Who Owns Tesla: The Largest Shareholders Overview

Tesla, Inc. (TSLA) is an electric car manufacturer that single-handedly changed the trajectory of the automotive industry. It makes money primarily by selling electric cars but also sells other products utilizing its battery technology. Its CEO is nobody else than Elon Musk. So, who owns Tesla, and who controls it?

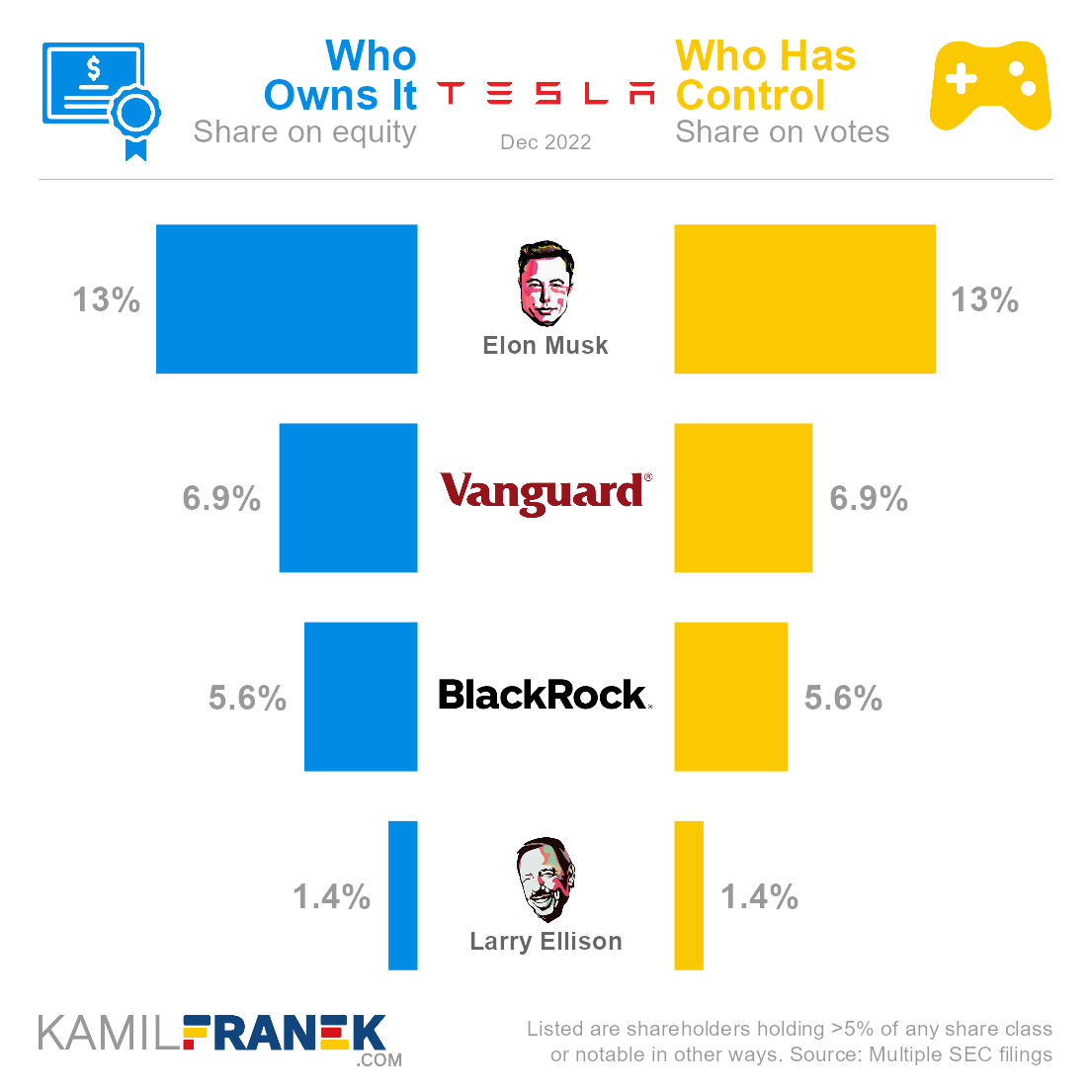

Tesla’s largest shareholders are Elon Musk, who owns 13.0% share, followed by Vanguard (6.9%) and BlackRock (5.6%). A notable shareholder is also Larry Ellison, who owns 1.4% of the company.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Elon Musk | 13.0% | 13.0% | |

| Vanguard | 6.9% | 6.9% | |

| BlackRock | 5.6% | 5.6% | |

| Larry Ellison | 1.4% | 1.4% | |

| Other | 73.0% | 73.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Tesla and who controls it. I will show you who Tesla’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who are the largest shareholders in other companies like Amazon, Meta(Facebook), Microsoft, Alphabet(Google), Apple, or Netflix.

📃 Who Owns Tesla?

