Who Owns Lenovo: The Largest Shareholders Overview

Lenovo Group Limited (HK:992) is a technology company that makes money predominantly by designing, manufacturing, and selling PCs, Tablets, Smartphones, and other devices. A small part of its revenue comes from hardware and services for corporate customers. Let’s now look at who owns Lenovo and who controls it.

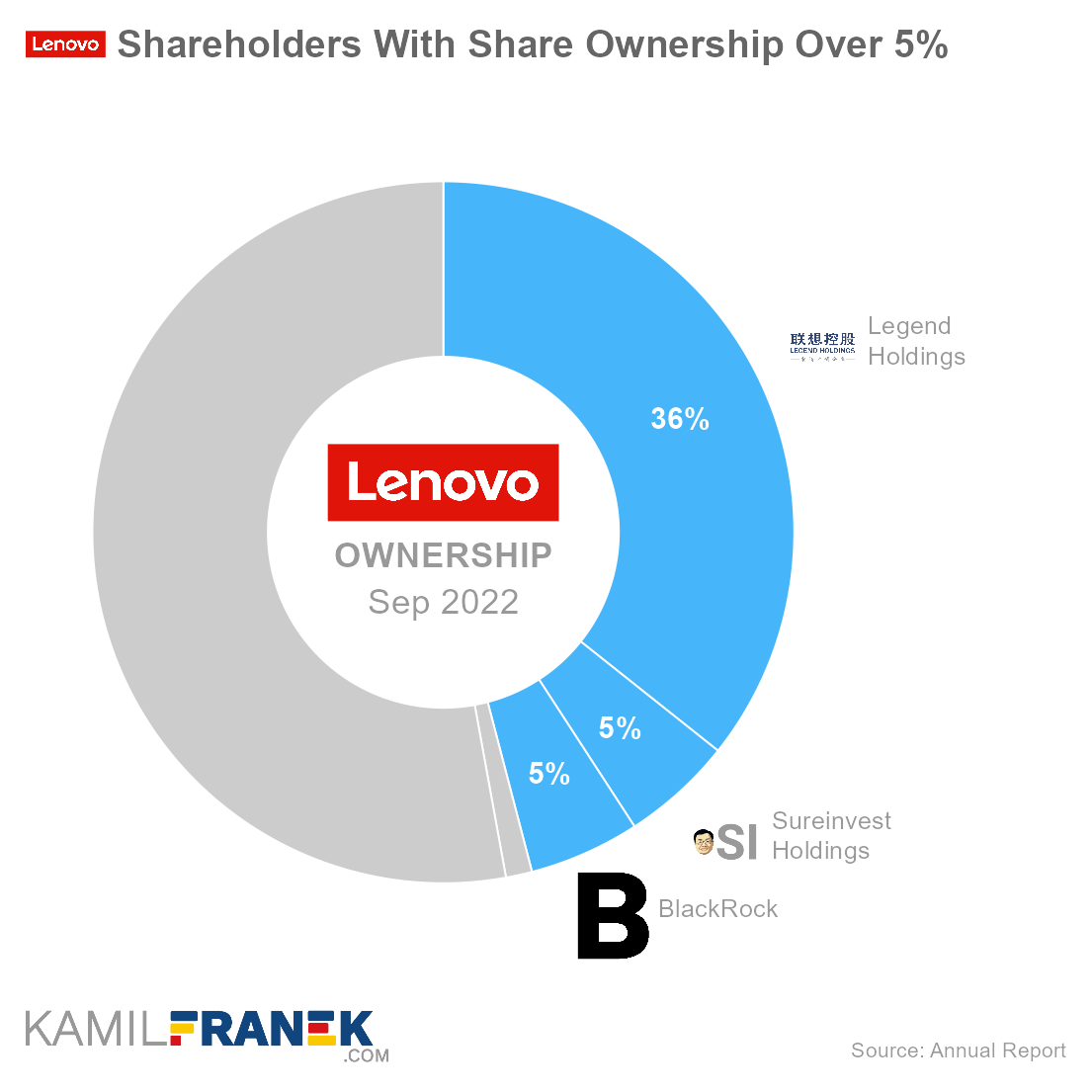

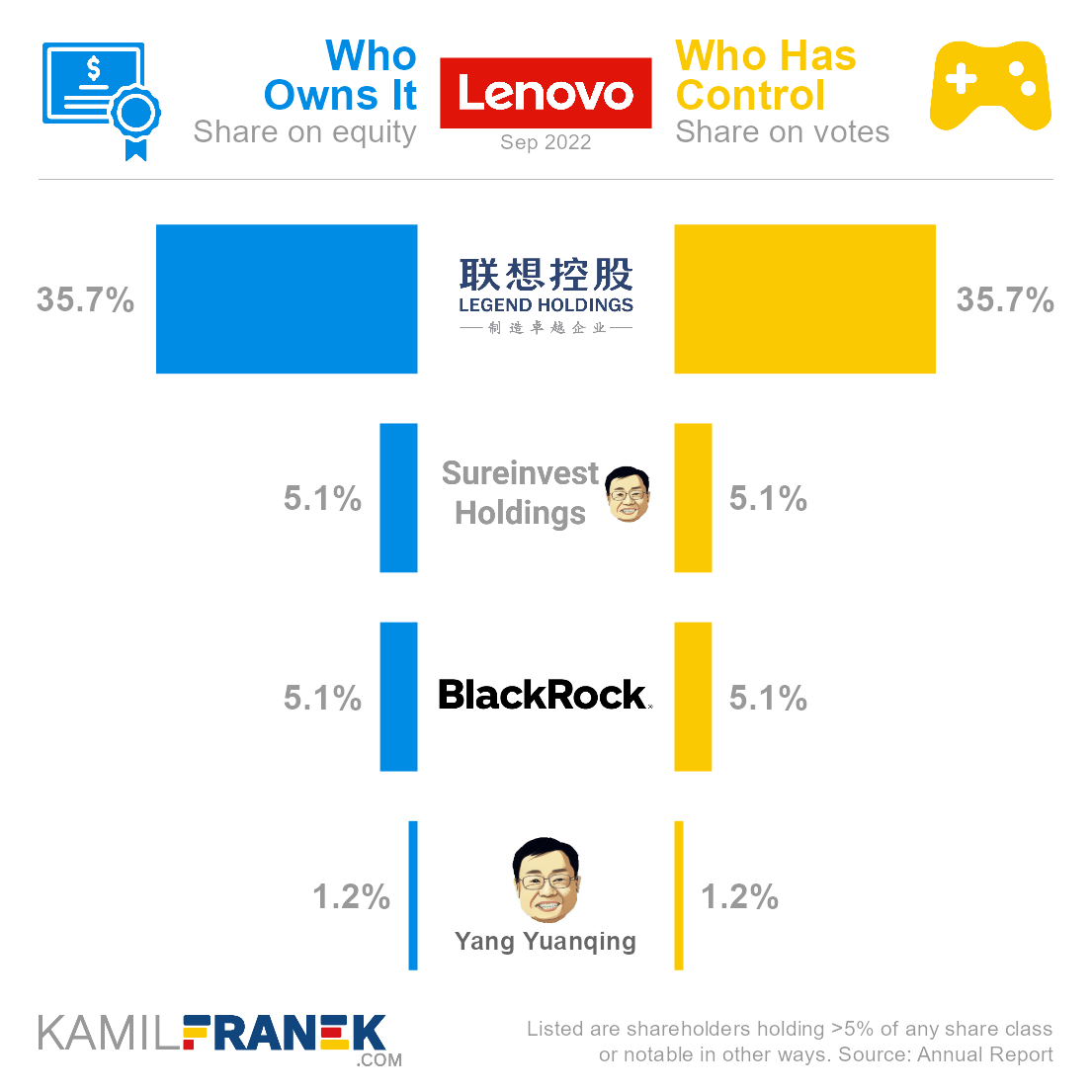

The largest shareholder of Lenovo Group Limited is Legend Holdings, which owns a 36% share. Legend Holdings is controlled by the Chinese Academy of Sciences and Legend’s management. Another significant shareholder is Lenovo’s CEO Yang Yuanqing, who controls 6% of Lenovo’s votes.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Legend Holdings | 35.7% | 35.7% | |

| Sureinvest Holdings | 5.1% | 5.1% | |

| BlackRock | 5.1% | 5.1% | |

| Yang Yuanqing | 1.2% | 1.2% | |

| Other | 52.9% | 52.9% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Annual Report Source: Annual Report |

|||

The top shareholder of Lenovo is Legend Holdings, founded in the 1980s by several people from the Chinese Academy of Sciences (CAS). The company is currently owned and controlled by CAS and the management of Lenovo and Legend Holdings.

Legend Holdings holds a stake in other companies, but Lenovo is the core part of it.

It is hard to think about Levovo without Legend Holdings and vice versa. Lenovo was actually called Legend Computer before it was rebranded for international markets to “Le” (part of Legend) + “novo” (new).

The Second largest shareholder of Lenovo is its CEO and Chairman Yang Yuanqing. He owns a 1% stake directly but also is the majority owner of Sureinvest Holdings, which owns 5% of Lenovo. If we add those together, he controls 6% of the voting power.

Asset manager BlackRock owns 5%% stake in the company.

Lenovo was founded by a team of people led by Liu Chuanzhi and Danny Lui. All of them were members of the Institute of Computing Technology of the Chinese Academy of Sciences (CAS).

Lenovo Group Limited is a company registered in Hong Kong, but its global headquarters are in Beijing. Company shares have been publicly traded in Hong Kong under ticker 992 since 1994, although it was called Legend at the time.

Another way to get exposure to Lenovo is through ADRs traded over the counter in the US.

