Who Owns Coca-Cola: The Largest Shareholders Overview

The Coca-Cola Company (KO) is an iconic business that makes money by manufacturing and selling beverages worldwide, especially its famous soft drinks. Let’s look at who owns Coca-Cola, and who controls it.

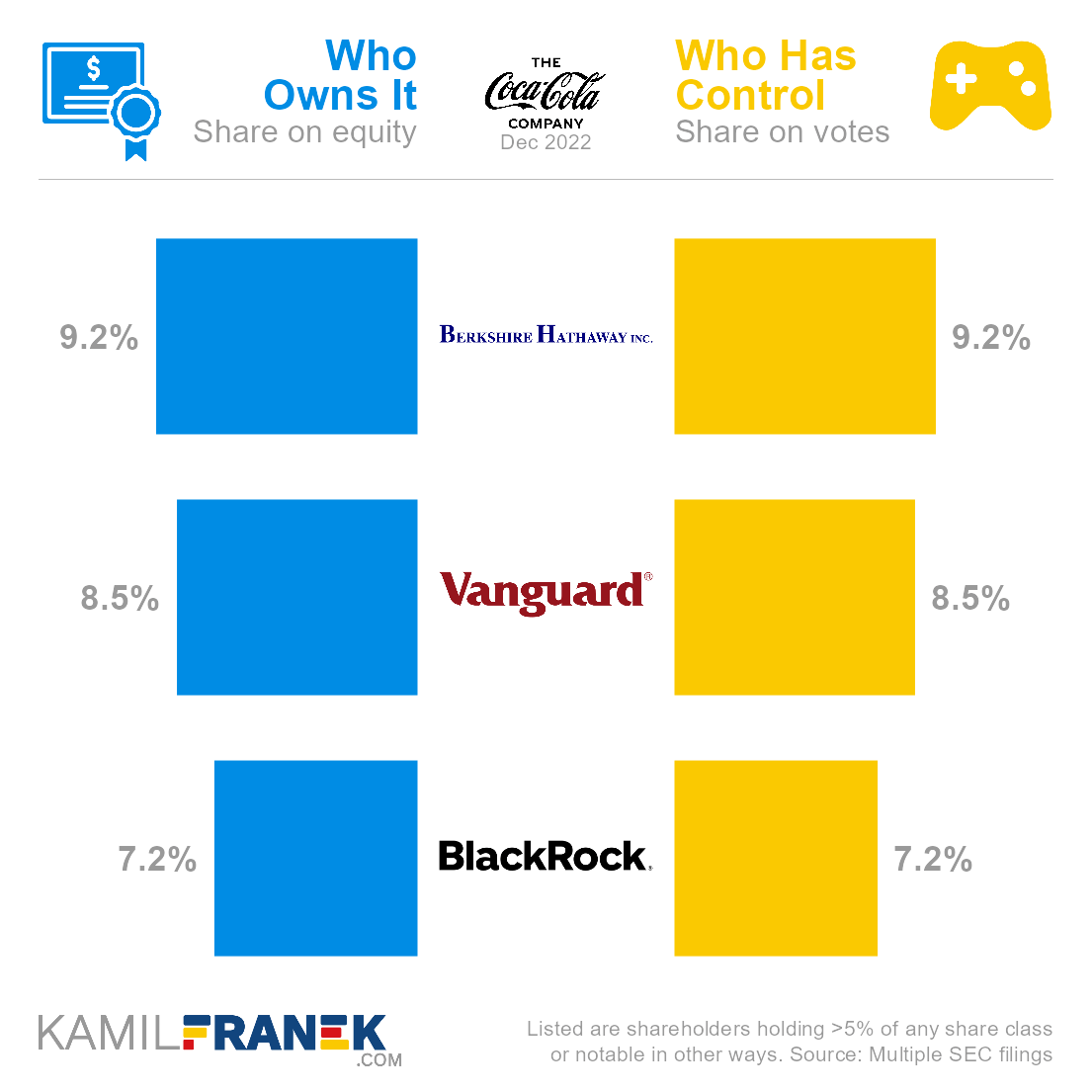

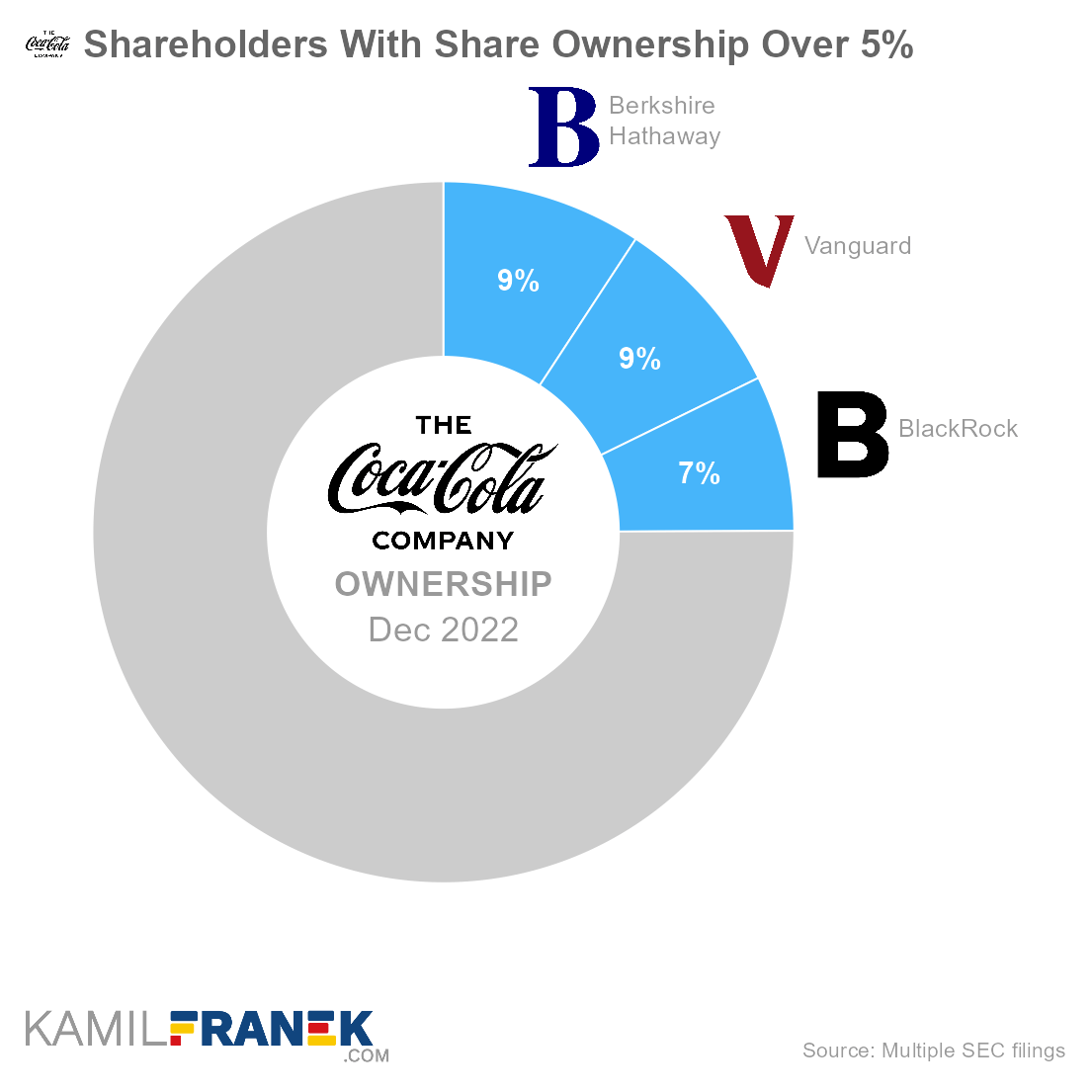

Coca-Cola’s largest shareholders are Berkshire Hathaway, a company led by legendary investor Warren Buffet, which owns 9.2% share, followed by asset manager Vanguard with 8.5% ownership, and asset manager BlackRock with 7.2% ownership share.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Berkshire Hathaway | 9.2% | 9.2% | |

| Vanguard | 8.5% | 8.5% | |

| BlackRock | 7.2% | 7.2% | |

| Other | 75.1% | 75.1% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Coca-Cola and who controls it. I will show you who Coca-Cola’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Apple, Meta (Facebook), Microsoft, IBM, or Tesla.

📃 Who Owns Coca-Cola?

Coca-Cola is owned by its shareholders. The largest ones are legendary investor Warren Buffet’s Berkshire Hathaway, which owns 9.2% of the company, followed by Vanguard with 8.5% ownership share, and BlackRock with 7.2% ownership share.

