Who Owns Apple: The Largest Shareholders Overview

Apple Inc. (AAPL) is one of the biggest companies in the world. It makes money mainly by selling mobile phones and connected services within its tightly closed ecosystem. The company is tied to the legacy of its iconic co-founder Steve Jobs who was also its CEO. So, who owns Apple, and who controls it?

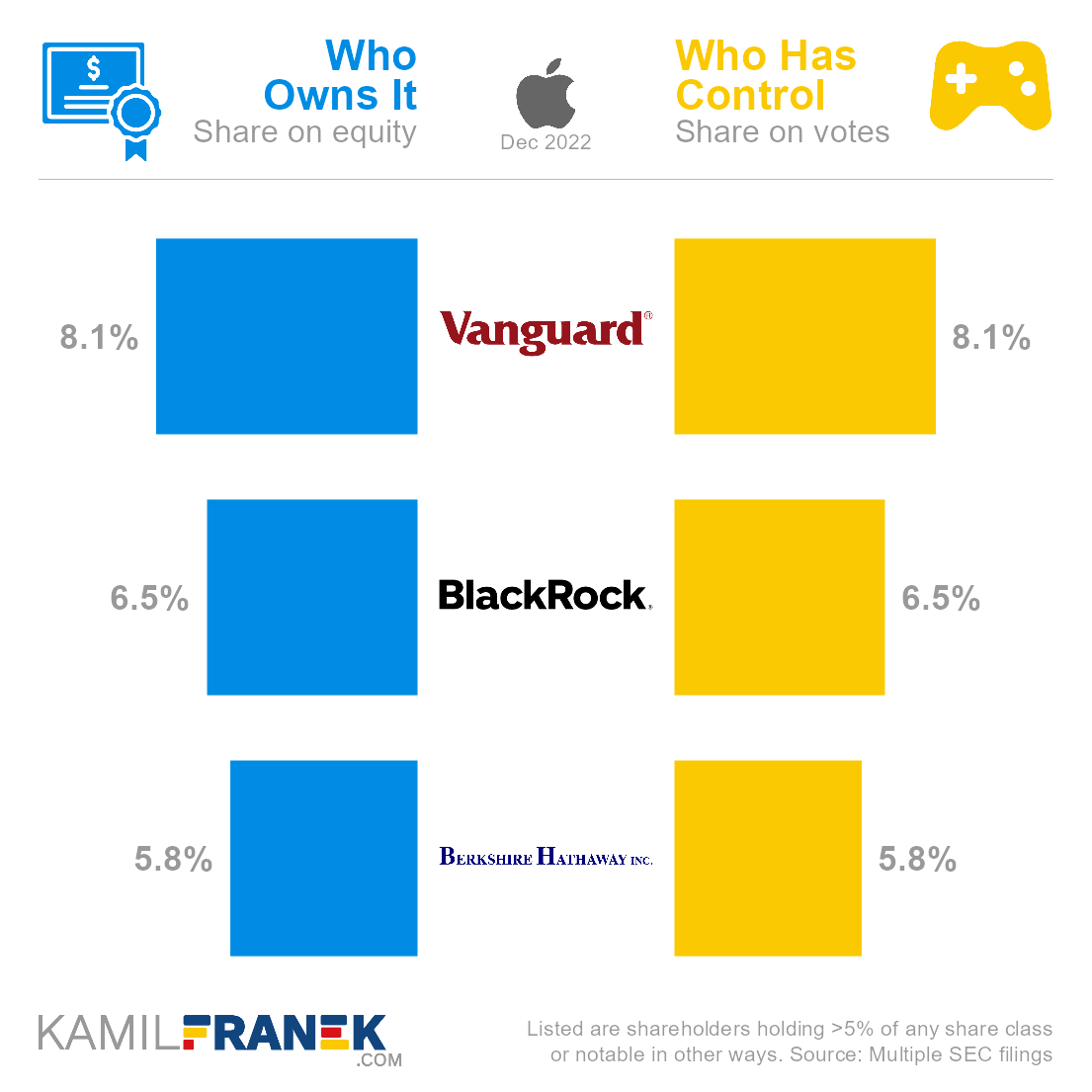

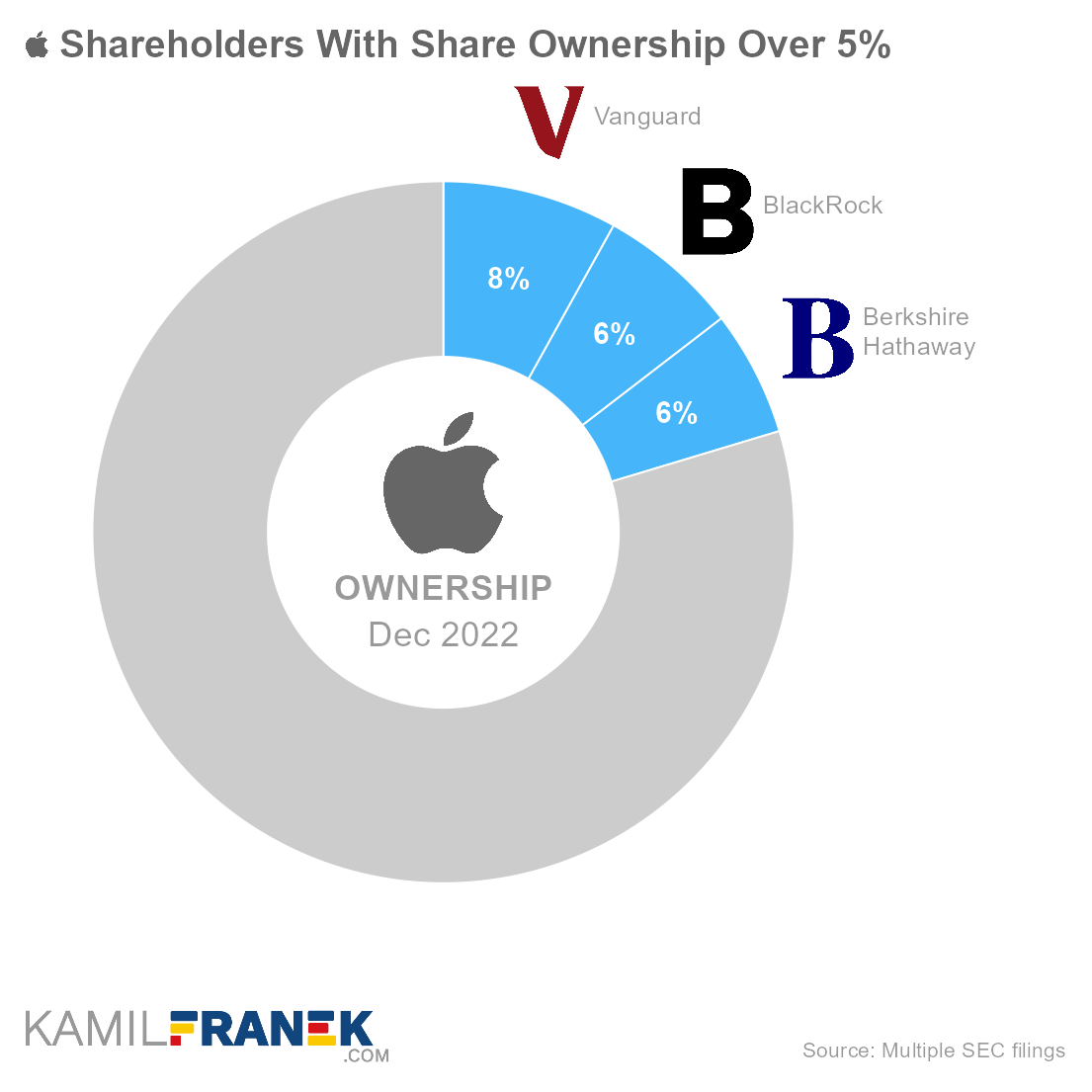

The largest shareholders that own Apple are asset managers Vanguard (8.1% ownership), BlackRock (6.5%), and Berkshire Hathaway (5.8%), a company led by legendary investor Warren Buffet. None of the Apple founders (Steve Jobs and Steve Wozniak) or their families own significant stakes anymore.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 8.1% | 8.1% | |

| BlackRock | 6.5% | 6.5% | |

| Berkshire Hathaway | 5.8% | 5.8% | |

| Other | 79.7% | 79.7% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Apple and who controls it. I will show you who Apple’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who are the largest shareholders in other companies like Amazon, Meta(Facebook), Microsoft, Alphabet (Google), Tesla, or PayPal.

