Who Owns Nike: The Largest Shareholders Overview

Nike, Inc. (NKE) is an iconic company that makes money by designing, promoting, and selling footwear and apparel. They sell both through third-party retailers and also directly. Let’s now look at who owns Nike and who controls it.

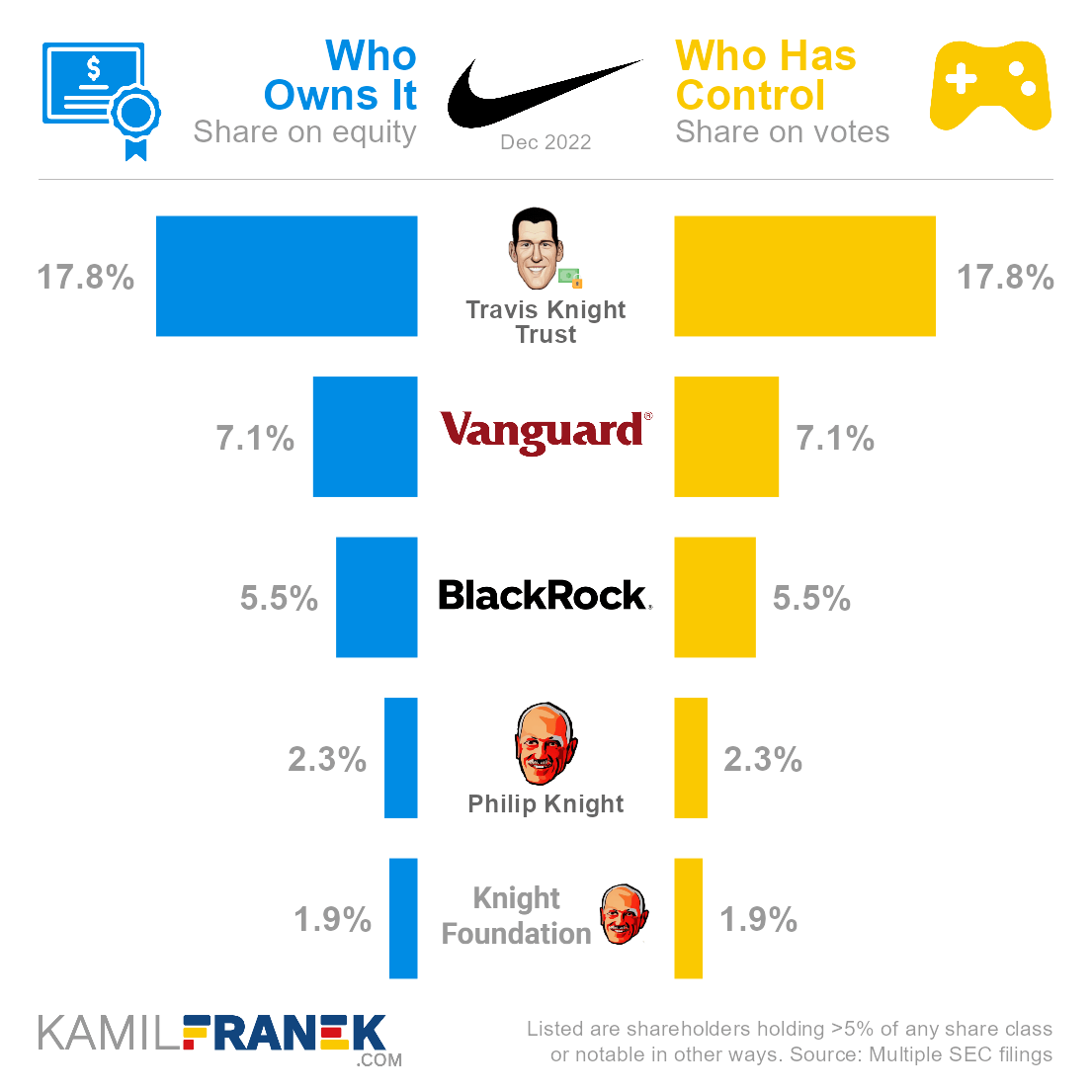

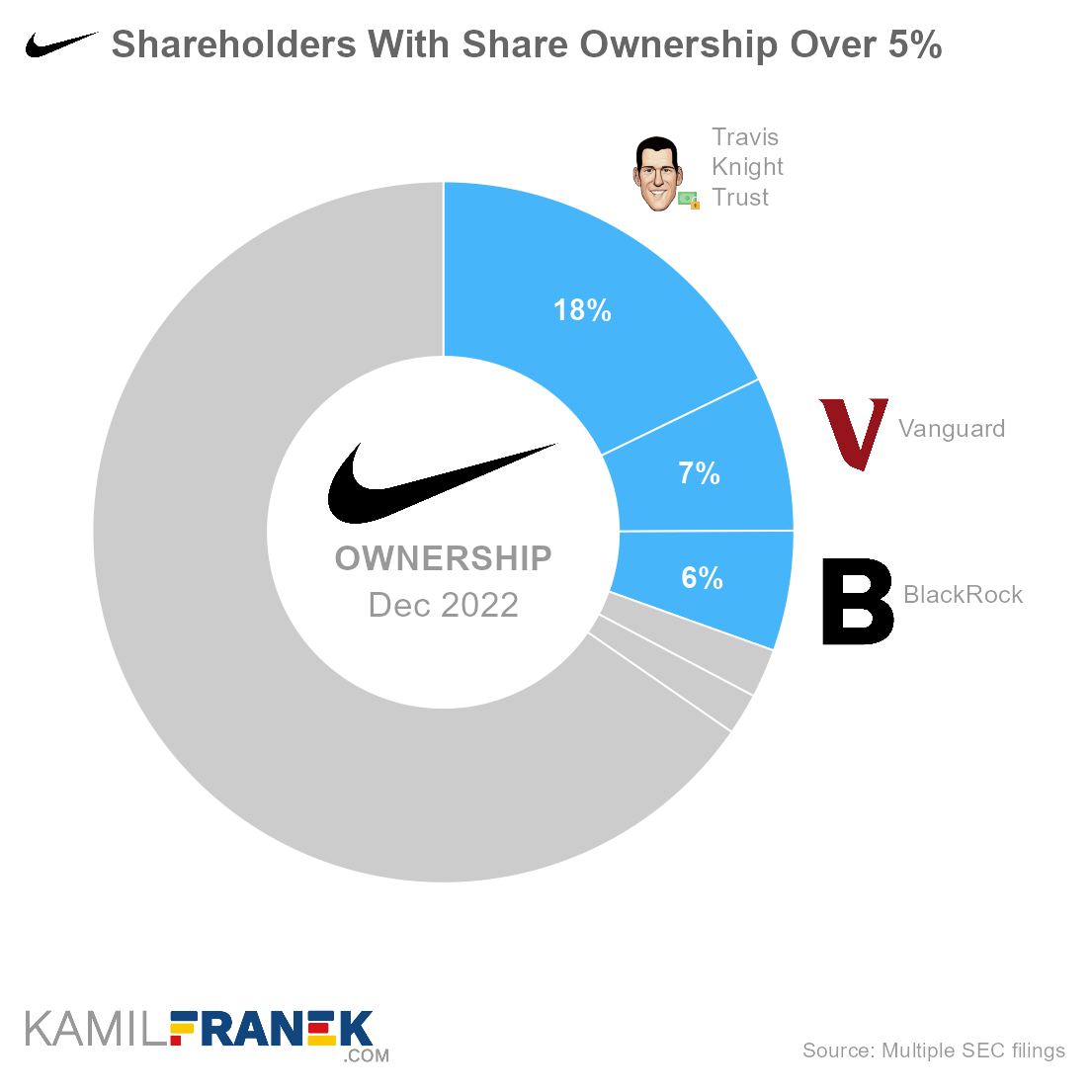

Nike’s largest shareholders are mainly members of Knight’s family, represented by Nike’s co-founder Philip Knight and his son Travis Knight, who own 22% of the company shares. Other large shareholders that own Nike are asset managers Vanguard (7.1%) and BlackRock (5.5%).

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Travis Knight Trust | 17.8% | 17.8% | |

| Vanguard | 7.1% | 7.1% | |

| BlackRock | 5.5% | 5.5% | |

| Philip Knight | 2.3% | 2.3% | |

| Knight Foundation | 1.9% | 1.9% | |

| Other | 65.4% | 65.4% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Nike and who controls it. I will show you who Nike’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Tesla, Apple, PayPal, IBM, or Starbucks.

📃 Who Owns Nike?

Nike is owned mainly by the family of Nike’s co-founder Philip Knight. The Knight family owns 22% of the company through various entities. Other large owners are asset manager Vanguard with a 7.1% ownership share, and asset manager BlackRock, with a 5.5% ownership share.

The largest part of the Knight family stake is owned by Travis A. Knight 2009 Irrevocable Trust II (Trust), which holds 17.8% of Nike’s shares. Part of the Trust is also company Swoosh, LLC, which owns the most significant piece of the family ownership.

- Swoosh LLC holds the majority of the family stake in Nike, and Travis Knight controls 2 out 5 of its board seats. He is reported as the beneficial owner. The rest of the Swoosh seats are controlled by the Trust.

- Swoosh LLC was originally created by Nike’s founder Phil Knight to hold most of his shares. In 2016, he transferred voting interest in Swoosh to the Trust that bears the name of his son Travis (Travis A. Knight 2009 Irrevocable Trust II).

- The Trust holds a smaller part of the stake in Nike also directly. Although the Trust is named after Travis Knight, son of Nike’s founder, he disclaims beneficial ownership. Travis Knight used to be the trustee of the Trust, which changed in 2022. Despite this change, he and his immediate family are still beneficiaries of this trust.

A sizable part of the Knight family stake is owned directly by the founder Philip Knight, who owns 2.3% of Nike’s shares. He is no longer involved in the company management but holds the position of Chairman Emeritus and can attend board meetings as an observer.