The largest owner of Coca-Cola is Berkshire Hathaway, which owns 9.2% of the company. Berkshire Hathaway is led by legendary investor Warren Buffet.

- Buffet first bought Coca-Cola stock in 1988, built a significant stake in the company, and held on to it ever since. Even today, he says he does not think about selling.

- Buffet’s Berkshire Hathaway purchased Coca-Cola cheaply when Coca-Cola shares were decimated after the 1987 Black Monday stock market crash.

- Initially, Coca-Cola was quite a significant part of Berkshire’s portfolio. Today, concentration is not so extreme anymore, and Berkshire is heavily concentrated in Apple.

Other large shareholders are asset managers Vanguard and BlackRock, who invest money on behalf of their clients. Vanguard and BlackRock are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies.

Coca-Cola was founded in 1888 and has been a publicly listed company since its initial public offering on NYSE in 1919 (Ticker: KO).

The Coca-Cola Company is incorporated in the State of Delaware (US), but its headquarters are in Atlanta, Georgia (US).

As the largest investor, it is no surprise that Waren Buffet likes Coke, and he became something of an unpaid company ambassador. You can often spot a can of Coca-Cola nearby whenever he is on camera. Sometimes he goes even a little bit further to promote his investment.😄

🎮 Who Controls Coca-Cola (KO)?