📃 Who Owns Apple?

Apple is owned by its shareholders. The largest ones are asset manager Vanguard which owns 8.1% of the company, followed by BlackRock, with a 6.5% ownership share, and Berkshire Hathaway, with a 5.8% ownership share.

No shareholder has a dominant ownership stake in the company. Apple’s largest shareholders are asset managers who invest other people’s money. This is to be expected for one of the largest companies in the world.

The only interesting thing about Apple’s ownership structure is that the third-largest owner is Berkshire Hathaway, a company led by legendary investor Warren Buffet.

- Berkshire Hathaway’s portfolio has quite a large concentration in Apple stocks, so even though Berkshire’s whole invested portfolio is much smaller than that of Vanguard or Blackrock, they are a significant shareholder in Apple.

Apple was founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne. Apple Inc. has been a publicly listed company since its initial public offering (IPO) on NASDAQ in 1980 (Ticker: AAPL)

You won’t find founders Steve Jobs, Steve Wozniak, or their families among significant shareholders because they sold their large stakes in the mid-1980s.

- Steve Jobs owned around 14% of apple right after Apple’s IPO in 1980, but his ownership was quickly diluted to around 12% tanks to shares issued to employees.

- Steve Wonzniak owned after the IPO around 7%, later diluted to 6%.

- Jobs sold all of his shares in 1985 when he was ousted from Apple. He kept only one share.

- When Steve Jobs returned to Apple after 1997, he received some Apple shares over the years. Shortly before his death, Steve Jobs’s owned 0.6% of Apple. It was not a significant stake but was still worth nearly $2 billion at the time.

Apple Inc. is incorporated in California (US), where it also has its headquarters in Cupertino.

🎮 Who Controls Apple (AAPL)?

