Who Owns Microsoft: The Largest Shareholders Overview

Microsoft Corporation (MSFT) is one of the biggest companies in the world. It makes money primarily by providing businesses with cloud resources and a wide range of software tools. Its financial performance for the last couple of years has been outstanding. But who ows Microsoft, and who controls it?

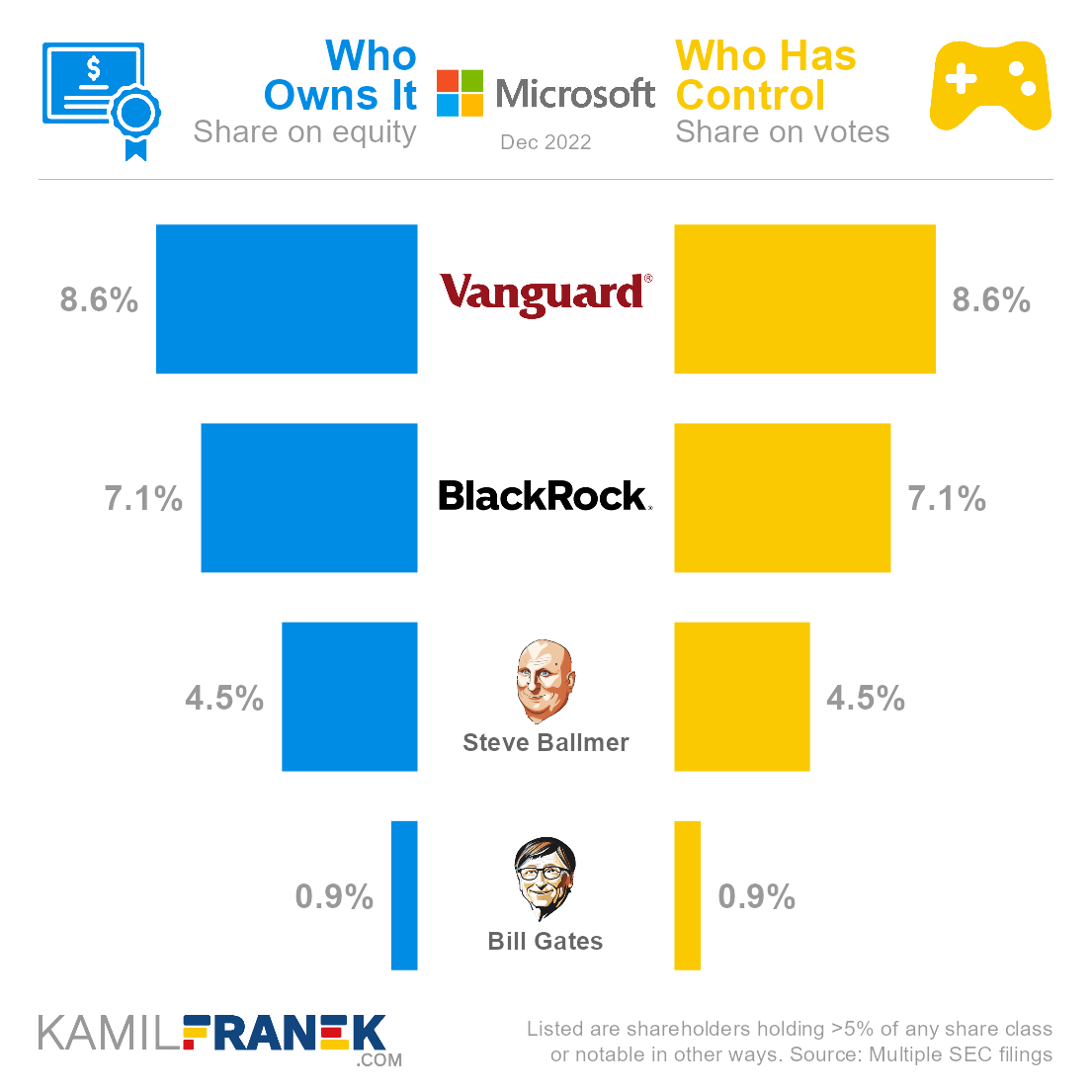

Microsoft’s largest shareholders are Vanguard, which owns 8.6% share, followed by BlackRock (7.1%) and former CEO and early employee Steve Ballmer (4.5%). Microsoft’s founder Bill Gates still owns around 0.9% of Microsoft, but his stake will continue to decrease.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 8.6% | 8.6% | |

| BlackRock | 7.1% | 7.1% | |

| Steve Ballmer | 4.5% | 4.5% | |

| Bill Gates | 0.9% | 0.9% | |

| Other | 78.9% | 78.9% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Microsoft and who controls it. I will show you who Microsoft’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also check my other articles about Microsoft. For example, I wrote an article about how Microsoft makes money and how its business model work or an article with a visual overview of Microsoft’s financial statements.

You can also explore who are the largest shareholders in other like Apple, Meta(Facebook), Amazon, Alphabet (Google), Tesla, or Coca-Cola.

📃 Who Owns Microsoft?