- Ticker LNVGY: One LNVGY ADR represents twenty (20) ordinary shares

- Ticker LNVGF: where one ADR represents one ordinary share

In this article, I will dive more into who Lenovo’s largest shareholders are, how many shares and votes they have, and how much their stake is worth. I will also explore some other topics related to its ownership structure.

If you are interested, you can also explore who owns other companies like Microsoft, Alphabet(Google), L’Oréal, or Apple.

🕹️ Who Owns Lenovo (HK:992) and Who Has Control?

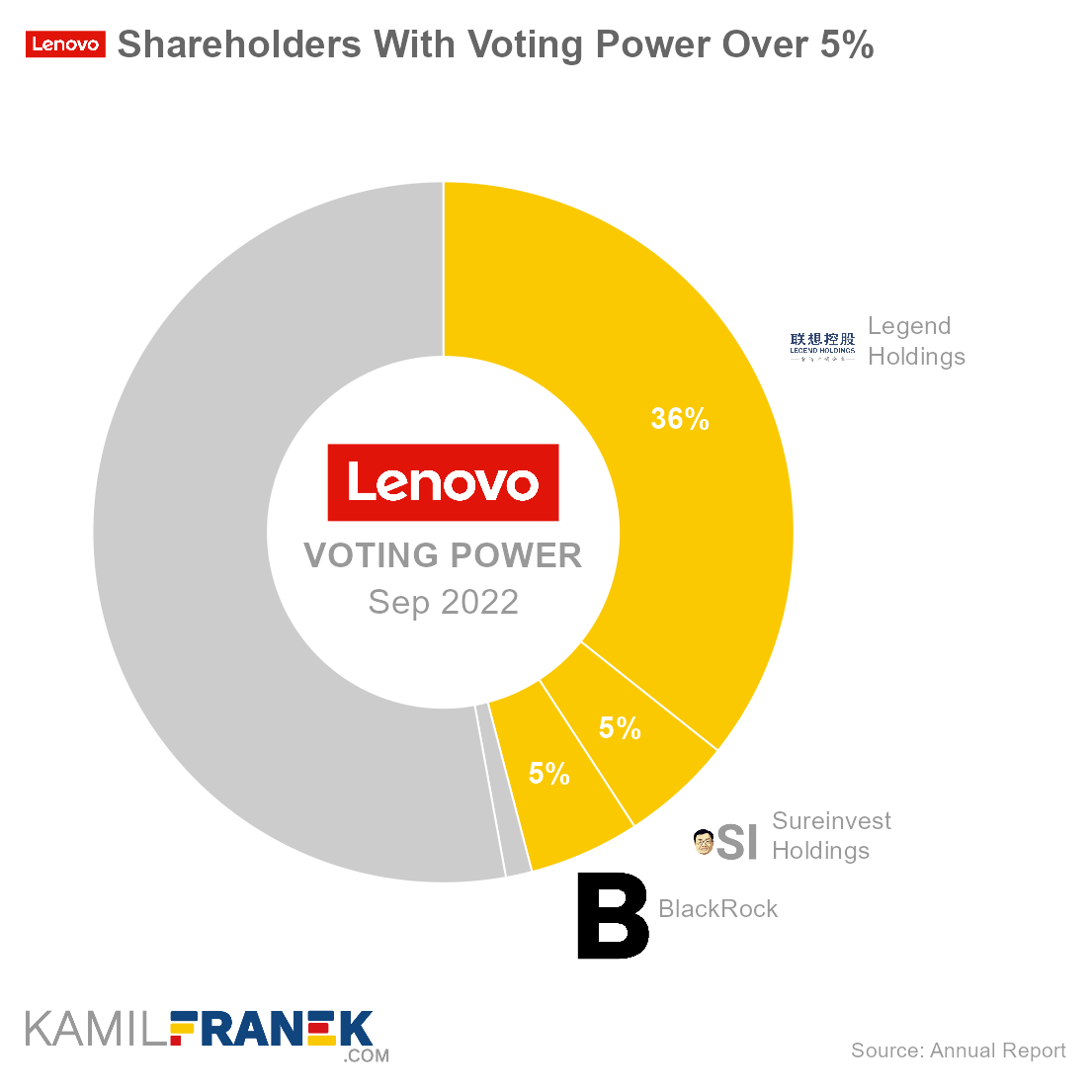

Lenovo does not have any outstanding super-voting shares, and one share equals one vote. Therefore there is no difference between the shareholder’s ownership and voting power.

Lenovo Group Limited ‘s largest shareholder is Legend Holdings, with a 36% ownership share. Legend Holdings itself is controlled by a combination of China’s Academy of Science and current and former management of Legend Holdings. Lenovo is the main business Legend is invested in, so to know who owns and controls Lenovo, you need to know who owns Legend Holdings.

- Chinese Academy of Science is a state-owned research institute and Legend’s largest shareholder and controls 29% of Legend Holdings’ voting power.

- A large part of Legends Holdings shares is controlled by current or former management of Legend Holdings through various holding companies. One of those persons is also Liu Chuanzhi, one of the founders.

