Who Owns Meta (Facebook): The Largest Shareholders Overview

Meta Platforms, Inc. (META) was known as Facebook, Inc. (FB) until 2021. Meta operates Facebook, Instagram, and WhatsApp social media apps. It has started significantly investing in virtual and augmented reality. However, the main business of Meta is still social media, and the main revenue and profit source is advertising. So, who owns Meta (Facebook), and who controls it?

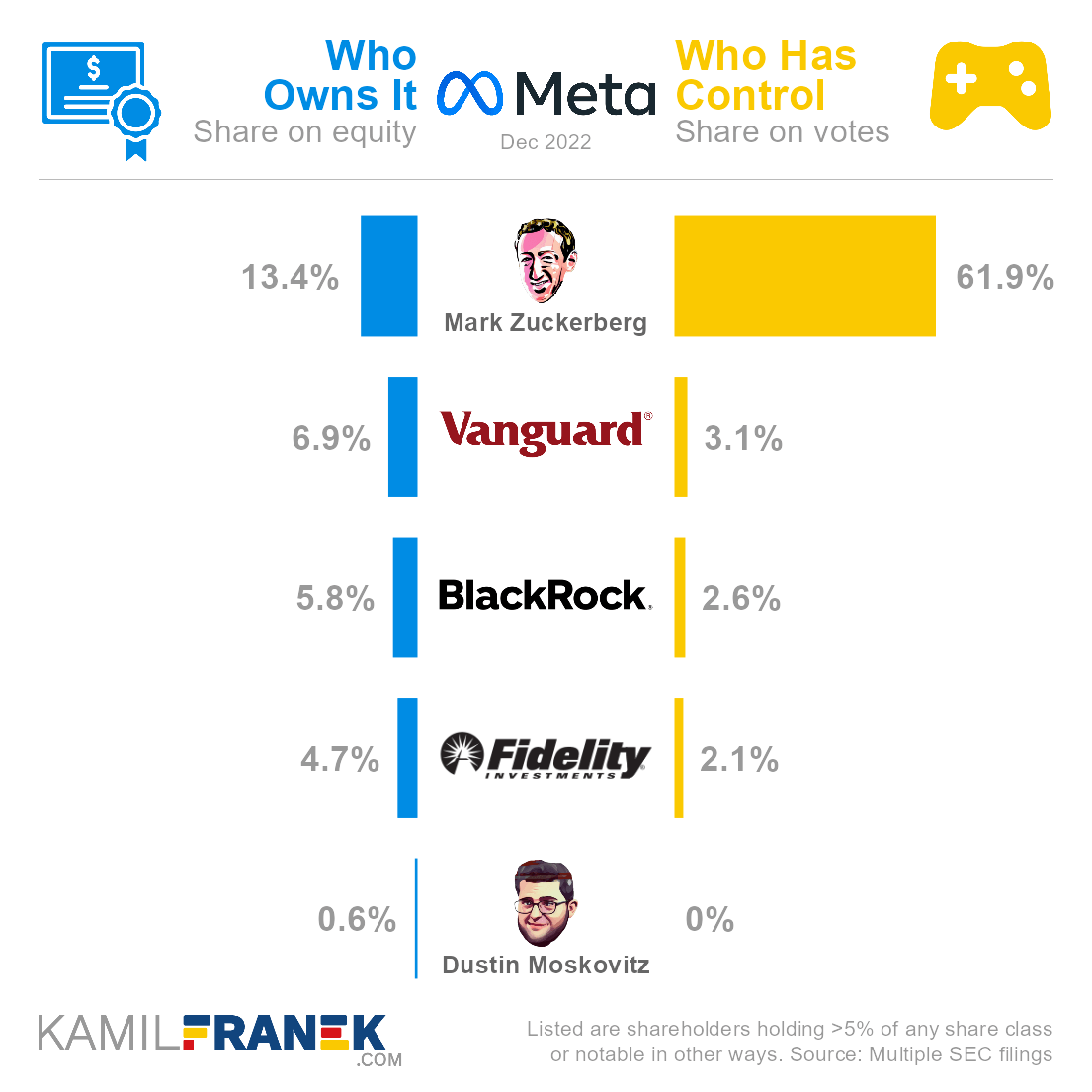

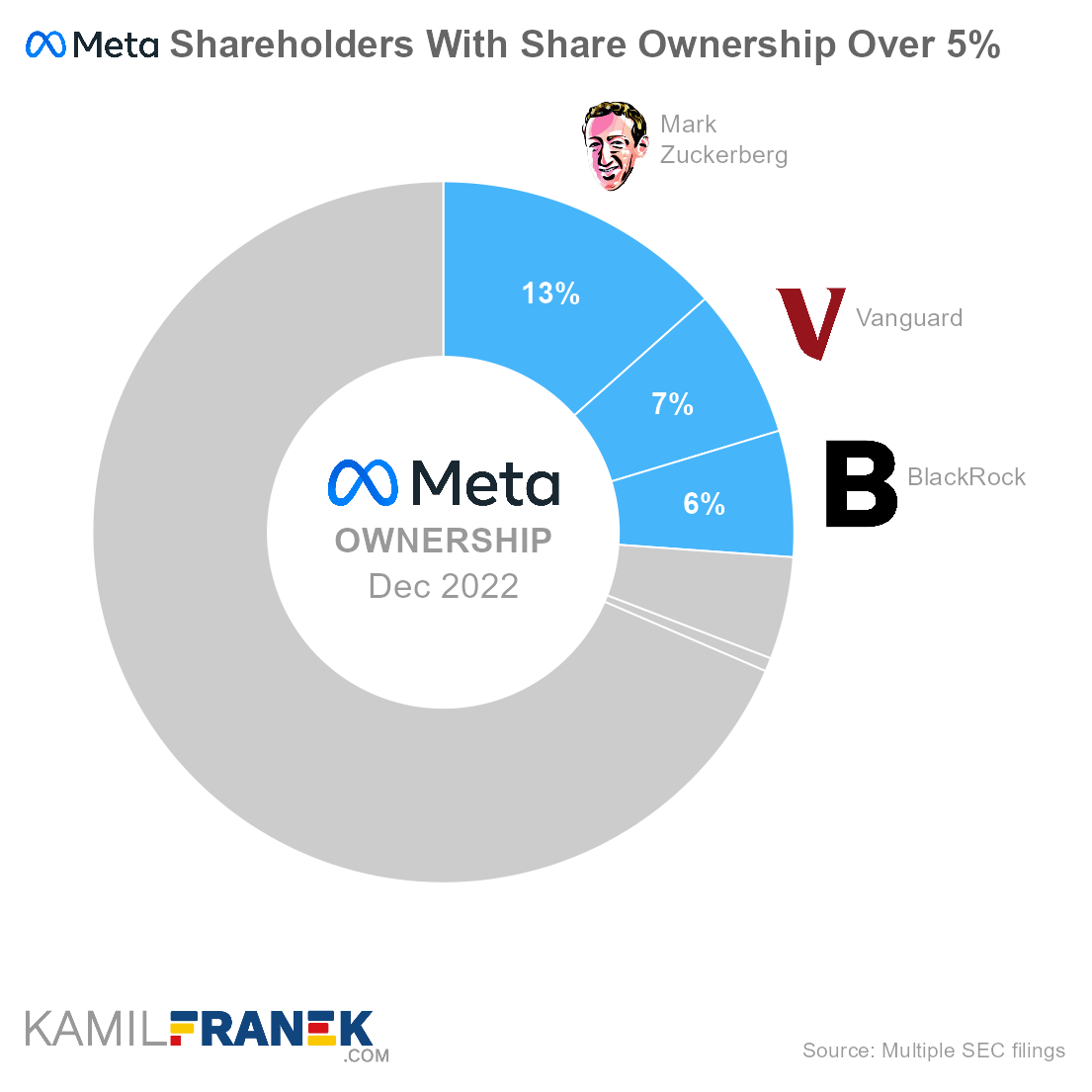