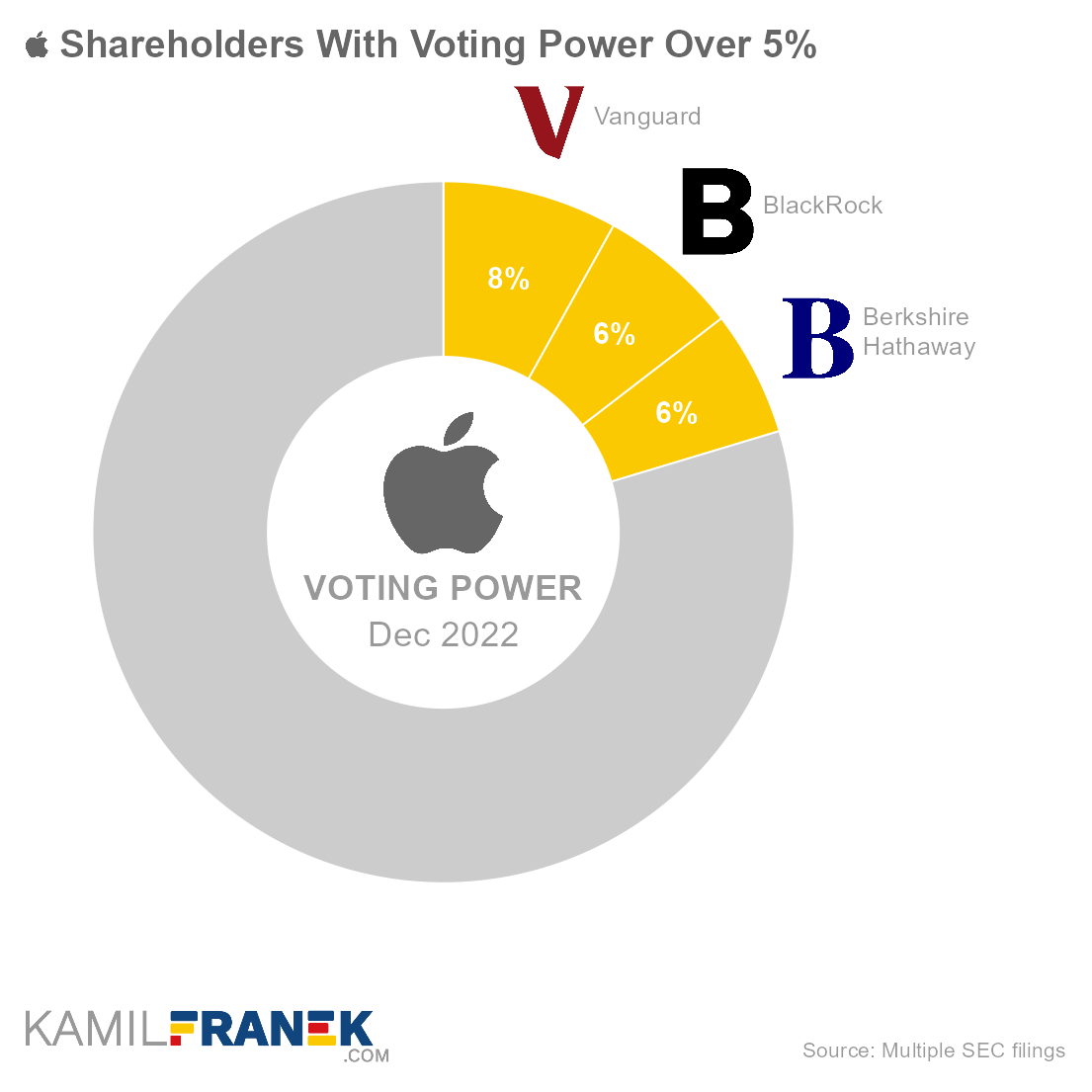

Apple’s shareholders with the largest voting power are Vanguard, which holds 8.1% of all votes, followed by BlackRock (6.5%) and Berkshire Hathaway (5.8%).

Apple has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

Ownership of Apple Inc. is quite dispersed, and the main shareholders are asset managers investing money that belongs to other investors. None of them control the company individually, but together they have a big influence.

Apple ‘s dispersed ownership might create conflicts of interest between Apple ‘s management and its investors, which are represented by another management layer in the form of asset managers. In situations like these, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

In the case of Apple, insiders are mainly CEO Tim Cook, chairman Arthur Levinson, and other board members and executives.

- Apple currently has a 9-member board of directors.

- Nobody from the current board of directors or executive officers holds a significant stake in Apple.

- The largest insider stake is held by Arthur Levinson (Chairman of the Board) and Tim Cook (CEO). Each owns a few million shares, meaning nearly zero % ownership. Nevertheless, even 0.02% ownership, which Tim Cook held based on Apple’s proxy statement, is worth hundreds of millions of US dollars.

🗳️ Breakdown of Apple’s Outstanding Shares and Votes by Top Shareholders

Apple Inc. had a total of 15,842 million outstanding shares as of December 2022. The following table shows how many shares each Apple’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 1,278 | 1,278 | 8.1% | |

| BlackRock | 1,029 | 1,029 | 6.5% | |

| Berkshire Hathaway | 916 | 916 | 5.8% | |

| Other | 12,619 | 12,619 | 79.7% | |

| Total (# millions) | 15,842 | 15,842 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 15,842 million votes distributed among shareholders of Apple Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 1,278 | 1,278 | 8.1% | |

| BlackRock | 1,029 | 1,029 | 6.5% | |

| Berkshire Hathaway | 916 | 916 | 5.8% | |

| Other | 12,619 | 12,619 | 79.7% | |

| Total (# millions) | 15,842 | 15,842 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Apple’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Apple Inc. worth.

However, keep in mind that a stake in Apple could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $166.1 | $166.1 | 8.1% | |

| BlackRock | $133.7 | $133.7 | 6.5% | |

| Berkshire Hathaway | $119.0 | $119.0 | 5.8% | |

| Other | $1,639.6 | $1,639.6 | 79.7% | |

| Total ($ billions) | $2,058.4 | $2,058.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Apple shareholder individually.

📒 Who Are Apple’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Apple Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Apple worth.