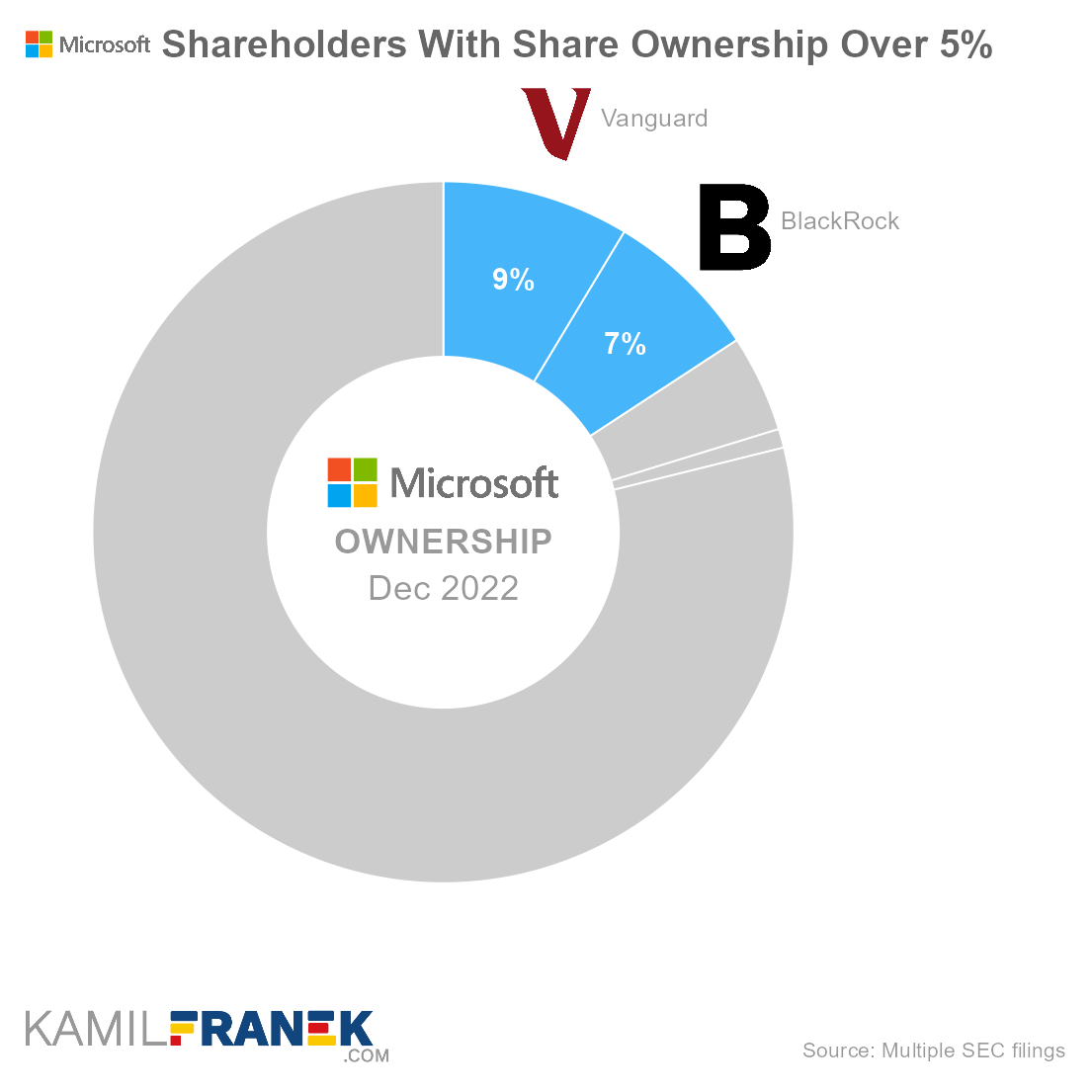

Microsoft is owned by its shareholders. The largest ones are asset management giant Vanguard which owns 8.6% of the company, followed by asset manager BlackRock with a 7.1% share. The largest individual owner is Steve Ballmer, who owns 4.5% of Microsoft.

The two largest Microsoft owners are asset management giants Vanguard and BlackRock. This is not surprising since Microsoft is a large mature company, and BlackRock and Vanguard are the largest asset managers in the world.

The largest individual owner of Microsoft is its former CEO Steve Ballmer who owns 4.5% of the company.

- Ballmer’s stake is an estimate based on his latest official SEC filing when he was still in Microsoft. I assume that he still holds the same amount of shares as before, which is in line with his statements in multiple interviews.

Notable owner of Microsoft shares is also its co-founder and former CEO Bill Gates, who, based on my estimates, owns around 0.9% of Microsoft.

- Bill Gates is no longer required to disclose his stake, and my estimate is based on the last official stake that was reported when he was still on Microsoft’s board, adjusted for a large donation of Microsoft shares to Bill & Melinda Gates’s foundation in 2022.

- My estimate of Gates’s ownership of Microsoft does not include shares owned by Bill & Melinda Gates Foundation, although he certainly has influence over those shares until the foundation liquidates them to fund its needs.

Microsoft was founded in 1975 by Bill Gates, and Paul Allen. Its shares became publicly traded after its initial public offering (IPO) on NASDAQ in 1986 under the ticker MSFT.