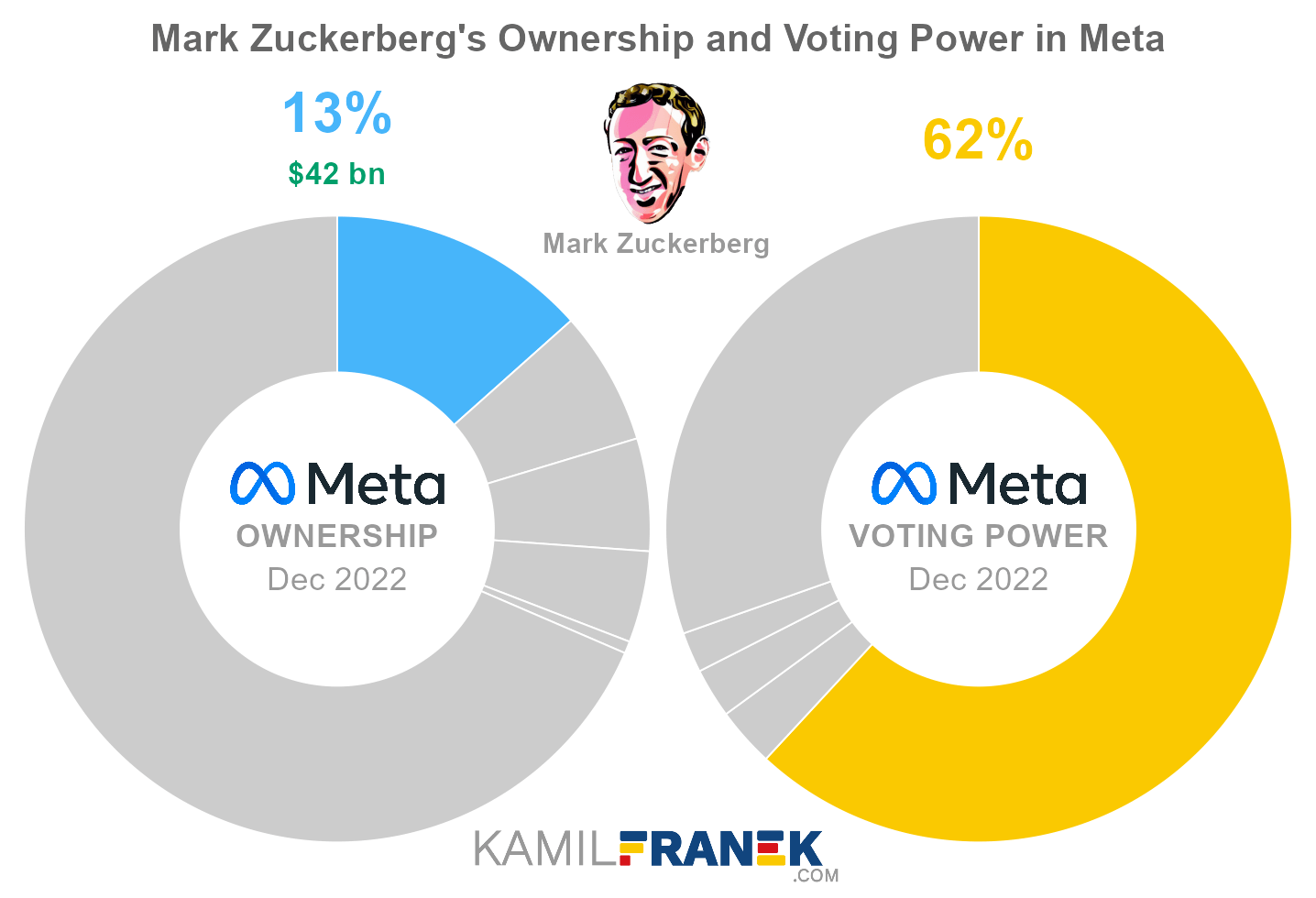

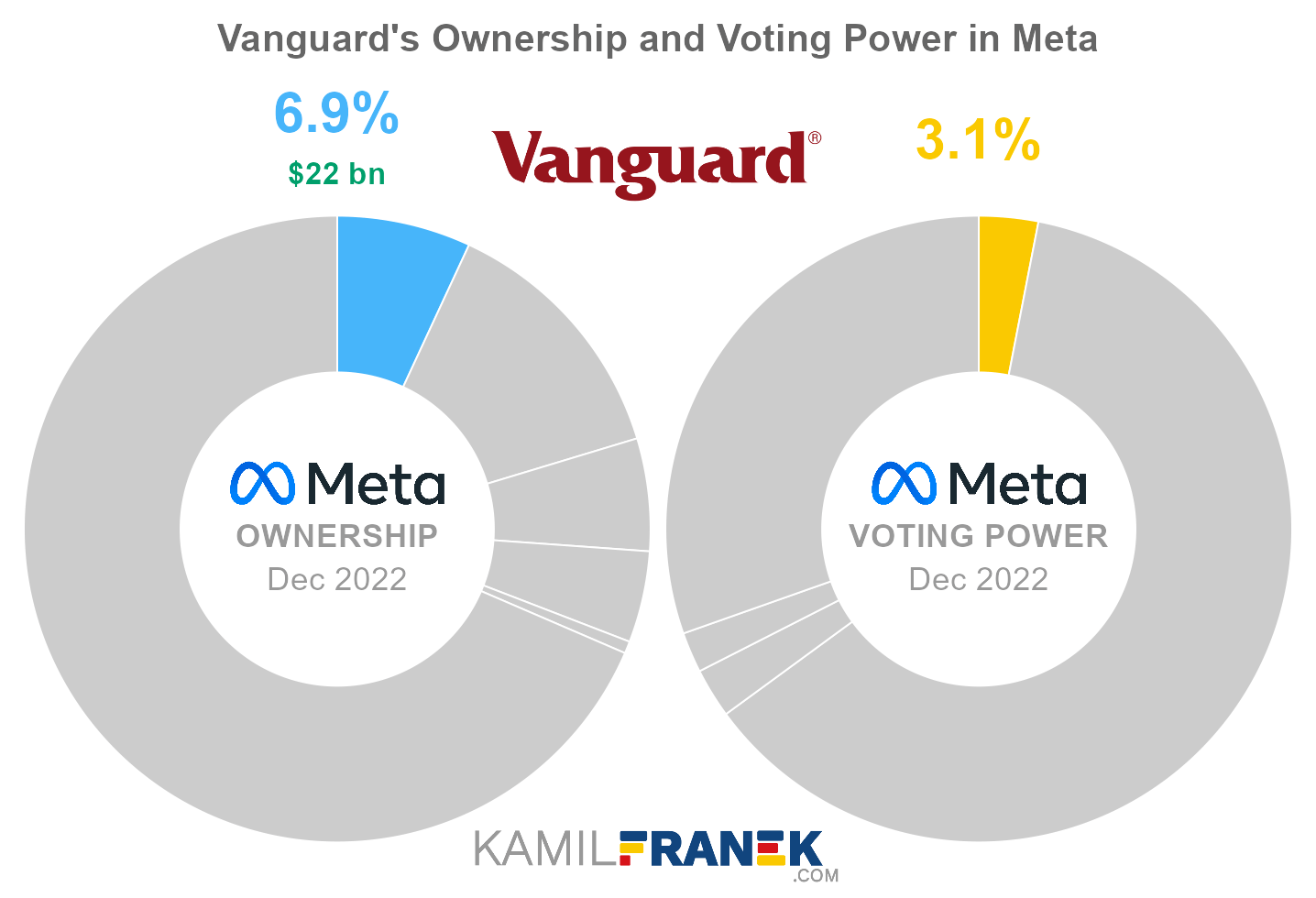

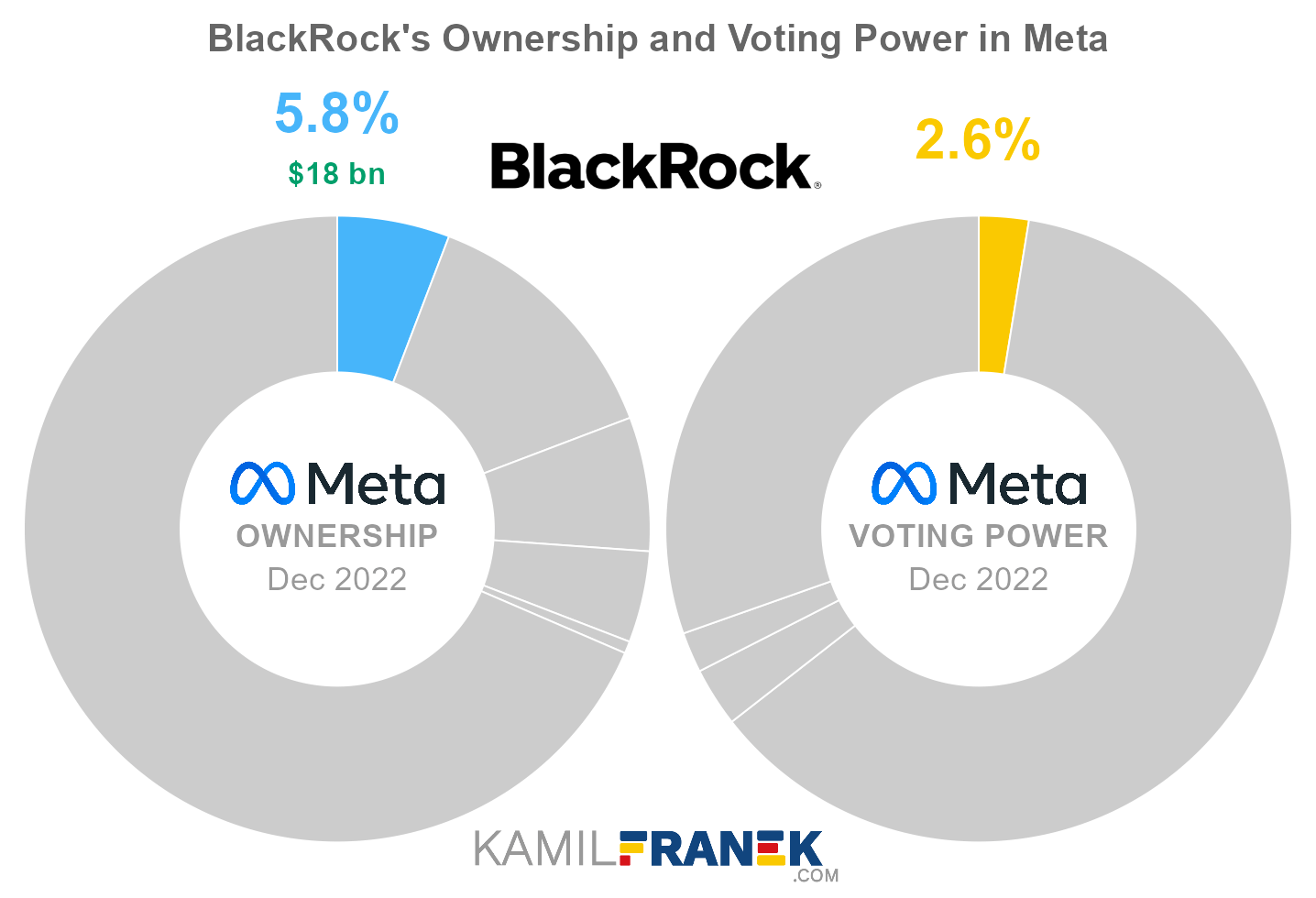

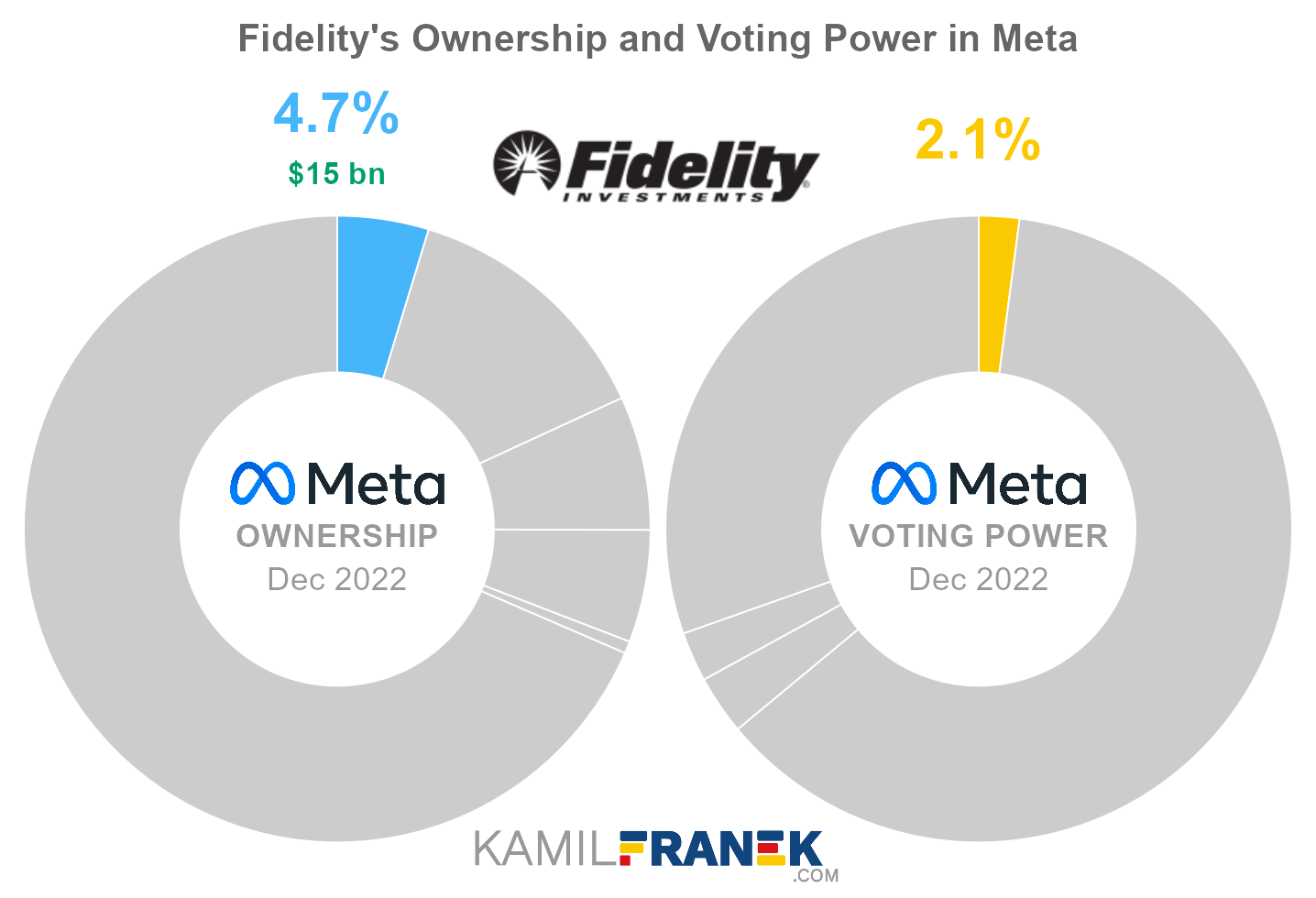

The largest shareholders that own Meta (Facebook) are founder Mark Zuckerberg, who owns 13.4% share, and asset managers Vanguard (6.9%), BlackRock (5.8%), and Fidelity (4.7%). However, thanks to his “super-voting” shares, Mark Zuckerberg controls Meta with 61.9% of all votes.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Mark Zuckerberg | 13.4% | 61.9% | |

