Who Owns Twitter: The Largest Shareholders Overview

Twitter, Inc. (TWTR) is the company behind Twitter, a short message social media app. The company makes money predominantly from advertising. Let’s look at who owns and controls Twitter after it went private in 2022.

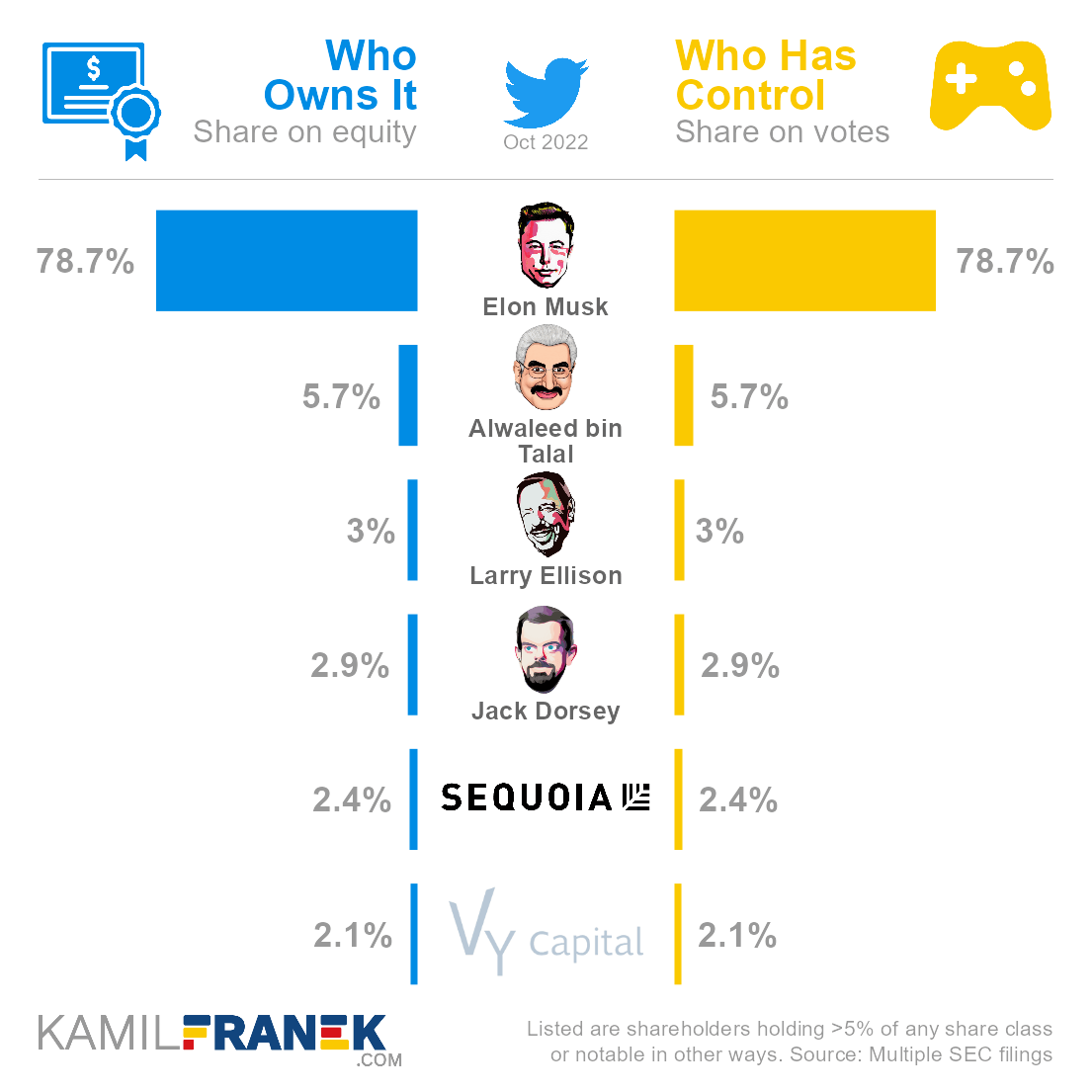

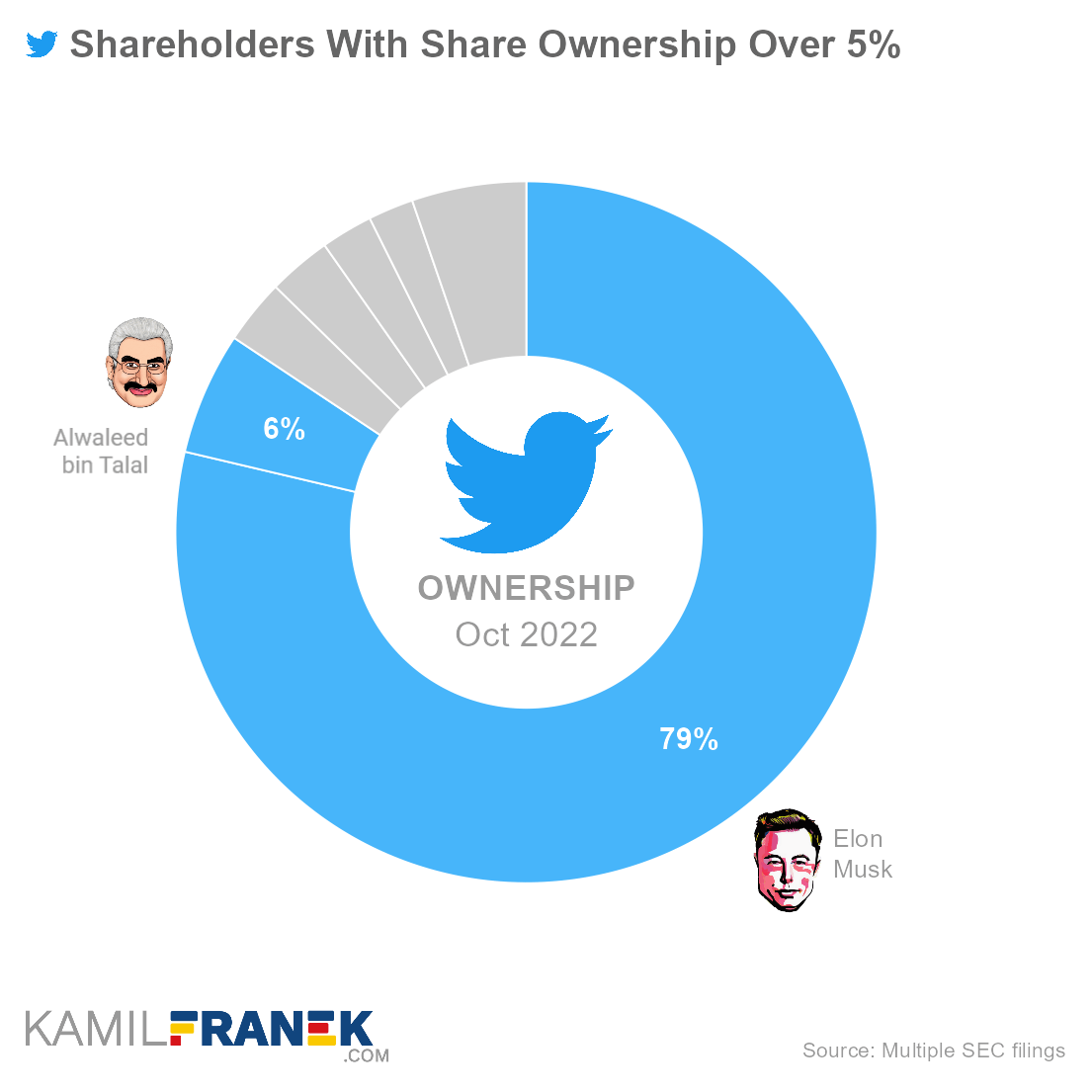

Twitter’s largest shareholder is Elon Musk, who owns 79% of the company. Other sizable shareholders are a Saudi prince Alwaleed bin Talal (5.7%), Oracle’s founder Larry Ellison (3.0%), Twitter co-founder and former CEO Jack Dorsey (2.9%), Sequoia Capital (2.4%), and Vy Capital (2.1%).

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Elon Musk | 78.7% | 78.7% | |

| Alwaleed bin Talal | 5.7% | 5.7% | |

| Larry Ellison | 3.0% | 3.0% | |

| Jack Dorsey | 2.9% | 2.9% | |

| Sequoia Capital | 2.4% | 2.4% | |

| Vy Capital | 2.1% | 2.1% | |

| Other | 5.3% | 5.3% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Twitter and controls it after it went private in October 2022.

However, remember that Twitter is currently a private company and does not need to disclose its largest shareholders anymore. Therefore the information in this article reflects the situation as of the end of October 2022, when Twitter ceased to be a public company. It is based on various SEC filings from that time.

When I mention the dollar amount of shareholders’ stakes in Twitter, they are based on how much those shareholders put into the company when it was acquired and not how much their stake is worth now. Twitter shares are no longer publicly traded.

If you are interested, you can also explore who are the largest shareholders in other companies like Apple, Meta(Facebook), Microsoft, Ferrari, or Tesla.

📃 Who Owns Twitter?

Twitter is owned mainly by Elon Musk, who owns 79% of the company. Other large owners are a Saudi prince Alwaleed bin Talal with a 5.7% ownership share, Oracle’s founder Larry Ellison (3.0%), Jack Dorsey (3.0%), Sequoia Capital (2.4%), and Vy Capital (2.1%).

The largest owner of Twitter is entrepreneur Elon Musk, which owns 78.7% of the company.