- Interestingly, despite Bill Gates and Paul Allen being founders of Microsoft, neither Bill nor Paul’s descendants (Paul died in 2018) have significant ownership of the company. They continued to sell their shares aggressively throughout the years, and both diversified into other investments and spent significant sums on philanthropy.

- Just after Microsoft’s IPO in 1986, Bill Gates’ ownership was 45% and Paul Allen, who at the time was no longer playing an active role in the company, had a 25% stake. When we move forward to the year 2000, Bill’s stake decreased to 13.7%, and Paul’s stake dropped to under 5%.

- Meanwhile, Steve Ballmer, whose stake in Microsoft after its IPO was 6.8%, held on to most of its original shares, making him now the largest individual shareholder. He sold some stock early on but since then held its stake stable at around 4.5% for a long time.

Microsoft Corporation is incorporated in the State of Washington (US), where it also has its headquarters in Redmont.

🎮 Who Controls Microsoft (MSFT)?

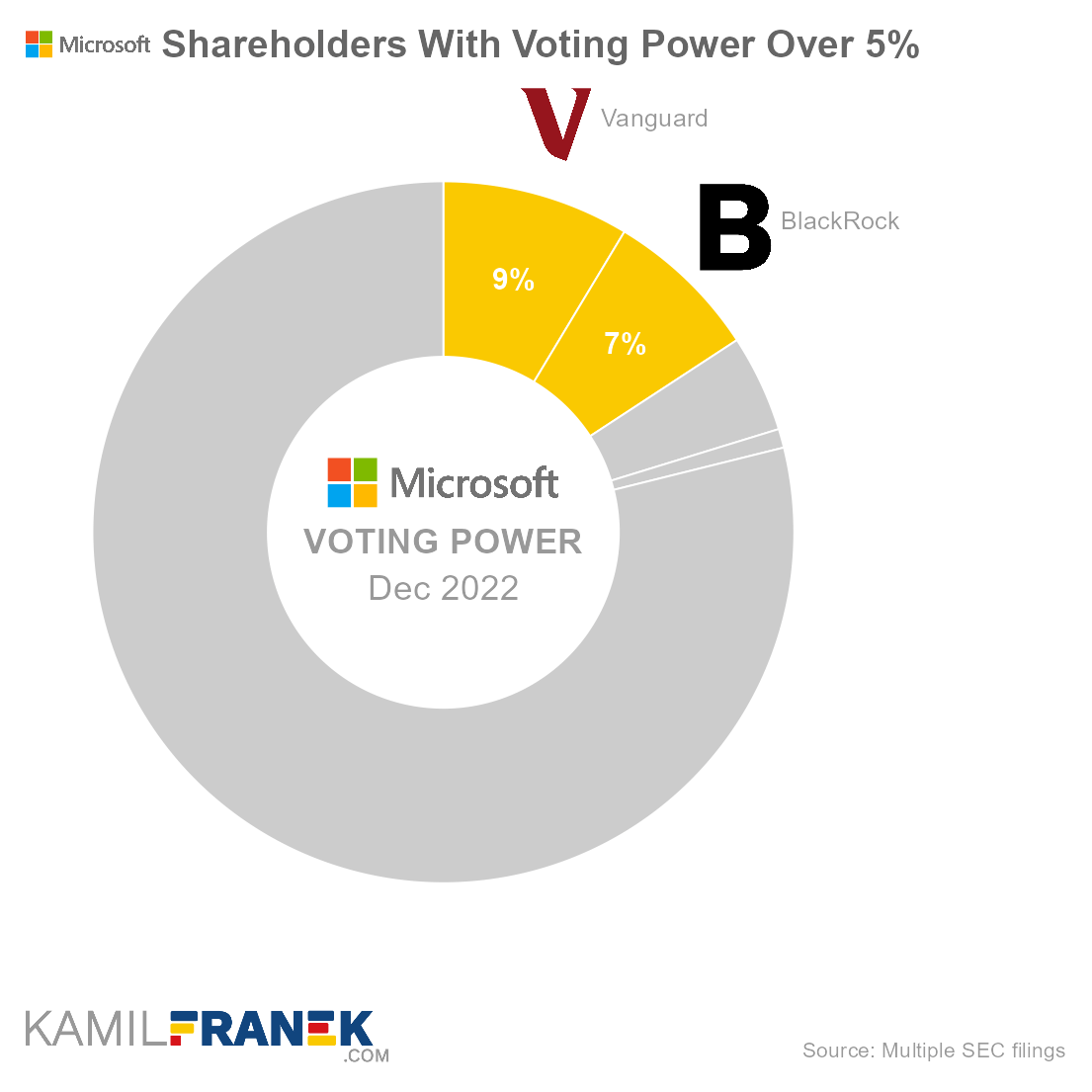

Microsoft’s shareholder with the largest voting power is Vanguard, which holds 8.6% of all votes, followed by BlackRock with 7.1% voting power. Steve Ballmer’s voting power is 4.5%.