| Vanguard | 6.9% | 3.1% | |

| BlackRock | 5.8% | 2.6% | |

| Fidelity | 4.7% | 2.1% | |

| Dustin Moskovitz | 0.6% | 0.0% | |

| Other | 68.5% | 30.4% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Meta and who controls it. I will show you who Meta’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also check my article about how Meta (Facebook) makes money and how its business model works.

Or you can explore who are the largest shareholders in other companies like Apple, Alphabet (Google), Amazon, Microsoft, Tesla, or Twitter.

📃 Who Owns Meta (Facebook)?

Meta (Facebook) is owned by its shareholders. The largest one is its founder and CEO, Mark Zuckerberg, who owns 13.4% of the company. Other large shareholders are asset managers Vanguard with 6.9% share, BlackRock with 5.8% share, and Fidelity with 4.7% share.

- Mark Zuckerberg is not only the largest shareholder but also controls the majority of votes thanks to super-voting shares.

- Mark Zuckerberg holds most of his shares through CZI Holdings LLC, which is a holding company for The Chan Zuckerberg Initiative (CZI). CZI is a philanthropic vehicle for Zuckerberg’s family, founded in 2015. Unlike typical foundation, it is structured as LLC, which gives them more flexibility.

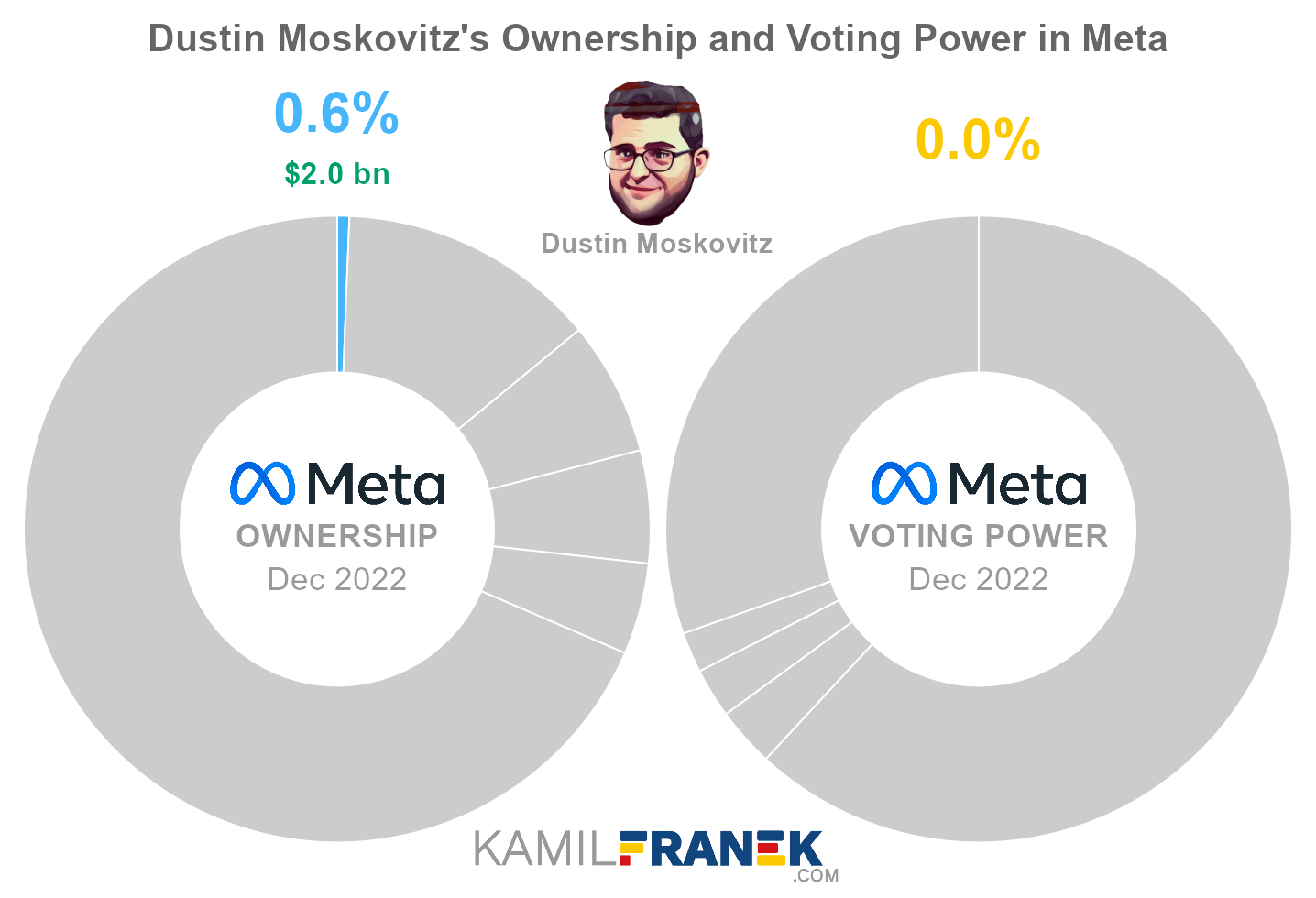

The sizable stake is also owned by Facebook’s co-founder Dustin Moskovitz, who owns 0.6% of Meta.