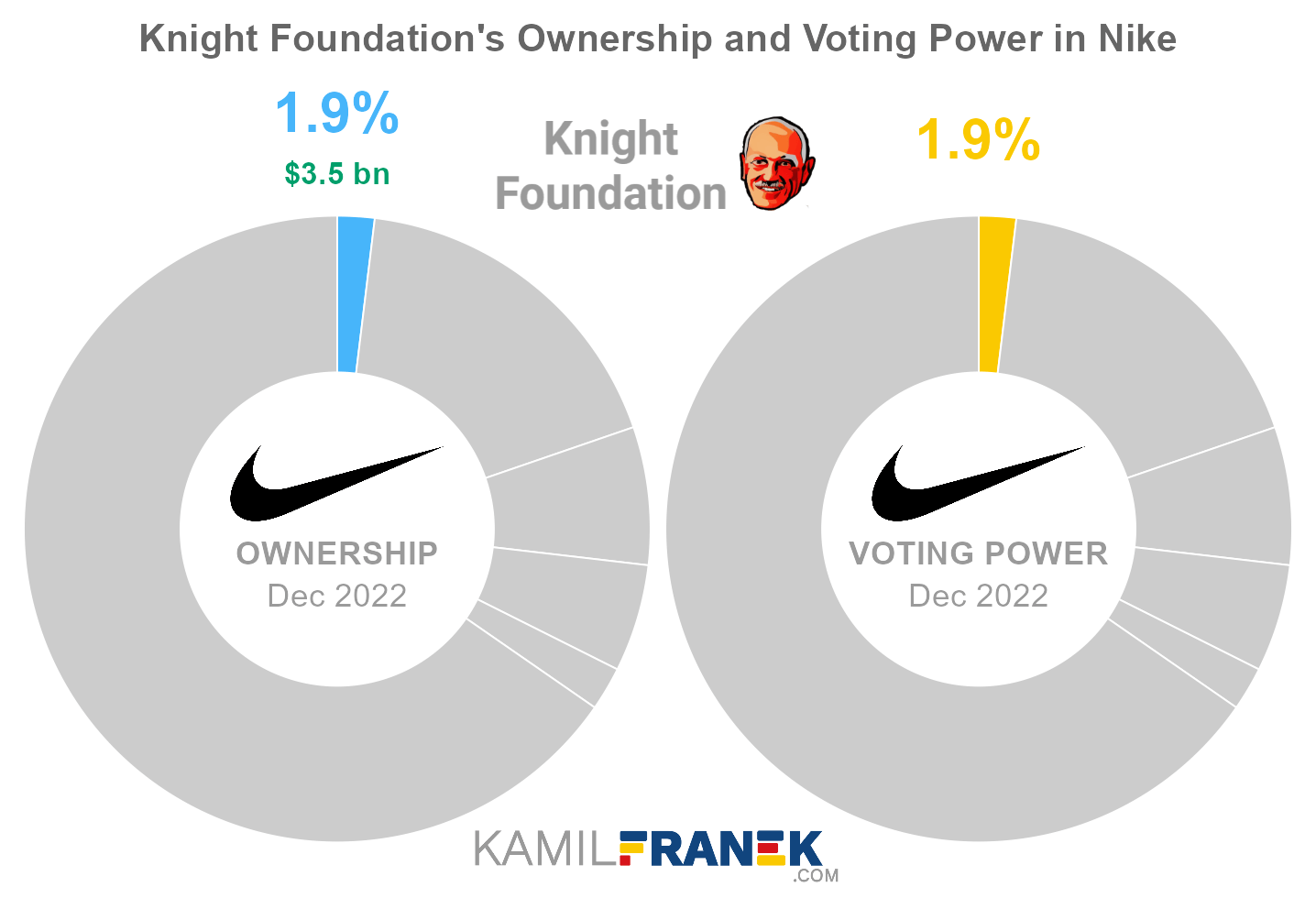

Part of Nike’s ownership by the Knight family is owned by the Knights Foundation, which owns 1.9% of Nike shares. Philip Knight and his spouse are directors of the foundation, but they disclaim ownership.

Travis Knight also holds a tiny amount of Nike’s shares directly, be this is just a symbolic amount that rounds up to 0.00% of company shares.

Other largest owners of Nike are asset managers Vanguard, which owns a 7.1% stake, and asset manager BlackRock with 5.5% ownership.

Nike was founded in 1964 by Philip Knight and Bill Bowerman and has been publicly listed since its initial public offering on NYSE in 1980 under the ticker NKE.

Nike, Inc. is incorporated in the State of Oregon (US), where it also has its world headquarters in Beaverton.

🎮 Who Controls Nike (NKE)?

