom’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.