- Chinese Academy of Sciences, together with several management-related companies, hold the majority of equity and voting power in Legend Holdings.

- Additionally, China Oceanwide, controlled by Lu Zhiqiang owns a 12% stake.

The second largest shareholder of Lenovo is its CEO and Chairman, Yang Yuanqing. He controls 6% of the voting power. He owns some of it directly, but the majority is controlled through his company Sureinvest Holdings, incorporated in the British Virgin Islands.

- Yang Yuanqing. is the majority owner Sureinvest Holding and owns around 87% of the company. Mine ownership stakes also belong to other people. One of them is Lenovo’s CFO, Wong Wai Ming, with a 4.65% share, which translates to around 0.2% stake in Lenovo Group.

Legend Holdings and CEO Yang Yuanqing control together 42% of the voting power. They do not have the majority of votes technically, but together, they are controlling the company, when you consider that usually not all votes are present at annual shareholder meetings, and large asset managers like BlackRock usually follow management recommendations.

- There also might be other management members of Lenovo or Legend Holdings having smaller stakes in Lenovo that do not require public disclosure.

Management has a significant influence over the company. CEO and Chairman Yang Yuangin is a significant shareholder. Also, Lenovo’s CFO is invested in the company.

Lenovo’s Board of Directors has eleven(11) members. Apart from Chairman, none of the board members own over 0.05% of Lenovo’s equity.

Member of Lenovo’s board is also Jerry Yang, founder of Yahoo.

Liu Chuanzhi, the founder of Legend and Lenovo, has the title of honorary chairman. However, he does not play an active role in the company today.

🗳️ Breakdown of Lenovo’s Outstanding Shares and Votes by Top Shareholders

Lenovo Group Limited had a total of 12,128 million outstanding shares as of September 2022. The following table shows how many shares each Lenovo’s large shareholder holds.

|

|

||||

| In millions of shares as of September 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Legend Holdings | 4,329 | 4,329 | 35.7% | |

| Sureinvest Holdings | 623 | 623 | 5.1% | |

| BlackRock | 619 | 619 | 5.1% | |

| Yang Yuanqing | 147 | 147 | 1.2% | |

| Other | 6,411 | 6,411 | 52.9% | |

| Total (# millions) | 12,128 | 12,128 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Annual Report Source: Annual Report |

||||

There were 12,128 million votes distributed among shareholders of Lenovo Group Limited. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of September 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Legend Holdings | 4,329 | 4,329 | 35.7% | |

| Sureinvest Holdings | 623 | 623 | 5.1% | |

| BlackRock | 619 | 619 | 5.1% | |

| Yang Yuanqing | 147 | 147 | 1.2% | |

| Other | 6,411 | 6,411 | 52.9% | |

| Total (# millions) | 12,128 | 12,128 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Annual Report Source: Annual Report |

||||

💵 Breakdown of Lenovo’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Lenovo Group Limited worth.

However, keep in mind that a stake in Lenovo could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of September 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Legend Holdings | $3.0 | $3.0 | 35.7% | |

| Sureinvest Holdings | $0.4 | $0.4 | 5.1% | |

| BlackRock | $0.4 | $0.4 | 5.1% | |

| Yang Yuanqing | $0.1 | $0.1 | 1.2% | |

| Other | $4.5 | $4.5 | 52.9% | |

| Total ($ billions) | $8.4 | $8.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Annual Report Source: Annual Report |

||||

Let’s now look at each Lenovo shareholder individually.

📒 Who Are the Largest Shareholders of Lenovo Group Limited

Let’s now go through the list of the largest shareholders of Lenovo Group Limited one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Lenovo worth.