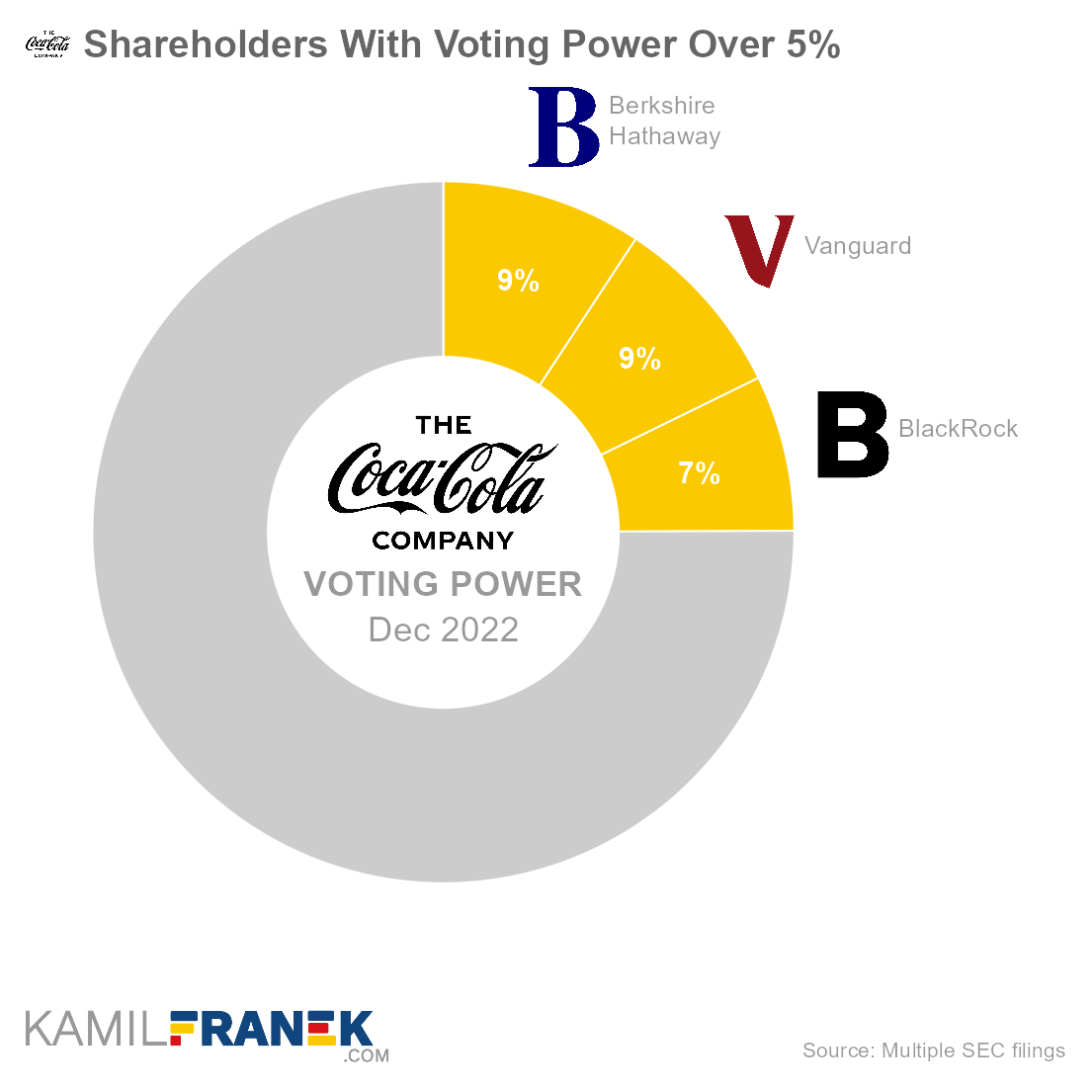

Coca-Cola’s shareholders with the largest voting power are Berkshire Hathaway, which holds 9.2% of all votes, followed by asset manager Vanguard with 8.5% voting power, and asset manager BlackRock with 7.2% of all votes.

Coca-Cola has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

None of the shareholders has individual control over the company. However, Berkshire Hataway and its CEO, Warren Buffet, have a considerable influence over the company and its management.

- Buffett previously served for a long time on Coke’s board of directors.

- Berkshire Hataway does not control Coca-Cola, but his influence is significant because the rest of the ownership is dispersed, and other large shareholders are asset managers investing on behalf of other clients.

Coca-Cola ‘s insiders that have influence over the company are mainly CEO and chairman James Quincey and other board members and executives.

- Coca-Cola currently has a 12-member board of directors.

- Directors or executive officers mostly hold less than 0.05% share of Coca-Cola ‘s stocks, except Herb Allen (0.45%), David B. Weinberg (0.22%), and Barry Diller (0.09%)

🗳️ Breakdown of Coca-Cola’s Outstanding Shares and Votes by Top Shareholders

The Coca-Cola Company had a total of 4,328 million outstanding shares as of December 2022. The following table shows how many shares each Coca-Cola’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Berkshire Hathaway | 400 | 400 | 9.2% | |

| Vanguard | 368 | 368 | 8.5% | |

| BlackRock | 311 | 311 | 7.2% | |

| Other | 3,249 | 3,249 | 75.1% | |

| Total (# millions) | 4,328 | 4,328 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 4,328 million votes distributed among shareholders of The Coca-Cola Company. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Berkshire Hathaway | 400 | 400 | 9.2% | |

| Vanguard | 368 | 368 | 8.5% | |

| BlackRock | 311 | 311 | 7.2% | |

| Other | 3,249 | 3,249 | 75.1% | |

| Total (# millions) | 4,328 | 4,328 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Coca-Cola’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in The Coca-Cola Company worth.

However, keep in mind that a stake in Coca-Cola could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Berkshire Hathaway | $25.4 | $25.4 | 9.2% | |

| Vanguard | $23.4 | $23.4 | 8.5% | |

| BlackRock | $19.8 | $19.8 | 7.2% | |

| Other | $206.7 | $206.7 | 75.1% | |

| Total ($ billions) | $275.3 | $275.3 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Coca-Cola shareholder individually.

📒 Who Are Coca-Cola’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of The Coca-Cola Company one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Coca-Cola worth.

