Who Owns IBM: The Largest Shareholders Overview

International Business Machines Corporation (IBM) is a technology company that is behind the invention of modern PC, servers, and advanced AI. It makes money predominantly from software, hybrid cloud solutions, and consulting. Let’s look at who owns IBM and who controls it.

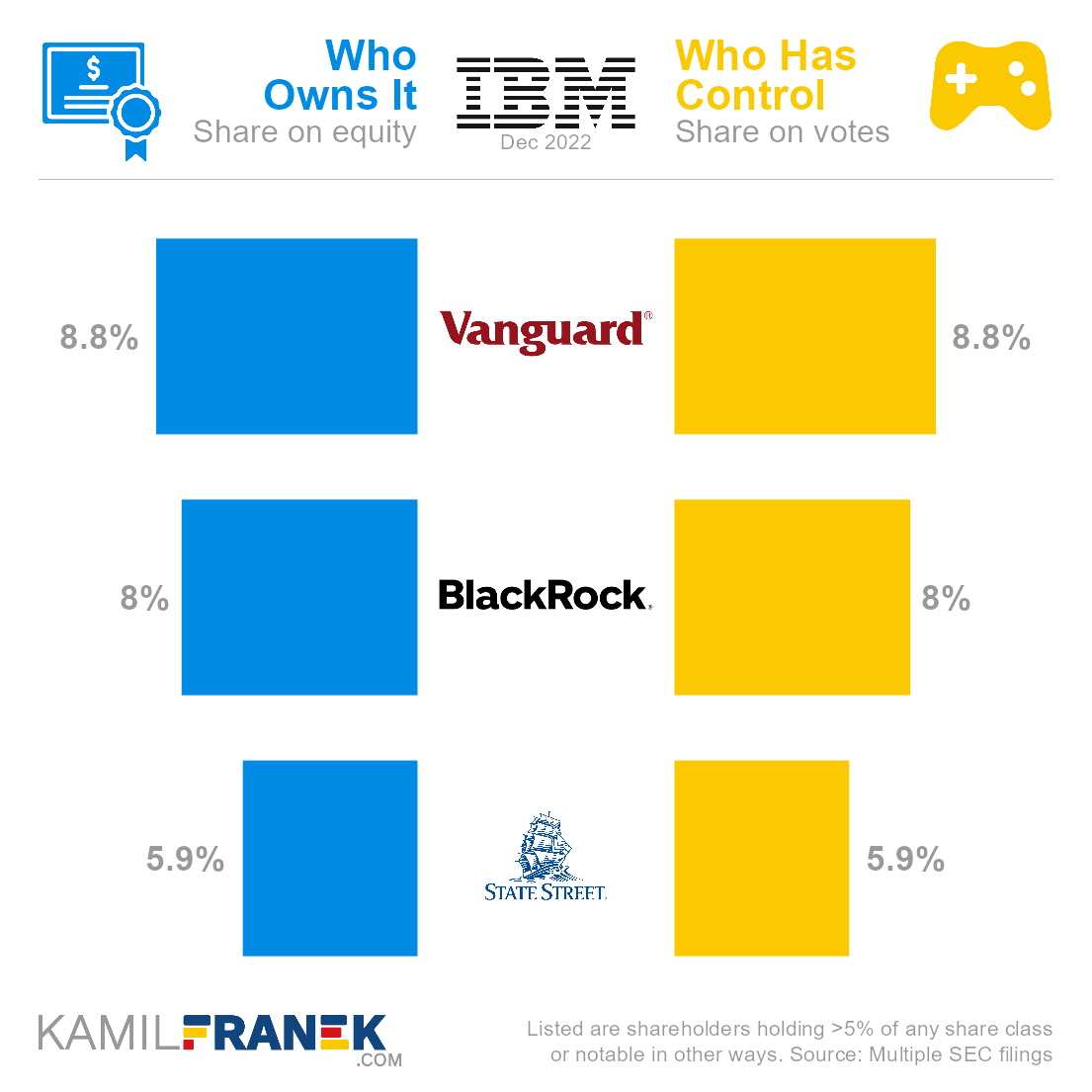

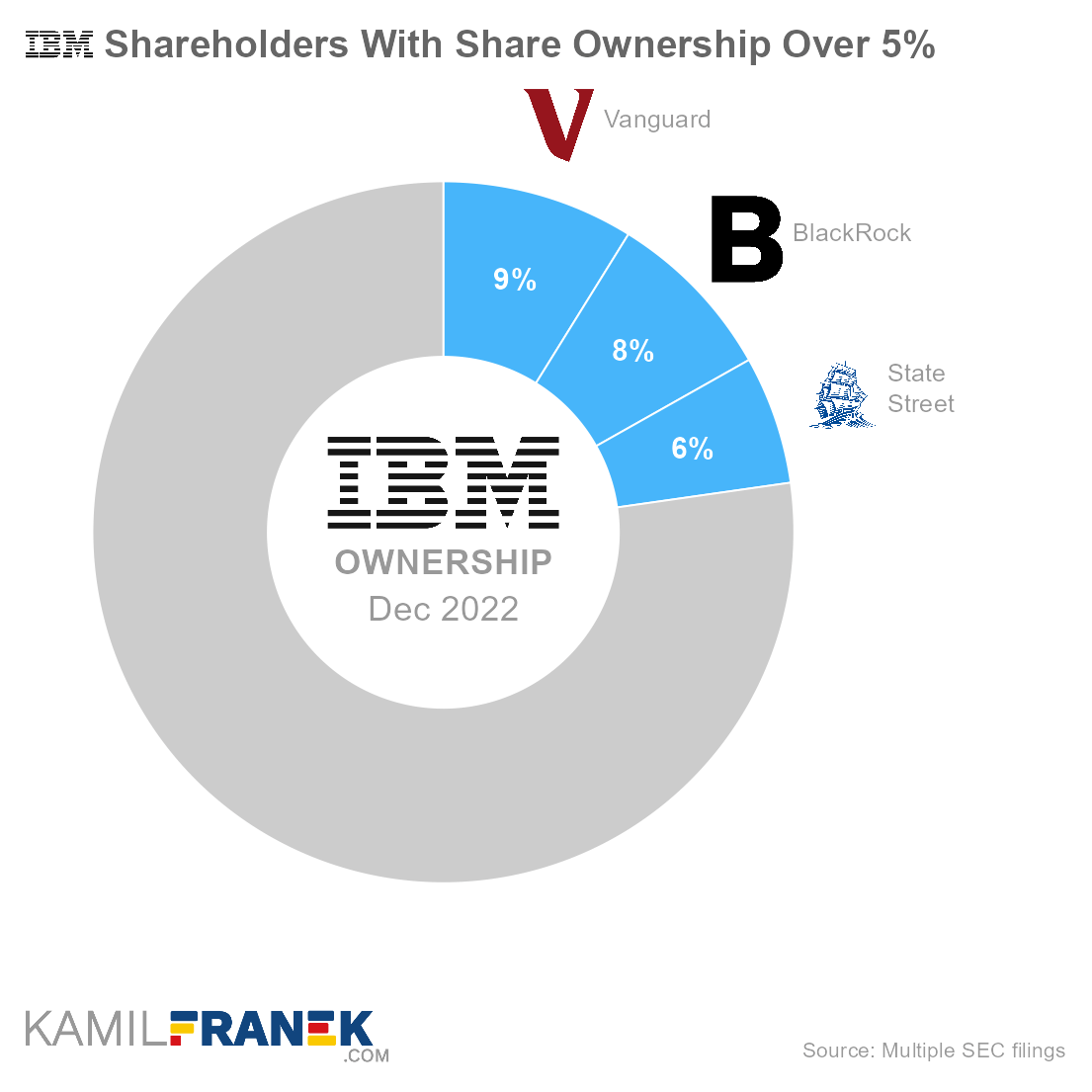

IBM’s largest shareholders are asset managers investing money on behalf of their clients. The largest ones are Vanguard, which owns an 8.8% share, followed by BlackRock (8.0%) and State Street (5.9%).