Microsoft has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

Ownership of Microsoft Corporation is quite dispersed, and the main shareholders are asset managers investing money that belongs to other investors. None of them controls the company individually, but together they have a big influence.

Microsoft ‘s dispersed ownership and large control by asset managers might bring issues thanks to conflicts of interest between Microsoft’s management and its investors. However, the presence of Steve Ballmer and partially also Bill Gates as shareholders balances the power of asset managers and Microsoft’s insiders.

In the case of Microsoft, insiders are mainly CEO and Chairman Satya Nadella and other board members.

- Microsoft currently has a 12-member board of directors.

- Nobody from the current board of directors or executive officers holds more than 0.05% share of Microsoft’s stocks.

- Microsoft’s board includes some recognizable names like Reid Hoffman, co-founder of LinkedIn that Microsoft acquired in 2016, and Charles W. Scharf, CEO of Well Fargo.

🗳️ Breakdown of Microsoft’s Outstanding Shares and Votes by Top Shareholders

Microsoft Corporation had a total of 7,447 million outstanding shares as of December 2022. The following table shows how many shares each Microsoft’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 643 | 643 | 8.6% | |

| BlackRock | 532 | 532 | 7.1% | |

| Steve Ballmer | 333 | 333 | 4.5% | |

| Bill Gates | 65 | 65 | 0.9% | |

| Other | 5,874 | 5,874 | 78.9% | |

| Total (# millions) | 7,447 | 7,447 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 7,447 million votes distributed among shareholders of Microsoft Corporation. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 643 | 643 | 8.6% | |

| BlackRock | 532 | 532 | 7.1% | |

| Steve Ballmer | 333 | 333 | 4.5% | |

| Bill Gates | 65 | 65 | 0.9% | |

| Other | 5,874 | 5,874 | 78.9% | |

| Total (# millions) | 7,447 | 7,447 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Microsoft’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Microsoft Corporation worth.

However, keep in mind that a stake in Microsoft could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $154.1 | $154.1 | 8.6% | |

| BlackRock | $127.6 | $127.6 | 7.1% | |

| Steve Ballmer | $79.9 | $79.9 | 4.5% | |

| Bill Gates | $15.5 | $15.5 | 0.9% | |

| Other | $1,408.8 | $1,408.8 | 78.9% | |

| Total ($ billions) | $1,785.9 | $1,785.9 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Microsoft shareholder individually.

📒 Who Are Microsoft’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Microsoft Corporation one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Microsoft worth.