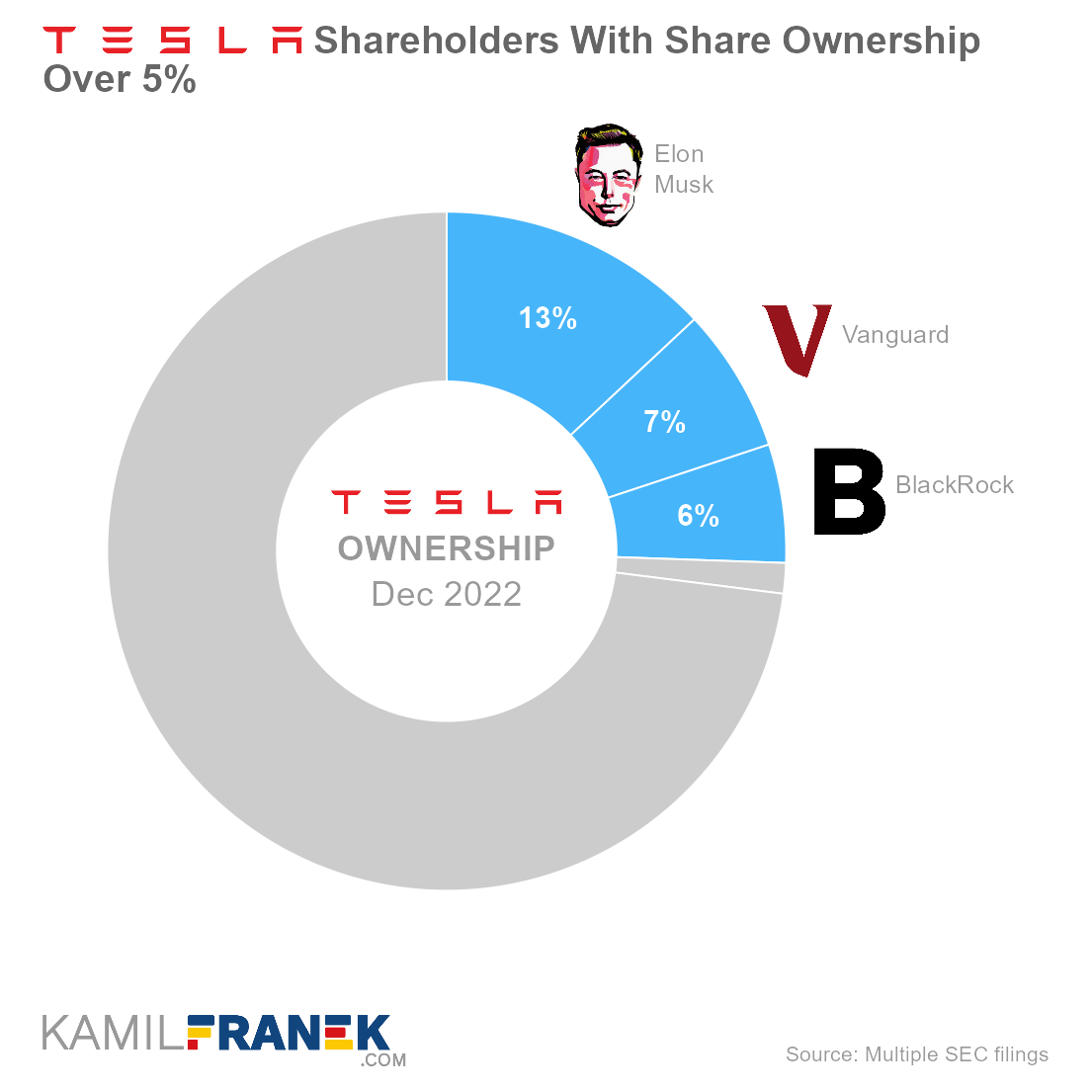

Tesla is owned by its shareholders. The largest one is its CEO Elon Musk, who owns 13.0% of the company, followed by asset managers Vanguard with 6.9% ownership share and BlackRock with 5.6% ownership share.

The largest owner of Tesla is its CEO, early investor, and driving force behind Tesla’s success, Elon Musk, who owns 13.0% of the company.

- Musk’s ownership stake in Tesla decreased over the years as Tesla raised more outside capital. Just before Tesla’s IPO in 2010, Musk owned 36% of the company, which was reduced to 29.05% after the IPO. As Tesla raised more capital after its initial IPO, Musk’s stake decreased further.

- Musk was a large seller of Tesla stocks recently as a way to fund its Twitter acquisition. On the other hand, he received a huge pile of stock options as part of its CEO performance award that he exercised. Despite that, his ownership share is gradually decreasing.

- Roughly half of Musk’s stake in Tesla is pledged as collateral for his personal loans.

- When you look at Elon Musk’s annual SEC filing about his Tesla ownership, it stated that Musk owned 20.6% of Tesla as of December 20222. However, this is a theoretical number that tells us what would be Elon Musk’s ownership of Tesla in case he exercised all the Tesla options he holds and kept the underlying stocks. It is important information for investors, but it does not represent real stock ownership.

Other large Tesla owners are asset managers giants Vanguard and BlackRock, which invest on behalf of other investors.

A sizable Tesla owner is also co-founder and former CEO of Oracle, Larry Ellison, who owns a 1.4% share in the company.

- He was also on Tesla’s board since 2018 but left in 2022.