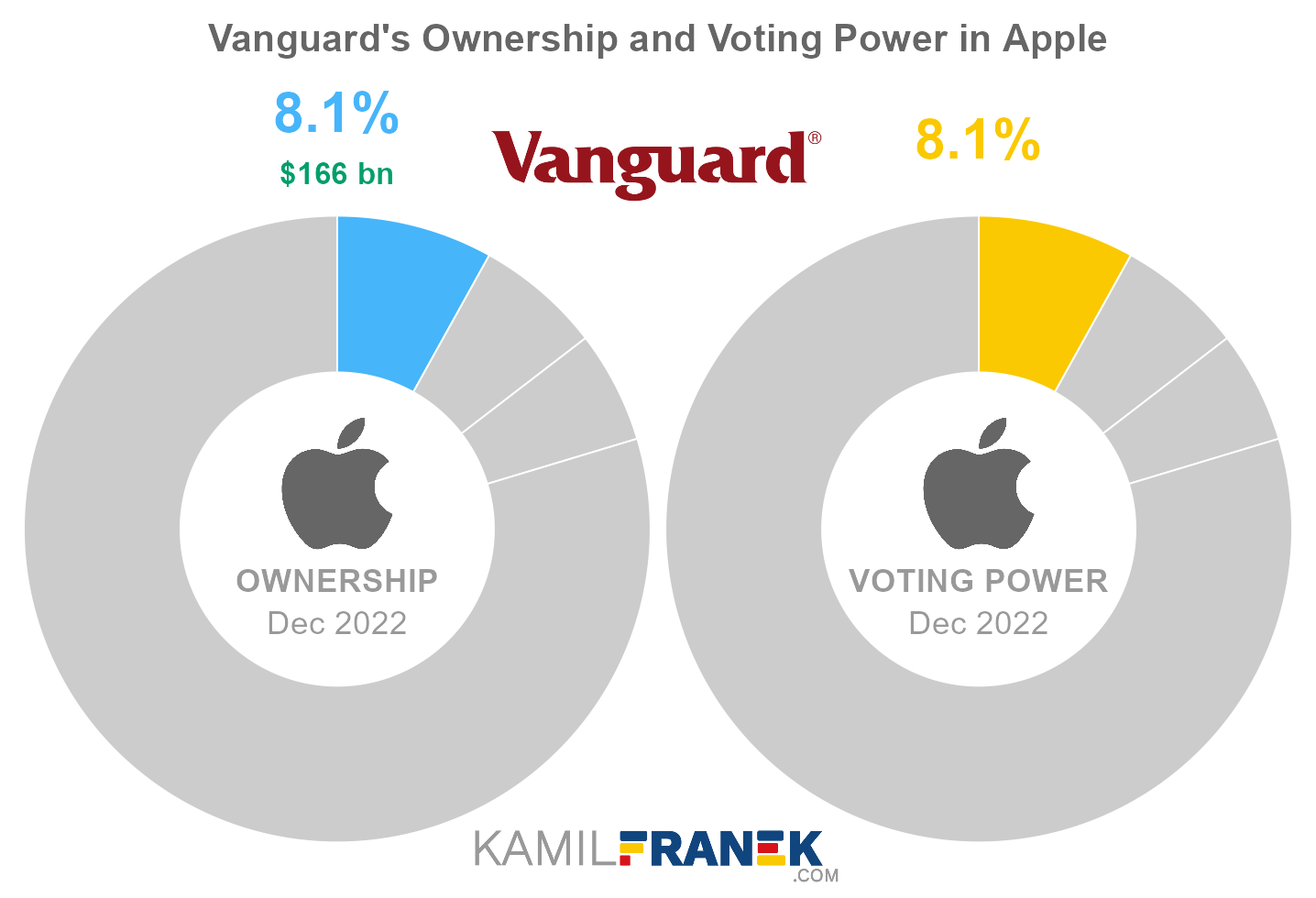

#1 Vanguard (8.1%)

Vanguard is the largest shareholder of Apple, owning 8.1% of its shares. As of December 2022, the market value of Vanguard’s stake in Apple was $166.1 billion.

Vanguard owned 1,278 million shares in Apple and controlled 1,278 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