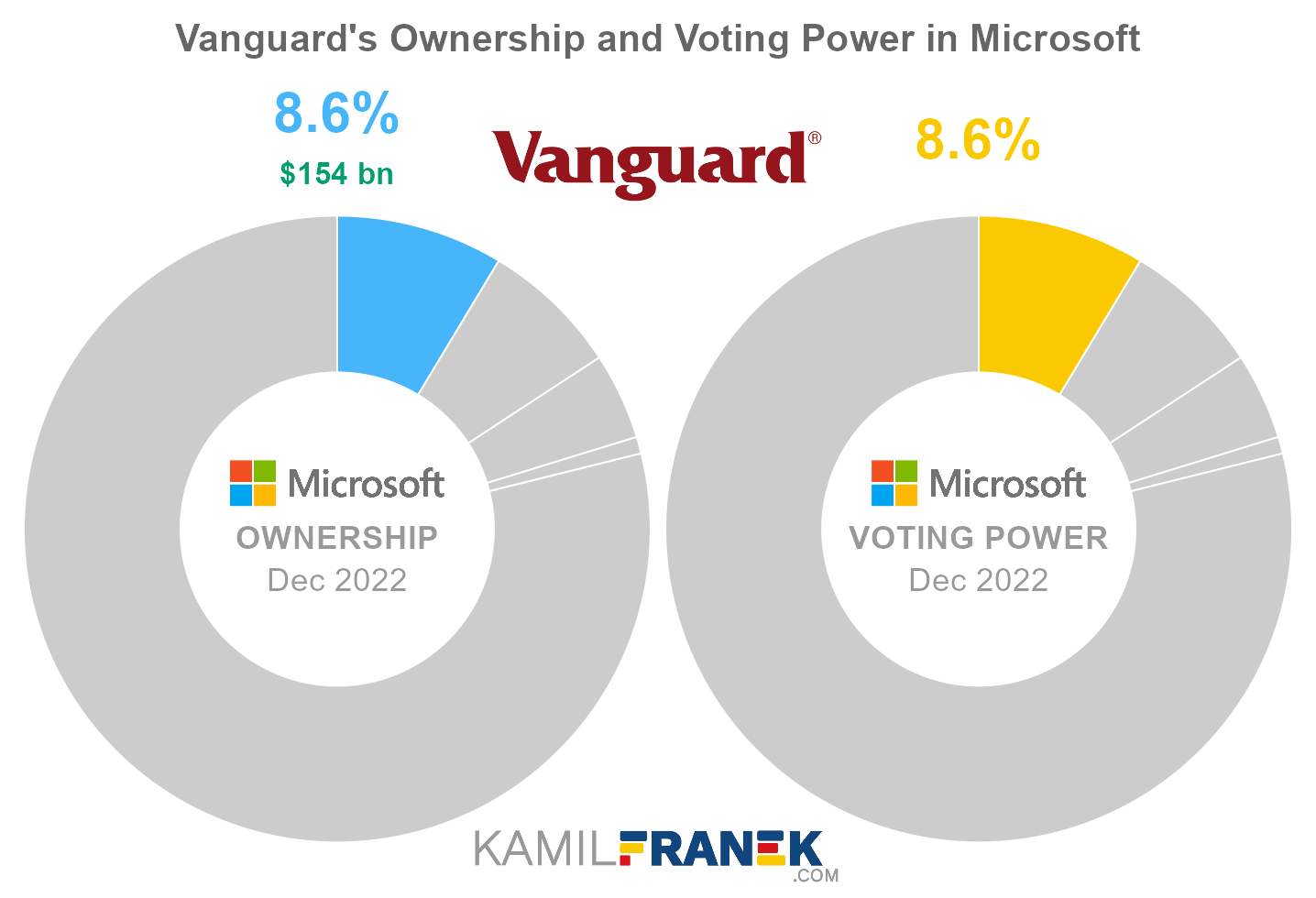

#1 Vanguard (8.6%)

Vanguard is the largest shareholder of Microsoft, owning 8.6% of its shares. As of December 2022, the market value of Vanguard’s stake in Microsoft was $154.1 billion.

Vanguard owned 643 million shares in Microsoft and controlled 643 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

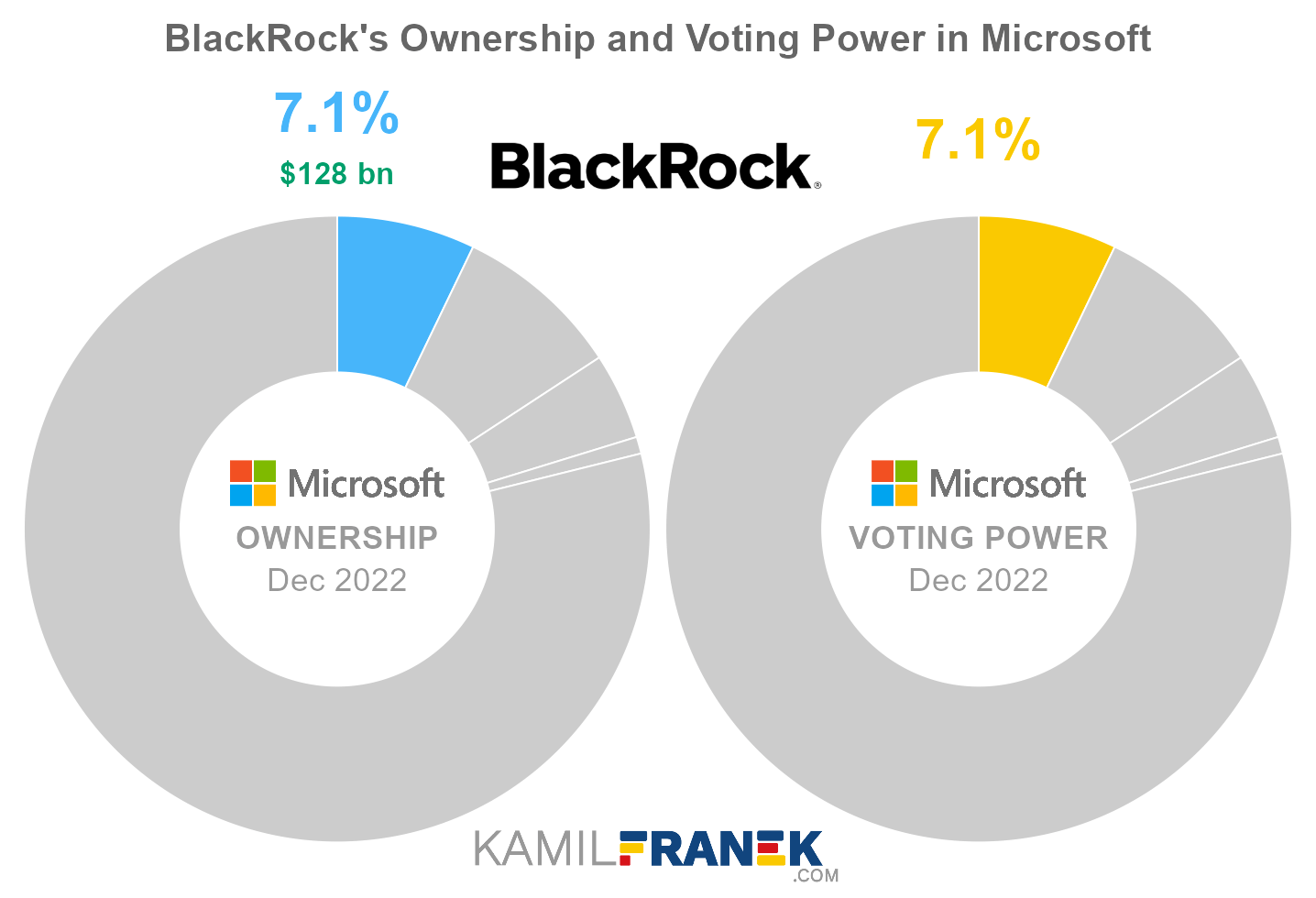

#2 BlackRock (7.1%)

BlackRock is the second-largest shareholder of Microsoft, owning 7.1% of its shares. As of December 2022, the market value of BlackRock’s stake in Microsoft was $127.6 billion.