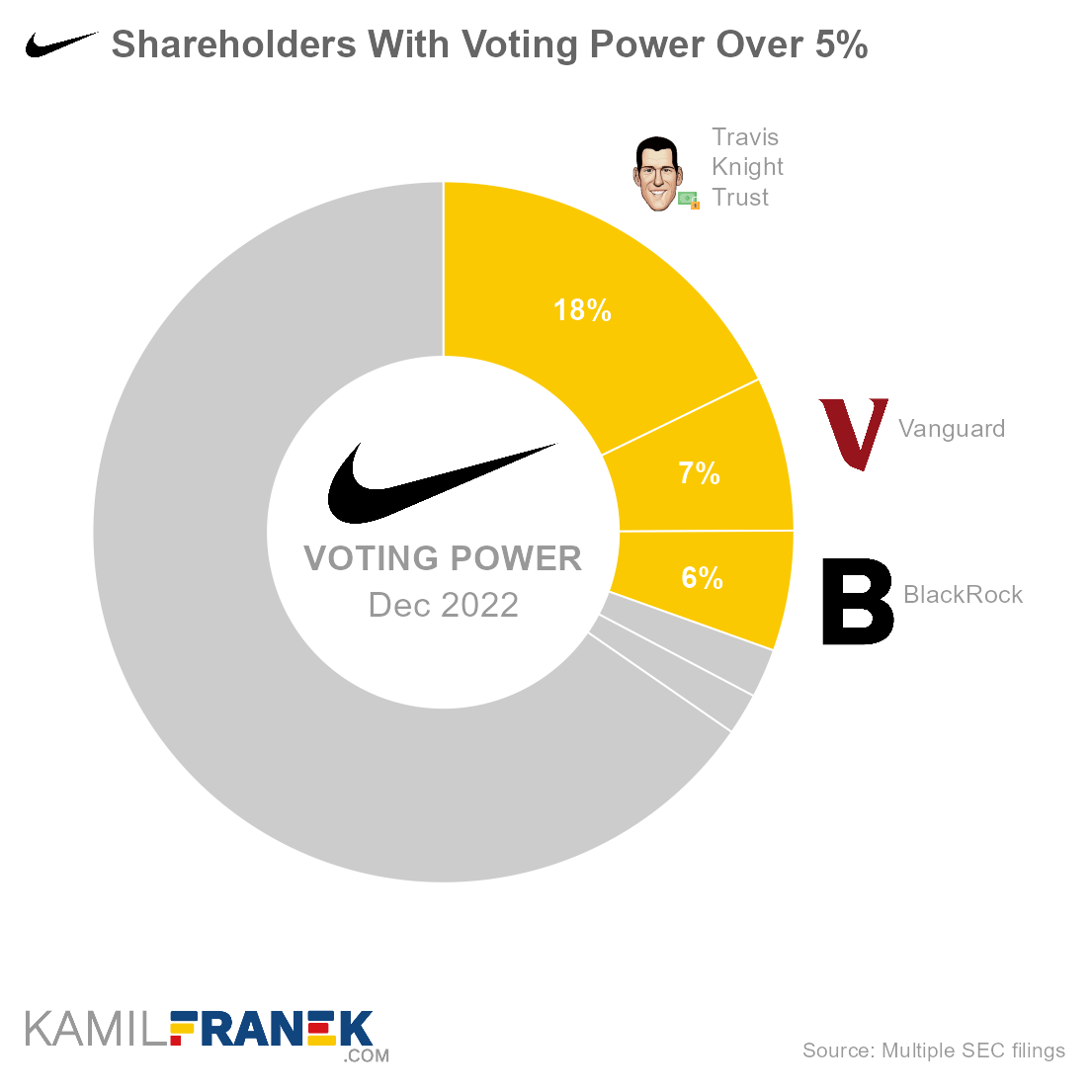

Nike is controlled by the family of the company founder Philip Knight. The Knight family controls 22% of the voting power, and, more importantly, the family owns the majority of Class A shares, which gives them the power to nominate 75% of Nike’s board.

Sizable nominal voting power is also held by asset managers Vanguard (7.1%) and BlackRock (5.5%). But because of the Knight family’s control over Nike’s board, their voting power does not have real significance.

As you can see above, although it looks like the shareholders’ nominal voting power is equal to their ownership, it is not really the case. Knight family holds outsized voting power over the company because Nike, Inc. has different classes of outstanding shares with different rights.

Nike Inc. has three types of outstanding shares:

- Class A common shares: These are not publicly tradable but are convertible into Class B publicly traded shares. Knight’s family holds 97% of Class A shares which gives them the power to elect nine(9) directors from Nike’s 12-member board.

- Class B common shares: These are ordinary shares traded under the ticker NKE. They are mostly held by outside shareholders. Even though both Class B and A shares have one vote per share, the power of Class B shareholders is impaired by being able to decide only about three (3) directors on Nike’s board.

- Preferred Shares: The company has a tiny number of preferred shares outstanding, and all of them are held by “Sojitz Corporation of America .” Preferred shares give the right to $.10 per share per annum cumulative dividend. Preferred shares have no voting power except in specific situations concerning mergers or significant sales of company assets.

Class A shares are the key to Nike’s control by the Knight family. Class A shares do not give multiple votes per share as is common in other companies, but they give their holders the right to nominate 75% of directors on Nike’s 12-person board

- This Class A power is only valid if the proportion of Class B shares to total common shares is between 25% and 87,5%. Currently, this condition is valid, and the proportion of Class B shares on total shares is 81%.

- Knight family controls 97% of Class A shares.

- Class A shares’ power can be revoked only by the approval of 80% of all votes. The company also requires 80% of all votes to approve business combinations, with anyone owning 10% or more of Nike.

The power that Knight’s family currently has over NIKE is transferable to others if they decide to sell their Class A shares in the future. This is different from super-voting shares in, e.g., Alphabet(Google) or Meta, where super-voting shares automatically convert to ordinary shares when sold to outside shareholders.

Nike ‘s insiders are CEO and president John Donahoe, chairman of the board Mark Parker, and other board members and executives.

- Knight family controls 75% of Nike’s 12-member board. Founder Philip Knight is chairman Emeritus and can attend a board meeting as a non-voting observer. His son Travis Knight is also a board member.

- Outside of the Knight family, only chairman Mark Parker ship holds noticeable ownership (0.09%). Nobody else from the board or management owns over 0.05% of Nike ‘s shares.

- When you look at who is currently on Nike’s board, you will notice that Tim Cook, CEO of Apple, serves as a Lead Independent Director. However, “independent” does not mean that he is a nominee of a Class B shareholders. On the contrary, he is a nominee of Knight’s family (Class A shareholders)

🗳️ Breakdown of Nike’s Outstanding Shares and Votes by Top Shareholders

Nike, Inc. had a total of 1,542 million outstanding shares as of December 2022. The following table shows how many shares each Nike’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Travis Knight Trust | 275 | 0 | 275 | 17.8% | |

| Vanguard | - | 110 | 110 | 7.1% | |

| BlackRock | - | 85 | 85 | 5.5% | |

| Philip Knight | 21 | 13 | 35 | 2.3% | |

| Knight Foundation | - | 30 | 30 | 1.9% | |

| Other | - | 1,008 | 1,008 | 65.4% | |

| Total (# millions) | - | 1,246 | 1,542 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

There were 1,542 million votes distributed among shareholders of Nike, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

|||||

| In millions of votes as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Travis Knight Trust | 275 | 0 | 275 | 17.8% | |

| Vanguard | - | 110 | 110 | 7.1% | |

| BlackRock | - | 85 | 85 | 5.5% | |

| Philip Knight | 21 | 13 | 35 | 2.3% | |

| Knight Foundation | - | 30 | 30 | 1.9% | |

| Other | - | 1,008 | 1,008 | 65.4% | |

| Total (# millions) | - | 1,246 | 1,542 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

💵 Breakdown of Nike’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Nike, Inc. worth.