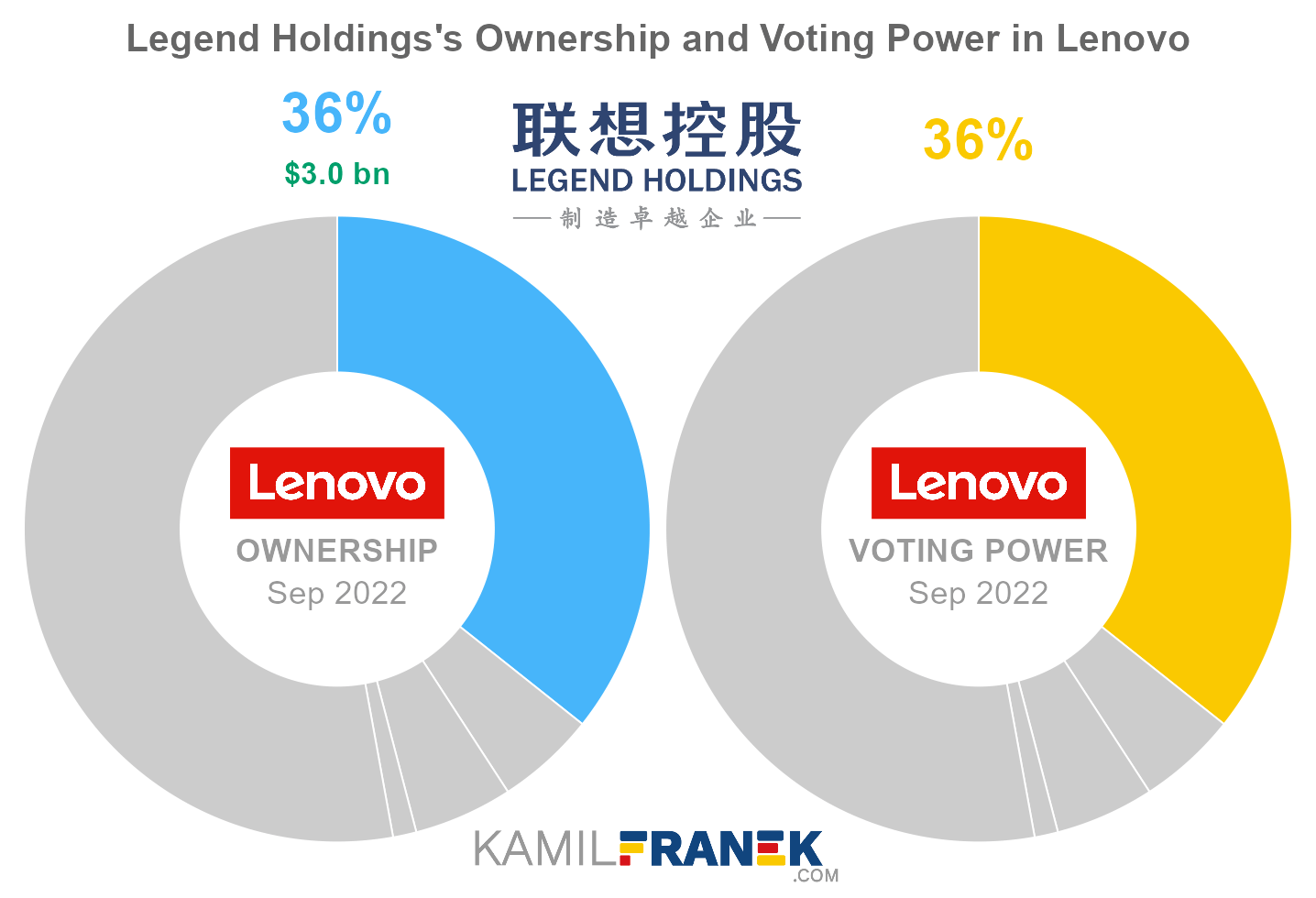

#1 Legend Holdings

Legend Holdings holds 36% of Lenovo’s shares, making it its largest shareholder.

Legend Holdings owns 4,329 million Lenovo shares, representing 4,329 million shareholder votes. The market value of Legend Holdings’s stake in Lenovo was $3 billion as of September 2022.

Legend Holdings Corporation is a Chinese holding company that owns stakes in several businesses. The most prominent holding is Lenovo, where Legend Holdings owns a 36% stake.

Initially, the Chinese Academy of Sciences (CAS) was Legend Holdings’ controlling shareholder. CAS still holds a sizable stake but is not a controlling shareholder anymore.

Next to Lenovo, which is its largest investment, Legend Holdings also owns a stake in the following businesses:

- Levima Advance Materials: engages in R&D, production, and sales of new material products.

- Joyvio Group: a group of several businesses focused on agriculture and food.

- BIL (Banque Internationale à Luxembourg): one of the oldest Luxembourg banks.

Legend Holding is publicly traded in Hong Kong.