Another famous Facebook co-founder is Eduardo Saverin, who also used to be a significant shareholder, owning around 2% of the company and holding 7% of votes thanks to super-voting shares. However, as can be seen from the company’s annual report, Eduardo got rid of its Class-B super-voting shares in Q4 2022. His current level of ownership of Meta shares is uncertain.

- One possibility is that Eduardo Saverin sold his stake in Meta, which would trigger the conversion of Class-B shares to common Class A shares. Coincidently, soon after that, Eduardo’s venture capital firm B Capital Group raised $2.1 billion for its latest fund.

- Another possibility is that Eduardo just transformed his Class B shares into common Class A shares and still holds them. By this move, he will avoid further disclosure of his stake.

- A combination of the above is also a possibility.

- Eduardo, a Singapore resident, renounced his US citizenship in 2011, which got media attention as it allowed him to avoid capital gains tax. Eduardo obviously denied that taxes were his primary motivation.

Meta was founded in 2004 by Mark Zuckerberg, Dustin Moskovitz, Eduardo Saverin, Andrew McCollum, and Chris Hughes.

- Mark Zuckerberg famously tried to dilute Eduardo’s share in Facebook, resulting in lawsuits filed by both sides. But in the end, lawsuits were settled, and Eduardo became a rich man.

Meta Platforms, Inc. is a publicly listed company. Its shares have been traded on the NASDAQ exchange since its IPO in 2012. Initially, its ticker was FB, but it changed to META in 2022 in line with the company’s name change from Facebook to Meta.

Meta Platforms, Inc. is incorporated in the State of Delaware (US), but its headquarters are in Menlo Park, California (US).

🎮 Who Controls Meta (Facebook)?

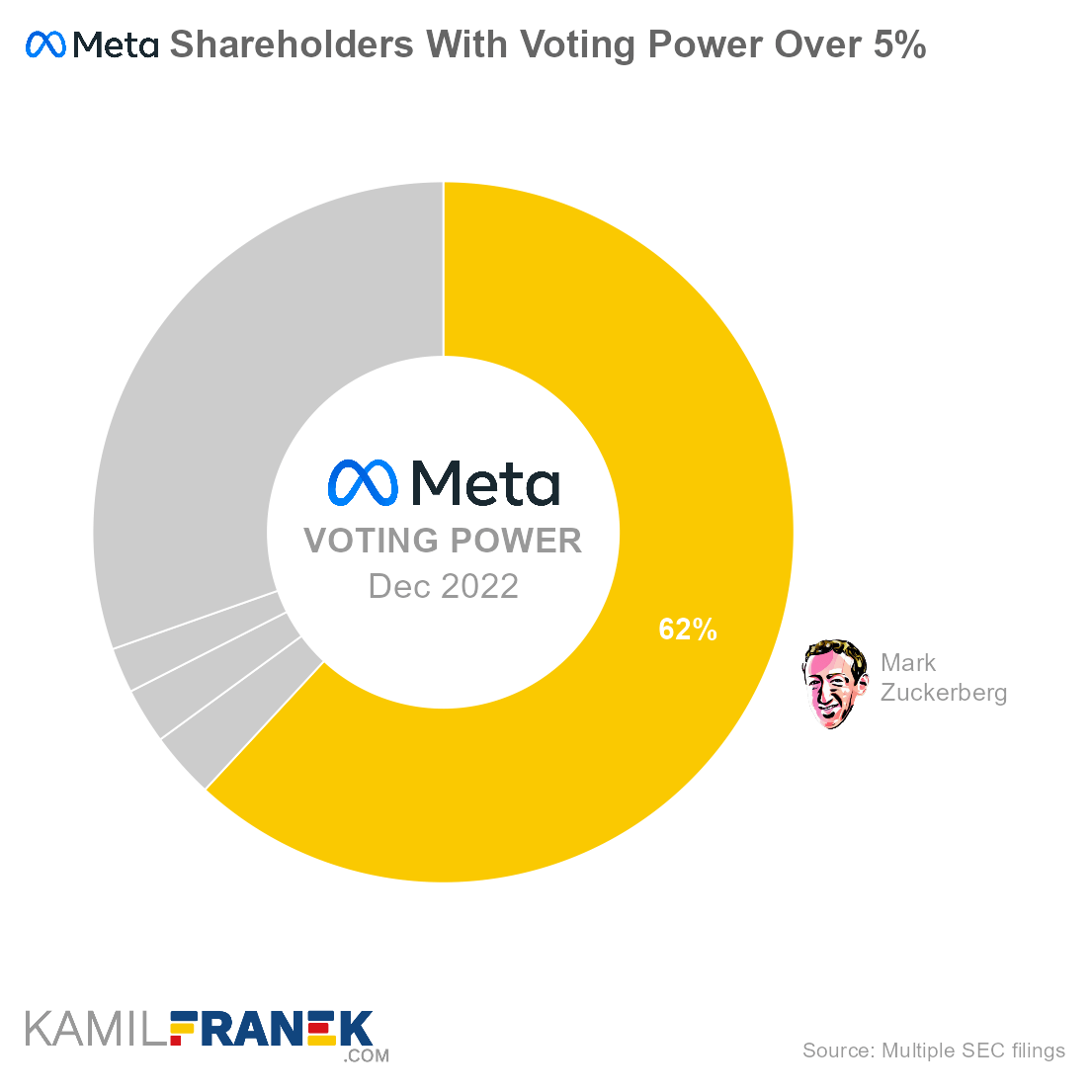

Meta’s shareholders with the largest voting power are founder and CEO Mark Zuckerberg, who holds 61.9% of all votes, followed by Vanguard (3.1%), BlackRock (2.6%), and Fidelity (2.1%).