- Technically, Twitter is owned by the Delaware-registered company “X Holdings I, Inc.” Elon Musk and all other current shareholders are owners of this corporation and not Twitter Inc. directly.

- Elon Musk has been a majority shareholder of Twitter since October 2022, when he finalized his $44bn acquisition of Twitter.

- Musk had to put together $46.5bn financing, which also included closing costs, with the help of debt financing ($13bn), equity financing from other investors ($7.1bn), and the rest was covered by his own funds ($26.4bn). He had to sell a sizable part of his stake in Tesla to be able to afford it.

- After the acquisition, Musk assumed the position of CEO and started radical changes in Twitter.

- Twitter acquisition and everything that happened after that was like watching a movie 🍿. In fact, I am confident it is bound to become a Hollywood movie someday.

- Twitter’s acquisition story started in April 2022, but in July 2022, Musk tried to terminate the deal. Twitter sued him for it, and the court was scheduled for September. At the beginning of September, Musk changed his mind and decided to go through with the acquisition, probably realizing he won’t be able to get out of it.

- The acquisition was closed on October 27, 2022. The next day Musk famously tweeted: “the bird is freed.”

the bird is freed

— Elon Musk (@elonmusk) October 28, 2022

The second-largest Twitter owner is Alwaleed bin Talal, a Saudi prince, which owns a 5.7% stake.

- Al Waleed bin Talal Al Saud is a Saudi prince who invested in Twitter in 2011 through his company Kingdom Holding.

- He decided to roll over his shares in Twitter into a new company when Elon Musk acquired it.

The third-largest Twitter owner is Larry Ellison, Oracle’s founder, with a 3.0% stake.

- Larry Ellison is Elon Musk’s friend, and until 2022 served on Tesla’s board of directors. He provided $1bn of equity for Musk’s Twitter acquisition.

The notable owner is also Twitter co-founder and former CEO Jack Dorsey, which owns 2.9% of the company.

- Jack Dorsey is a Twitter co-founder and former CEO. - He rolled over his 18 million shares he had in old Twitter into a new company that acquired Twitter in 2022.