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 8.8% | 8.8% | |

| BlackRock | 8.0% | 8.0% | |

| State Street | 5.9% | 5.9% | |

| Other | 77.3% | 77.3% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns IBM and who controls it. I will show you who IBM’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Microsoft, Alphabet(Google), Lenovo, Shell, Kahoot!, and others.

📃 Who Owns IBM?

IBM is owned by its shareholders. The largest ones are asset manager giant Vanguard, which owns 8.8% of the company, followed by asset manager giant BlackRock with an 8.0% ownership share, and asset manager State Street with 5.9% ownership.

No shareholder has dominant ownership in the company. IBM’s ownership is dispersed, and the largest owners are asset managers who invest money on behalf of their clients.

- It is not surprising to see Vanguard and BlackRock among the top shareholders. They are the largest asset managers worldwide, and it is common to see them among the top shareholders of large public companies.

IBM is over 100 years old and was founded in 1911 by financier Charles Ranlett Flint, who combined four separate companies under one holding company.

- The company was first named Computing-Tabulating-Recording Company and, in 1924, renamed International Business Machines (IBM)

- IBM’s shares are publicly traded under the ticker IBM on New Your Stock Exchange.

International Business Machines Corporation is incorporated in the State of New York (US), and its headquarters are in Armonk, part of the Town of North Castle in New York (US).

IBM is not such a dominant force in technology as in the past, but it is still a large public company.

🎮 Who Controls IBM (IBM)?