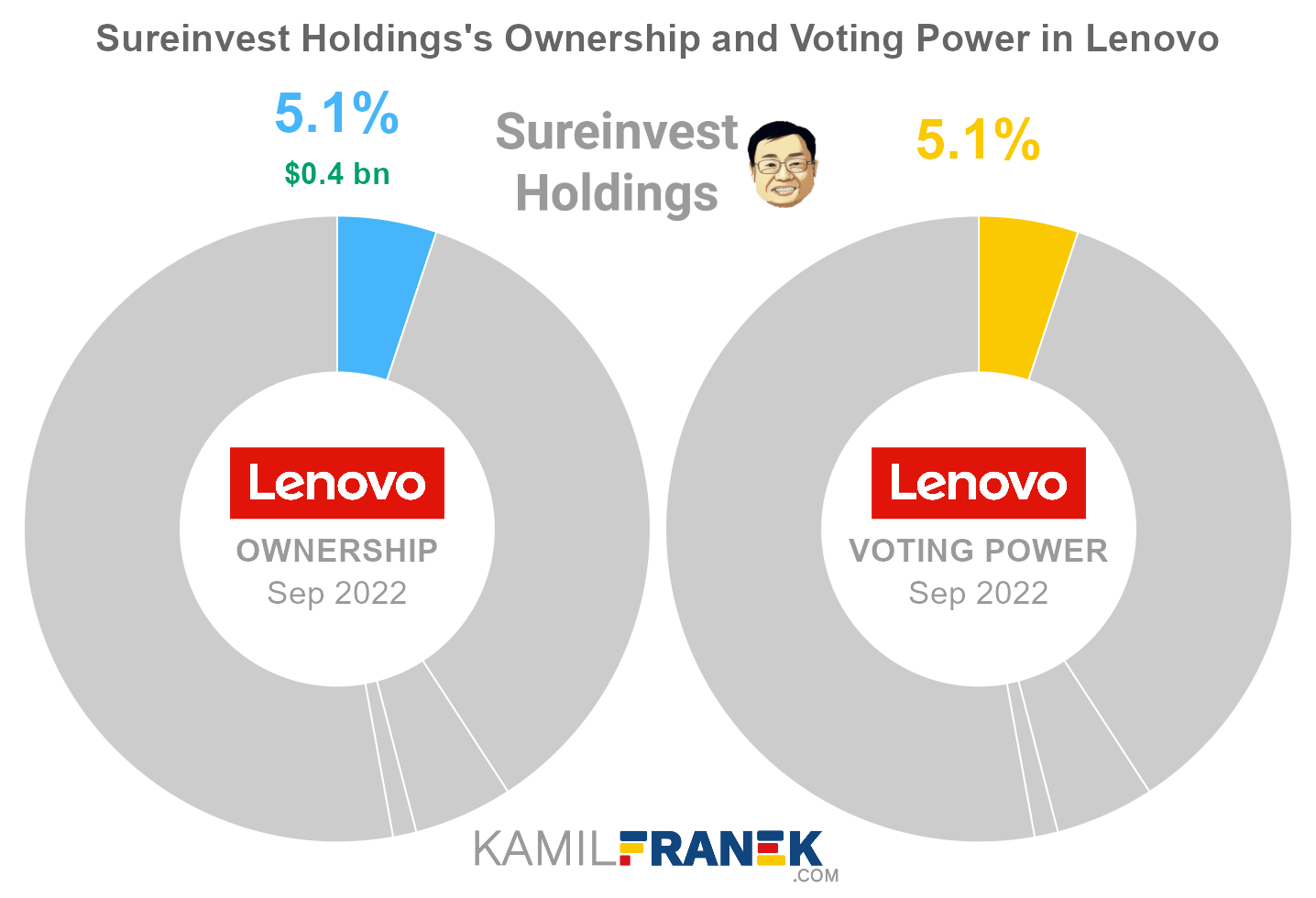

#2 Sureinvest Holdings

Sureinvest Holdings holds 5% of Lenovo’s shares which makes it its second-largest shareholder.

Sureinvest Holdings owns 623 million Lenovo shares, representing 623 million shareholder votes. The market value of Sureinvest Holdings’s stake in Lenovo was $0 billion as of September 2022.

Sureinvest Holdings Limited is a holding company incorporated in the British Virgin Islands. The company is controlled by Yang Yuanqing, Lenovo’s CEO. Yang Yuanqing is the director and owner of approximately 87% of the company.

The rest is owned by other individuals. One of them is Lenovo’s CFO Wong Wai Ming, with a 4.65% share.