Tesla was founded in 2004 by Martin Eberhard and Marc Tarpenning. In 2005, Elon Musk joined as a lead investor and chairman. Tesla, Inc. has been a publicly listed company since its initial public offering on NASDAQ in 2010 (Ticker: TSLA)

You won’t find original Tesla founders Martin Eberhard and Marc Tarpenning on the list of large shareholders. They both claim that they are still Tesla shareholders, but their ownership share is tiny.

Tesla, Inc. is incorporated in the State of Delaware, but its headquarters are in Austin, Texas (US).

🎮 Who Controls Tesla (TSLA)?

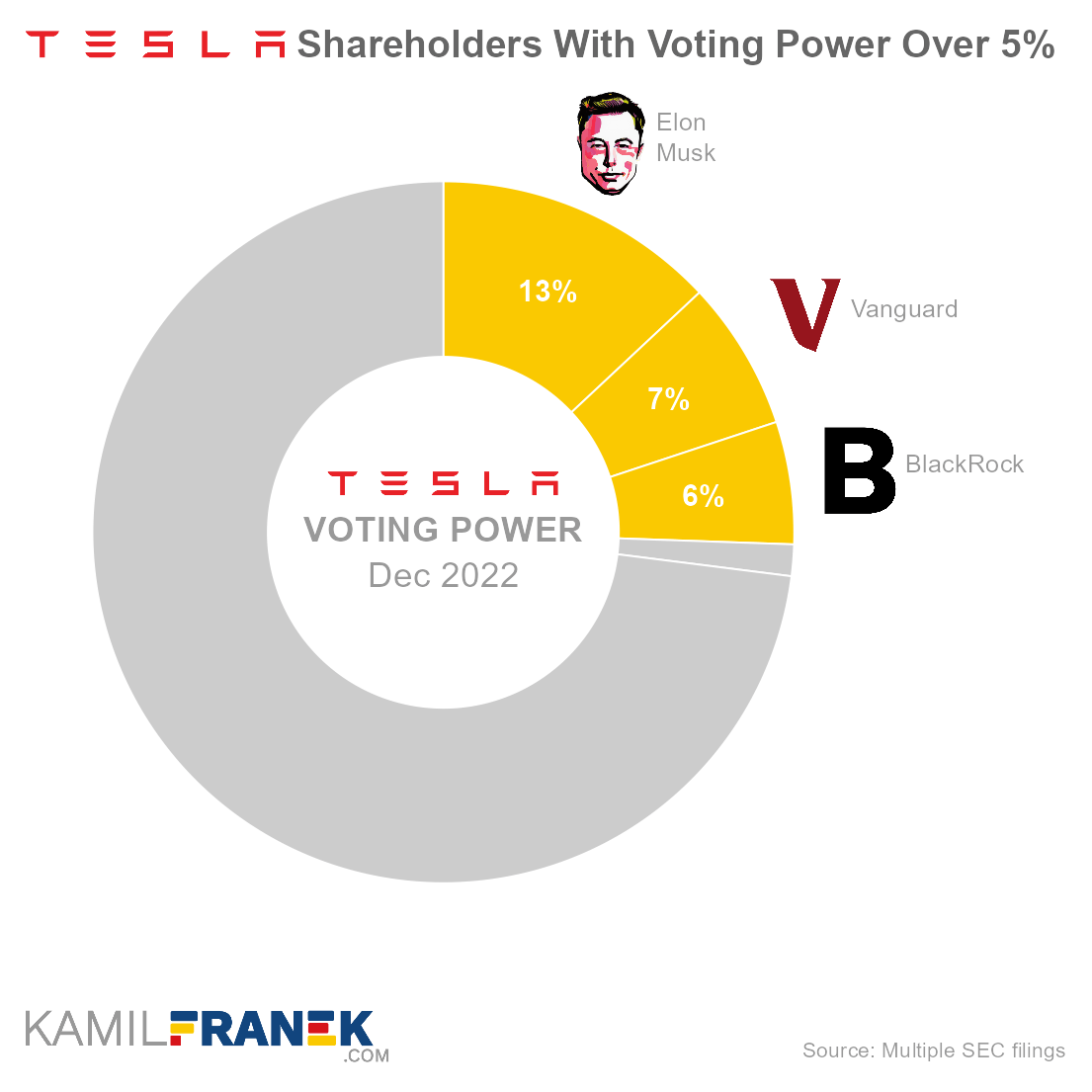

Tesla’s shareholders with the largest voting power are CEO Elon Musk, which holds 13.0% of all votes, followed by asset managers Vanguard (6.9%) and BlackRock (5.6%).

Tesla has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

None of the shareholders has enough votes to control the company. However, with 13.0% voting power, Elon Musk has an outsized influence on Tesla as a major shareholder and CEO.

Tesla ‘s insiders, aside from CEO and board member Elon Musk, that have influence over the company, are mainly chairman Robyn Denholm and other board members and executives.

- Tesla currently has an 8-member board of directors.

- Nobody from the current board of directors or executive officers holds more than 0.05% share of Tesla’s stocks.

- Members of Tesla’s board of directors are, for example, Elon Musk’s brother Kimbal, and James Murdoch, who is the son of media mogul Rupert Murdoch and previously served as CEO of 21st Century Fox.