- Jack Dorsey stepped down as Twitter CEO in November 2021.

Other owners with stakes in Twitter are Sequoia Capital (2.4%), Vy Capital (2.1%), and even crypto exchange Binance invested $0.5bn.

Twitter was founded in 2006 by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams and has been a publicly listed company since its initial public offering on Nasdaq in 2013 (Ticker: TWTR).

- Of all of the Twitter co-founders, only Jack Dorsey and Evan Williams had a sizable stake at the time of Twitter’s IPO in 2013.

- After the IPO, Jack Dorsey’s stake was 4.3%, and Evan Williams’s stake was 10.4%.

- However, Williams, throughout the years, sold its stake. When he stepped down from the Twitter board in 2019, he only had 10.5 million shares (approximately 1.4%).

- Before Elon Musk acquired Twitter and took it private, Twitter’s main shareholders were assets managers Vanguard, Morgan Stanley, and BlackRock, who were investing money of other people and institutions. Sizable individual investors were Al Waleed and Jack Dorsey, who both rolled over their stake into Musk’s Twitter.

Twitter, Inc. is incorporated in the State of Delaware (US), and its headquarters are in San Francisco, California (US).

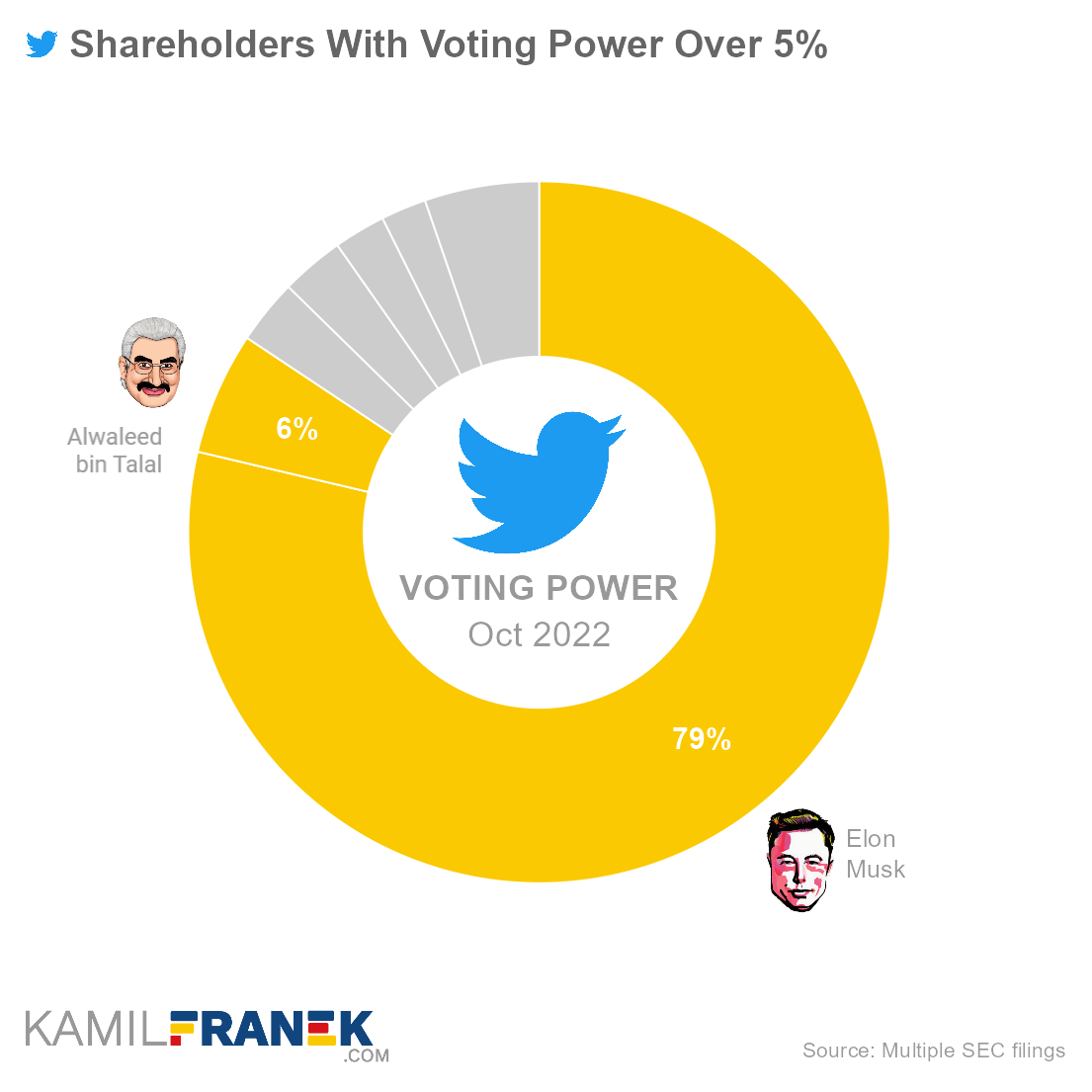

🎮 Who Controls Twitter (TWTR)?