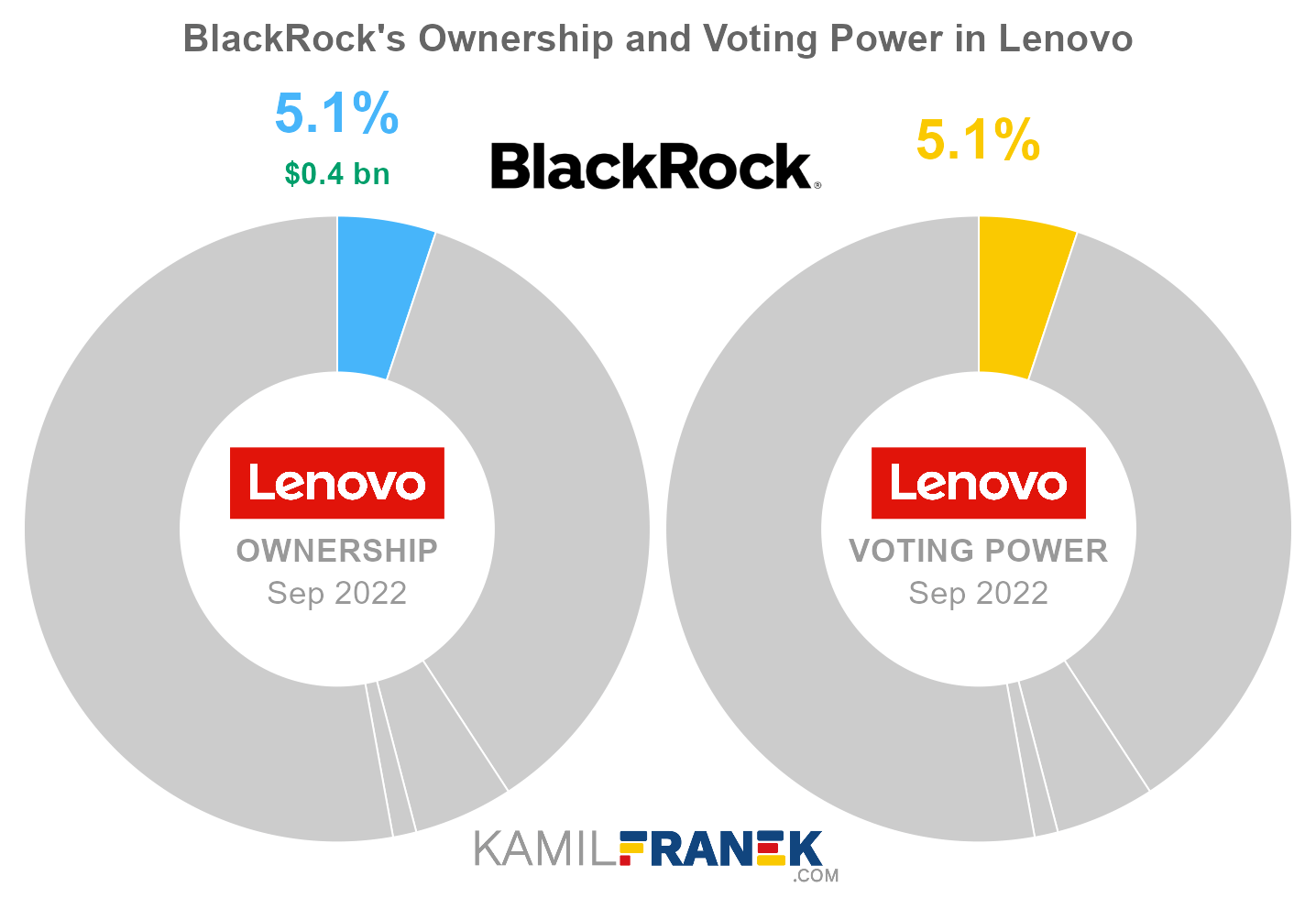

#3 BlackRock

BlackRock holds 5% of Lenovo’s shares which makes it its third-largest shareholder.

BlackRock owns 619 million Lenovo shares, representing 619 million shareholder votes. The market value of BlackRock’s stake in Lenovo was $0 billion as of September 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders.

-

BlackRock and other large asset managers do not invest their own money, but they have significant voting power that, in most cases, is not passed through to the underlying investors. Therefore, BlackRock itself and its representatives have significant sway over decisions in those companies.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties in the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

-

Recently, large asset managers started to be more sympathetic to different climate and environmental-related proposals and even supported activists that went against the management’s wishes. BlackRock was particularly aggressive in this change. Another proof of the power these companies have.