As you can see, the size of the voting power is not equal to ownership, and the founder and CEO of Meta, Mark Zuckerberg, is clearly in control. It makes the voting power of all other shareholders irrelevant.

The reason behind Mark Zuckerberg’s large voting power is that Meta has two classes of outstanding shares with different rights.

- Class A Shares: These are regular shares traded on NASDAQ with one vote per share. (Ticker: META)

- Class B Shares: Shares that Meta (Facebook) early investors and founders hold, which have ten(10) votes per share and are not publicly traded.

The largest Meta shareholder, founder, and CEO, Mark Zuckerberg, owns 13.4% of Meta’s shares. However, he holds 61.9% of the voting power and single-handedly controls the company thanks to the super-voting shares he owns.

- Most of Mark Zuckerberg’s shares are super-voting (Class B) shares, with ten(10) votes per share.

- Mark’s voting power is slightly higher than you would expect based on the number of his shares and associated votes because he has an agreement with Dusting Moskovitz that Mark will exercise voting power for Dustin’s shares. This adds around 2.5% of voting power to Mark.

- There is also a provision that gives the majority of B-class shareholders (which means Mark Zuckerberg) the power to approve any potential merger or outside acquisitions, even if Mark is no longer a majority shareholder of Meta. This provision will be valid until Class B votes fall below 35% of total votes, which has a long way to go because Class B shares now constitute over 60% of the total voting power.

- A different provision secures Mark’s seat on Meta’s board for three years after Class B shareholders lose the voting majority.

Mark Zuckerberg’s voting power at the end of 2021 was 57%, which is lower than the current level. That fact is that at the end of 2022 voting power of all shareholders jumped up. It was caused by Eduardo Saverin, who sold his super-voting shares or possibly just converted them to regular ones. He controlled around 7% of the votes, so this move greatly influenced the voting power of the remaining shareholders.

Meta’s insiders that have influence over the Company are mainly CEO and chairman Mark Zuckerberg and other [board members and executives] (https://investor.fb.com/leadership-and-governance/default.aspx){:target=”_blank”}{:target=”_blank”}. However, because Mark Zuckerberg holds 61.9% of the voting power, it is clear he holds the reigns of the company.

- Meta’s board has 9 members who are reelected annually.

- Sizable influence historically also had Sheryl Sandberg, who was, until 2022, Meta’s Chief Operation Officer. She owns 0.06% of Meta’s shares and is the only company insider with share ownership over 0.05%, with the exception of Mark Zuckerberg.

🗳️ Breakdown of Meta’s Outstanding Shares and Votes by Top Shareholders

Meta Platforms, Inc. had a total of 2,614 million outstanding shares as of December 2022. The following table shows how many shares each Meta’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Mark Zuckerberg | 1 | 350 | 351 | 13.4% | |

| Vanguard | 181 | - | 181 | 6.9% | |

| BlackRock | 152 | - | 152 | 5.8% | |

| Fidelity | 123 | - | 123 | 4.7% | |

| Dustin Moskovitz | - | 16 | 16 | 0.6% | |

| Other | 1,790 | 1 | 1,791 | 68.5% | |

| Total (# millions) | 2,247 | 367 | 2,614 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

There were 5,916 million votes distributed among shareholders of Meta Platforms, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||||

| In millions of votes as of December 2022 | ||||||

| Shareholder | Class A | Class B | Proxy | Total | % Share | |

|---|---|---|---|---|---|---|

| Mark Zuckerberg | 1 | 3,497 | 163 | 3,661 | 61.9% | |

| Vanguard | 181 | - | - | 181 | 3.1% | |

| BlackRock | 152 | - | - | 152 | 2.6% | |

| Fidelity | 123 | - | - | 123 | 2.1% | |

| Dustin Moskovitz | - | 163 | -163 | - | 0.0% | |

| Other | 1,790 | 8 | - | 1,799 | 30.4% | |

| Total (# millions) | 2,247 | 3,669 | - | 5,916 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||||

Owning class B shares is the key to Mark Zuckerberg’s control of Meta. His 10x voting power allows him to control the company single-handedly.

💵 Breakdown of Meta’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Meta Platforms, Inc. worth.

However, keep in mind that a stake in Meta could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Mark Zuckerberg | $0.1 | $42.1 | $42.2 | 13.4% | |

| Vanguard | $21.7 | - | $21.7 | 6.9% | |

| BlackRock | $18.3 | - | $18.3 | 5.8% | |

| Fidelity | $14.8 | - | $14.8 | 4.7% | |

| Dustin Moskovitz | - | $2.0 | $2.0 | 0.6% | |

| Other | $215.4 | $0.1 | $215.5 | 68.5% | |

| Total ($ billions) | $270.4 | $44.1 | $314.6 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Let’s now look at each Meta shareholder individually.

📒 Who Are Meta’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Meta Platforms, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Meta worth.

#1 Mark Zuckerberg (13.4%)

Mark Zuckerberg is the largest shareholder of Meta, owning 13.4% of its shares. However, Mark Zuckerberg controls 61.9% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Mark Zuckerberg’s stake in Meta was $42.2 billion.

Mark Zuckerberg owned 351 million shares in Meta and controlled 3,661 million shareholder votes as of December 2022.

Mark Zuckerberg is the founder of Facebook. Besides being the controlling shareholder, he serves as CEO and chairman of Meta’s Board of Directors.

Mark founded Facebook in 2004 with his roommates at Harward. Those roommates and Facebook co-founders were Dustin Moskovitz, Eduardo Saverin, Andrew McCollum, and Chris Hughes.