However, keep in mind that a stake in Nike could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Travis Knight Trust | $32.1 | $0.0 | $32.1 | 17.8% | |

| Vanguard | - | $12.8 | $12.8 | 7.1% | |

| BlackRock | - | $10.0 | $10.0 | 5.5% | |

| Philip Knight | $2.5 | $1.6 | $4.1 | 2.3% | |

| Knight Foundation | - | $3.5 | $3.5 | 1.9% | |

| Other | - | $117.9 | $117.9 | 65.4% | |

| Total ($ billions) | - | $145.8 | $180.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Let’s now look at each Nike shareholder individually.

📒 Who Are Nike’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Nike, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Nike worth.

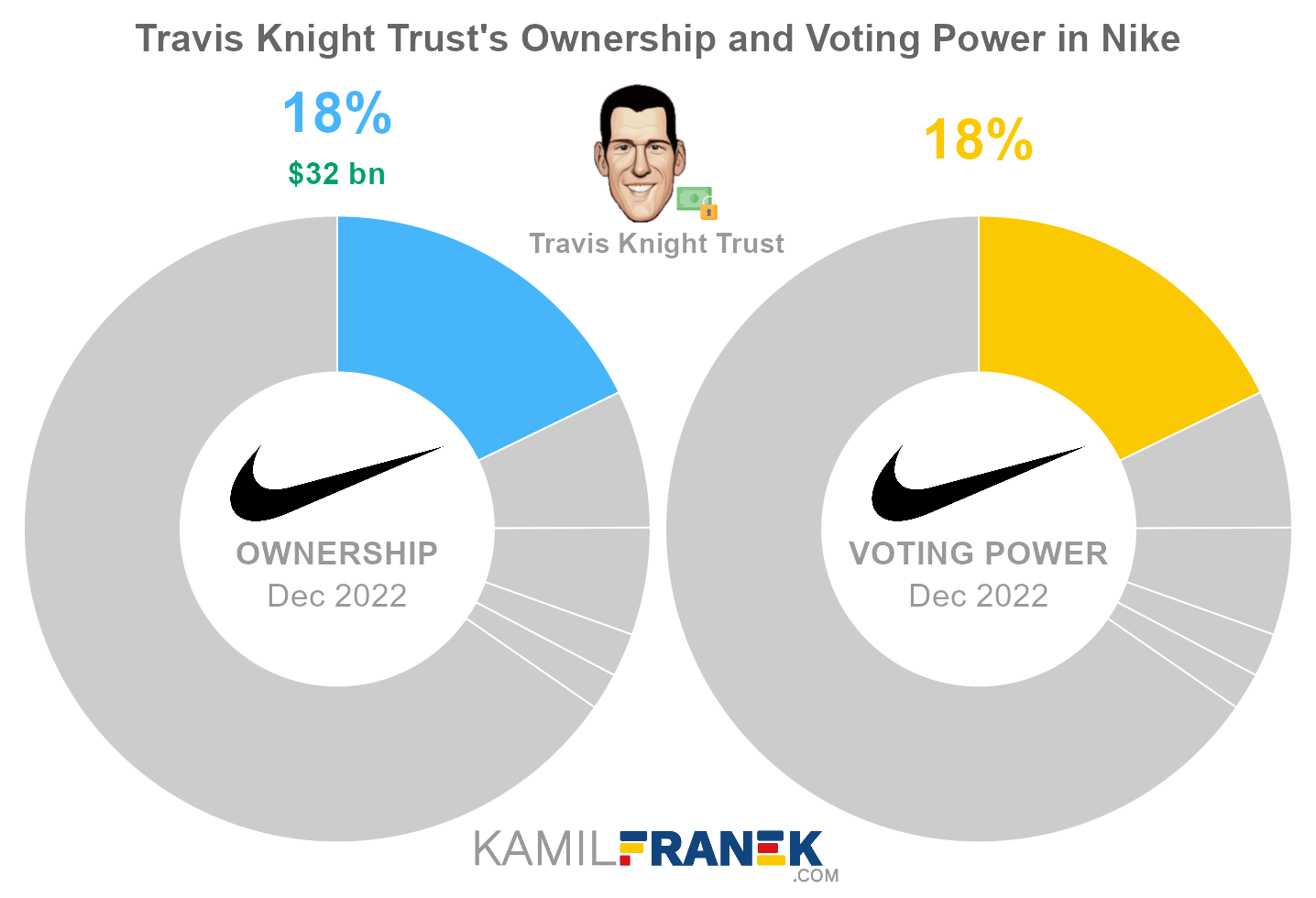

#1 Travis Knight Trust (17.8%)

Travis Knight Trust is the largest shareholder of Nike, owning 17.8% of its shares. As of December 2022, the market value of Travis Knight Trust’s stake in Nike was $32.1 billion.

Travis Knight Trust owned 275 million shares in Nike and controlled 275 million shareholder votes as of December 2022.

Travis A. Knight 2009 Irrevocable Trust II is a trust set up by Knight’s family and holds the majority of their stake in Nike Inc.

Travis Knight is the son of Nike’s founder Philip Knight. Since Travis Knight is a trustee and beneficiary of the trust, therefore it is assumed that he is the person with the largest influence over those stocks.

Travis A. Knight 2009 Irrevocable Trust II also includes the company Swoosh, LLC, which was set up by Nike’s co-founder Philip Knight to hold his stake in the company and was later transferred into the trust.

Travis Knight holds only a tiny amount of shares directly outside of the above mention family trust and is not currently involved in Nike’s business outside of his role as a board director.

He is the current president and CEO of Laika animation studio, currently owned by the Knight family. He is also a successful producer and director and worked for some time as an animator.