- Tesla’s certificate of incorporation make it difficult to easily replace the board by using a classified board system where directors are split into three groups (classes). In each year, only one group is up for reelection for a three-year term, and directors can be replaced only for cause.

🗳️ Breakdown of Tesla’s Outstanding Shares and Votes by Top Shareholders

Tesla, Inc. had a total of 3,164 million outstanding shares as of December 2022. The following table shows how many shares each Tesla’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Elon Musk | 412 | 412 | 13.0% | |

| Vanguard | 218 | 218 | 6.9% | |

| BlackRock | 178 | 178 | 5.6% | |

| Larry Ellison | 46 | 46 | 1.4% | |

| Other | 2,309 | 2,309 | 73.0% | |

| Total (# millions) | 3,164 | 3,164 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 3,164 million votes distributed among shareholders of Tesla, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Elon Musk | 412 | 412 | 13.0% | |

| Vanguard | 218 | 218 | 6.9% | |

| BlackRock | 178 | 178 | 5.6% | |

| Larry Ellison | 46 | 46 | 1.4% | |

| Other | 2,309 | 2,309 | 73.0% | |

| Total (# millions) | 3,164 | 3,164 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Tesla’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Tesla, Inc. worth.

However, keep in mind that a stake in Tesla could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Elon Musk | $50.8 | $50.8 | 13.0% | |

| Vanguard | $26.8 | $26.8 | 6.9% | |

| BlackRock | $22.0 | $22.0 | 5.6% | |

| Larry Ellison | $5.7 | $5.7 | 1.4% | |

| Other | $284.5 | $284.5 | 73.0% | |

| Total ($ billions) | $389.7 | $389.7 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Tesla shareholder individually.

📒 Who Are Tesla’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Tesla, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Tesla worth.

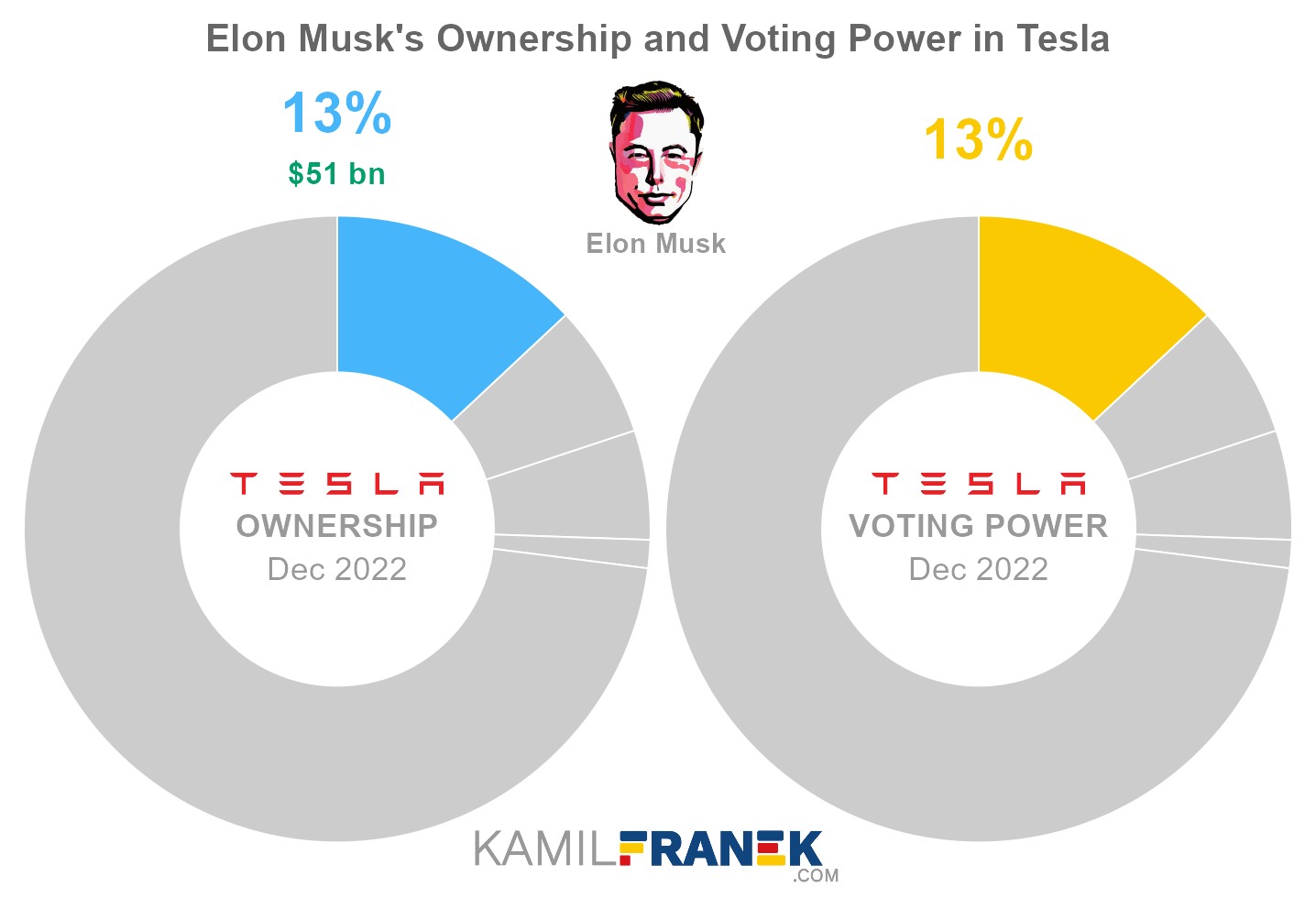

#1 Elon Musk (13.0%)

Elon Musk is the largest shareholder of Tesla, owning 13.0% of its shares. As of December 2022, the market value of Elon Musk’s stake in Tesla was $50.8 billion.