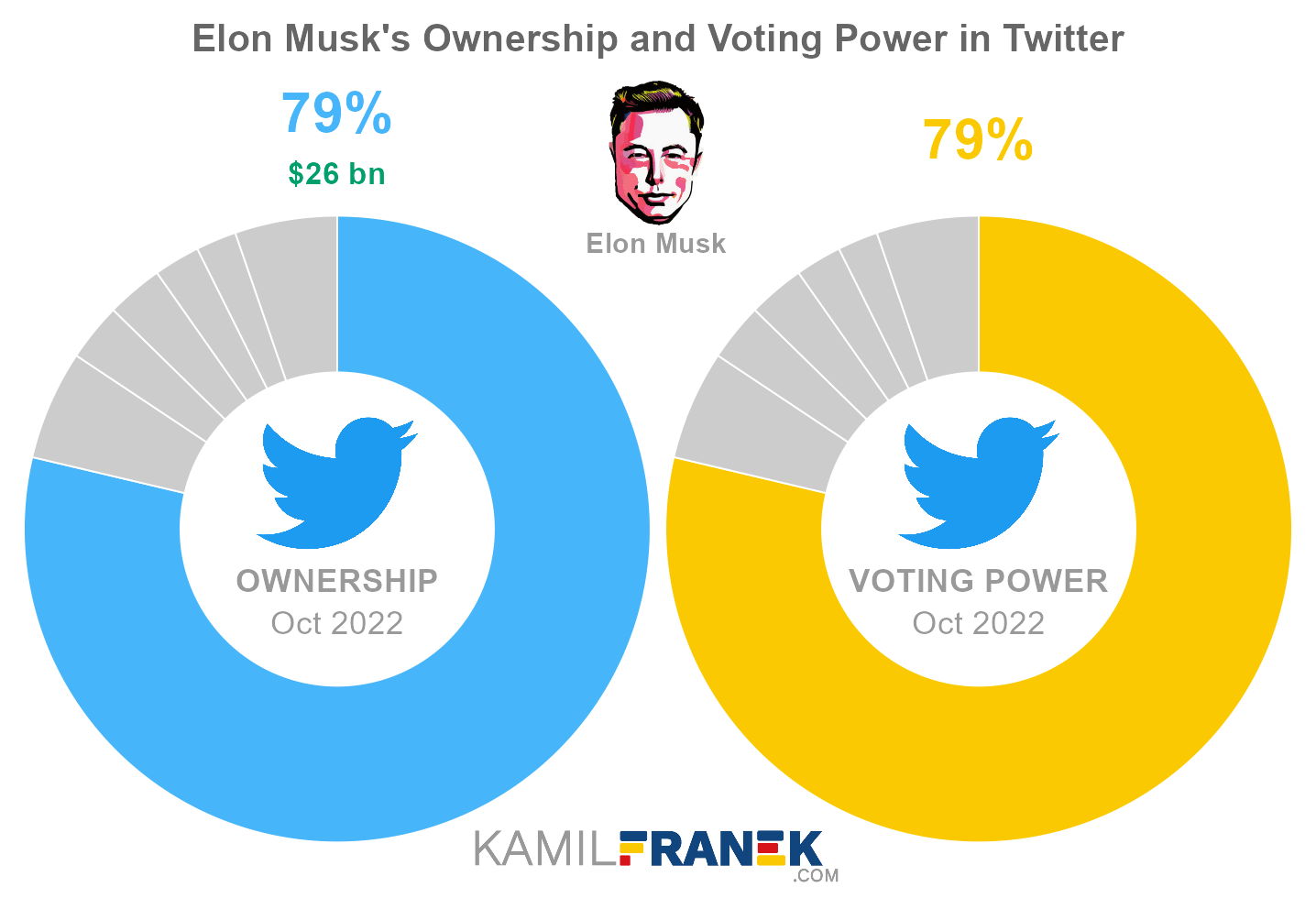

Twitter’s shareholder with the largest voting power is Elon Musk, who controls the company with 79% of all votes. Other large shareholders are a Saudi prince Alwaleed bin Talal (5.7%), Larry Ellison (3.0%), and Jack Dorsey (2.9%). However, thanks to Musk’s control, their influence is limited.

Twitter has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

Twitter’s shareholder with the largest voting power is entrepreneur Elon Musk who holds 78.7% of all votes and clearly controls the company. He also currently serves as Twitter CEO, so the company is firmly in his hands.

Let’s now look at each Twitter shareholder individually.

📒 Who Are Twitter’s Largest Shareholders?

Let’s go through the list of the largest shareholders of Twitter, Inc. one by one and look at who they are, what stake they own, and how much they invested in Twitter when it was acquired in 2022 and became a private company.

#1 Elon Musk (79%)

Elon Musk is the largest shareholder of Twitter, owning 79% of its shares. His investment in Twitter when it was taken private in 2022 was $26.4 billion.

Elon Reeve Musk is an iconic CEO and significant investor in Tesla, SpaceX, and other businesses. He recently added to the list also Twitter, where he is doing quite a radical cleanup. He is one of the most wealthy people on the planet.

Musk’s first venture was Zip2, which he co-founded in 1995. He exited in 1999 with a $22 million payout.

After that, he founded X.com online payment company that later merged with Confinity, co-founded by Peter Thiel. The company was later renamed PayPal. In 2002, Paypal was acquired by eBay for $1.5 billion, and Musk received a $175.8 million payout.

SpaceX , another of Musk’s ventures, was founded in 2002. After several failures, they finally succeeded in launching Falcon 1 rocket in 2008. A subsequent contract from NASA saved the company from possible bankruptcy. The company has thrived since then and is now a clear leader in the field.

Tesla was incorporated in 2003, and although Musk was not the original founder, he joined shortly after as a lead investor in 2004 and was an instrumental force in Tesla’s success. Conflict with Martin Eberhard, Tesla’s founder, and first CEO, led to Musk pushing him out. Later in 2008, Musk became the CEO of Tesla.

During several interviews, Musk recalled the year 2008 as “The Worst Year of My Life.” Tesla and SpaceX were fighting for their survival, and he was in the middle of a divorce. He was also essentially out of money. All the money from the PayPal sale was gone.

Tesla and SpaceX narrowly survived, and the US government played some role here. SpaceX got a contract from NASA, and a $465 million loan for Tesla from the US Department of Energy was also helpful.

There were a few other critical years ahead of Musk, mainly thanks to Tesla trying to ramp up production and become profitable, and there might be a few of them still on, given his risk-taking attitude.