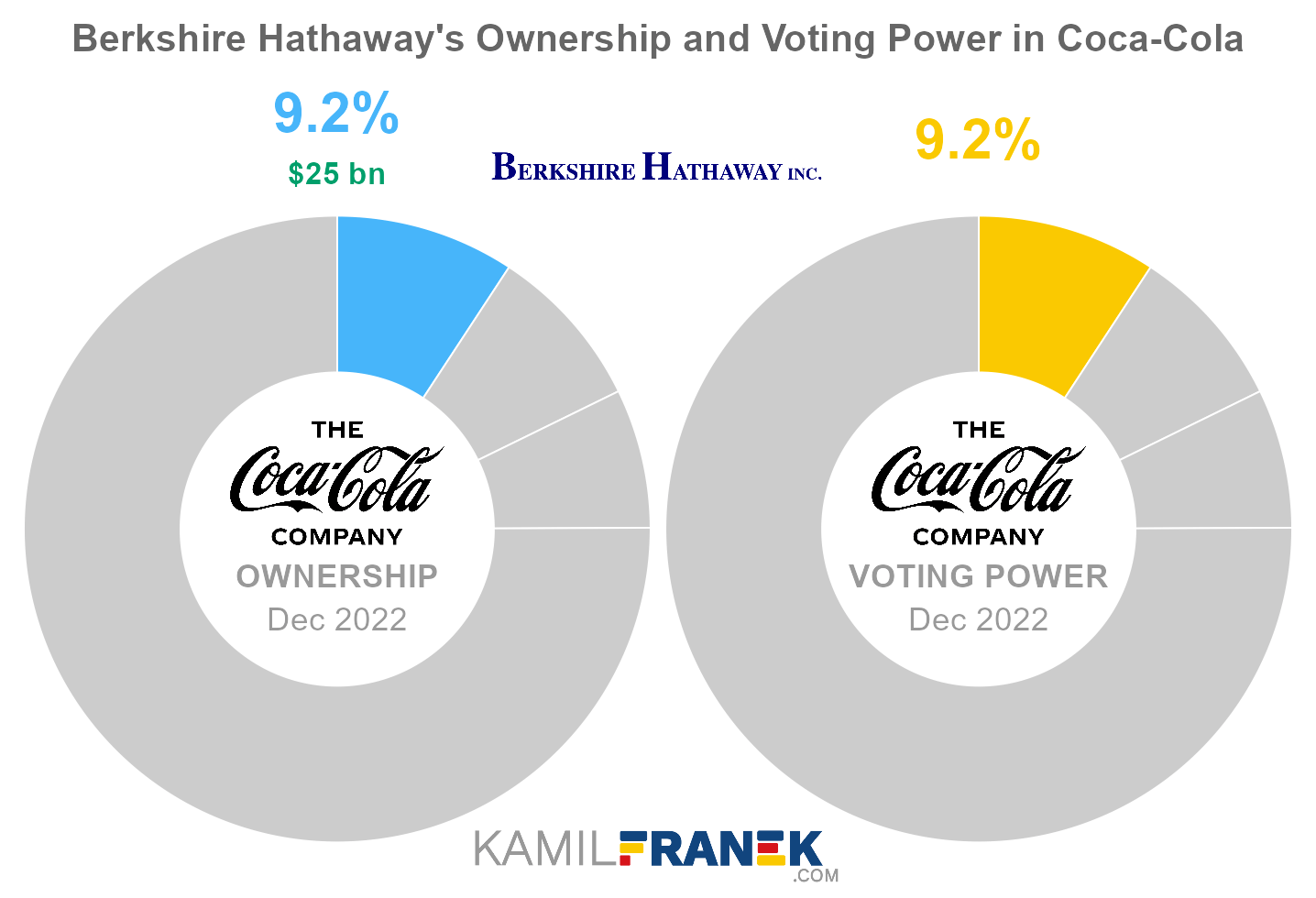

#1 Berkshire Hathaway (9.2%)

Berkshire Hathaway is the largest shareholder of Coca-Cola, owning 9.2% of its shares. As of December 2022, the market value of Berkshire Hathaway’s stake in Coca-Cola was $25.4 billion.

Berkshire Hathaway owned 400 million shares in Coca-Cola and controlled 400 million shareholder votes as of December 2022.

Berkshire Hathaway is an iconic company represented by legendary investor Warren Buffet who is also its significant shareholder and CEO.

Berkshire Hathaway is not a traditional asset manager. It is a conglomerate of insurance businesses, utilities, and other companies. As a result of its large insurance operations, it has a large investment portfolio of other people’s money (insurance float) that it can invest.

Unlike in traditional investment funds, if you buy stocks of Berkshire Hathaway, you don’t just buy a portfolio of stocks. You buy a range of fully owned businesses. Insurance companies with large reserves (float) are one group of those businesses. These reserves are then invested in various investment opportunities.

Company’s CEO Waren Buffet and his “sidekick” Charlie Munger are proponents of value-based, long-term investing. They stick to the business they understand and avoid new trendy things, whatever it means. I think that it is fair to call them “old-school.” Their old-school approach is not limited only to their investment style, as anyone who visited their company webpage can confirm.