For example, he directed and produced a highly regarded animated movie Kubo and the Two Strings. He also directed the live-action movie Bumblebee.

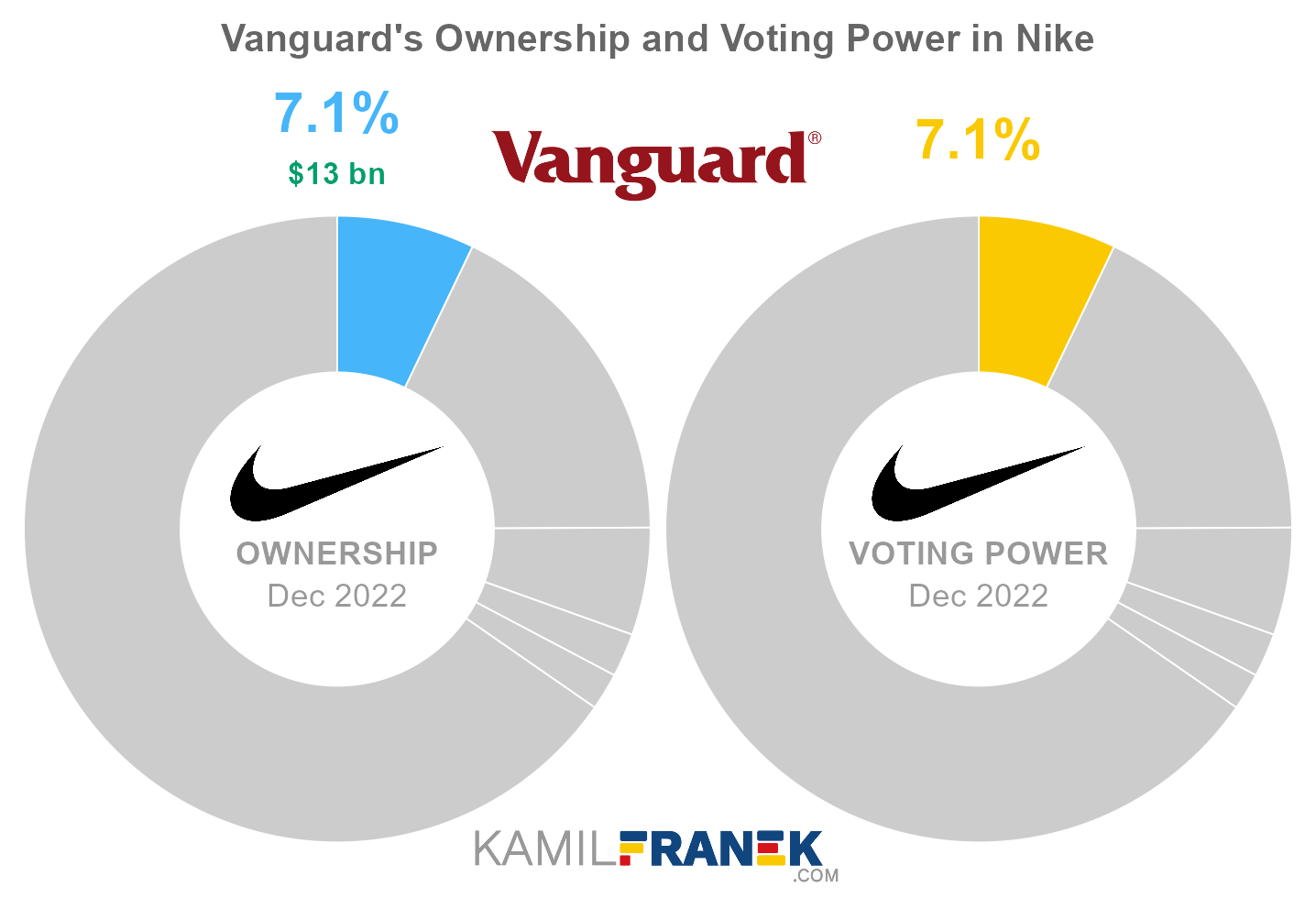

#2 Vanguard (7.1%)

Vanguard is the second-largest shareholder of Nike, owning 7.1% of its shares. As of December 2022, the market value of Vanguard’s stake in Nike was $12.8 billion.

Vanguard owned 110 million shares in Nike and controlled 110 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