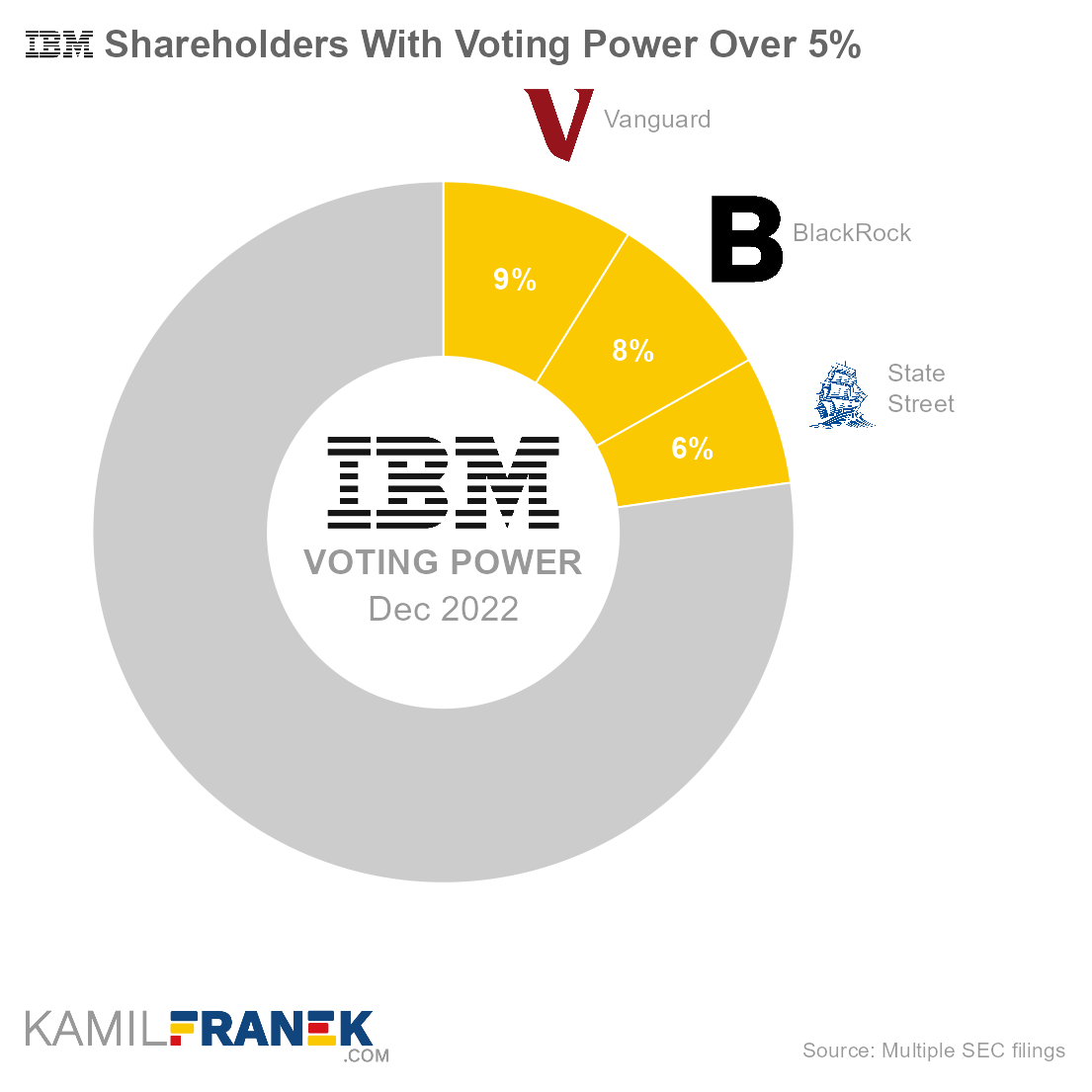

IBM’s shareholders with the largest voting power are asset manager giant Vanguard, which holds 8.8% of all votes, followed by asset manager giant BlackRock with 8.0% voting power, and asset manager State Street (5.9%).

IBM has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of International Business Machines Corporation is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients. None of them control the company individually, but together they have a big influence.

IBM’s dispersed ownership creates conflicts of interest between IBM’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

IBM’s insiders that have influence over the company are CEO and chairman Arvind Krishna and other board members and executives.

-

IBM currently has a 12-member board of directors.

-

Nobody from the board of directors or executive officers holds more than 0.05% share of IBM’s stocks.

🗳️ Breakdown of IBM’s Outstanding Shares and Votes by Top Shareholders

International Business Machines Corporation had a total of 906 million outstanding shares as of December 2022. The following table shows how many shares each IBM’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 80 | 80 | 8.8% | |

| BlackRock | 72 | 72 | 8.0% | |

| State Street | 54 | 54 | 5.9% | |

| Other | 700 | 700 | 77.3% | |

| Total (# millions) | 906 | 906 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 906 million votes distributed among shareholders of International Business Machines Corporation. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 80 | 80 | 8.8% | |

| BlackRock | 72 | 72 | 8.0% | |

| State Street | 54 | 54 | 5.9% | |

| Other | 700 | 700 | 77.3% | |

| Total (# millions) | 906 | 906 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of IBM’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in International Business Machines Corporation worth.

However, keep in mind that a stake in IBM could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $11.3 | $11.3 | 8.8% | |

| BlackRock | $10.2 | $10.2 | 8.0% | |

| State Street | $7.5 | $7.5 | 5.9% | |

| Other | $98.6 | $98.6 | 77.3% | |

| Total ($ billions) | $127.7 | $127.7 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each IBM shareholder individually.

📒 Who Are IBM’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of International Business Machines Corporation one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in IBM worth.