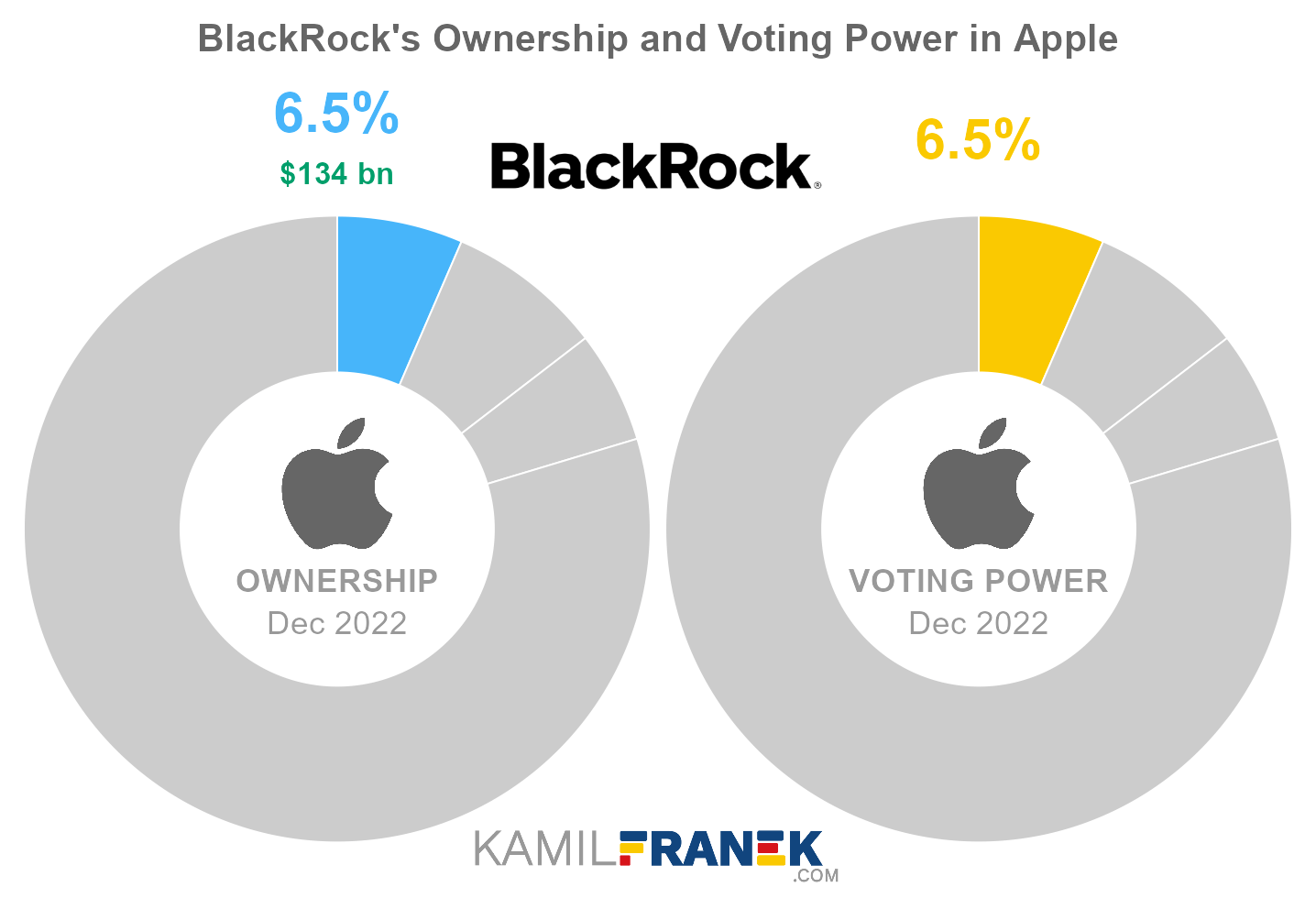

#2 BlackRock (6.5%)

BlackRock is the second-largest shareholder of Apple, owning 6.5% of its shares. As of December 2022, the market value of BlackRock’s stake in Apple was $133.7 billion.

BlackRock owned 1,029 million shares in Apple and controlled 1,029 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