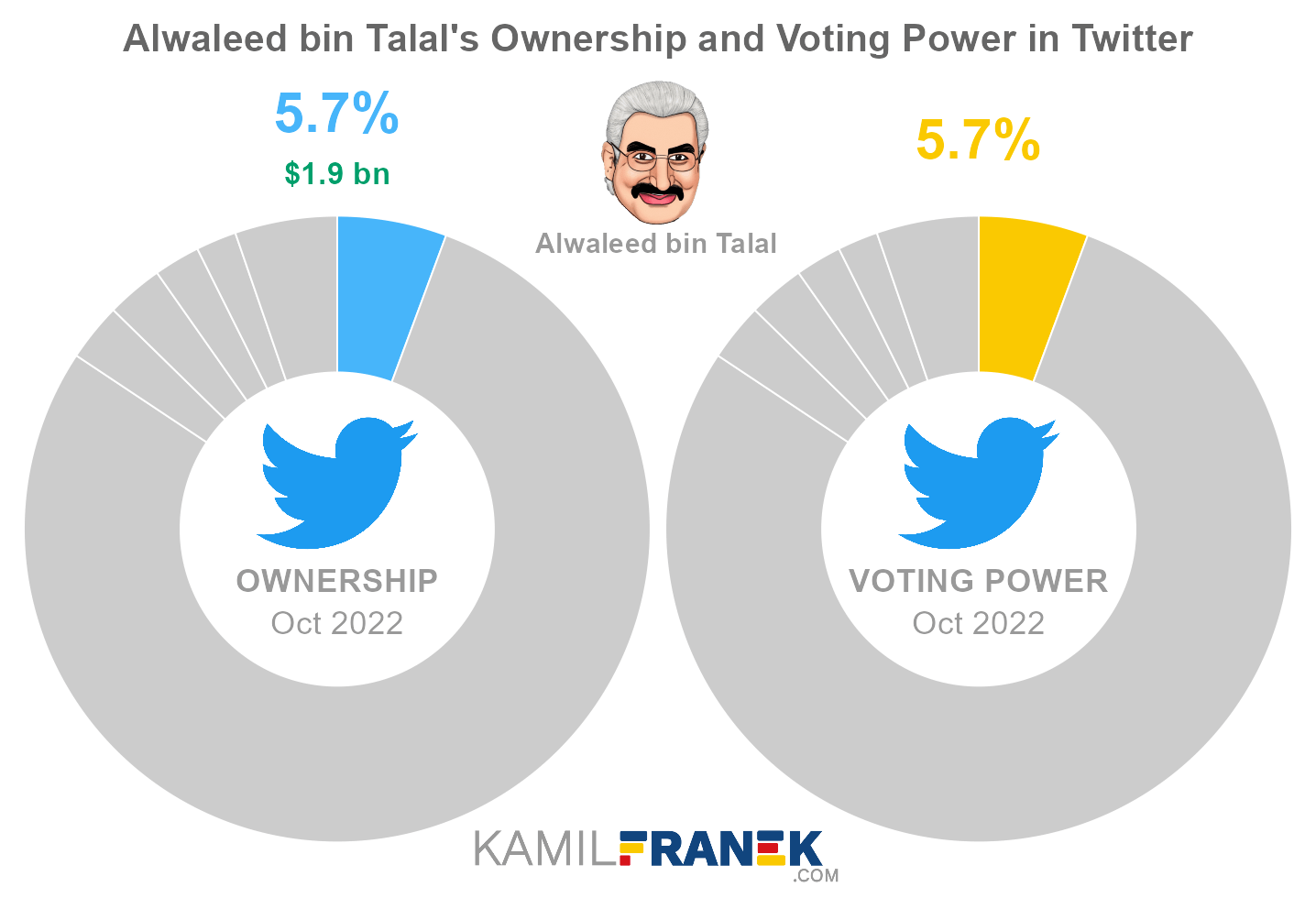

#2 Alwaleed bin Talal (5.7%)

Alwaleed bin Talal is the second-largest shareholder of Twitter, owning 5.7% of its shares. His investment in Twitter when it was taken private in 2022 was $1.9 billion.

Alwaleed bin Talal Al Saud is a member of the Saudi royal family. He is a founder and chairman of Kingdom Holding Company, through which he owns various businesses, hotels, and also minority interests in Twitter and Lyft. Kingdom Holding is publicly traded but Alwaleed bin Talal owns the majority of the company. His total wealth is considered to be around $19bn.