Mark Zuckerberg is a controversial figure thanks to various past scandals where Facebook, under Mark’s leadership, showed total disregard for people’s privacy and data security.

- It all culminated in the famous Cambridge Analytica scandal and the subsequent $5bn penalty from Federal Trade Commission in 2019.

Mark and his wife Priscilla committed to donating most of their wealth to philanthropy.

#2 Vanguard (6.9%)

Vanguard is the second-largest shareholder of Meta, owning 6.9% of its shares. However, because other shareholders hold super-voting shares, Vanguard’s voting power is only 3.1%. As of December 2022, the market value of Vanguard’s stake in Meta was $21.7 billion.

Vanguard owned 181 million shares in Meta and controlled 181 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

#3 BlackRock (5.8%)

BlackRock is the third-largest shareholder of Meta, owning 5.8% of its shares. However, because other shareholders hold super-voting shares, BlackRock’s voting power is only 2.6%. As of December 2022, the market value of BlackRock’s stake in Meta was $18.3 billion.

BlackRock owned 152 million shares in Meta and controlled 152 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

#4 Fidelity (4.7%)

Fidelity owns 4.7% of Meta’s shares. However, because other shareholders hold super-voting shares, Fidelity’s voting power is only 2.1%. As of December 2022, the market value of Fidelity’s stake in Meta was $14.8 billion.

Fidelity owned 123 million shares in Meta and controlled 123 million shareholder votes as of December 2022.

Fidelity (FMR LLC) is one of the four largest asset managers in the world, together with BlackRock, Vanguard, and State Street. Fidelity is controlled by the Jonhson family, holding 49% of the voting power.

Fidelity is currently managed by Abigail Johnson after her father, Edward Johnson III, died in 2022.

An interesting fact is that in 2004 Abigail pulled a pretty bold move on her further when she tried to oust him from the company. The attempt was unsuccessful then, but she holds the reins now.

Like other large asset managers, Fidelity is not free from potential conflicts of interest.

#5 Dustin Moskovitz (0.6%)

Dustin Moskovitz owns 0.6% of Meta’s shares. However, he has no voting power because he agreed that Mark Zuckerberg would execute his voting rights. As of December 2022, the market value of Dustin Moskovitz’s stake in Meta was $2.0 billion.

Dustin Moskovitz owned 16 million shares in Meta and controlled 0 million shareholder votes as of December 2022.

Dustin Moskovitz is one of the co-founders of Facebook, where he was the company’s first chief technology officer and later vice president of engineering.

He left Facebook in 2018 and co-founded Asana, a project and task management tool, and now serves as Asana’s CEO.

💸 Can Mark Zuckerberg and Other Co-founders Sell Their Meta’s Super-voting Shares to Somebody Else?

Mark Zuckerberg and other holders of Class B shares can sell them, and they are already doing that. However, if they do, those sold or transferred stocks will lose their super-voting power, and Class B shares will automatically convert to ordinary Class A shares with one vote per share.

The above is not true if they transfer or sell those Class B shares to family members (spouse, parents, descendants, siblings, and their descendants)

⚰️ What If Mark Zuckerberg Dies? Who Will Be in Control of Meta (Facebook)?

If Mark Zuckerberg dies, his shares will keep their super-voting power, but only if Mark’s family members will inherit them.

Transfer of those stocks outside Mark’s family members means that those stocks would automatically convert to ordinary Class A shares with one vote per share.

It means that Mark Zuckerberg’s family can keep controlling Meta Platforms, Inc. even after Mark’s death.

However, Mark and his wife Priscilla signed the Giving Pledge to give away the majority of their wealth to philanthropy during their lifetime or in their will, which would mean that Mark’s B-class shares would be sold and converted to ordinary shares.

📎 Does Microsoft Own Meta (Facebook)?

It is possible that Microsoft still holds some Facebook shares, but it is just a fraction of its original 1.6% stake that Microsoft purchased in 2007.

Microsoft, under CEO Steve Ballmer, invested $240 million in Facebook Inc in 2007 and received a 1.6% stake in it. This investment was connected with an agreement that Microsoft would sell advertisements on international versions of the Facebook service until 2011.

Microsoft partially decreased its stake during Facebook’s IPO in 2012. Microsoft mentioned it in its annual report: “…partial sale of our Facebook holding upon the initial public offering on May 18, 2012”.

Microsoft later significantly reduced its Facebook position or possibly even completely sold it off. Microsoft did not make any disclosures about its Facebook stake. However, it is evident from its disclosure about total equity investments in its financials that if it still holds some Meta (Facebook) shares, it would have to be just a fraction of its original stake.

📅 Meta (Facebook)’s History Timeline

These are selected events from Meta (Facebook)’s history:

- 2004: Facebook (later renamed to Meta) was founded by Mark Zuckerberg, Dustin Moskovitz, Eduardo Saverin, Andrew McCollum, and Chris Hughes.

- 2012: Initial Public Offering (IPO) on NASDAQ

- 2015: The Chan Zuckerberg Initiative (CZI) founded

- 2018: The Cambridge Analytica data scandal

- 2018: FTC fines Facebook $5bn for violating consumers’ privacy and imposes other restrictions on Facebook.

- 2021: The company was renamed from Facebook to Meta Platforms

- 2022: Eduardo Saverin got rid of its super-voting shares in Meta (Facebook)

📚 Recommended Articles & Other Resources

How Facebook Makes Money: Business Model Explained

Deep dive into how Facebook (Meta) makes money and how its business model works.

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Twitter: The Largest Shareholders Overview

Overview of who owns Twitter and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Zoom: The Largest Shareholders Overview

Overview of who owns Zoom Video Communications, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Meta’s Annual Financials Statements (K-10)

- Meta’s Proxy Statement

- Meta’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.