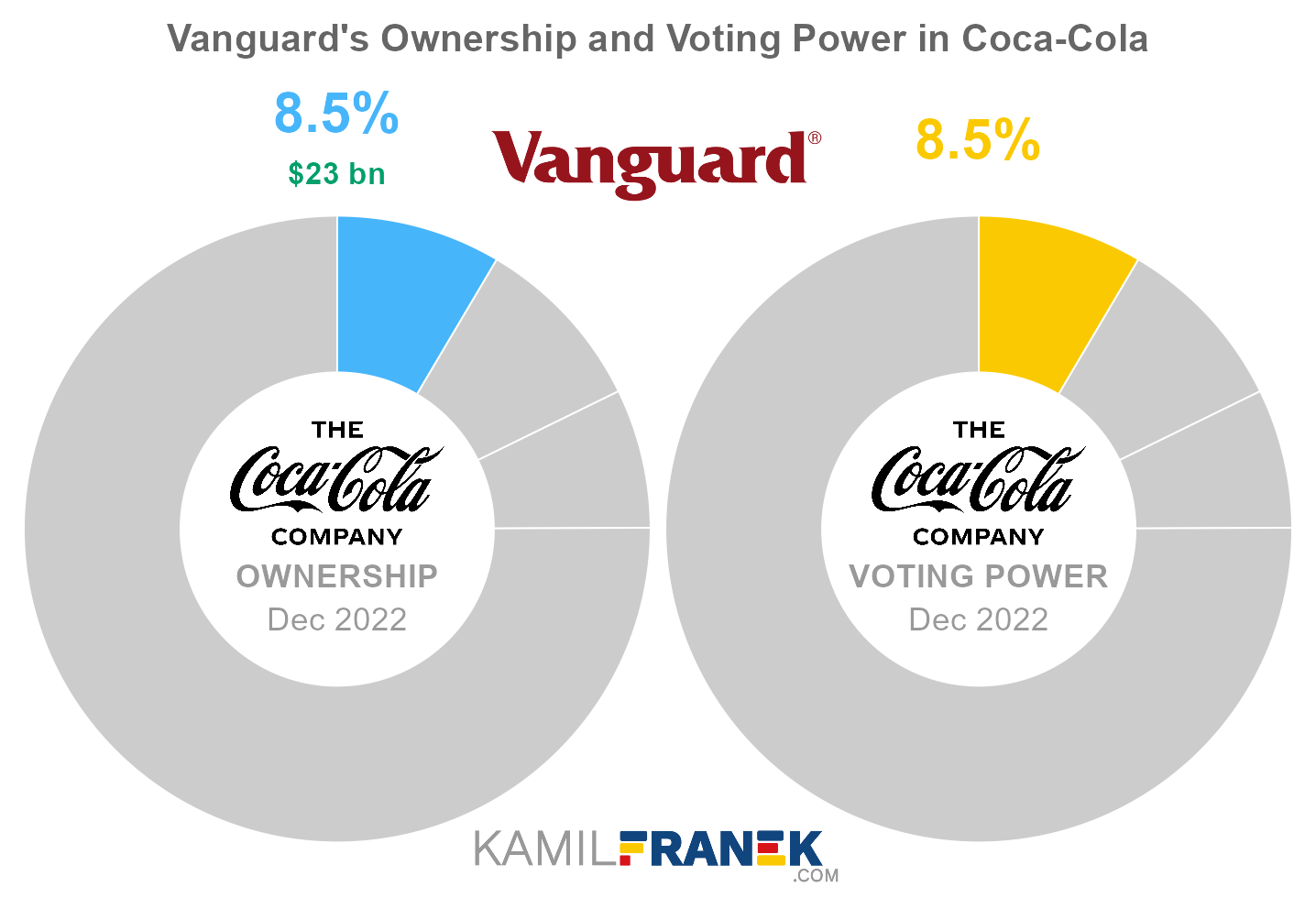

#2 Vanguard (8.5%)

Vanguard is the second-largest shareholder of Coca-Cola, owning 8.5% of its shares. As of December 2022, the market value of Vanguard’s stake in Coca-Cola was $23.4 billion.