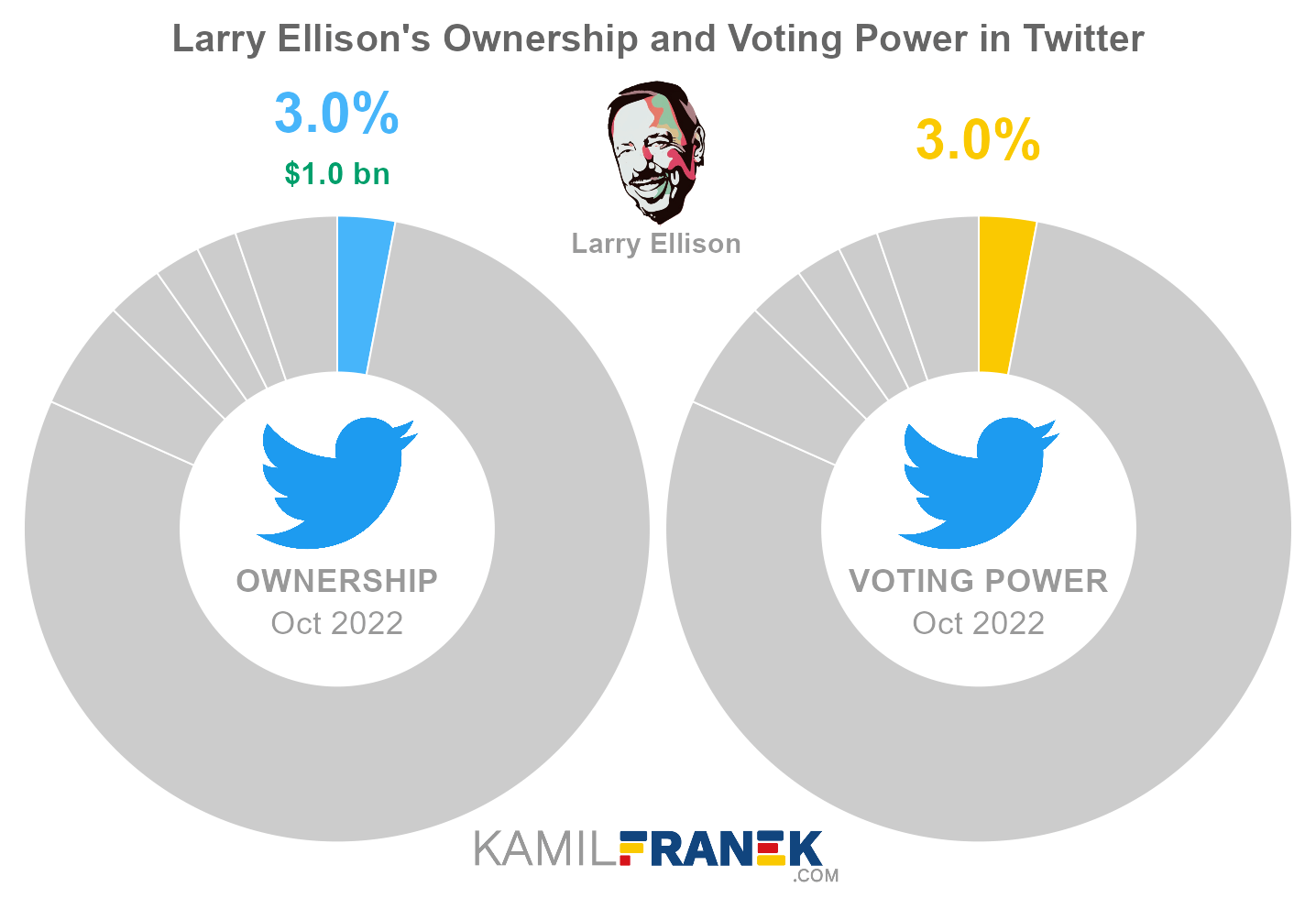

#3 Larry Ellison (3.0%)

Larry Ellison is the third-largest shareholder of Twitter, owning 3.0% of its shares. His investment in Twitter when it was taken private in 2022 was $1.0 billion.

Larry Ellison (Lawrence J. Ellison) is a significant shareholder and former CEO of Oracle Corporation, an enterprise software company. He co-founded Oracle in 1977 and turned it into a large corporation.

Ellison resigned as Oracle CEO in 2017 and currently serves as Oracle’s chairman of the board and chief technology officer.

He joined the Giving Pledge.