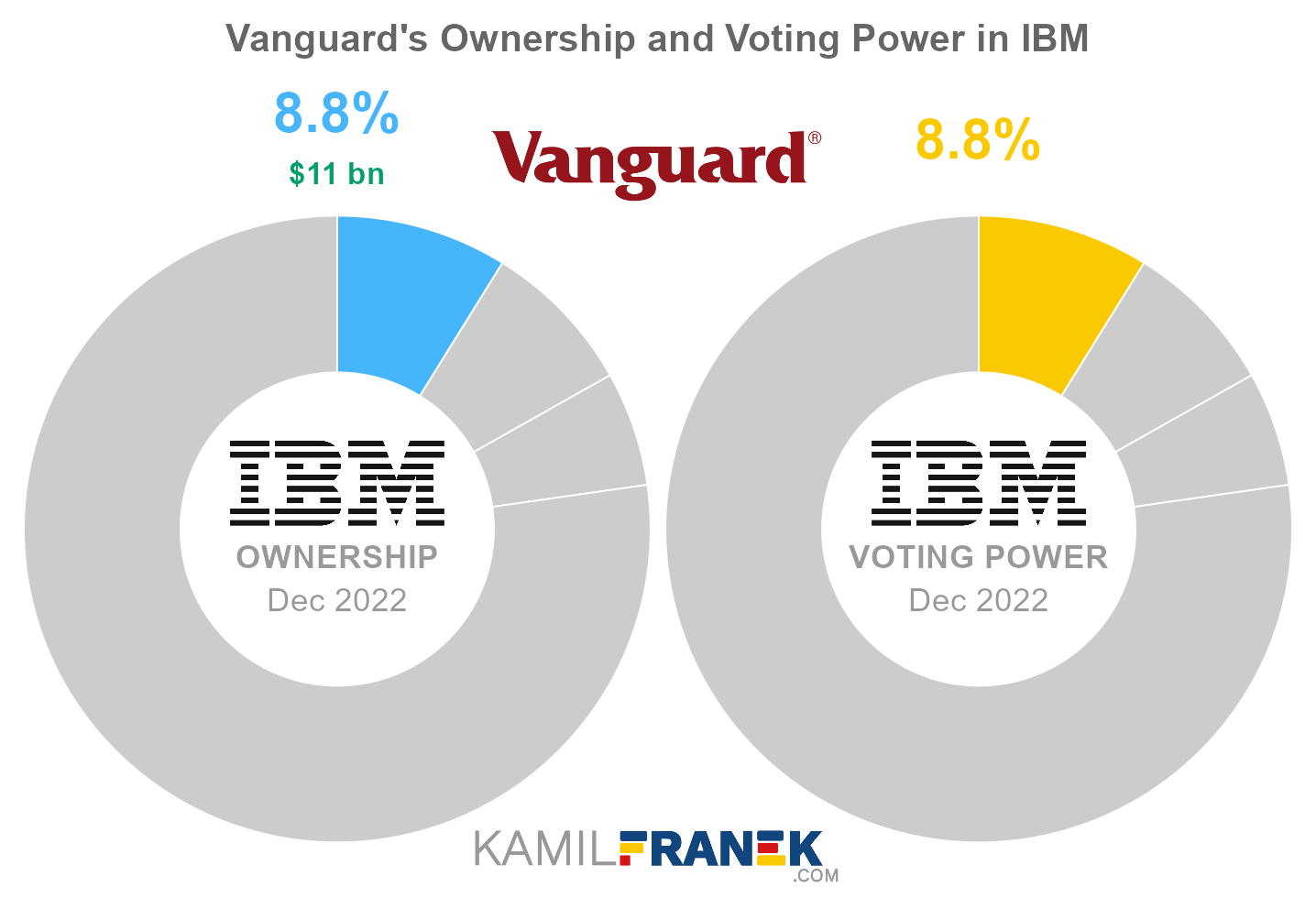

#1 Vanguard (8.8%)

Vanguard is the largest shareholder of IBM, owning 8.8% of its shares. As of December 2022, the market value of Vanguard’s stake in IBM was $11.3 billion.

Vanguard owned 80 million shares in IBM and controlled 80 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