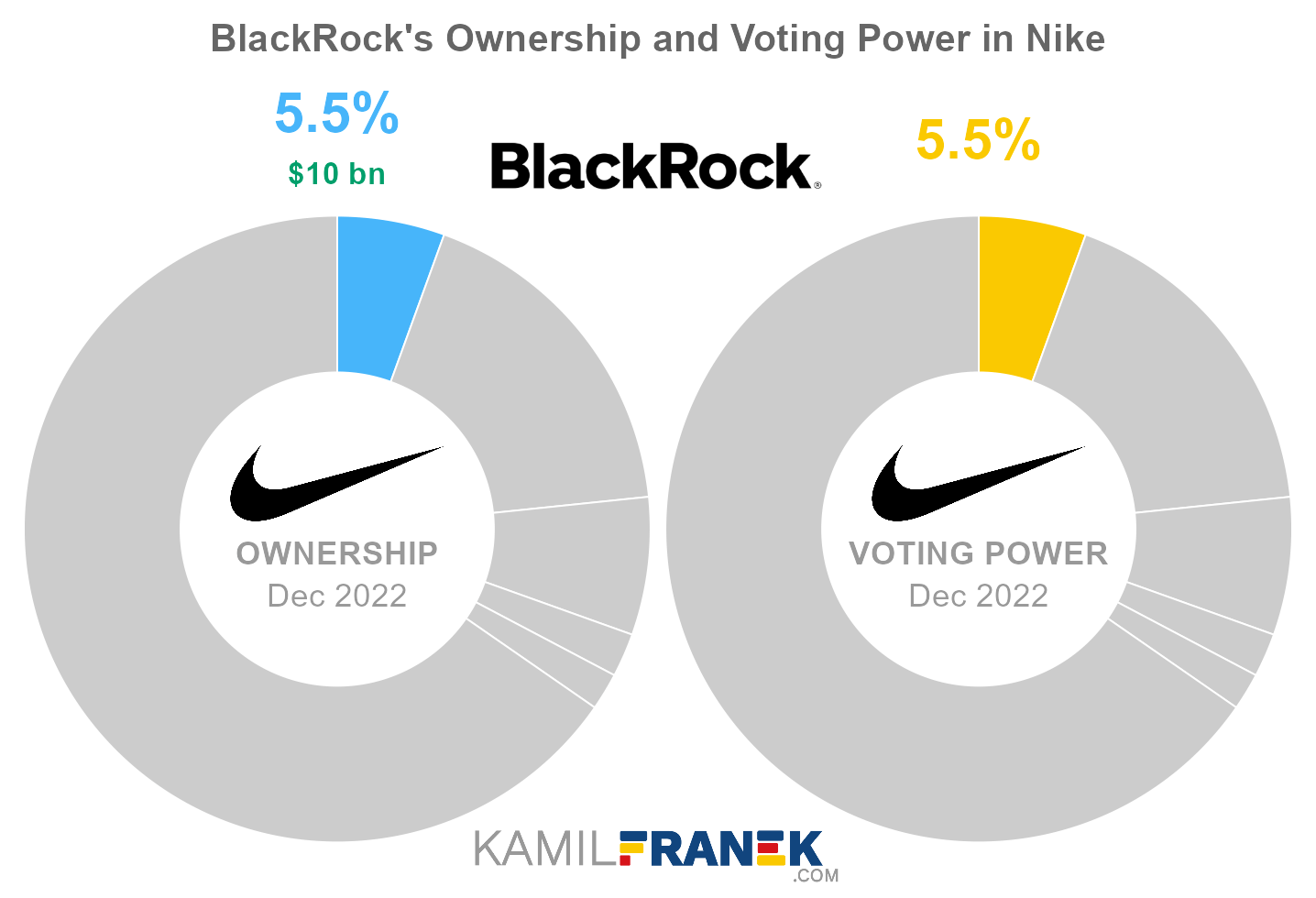

#3 BlackRock (5.5%)

BlackRock is the third-largest shareholder of Nike, owning 5.5% of its shares. As of December 2022, the market value of BlackRock’s stake in Nike was $10.0 billion.

BlackRock owned 85 million shares in Nike and controlled 85 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