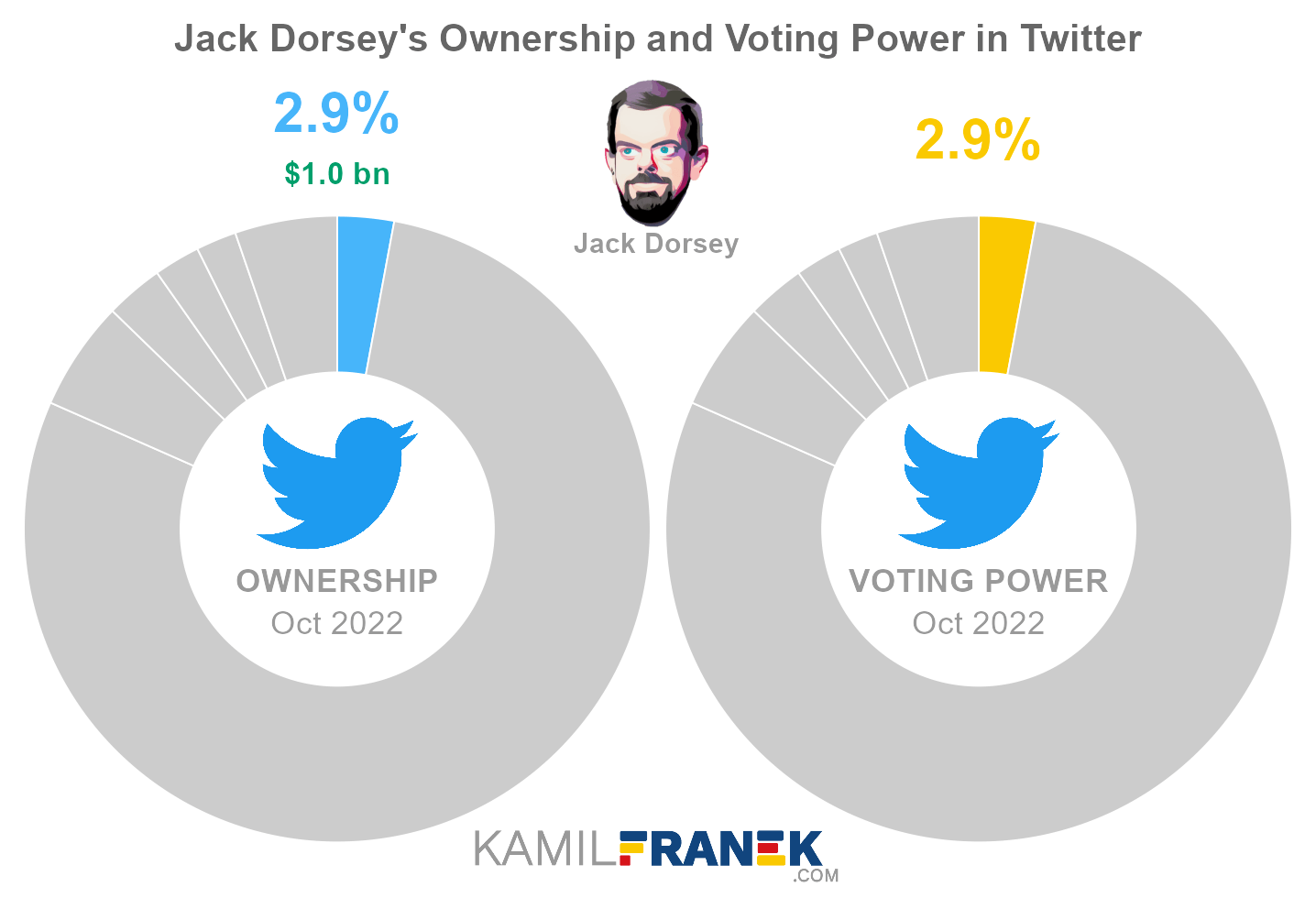

#4 Jack Dorsey (2.9%)

Jack Dorsey owns 2.9% of Twitter’s shares. His investment in Twitter when it was taken private in 2022 was $1.0 billion.

Jack Dorsey is the co-founder and former CEO of Twitter and also co-founder and CEO of digital payments company Block Inc.

Jack was Twitter’s first CEO and stepped down from that position in 2008. Soo after that, he co-founded another company Block Inc (formerly Square Inc.), which is now an established player in many areas of the digital payments market.

He later returned to Twitter for his second term as CEO from 2015 until 2021. During that time, he was also CEO of Block (Square), which earned him the label of “absentee” CEO among some Twitter investors.

The fact that he was not fully focused on Twitter and the company’s poor performance was one of the reasons that led to an attempt by Elliot Management to outs him as Twitter CEO.

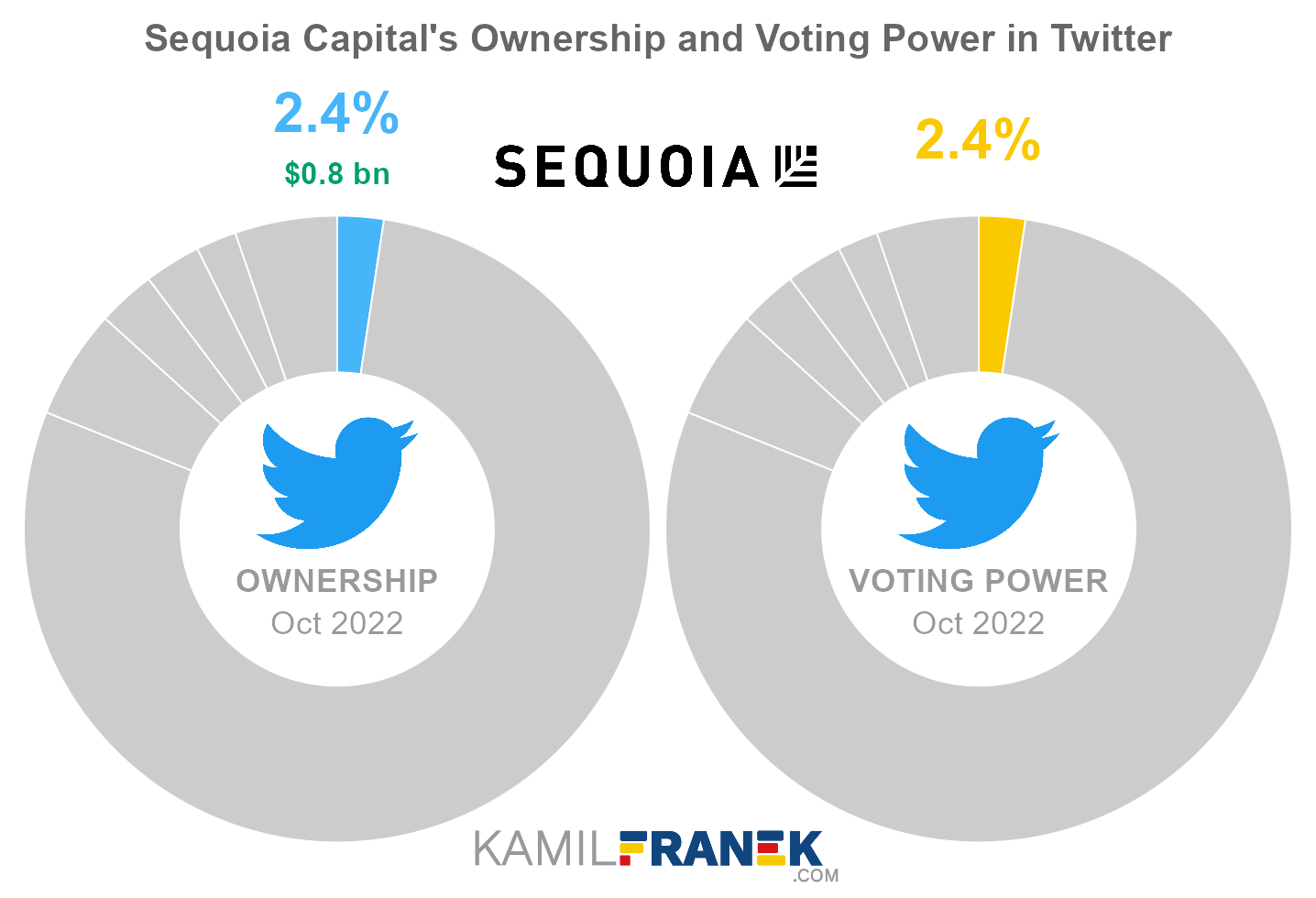

#5 Sequoia Capital (2.4%)

Sequoia Capital owns 2.4% of Twitter’s shares. Its investment in Twitter when it was taken private in 2022 was $0.8 billion.