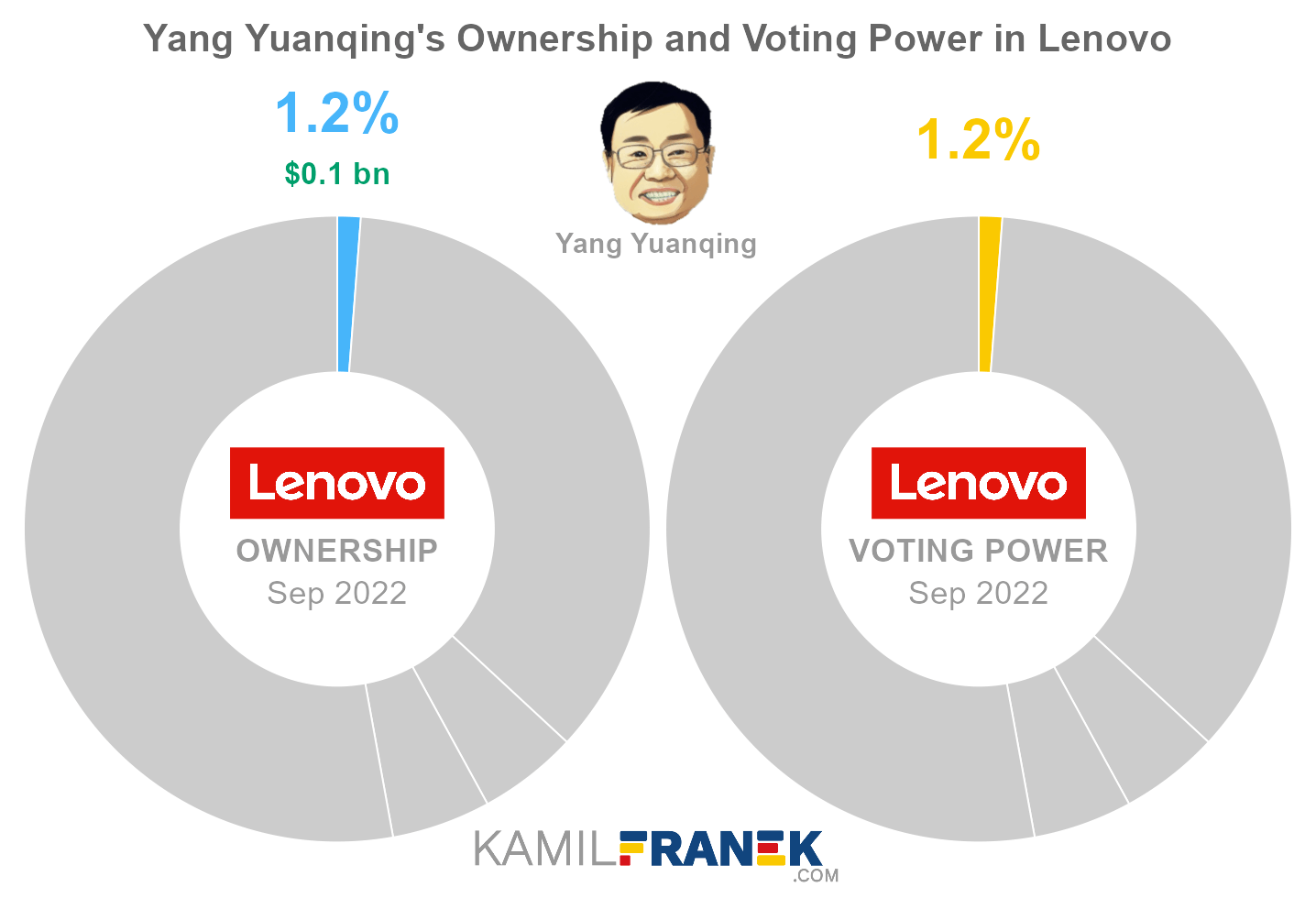

#4 Yang Yuanqing

Yang Yuanqing holds 1% of Lenovo’s shares.

Yang Yuanqing owns 147 million Lenovo shares, representing 147 million shareholder votes. The market value of Yang Yuanqing’s stake in Lenovo was $0 billion as of September 2022.

Yang Yuanquing is the long-time CEO and Chairman of Lenovo, a manufacturer of computers and other smart devices. His career in Lenovo/Legend started in 1989 when he was just 25. He first became CEO of Lenovo in 2001.

He remained CEO until 2004. After that, the CEO position was held by IBM’s Stephen Ward, followed by Bill Amerlion. In 2009, Yang became CEO of Lenovo again.

❔ Who and When Founded Lenovo?

Lenovo was founded as “Legend” in 1984 by employees of the Chinese Academy of Sciences (CAS). The company wanted to commercialize some of the research done by CAS. The leading founders were Liu Chuanzhi and Danny Lui. Early on, the Chinese Academy of Science was a controlling shareholder.

After a few unsuccessful business projects, they built their first computer in 1990 under the Legend brand.

The company rebranded its computer manufacturing part as Lenovo in 1993 for the international market, although it continues to use the Legend Computer brand for the Chinese market.

An important personality in company history was Liu Chuanzhi. He was one of the leading founders and was chairman of Legend, Lenovo’s holding company, until 2012, when he stepped down. He is also a shareholder of Legend Holdings and its honorary chairman.

Liu Chuanzhi was never CEO of Lenovo, but he was its board member since 1993 and also chairman until his resignation in 2011.

❔ Is Lenovo Owned by IBM?

IBM does not currently own Lenovo, but IBM owned a minority stake in the past. When IBM sold its computer manufacturing business to Lenovo in 2005, part of the purchase price was paid in Lenovo’s shares. Right after this transaction, IBM owned an 18.9% stake in Lenovo.

IBM slowly decreased its stake in Lenovo in the following years and sold the remaining stake in 2011.

📅 Lenovo’s History Timeline

These are selected events from Lenovo/Legend’s history:

- 1984: The company was founded under the name Legend in Beijing by a team led by Liu Chuanzhi and Danny Lui. All of them were members of the Institute of Computing Technology of the Chinese Academy of Sciences (CAS).

- 1990: First PC built under the “Legend” brand

- 1994: Initial public offering in Hong Kong

- 2003: Rebranded from Legend to Lenovo for international markets. “Le” was taken from the Legend name, and “novo” means new.

- 2005: Lenovo acquired IBM’s personal computer business, including ThinkPad and ThinkCentre brands, for $1.25bn. Part of the purchase price was paid in Lenovo stocks, and IBM was right after the deal a sizable shareholder with an 18.9% stake.

- 2008: Lenovo sold its smartphone and tablet division only to buy it back a year later.

- 2011: IBM sold its remaining shares in Lenovo after they were gradually decreasing it over the years.

- 2011: Join venture with NEC to boost its presence in Japan

- 2011: Acquisition of Medion, a German electronic manufacturing company.

- 2014: Acquired IBM x86 server business from IBM

- 2014: Acquisition of Motorola Mobily from Google. Part of it was paid by stocks. Google retained most of Motorola’s patents.

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Xiaomi: The Largest Shareholders Overview

Overview of who owns Xiaomi and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.