Vanguard owned 368 million shares in Coca-Cola and controlled 368 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

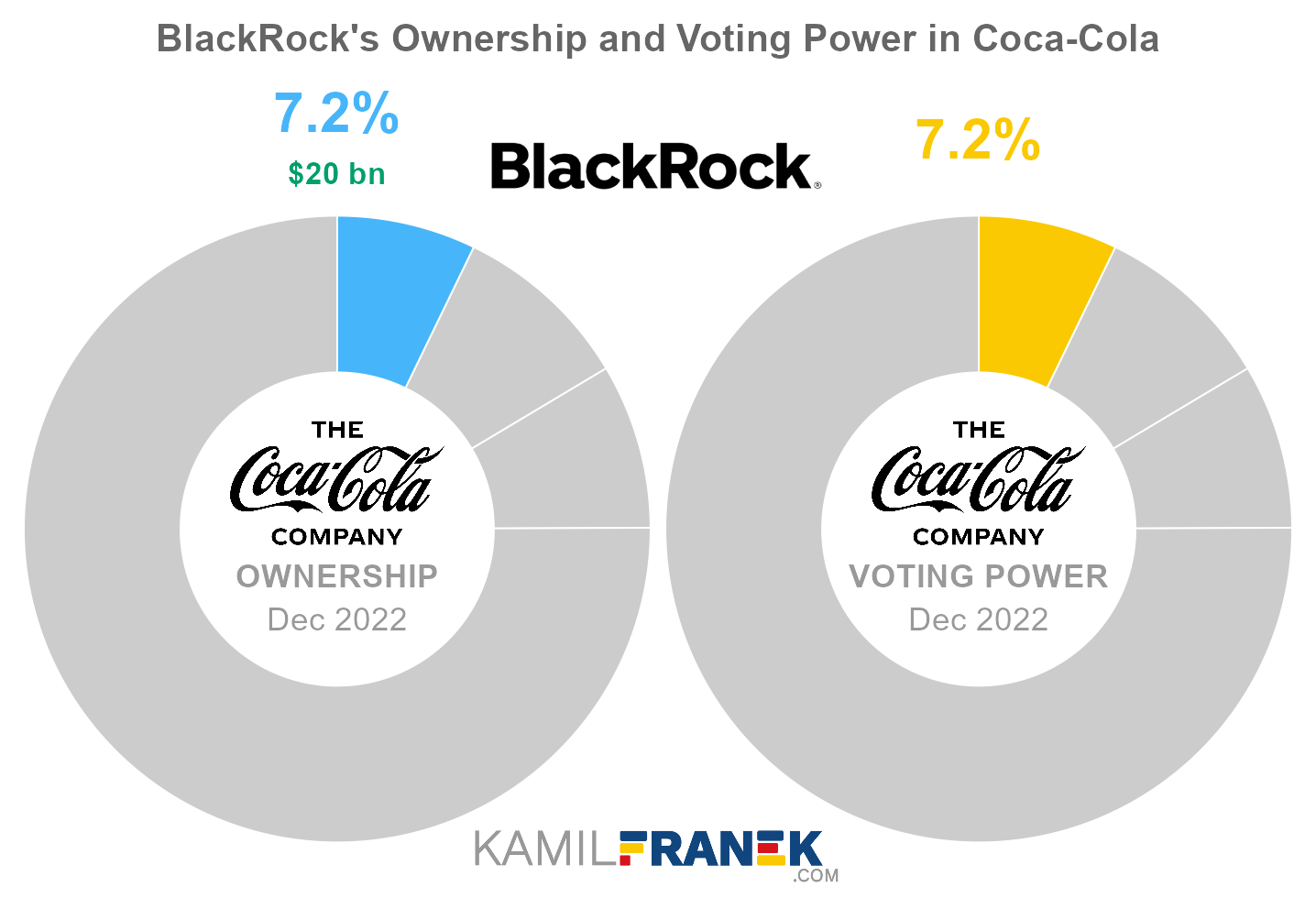

#3 BlackRock (7.2%)

BlackRock is the third-largest shareholder of Coca-Cola, owning 7.2% of its shares. As of December 2022, the market value of BlackRock’s stake in Coca-Cola was $19.8 billion.

BlackRock owned 311 million shares in Coca-Cola and controlled 311 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

📅 Coca-Cola’s History Timeline

These are selected events from Coca-Cola’s history:

- 1888: Coca-Cola was incorporated.

- 1919: Coca-Cola’s initial public offering (IPO)

📚 Recommended Articles & Other Resources

Who Owns Apple: The Largest Shareholders Overview

Overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Amazon: The Largest Shareholders Overview

Overview of who owns Amazon.com, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Nike: The Largest Shareholders Overview

Overview of who owns Nike and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Starbucks: The Largest Shareholders Overview

Overview of who owns the Starbucks Corporation and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Coca-Cola’s Annual Financials Statements (K-10)

- Coca-Cola’s Proxy Statement

- Coca-Cola’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.