Elon Musk owned 412 million shares in Tesla and controlled 412 million shareholder votes as of December 2022.

Elon Reeve Musk is an iconic CEO and significant investor in Tesla, SpaceX, and other businesses. He recently added to the list also Twitter, where he is doing quite a radical cleanup. He is one of the most wealthy people on the planet.

Musk’s first venture was Zip2, which he co-founded in 1995. He exited in 1999 with a $22 million payout.

After that, he founded X.com online payment company that later merged with Confinity, co-founded by Peter Thiel. The company was later renamed PayPal. In 2002, Paypal was acquired by eBay for $1.5 billion, and Musk received a $175.8 million payout.

SpaceX , another of Musk’s ventures, was founded in 2002. After several failures, they finally succeeded in launching Falcon 1 rocket in 2008. A subsequent contract from NASA saved the company from possible bankruptcy. The company has thrived since then and is now a clear leader in the field.

Tesla was incorporated in 2003, and although Musk was not the original founder, he joined shortly after as a lead investor in 2004 and was an instrumental force in Tesla’s success. Conflict with Martin Eberhard, Tesla’s founder, and first CEO, led to Musk pushing him out. Later in 2008, Musk became the CEO of Tesla.

During several interviews, Musk recalled the year 2008 as “The Worst Year of My Life.” Tesla and SpaceX were fighting for their survival, and he was in the middle of a divorce. He was also essentially out of money. All the money from the PayPal sale was gone.

Tesla and SpaceX narrowly survived, and the US government played some role here. SpaceX got a contract from NASA, and a $465 million loan for Tesla from the US Department of Energy was also helpful.

There were a few other critical years ahead of Musk, mainly thanks to Tesla trying to ramp up production and become profitable, and there might be a few of them still on, given his risk-taking attitude.