BlackRock owned 532 million shares in Microsoft and controlled 532 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

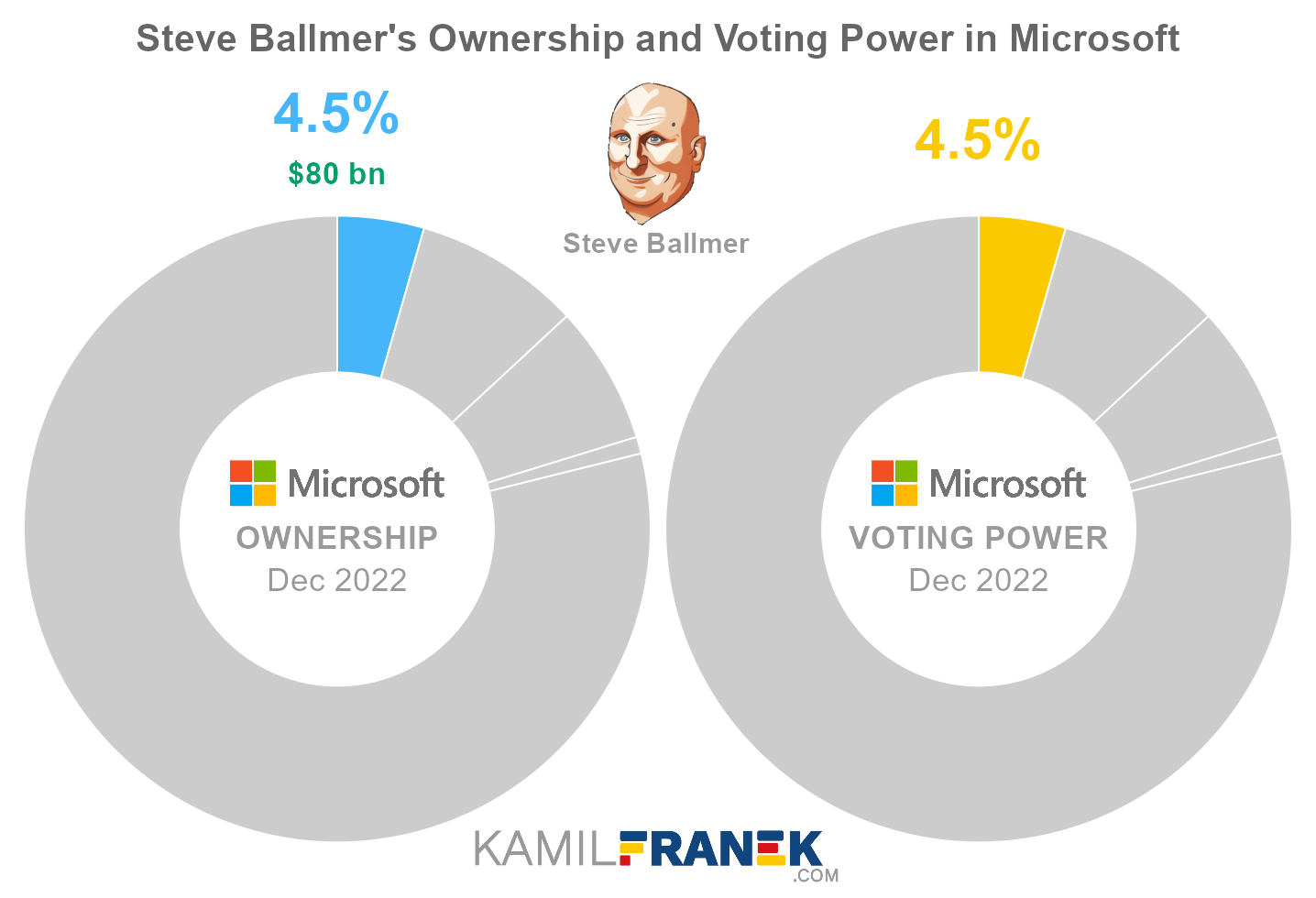

#3 Steve Ballmer (4.5%)

Steve Ballmer is the third-largest shareholder of Microsoft, owning 4.5% of its shares. As of December 2022, the market value of Steve Ballmer’s stake in Microsoft was $79.9 billion.

Steve Ballmer owned 333 million shares in Microsoft and controlled 333 million shareholder votes as of December 2022.

Steve Ballmer is a former Microsoft early employee and CEO. His time at Microsoft started in 1980 when Bill Gates hired him. He quickly became Gates’s number two and also a close friend.