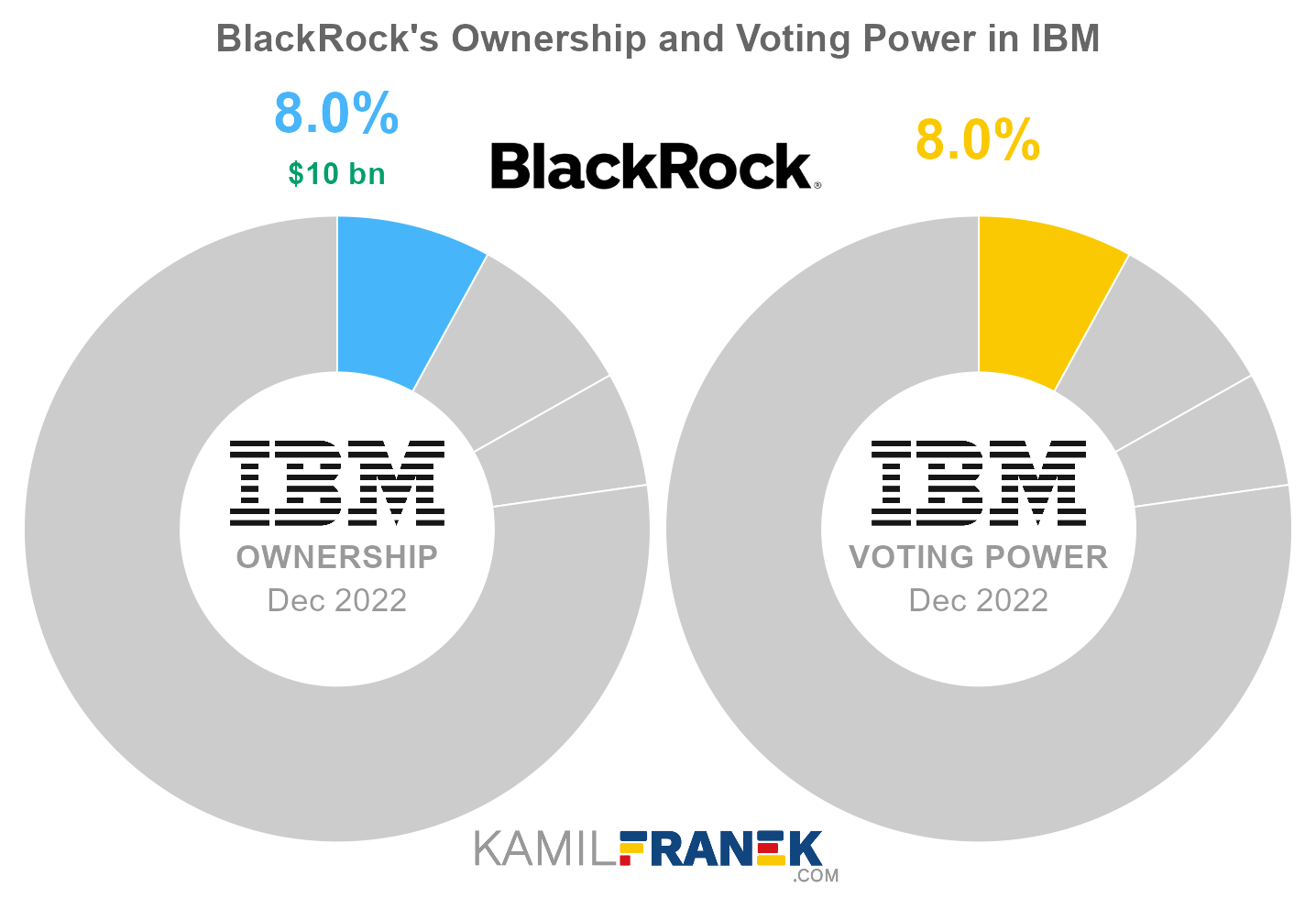

#2 BlackRock (8.0%)

BlackRock is the second-largest shareholder of IBM, owning 8.0% of its shares. As of December 2022, the market value of BlackRock’s stake in IBM was $10.2 billion.

BlackRock owned 72 million shares in IBM and controlled 72 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