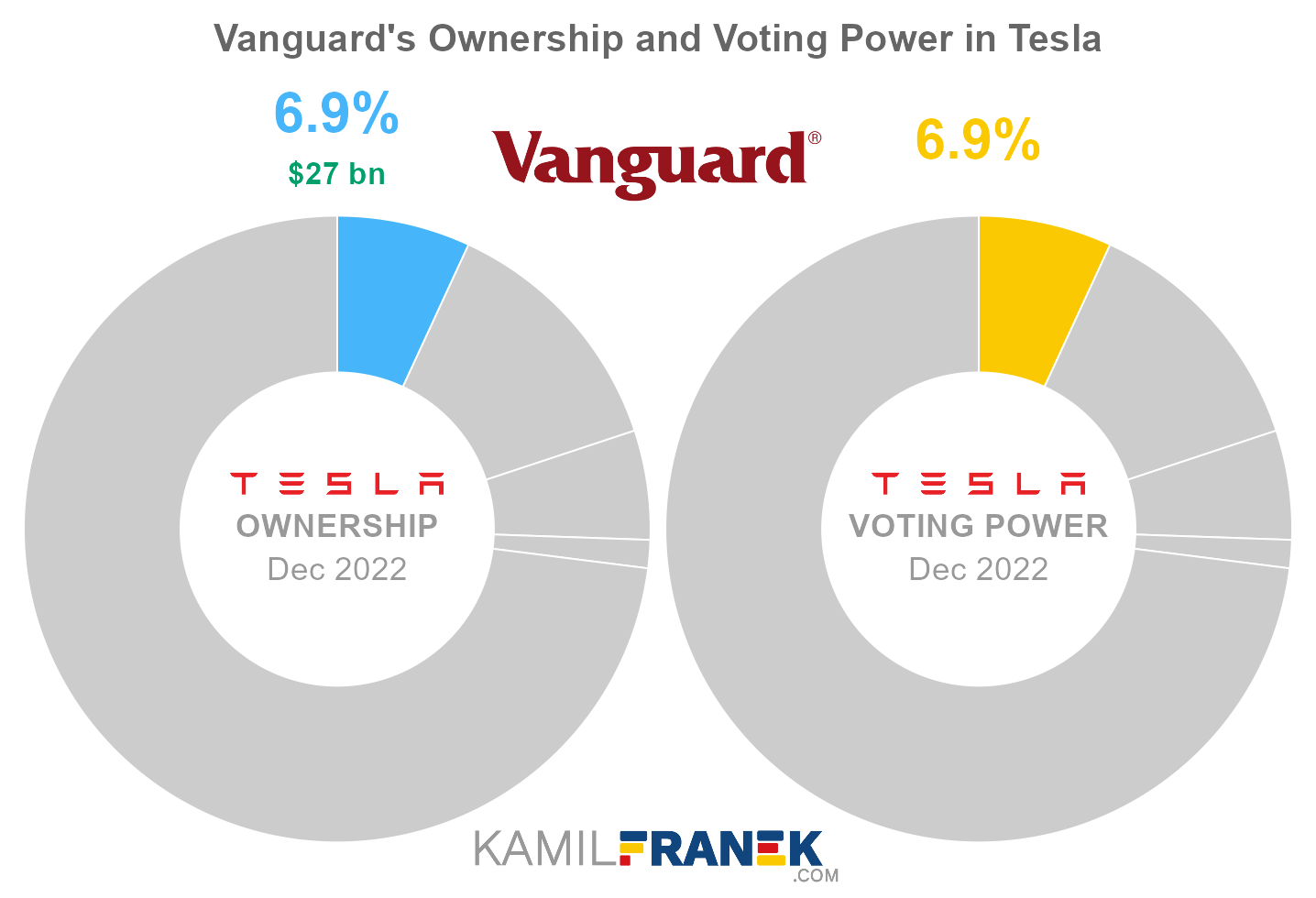

#2 Vanguard (6.9%)

Vanguard is the second-largest shareholder of Tesla, owning 6.9% of its shares. As of December 2022, the market value of Vanguard’s stake in Tesla was $26.8 billion.

Vanguard owned 218 million shares in Tesla and controlled 218 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

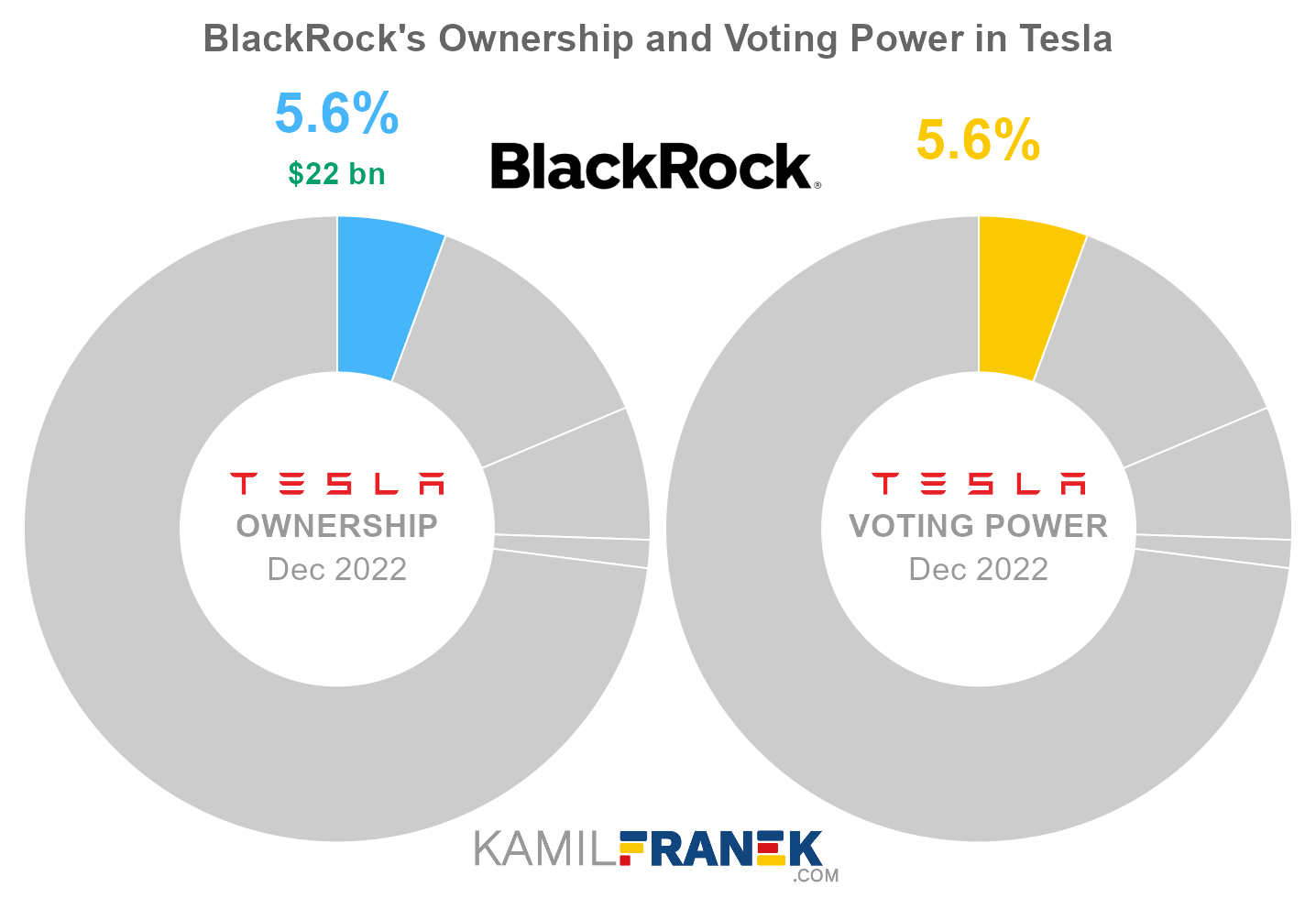

#3 BlackRock (5.6%)

BlackRock is the third-largest shareholder of Tesla, owning 5.6% of its shares. As of December 2022, the market value of BlackRock’s stake in Tesla was $22.0 billion.