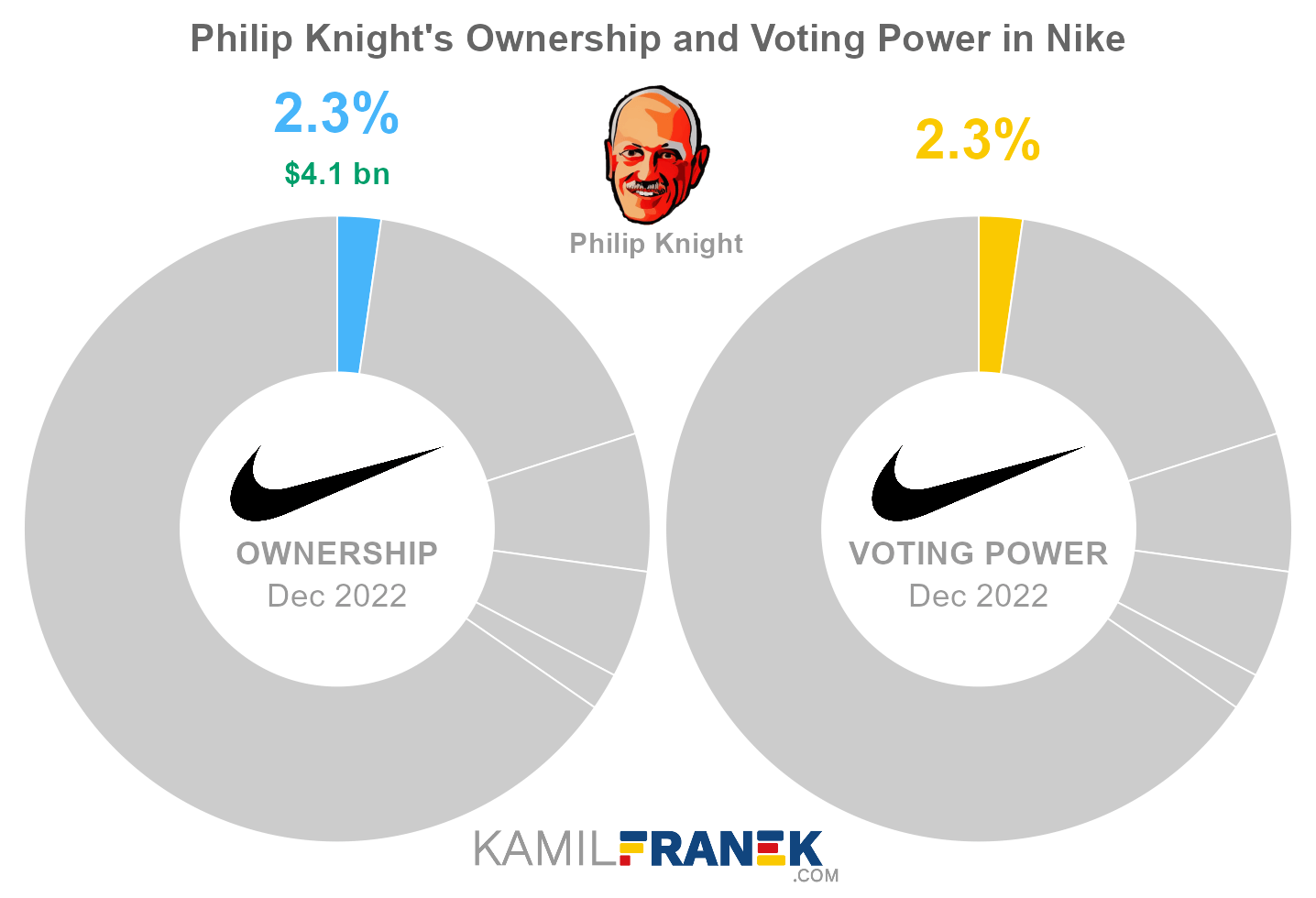

#4 Philip Knight (2.3%)

Philip Knight owns 2.3% of Nike’s shares. As of December 2022, the market value of Philip Knight’s stake in Nike was $4.1 billion.

Philip Knight owned 35 million shares in Nike and controlled 35 million shareholder votes as of December 2022.

Philip Hampson Knight is co-founder and former Chairman of NIKE, Inc. He co-founded Nike in 1964 with Bill Bowerman and has been involved with the company ever since.

Under his influence, Nike became one of the world’s most powerful brands, and he became one of the wealthiest persons in the world.

He retired as Nike’s chairman in 2016 and was appointed Chair Emeritus, a non-voting board member.

#5 Knight Foundation (1.9%)

Knight Foundation owns 1.9% of Nike’s shares. As of December 2022, the market value of Knight Foundation’s stake in Nike was $3.5 billion.

Knight Foundation owned 30 million shares in Nike and controlled 30 million shareholder votes as of December 2022.

Knight Foundation is a private foundation set up by the Knight family, where Philip Knight and his wife Penny are directors. Philip Knight disclaimed beneficial ownership of stocks that the foundation holds.

Nike is owned mainly by the family of Nike’s co-founder Philip Knight. The Knight family owns 22% of the company through various entities. Other large owners are asset manager Vanguard with a 7.1% ownership share, and asset manager BlackRock, with a 5.5% ownership share.

The largest part of the Knight family stake is owned by Travis A. Knight 2009 Irrevocable Trust II (Trust), which holds 17.8% of Nike’s shares. Part of the Trust is also company Swoosh, LLC, which owns the most significant piece of the family ownership.

- Swoosh LLC holds the majority of the family stake in Nike, and Travis Knight controls 2 out 5 of its board seats. He is reported as the beneficial owner. The rest of the Swoosh seats are controlled by the Trust.

- Swoosh LLC was originally created by Nike’s founder Phil Knight to hold most of his shares. In 2016, he transferred voting interest in Swoosh to the Trust that bears the name of his son Travis (Travis A. Knight 2009 Irrevocable Trust II).

- The Trust holds a smaller part of the stake in Nike also directly.

- Although the Trust is named after Travis Knight, son of Nike’s founder, he disclaims beneficial ownership. Travis Knight used to be the trustee of the Trust, which changed in 2022. Despite this change, he and his immediate family are still beneficiaries of this trust.

A sizable part of the Knight family stake is owned directly by the founder Philip Knight, who owns 2.3% of Nike’s shares. He is no longer involved in the company management but holds the position of Chairman Emeritus and can attend board meetings as an observer.

Part of Nike’s ownership by the Knight family is owned by the Knights Foundation, which owns 1.9% of Nike shares. Philip Knight and his spouse are directors of the foundation, but they disclaim ownership.

Travis Knight also holds a tiny amount of Nike’s shares directly, be this is just a symbolic amount that rounds up to 0.00% of company shares.

Other largest owners of Nike are asset managers Vanguard, which owns a 7.1% stake, and asset manager BlackRock with 5.5% ownership.

Nike was founded in 1964 by Philip Knight and Bill Bowerman and has been publicly listed since its initial public offering on NYSE in 1980 under the ticker NKE.

Nike, Inc. is incorporated in the State of Oregon (US), where it also has its world headquarters in Beaverton.

🧱 Who and When Founded Nike?

Nike was founded in 1964 by Philip Knight and Bill Bowerman. Initially, the company was named Blue Ribbon Sports but was later renamed Nike. Over many decades Nike has become the world’s most iconic brand and made Philip Knight and his family rich.

During Nike’s initial public offering in 1980, only B-class shares with limited power over board elections were offered. Power over the board was held by original shareholders.

Nike has made many acquisitions throughout the years. For example, in 2003, Nike acquired Converse, another iconic shoe brand.

Bowerman died in 1999, but he started reducing his role in the company and also his stake long before that.

The company also had periods where they were under a lot of heat when they were criticized for running sweatshops in Asia and for using child labor.

📅 Nike’s History Timeline

These are selected events from Nike’s history:

- 1964: Nike was founded by Philip Knight and Bill Bowerman.

- 1980: Nike’s initial public offering (IPO)

- 1980: Co-founder Bowerman died

- 2003: Acquisition of Converse

📚 Recommended Articles & Other Resources

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Starbucks: The Largest Shareholders Overview

Overview of who owns Starbucks and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Paypal: The Largest Shareholders Overview

Overview of who owns PayPal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns eBay: The Largest Shareholders Overview

Overview of who owns eBay and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lockheed Martin: The Largest Shareholders Overview

Overview of who owns Lockheed Martin and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Nike’s Annual Financials Statements (K-10)

- Nike’s Proxy Statement

- Nike’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.