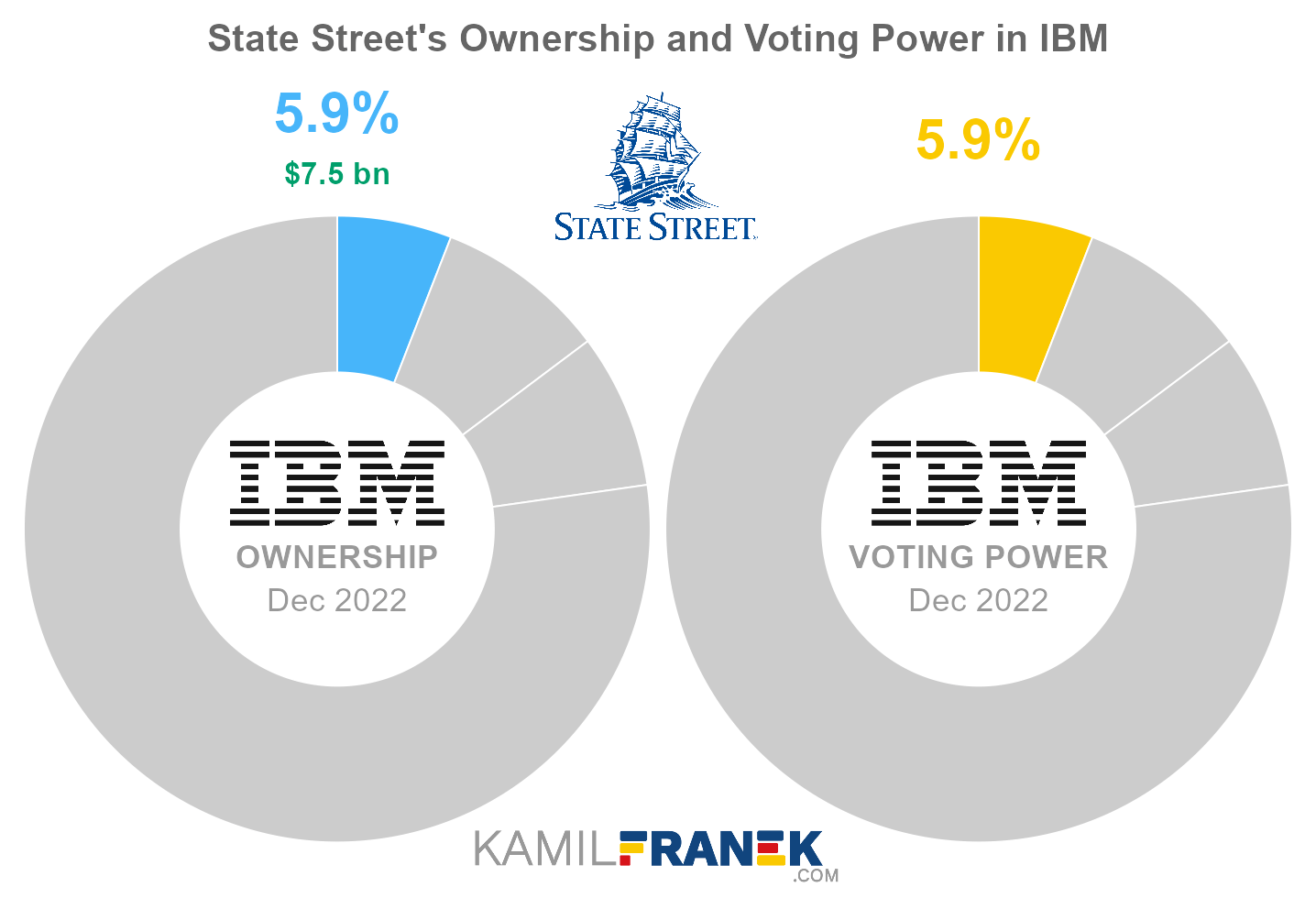

#3 State Street (5.9%)

State Street is the third-largest shareholder of IBM, owning 5.9% of its shares. As of December 2022, the market value of State Street’s stake in IBM was $7.5 billion.

State Street owned 54 million shares in IBM and controlled 54 million shareholder votes as of December 2022.

State Street Corporation is one of the largest asset managers in the world, with 4 trillion assets under management. It makes money mainly from servicing and management fees.

In 1993 company introduced the SPDR S&P 500 Trust ETF (traded under ticker SPY). It was the first exchange-traded fund, and State Street is now one of the largest ETF providers in the world.

State Street is a publicly traded company, and its largest shareholders are, ironically, its competitors, Vanguard and Blackrock. One of its largest shareholders is even State Street itself. Not directly but through their passive and active funds.