BlackRock owned 178 million shares in Tesla and controlled 178 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

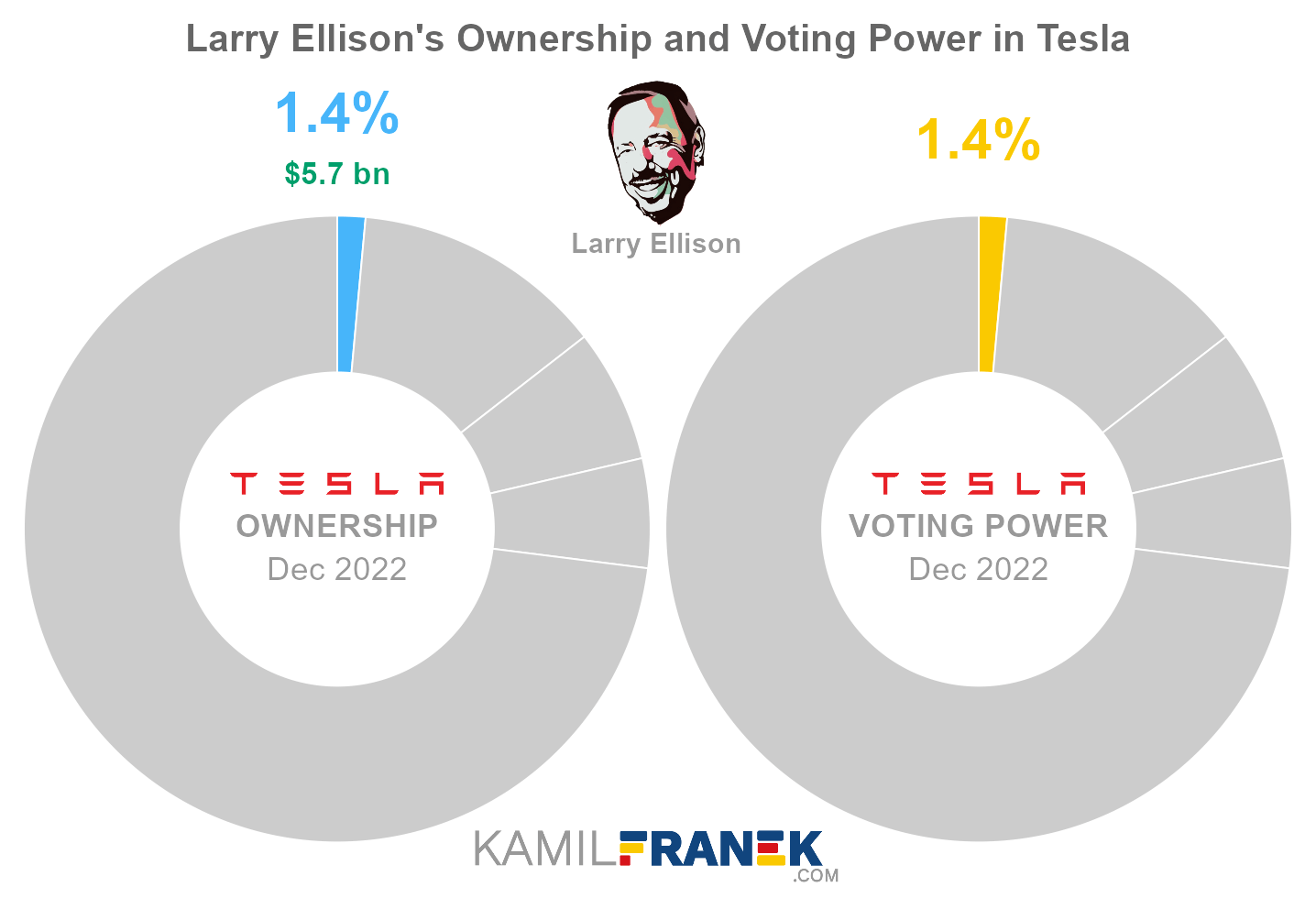

#4 Larry Ellison (1.4%)

Larry Ellison owns 1.4% of Tesla’s shares. As of December 2022, the market value of Larry Ellison’s stake in Tesla was $5.7 billion.

Larry Ellison owned 46 million shares in Tesla and controlled 46 million shareholder votes as of December 2022.

Larry Ellison (Lawrence J. Ellison) is a significant shareholder and former CEO of Oracle Corporation, an enterprise software company. He co-founded Oracle in 1977 and turned it into a large corporation.

Ellison resigned as Oracle CEO in 2017 and currently serves as Oracle’s chairman of the board and chief technology officer.

He joined the Giving Pledge.

❔ Are Tesla Founders Martin Eberhard and Marc Tarpenning Still Tesla Shareholders?