Steve replaced Bill Gates as Microsoft CEO in 2000. However, Bill stayed in Microsoft in a limited role and also as chairman of the Board and continued to look Steve over the shoulder, which, as Steve commented, meant Steve did not have complete autonomy over Microsoft. When Bill Gates left Microsoft, it was also the time when their once close friendship deteriorated, and they drifted off.

Ballmer’s reign as Microsoft CEO from 2000 to 2014 is not viewed at the time positively. However, in my view, it was a mixed bag. He made some important changes that helped Microsoft to get where it is now, mainly his focus on enterprise products and customers. Under his leadership, Microsoft started its successful journey into being a cloud infrastructure provider. On the other hand, he lost ist fight for the mobile phone market and other consumer products, and his desperate move to buy the Nokia phone manufacturer backfired. Microsoft later gave up its struggle to get into the mobile phone market.

Under Steve as CEO, Microsoft was doing well financially, but not so much Microsoft stocks. In the end, Steve was pushed to leave Microsoft, and in 2014 he handed over the CEO position to Satya Nadella.

Ballmer is no longer active in Microsoft except as a company shareholder. He does not even sit on the company’s Board. He is the owner of the Los Angeles Clippers professional basketball team that he purchased in 2014.

He is an owner of the Los Angeles Clippers, professional basketball team that he purchased in 2014.

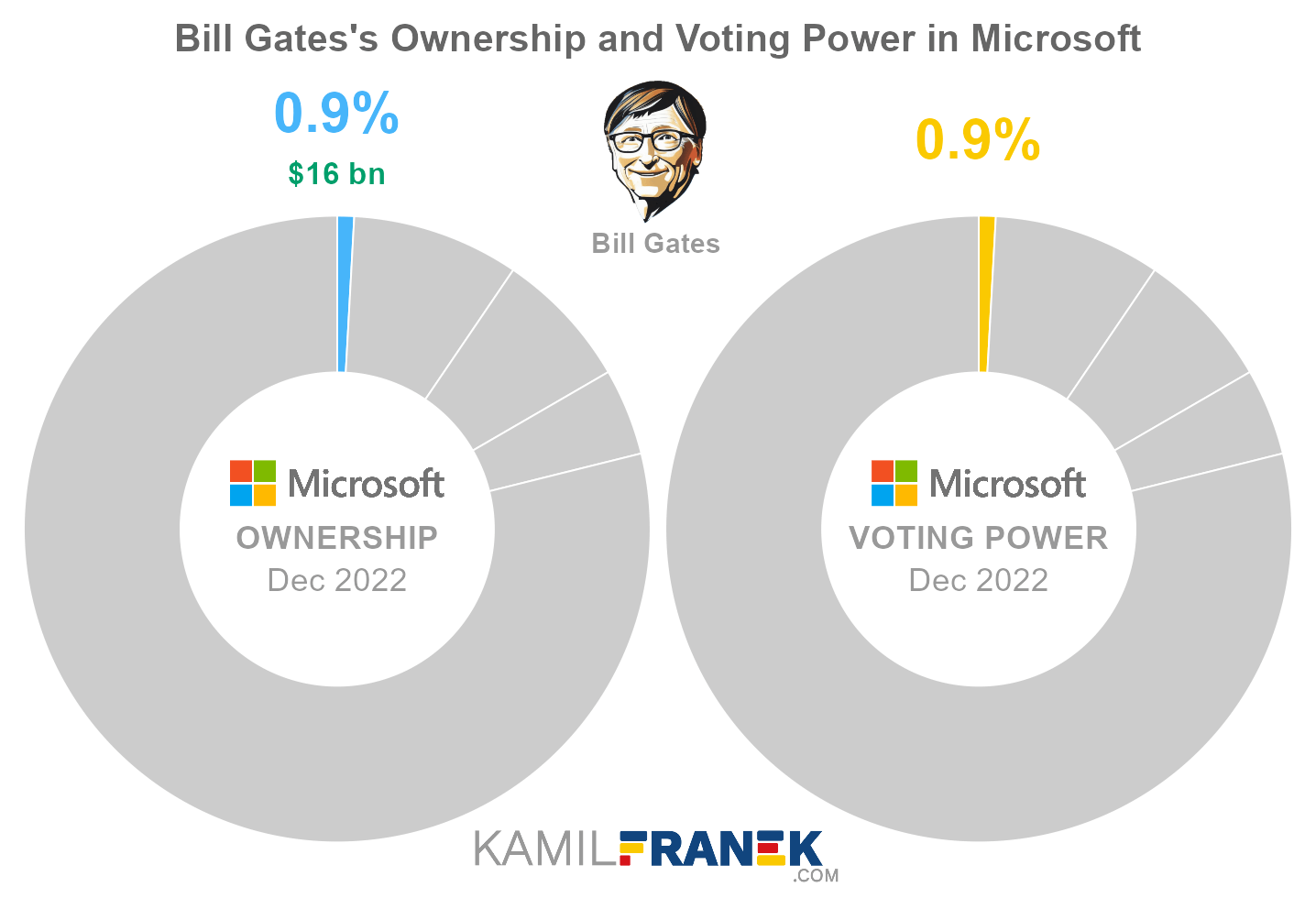

#4 Bill Gates (0.9%)

Bill Gates owns 0.9% of Microsoft’s shares. As of December 2022, the market value of Bill Gates’s stake in Microsoft was $15.5 billion.