This circular ownership between State Street, Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies where they usually belong to the most significant shareholders.

❔ Is IBM Owned by China?

The Chinese government does not own IBM, and none of its largest shareholders is based in China. There is some confusion around this because IBM sold its personal computer business to the Chinese company Lenovo in 2005 and its server division in 2015. However, IBM and Lenovo are separate companies.

IBM sold to Lenovo also some of IBM’s brands, including the iconic “ThinkPad” for laptops. Therefore if you buy a ThinkPad laptop now, it is made by Lenovo and not IBM.

Because part of the purchase price was paid in Lenovo stocks, IBM was right after the deal a sizable shareholder of Lenovo with an 18.9% stake. But IBM gradually decreased its stake and sold it off completely in 2011.

Lenovo is a Chinese company and is owned partially by the Chinese government.

I explained who owns Lenovo in a separate article.

🧱 Who and When Founded IBM

IBM was founded in 1911 by financier Charles Ranlett Flint by merging four different companies under one holding named Computing-Tabulating-Recording Company.

The four companies were:

- Bundy Manufacturing Company (founded 1889)

- Tabulating Machine Company (founded 1896)

- International Time Recording Company (founded 1900)

- Computing Scale Company of America (founded 1901)

Significant influence over the company in its beginnings had Thomas J. Watson, who joined the company in 1914. He soon became the leading force in the company, its general manager, and later president.

The company was renamed “International Business Machines” in 1924. In 1933, the holding structure was abandoned, and most of the businesses were merged into one “International Business Machines” entity.

📅 IBM’s History Timeline

These are selected events from IBM’s history:

- 1911: IBM was founded by financier Charles Ranlett Flint under the name Computing-Tabulating-Recording Company. It was not founded from scratch but by merging four existing companies under one holding company.

- 1914: Thomas J. Watson, a key figure in IBM’s beginnings, joined one of the subsidiaries Tabulating-Recording Company and was quickly after that promoted to general manager of the whole holding company.

- 1924: The company was renamed “International Business Machines.”

- 1924: Company founder Charles Fairchild dies

- 1933: Holding company disappeared, and separate businesses merged into one entity.

- 1949: Thomas J. Watson was named chairman of the board

- 1952: First commercial mainframe computer IBM 701 introduced

- 1956: IBM 305 RAMAC introduced with the first hard disk drive

- 1956: Thomas Watson dies, and his son Thomas Watson, Jr. becomes CEO and later, in 1961, chairman.

- 1964: Introduced IBM System/360, the first family of computers designed to cover both commercial and scientific applications of different complexity.

- 1969: IBM engineer Forrest Parry invented the magnetic stripe card.

- 1980s IBM pioneered multipurpose microcomputer, setting the standard for modern PC.

- 1992: IBM introduced a new line of iconic ThinkPad notebooks.

- 1997 Deep Blue, IBM’s artificial intelligence, won against Garry Kasparov in a six-game match. It was the first time a computer had ever beaten a world chess champion in a traditional match.

- 2002 IBM acquired the consulting arm of PwC

- 2005 IBM sold its personal computer division to Lenovo Group.

- 2011: IBM’s artificial intelligence program Watson won in Jeopardy! against previous champions.

- 2013: IBM employees created the film A Boy and His Atom, which was the first molecule movie to tell a story

- 2014: IBM announced it would sell its x86 server division to Lenovo

- 2019 IBM completed the acquisition of Red Hat

- 2020 IBM announced it is splitting itself into two public companies. IBM will focus on high-margin cloud computing and artificial intelligence, and the legacy Managed Infrastructure Services unit will be spun off into a separate public company Kyndryl.

- 2020: Arvind Krishna becomes CEO

- 2021: Kyndryl spinoff completed

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Kahoot!: The Largest Shareholders Overview

Overview of who owns Kahoot! and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lenovo: The Largest Shareholders Overview

Visual overview of who owns Lenovo and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Shell: The Largest Shareholders Overview

Overview of who owns Shell and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.