Tesla’s original founders, Martin Eberhard and Marc Tarpenning, are still Tesla shareholders, but their stakes in the company are tiny.

Because their stakes are small and they are not even active in Tesla for a long time, they do not need to disclose their ownership. However, they both claimed in recent interviews that they are still Tesla shareholders and also that they are not billionaires, so we know that their stakes are tiny now.

Martin Eberhard was cofounder and Tesla’s first CEO until 2007, when Elon Musk pushed him out. Eberhard claims that he has a “relatively small” stake in Tesla and also that he: “sold a good chunk of my stock a long time ago.”

When he left Tesla, Eberhard had a “somewhat below” 5% stake. His stake in the company decreased both naturally as a result of more additional capital raised by Tesla and also as a result of selling a “good chunk” of his stake.

Eberhard was not mentioned in Tesla’s 2010 IPO documents as a shareholder.

Tesla’s Co-founder Marc Tarpennin served as CFO and Vice President of Engineering at Tesla. He also claimed that he still is a shareholder of Tesla based on a 2019 interview by CNBC that you can check out below.

Tarpenning held onto his stake tighter than Eberhard. We can see from Tesla’s prospectus that Tarpening still had a 1.1% stake after Tesla’s IPO.

After IPO, their stakes decreased as a result of further dilution because Tesla continued to issue new stocks.

They also probably sold a sizable amount of their shares some time ago because both claim they are not billionaires, which is only possible if they sold a significant part of their stake before Tesla stock surged in 2020 and 2021. None of them could, therefore, have a stake higher than roughly 0.2%.

❔ Does Mercedes-Benz (Daimler) Own Tesla Inc.?

Mercedes-Benz Group AG (at the time Daimler AG) currently does not own a stake in Tesla Inc. However, Daimler acquired nearly a 10% stake in Tesla in 2009 and sold it fully in 2014.

Daimler AG invested in just below 10% of Tesla in 2009 for a reported $50 million, and Mercedes-Benz got a seat on Tesla’s board (through Herbert Kohler). The investment was made through Daimler’s subsidiary Blackstar Investco LLC.

Daimler AG then sold 40% of its stake in Blackstar lnvestco LLC to Aabar Investments, an Abu Dhabi-based investment company.

Mercedes-Benz even used some of the Tesla components in several of their EV projects, although their other cooperations predate the investment.

Part of the deal was an agreement that Tesla would inform Daimler when other car manufacturers approached it with acquisition proposals and gave Daimler the right to give a counteroffer. Also, Musk committed not to sell his stocks to other car manufacturers.

In 2014, Daimler sold its remaining Tesla stake for a reported $780 million.

❔ Does Toyota Own a Stake in Tesla Inc.?

Toyota currently does not own a stake in Tesla Inc., but it did invest around $50 million in Tesla in 2010, shortly after Tesla’s IPO. It represented around a 3 % stake assuming the IPO price of $17 per share.

The investment was part of the cooperation, where Tesla would take over the Fremont plant, and companies would cooperate on Model S production.

At the time, Tesla was already in another investment-cooperation deal with Mercedes/Benz (Daimler).

Toyota’s partnership (similar to the Daimler partnership) did not last long, and in 2014 Toyota reduced its stake and completely exited in 2016.

❔ Are Google Founders Larry Page and Sergey Brin Tesla Shareholders?

Both Larry Page and Sergey Brin were early investors in Tesla. They both participated in Tesla’s Series C funding round in 2006. The total amount invested in that round was $40 million. However, it is unclear if they are still shareholders. If they are, their stake is small.

Larry and Sergey were not to be seen even in the initial shareholder list of Tesla during its IPO in 2010. This means their stake was small, or they reduced it before Tesla’s IPO. Of course, it is not unheard of that people invest through some intermediary asset manager, in which case it becomes even more unclear.

There is also an unconfirmed report (a better name for “rumor”) that Musk was negotiating the acquisition of Tesla by Google when he was facing issues in 2013. In the end, Tesla solved their problems and grew on its own, and Musk got out of the deal.

Again, this is not confirmed. I just entertain it as a plausible possibility.

📅 Tesla’s History Timeline

These are selected events from Tesla’s history:

- 2003: Tesla was founded by Martin Eberhard and Marc Tarpenning. Eberhard became the CEO.

- 2004: Elon Musk invested in Tesla and became its Chairman.

- 2006: Series C funding round that included among other Larry Page and Sergey Brin as investors.

- 2007: Eberhard resigned as CEO

- 2008: Roadster entered production

- 2008: Elon Musk became CEO

- 2009: Daimler Group (Mercedes-Benz Group) acquired nearly a 10% stake in Tesla.

- 2010: Tesla’s initial public offering (IPO)

- 2010: Toyota acquired around 3% of Tesla.

- 2012: Launch of Model S

- 2012: Launch of Model 3

📚 Recommended Articles & Other Resources

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Amazon: The Largest Shareholders Overview

Overview of who owns Amazon.com, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Ferrari: The Largest Shareholders Overview

Overview of who owns Ferrari and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Ferrari: The Largest Shareholders Overview

Overview of who owns Ferrari and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Tesla’s Annual Financials Statements (K-10)

- Tesla’s Proxy Statement

- Tesla’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.