Bill Gates owned 65 million shares in Microsoft and controlled 65 million shareholder votes as of December 2022.

Bill Gates (William H. Gates III) is the founder of Microsoft and a philanthropist. He was CEO of Microsoft from 1975 to 2000. After this period, he handed over the CEO position to Steve Ballmer. Bill Gates is still one of the wealthiest people in the world.

Bill Gates founded Microsoft in 1975, together with his friend Paul Allen. Even after stepping down from the CEO position in 2000, he stayed on Microsoft’s board as chairman and later board member. In 2020 he left his board position to focus on his philanthropic efforts fully.

However, as was later reported, this sudden resignation from Microsoft’s board a few months after he was reelected was not fully voluntary. It seems to be a result of an ongoing investigation by Microsoft’s Board into the billionaire’s prior romantic relationship with a female Microsoft employee that was deemed inappropriate.

Another significant milestone in his life was Bill and Melinda Gates’s divorce, announced in May 2021.

Bill continues to be active in his philanthropic work and has announced that he will soon drop off the list of world wealthies persons as he plans to donate virtually all his wealth to Bill & Melinda Gates Foundation.

As I look to the future, I plan to give virtually all of my wealth to the foundation. I will move down and eventually off of the list of the world’s richest people.

— Bill Gates (@BillGates) July 13, 2022

❔ Does Bill Gates Still Owns Microsoft?

Bill Gates owns approximately 0.9% of Microsoft as of December 2022. His ownership share was 1.4% a year ago, but he made another large stock donation to Bill & Melinda Gates Foundation in 2022. His stake in Microsoft, therefore, dropped to around 0.9%, and he plans to decrease it even further.

To be clear, Bill Gates is no longer required to disclose his stake, so his ownership is estimated based on his last disclosed stake when he was still on the Microsoft board in 2019. We also know that no large block of Microsoft stock appeared in Bill & Melinda Gates’s portfolio from 2019 to the end of 2021, which makes it probable that Bill still held the same stake in Microsoft at the end of 2021.

Based on the 13F filing by Bill & Melinda Gates Foundation Trust, a large block of Microsoft shares (around 0.5% stake) appeared in the foundation’s portfolio during the third quarter of 2022, together with other donations Bill made at the time and which were reported by media. However, it looks media missed that Microsoft stocks are part of that donation.

So even though Bill did not publicly disclose the drop in his Microsoft stake, circumstantial evidence suggests that it happened. It is in line with his announcements on Twitter in July 2022 that he is planning to give virtually all of his wealth to his foundation and that he is donating $20 billion to his foundation.

With the support and guidance of our board, we plan to increase our spending from nearly $6 billion per year today to $9 billion per year by 2026. To help make this spending increase possible, I am transferring $20 billion to the foundation’s endowment this month. pic.twitter.com/ybLMAKPx7I

— Bill Gates (@BillGates) July 13, 2022

❔ Does Paul Allen Still Owns Microsoft?

Paul Allen, a co-founder of Microsoft, died in 2018. However, he reduced his stake below the 5% threshold long before that. The last time Paul Allen appeared in Microsoft’s Proxy Statements as a shareholder was in 1999.

Paul Allen’s stake after Microsoft’s IPO in 1986 was 25%. Bill Gates’s stake at the same time was 45%.

📅 Microsoft’s History Timeline

These are selected events from Microsoft’s history:

- 1975: Microsoft was founded by Bill Gates and Paul Allen

- 1980: Microsoft was awarded a contract from IBM to provide OS for IBM PC.

- 1986: Release of Windows

- 1986: Microsoft’s initial public offering

- 1990: Introduction of Microsoft Office suite.

- 2000: Bill Gates handed over the CEO job to Steve Ballmer

- 2008: Launch of Azure Platform

- 2014: Steve Ballmer stepped down as CEO. The new CEO became Satya Nadella.

- 2016: Microsoft acquired LinkedIn

- 2020: Bill Gates left Microsoft’s board

📚 Recommended Articles & Other Resources

How Microsoft Makes Money: Business Model Explained

Deep dive into how Microsoft makes money and how its business model works.

Microsoft’s Financial Statements: Overview & Analysis

Overview and analysis of Microsoft’s financial statements from its annual report with financial statement visualizations.

Microsoft Revenue Breakdown by Product, Segment, and Country

A detailed breakdown of Microsoft’s revenue by product, segment, and geography with core takeaways, charts, and visuals.

Who Owns Amazon: The Largest Shareholders Overview

Overview of who owns Amazon.com, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Nike: The Largest Shareholders Overview

Overview of who owns Nike and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Zoom: The Largest Shareholders Overview

Overview of who owns Zoom Video Communications, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Roblox: The Largest Shareholders Overview

Overview of who owns Roblox Corporation and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Spotify: The Largest Shareholders Overview

Overview of who owns Spotify and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Microsoft’s Annual Financials Statements (K-10)

- Microsoft’s Proxy Statement

- Microsoft’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.