Sequoia Capital is a renowned venture capital firm focusing on investment in promising startups early on. It was founded in 1972 by Don Valentine. Sequoia Capital invested in many well-known companies, like Apple, Atari, Cisco, Google, Instagram, Airbnb, and Stripe.

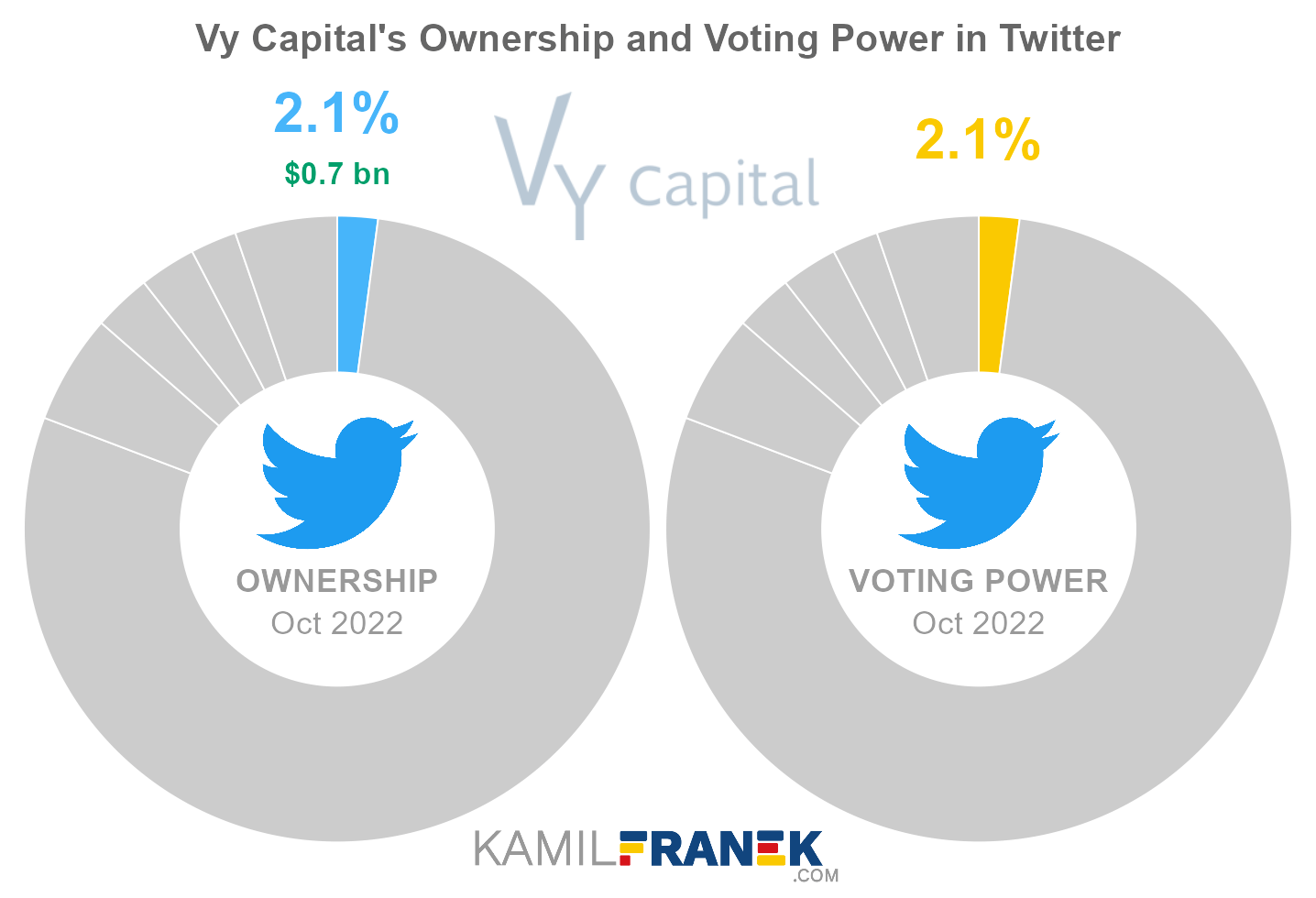

#6 Vy Capital (2.1%)

Vy Capital owns 2.1% of Twitter’s shares. Its investment in Twitter when it was taken private in 2022 was $0.7 billion.

Vy Capital is a Dubai-based private investment firm that was founded in 2013 by Alexander Tamas and Mateusz Szeszkowski. Among other investments, it also invested in several projects backed by entrepreneur Elon Musk, including The Boring Company, Neuralink, and Twitter.

❔ Does Twitter Co-founder Evan Williams Still Owns Stake in Twitter?

Evan Williams is one of the Twitter co-founders and an early investor. He was, for some time, also Twitter’s CEO and was a member of Twitter’s board until he stepped down in February 2019. He is no longer active in the company.

It is unclear if Evan Williams still owns some stake in Twitter since he did not need to disclose his stake after he left the Twitter board in 2019. At that time, he owned 10.5 million shares, and his stake was approximately 1.4%.

Williams was the largest individual shareholder after Twitter’s IPO in 2013, with a 10.4% stake. Through the years, however, he kept selling shares.

- In 2017 he still had 6% ownership when he announced a plan to sell up to 30% of his shares.

When Williams left the Twitter board in 2019, his stake was only 1.4%.

Williams was not required to disclose its stock sales after that, so his current stake in Twitter is unknown. Even if he kept some stake after leaving Twitter, he probably cashed out when Elon Musk acquired Twitter in 2022.

📚 Recommended Articles & Other Resources

Who Owns Apple: The Largest Shareholders Overview

Overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Meta: The Largest Shareholders Overview

Overview of who owns Meta Platforms and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lockheed Martin: The Largest Shareholders Overview

Overview of who owns Lockheed Martin and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Paypal: The Largest Shareholders Overview

Overview of who owns PayPal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources (from the time before Twitter was taken private in 2022)

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.