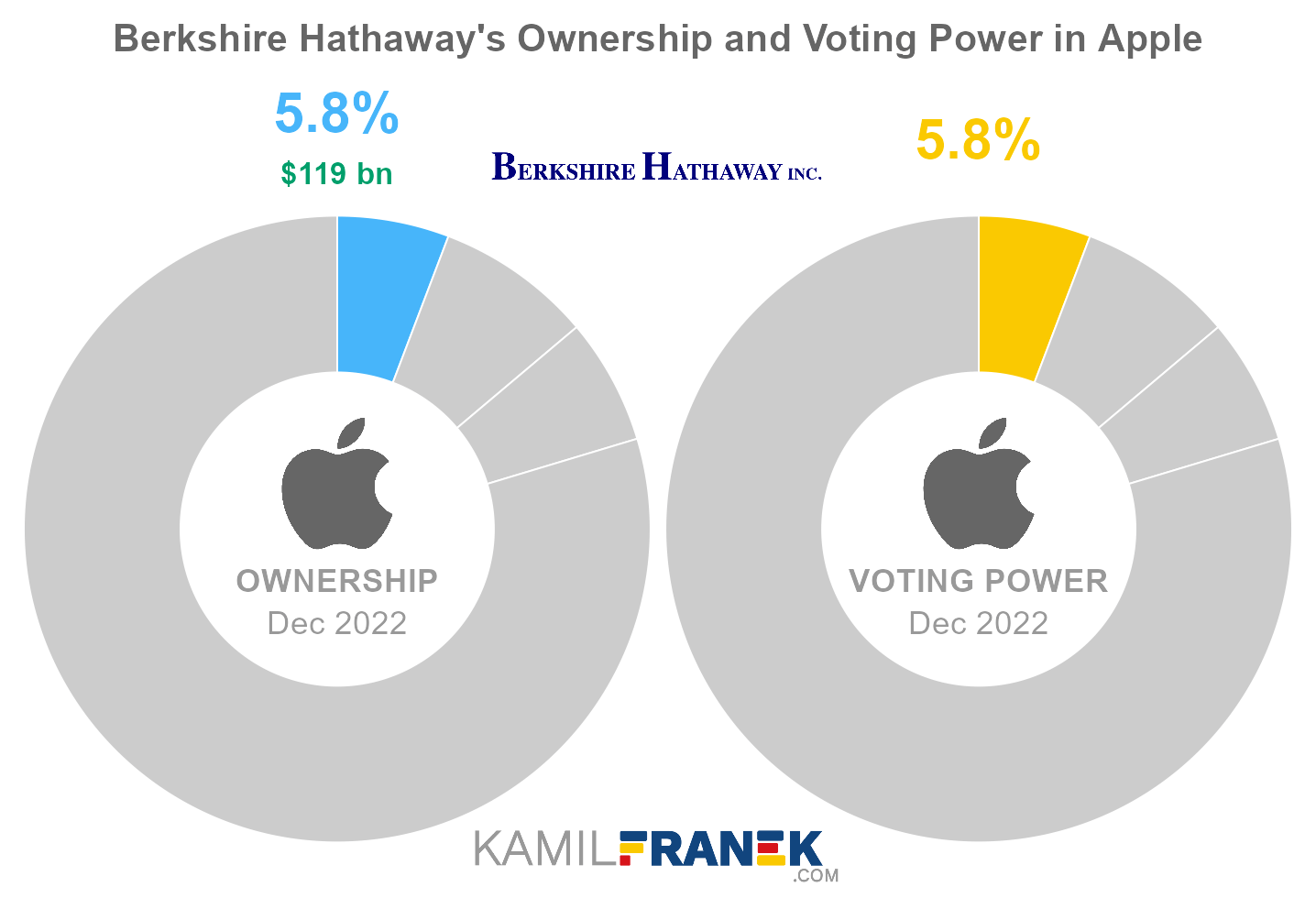

#3 Berkshire Hathaway (5.8%)

Berkshire Hathaway is the third-largest shareholder of Apple, owning 5.8% of its shares. As of December 2022, the market value of Berkshire Hathaway’s stake in Apple was $119.0 billion.

Berkshire Hathaway owned 916 million shares in Apple and controlled 916 million shareholder votes as of December 2022.

Berkshire Hathaway is an iconic company represented by legendary investor Warren Buffet who is also its significant shareholder and CEO.

Berkshire Hathaway is not a traditional asset manager. It is a conglomerate of insurance businesses, utilities, and other companies. As a result of its large insurance operations, it has a large investment portfolio of other people’s money (insurance float) that it can invest.

Unlike in traditional investment funds, if you buy stocks of Berkshire Hathaway, you don’t just buy a portfolio of stocks. You buy a range of fully owned businesses. Insurance companies with large reserves (float) are one group of those businesses. These reserves are then invested in various investment opportunities.

Company’s CEO Waren Buffet and his “sidekick” Charlie Munger are proponents of value-based, long-term investing. They stick to the business they understand and avoid new trendy things, whatever it means. I think that it is fair to call them “old-school.” Their old-school approach is not limited only to their investment style, as anyone who visited their company webpage can confirm.

❔ Does Steve Jobs and His Family Still Own Apple?

Steve Jobs (Steven P. Jobs) died of cancer in 2011, and his wife, Lauren Power Jobs, inherited his wealth which consisted mainly of a stake in Disney but also of 5.5 million Apple shares, representing 0.6% of the company. It is unclear if Ms. Jobs sold her shares or still holds onto them.

Her ownership is not clear because such a small stake does not require any public disclosure. However, since she significantly reduced her Disney stake, the assumption is that she might have also reduced her stain in Apple, Inc.

Steve Jobs’s owned, at the time of his death, “only” 0.6% of Apple, but his original stake as one of the founders of Apple was much larger. So what happened?

Steve Jobs’s ownership in Apple, Inc. just after Apple’s IPO in 1980 was around 14% (7.5 million shares). However, this stake was diluted to around 12% shortly after, thanks to new shares issued to employees.

After a few years, in 1985, Steve Jobs lost a power struggle with then-CEO John Sculley. Jobs left Apple and sold all of his shares which at the time still represented around 11% of Apple. He famously owned only one Apple stock since hen.

After he left Apple, Jobs founded NeXT and bought a stake in Pixar from George Lucas. When we fast-forward to 1997, when Apple purchased NeXT because they needed a modern operating system, Jobs returned to Apple as an interim CEO. At that time, he still held just one Apple stock. Over the years, his stake grew to 0.6% of Apple, thanks to his CEO rewards.

❔ Does Steve Wozniak Still Own Apple Shares

It is not clear if Steve Wozniak owns some Apple stock currently. He sold all or most of his Apple stocks in 1985 when he left Apple. He might be an Apple shareholder now, but his stake would be minuscule if he were.

Steve Wozniak’s owned 7% (4 million shares) after Apple’s IPO in 1980, diluted to 6% thanks to stock issued to employees shortly after the IPO. He also famously sold cheaply around 450 000 shares to some of his coworkers when Steve Jobs, in his jerky way, refused to do so.

At the time after the IPO, Wozniak was still a large shareholder. However, as I mentioned, he sold his shares around 1985 when he left active work at Apple.

Steve Wozniak, from time to time, represents Apple at some events. Based on his claims, he technically never stopped to be an employee of Apple, even after he left the company in 1985.

❔ Why Did Steve Wozniak Have a Lower Stake in Apple Inc. than Steve Jobs?

Sometimes people ask why Steve Wozniak had so much lower owneship stake when compared to Steve Jobs. However, the fact is Steve Wozniak did not have a smaller share. He just got rid of his stake sooner.

It is true that Jobs, at the end of his life, was far richer than Wozniak, but this was a result mainly of his other ventures like NeXT and Pixar Jobs invested in after he left Apple.

Apple was founded in 1976 by Steve Jobs and Steve Wozniak. At the time, they owned equal share of 45% each. The remaining 10% was a share of third minority co-founder Ronald Wayne. Wayne decided to sell its share very quickly after that.

After Apple raised capital, Wozniak and Jobs still owned an equal stake of 8.3 million shares. However, soon after that, their ownership started to diverge as Wozniak sold more shares before the company IPO. Another reason was that his former wife got around 1.2 million shares as part of their separation agreement.

As a result of the above, just before Apple’s IPO, when Jobs’s owned 15% of Apple (7.5 million shares), Wozniak’s ownership was already reduced to around 8% (4 million shares).

📅 Apple’s History Timeline

These are selected events from Apple’s history:

- 1976: Apple was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne.

- 1977: Apple incorporated

- 1980: Apple’s initial public offering (IPO)

- 1984: Apple Macintosh launched

- 1985: Steve Jobs left Apple and founded NeXT

- 1997: Apple acquired NeXT, and Steve Jobs came back as an advisor and was later named interim CEO.

- 2001: Apple introduced the iPod audio player

- 2007: iPhone introduced

- 2011: Steve Jobs resigned as CEO, replaced by Tim Cook. Steve Jobs died later that year.

📚 Recommended Articles & Other Resources

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Xiaomi: The Largest Shareholders Overview

Overview of who owns Xiaomi and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Paypal: The Largest Shareholders Overview

Overview of who owns PayPal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Spotify: The Largest Shareholders Overview

Overview of who owns Spotify and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Apple’s Annual Financials Statements (K-10)

- Apple’s Proxy Statement

- Apple’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.