Who Owns PayPal: The Largest Shareholders Overview

PayPal Holdings, Inc. (PYPL) is a company behind an online payment system that allows individuals and businesses to send and accepts payments worldwide. It makes money predominantly from fees it charges businesses to accept payments through PayPal and currency conversions. Let’s now look at who owns PayPal and who controls it.

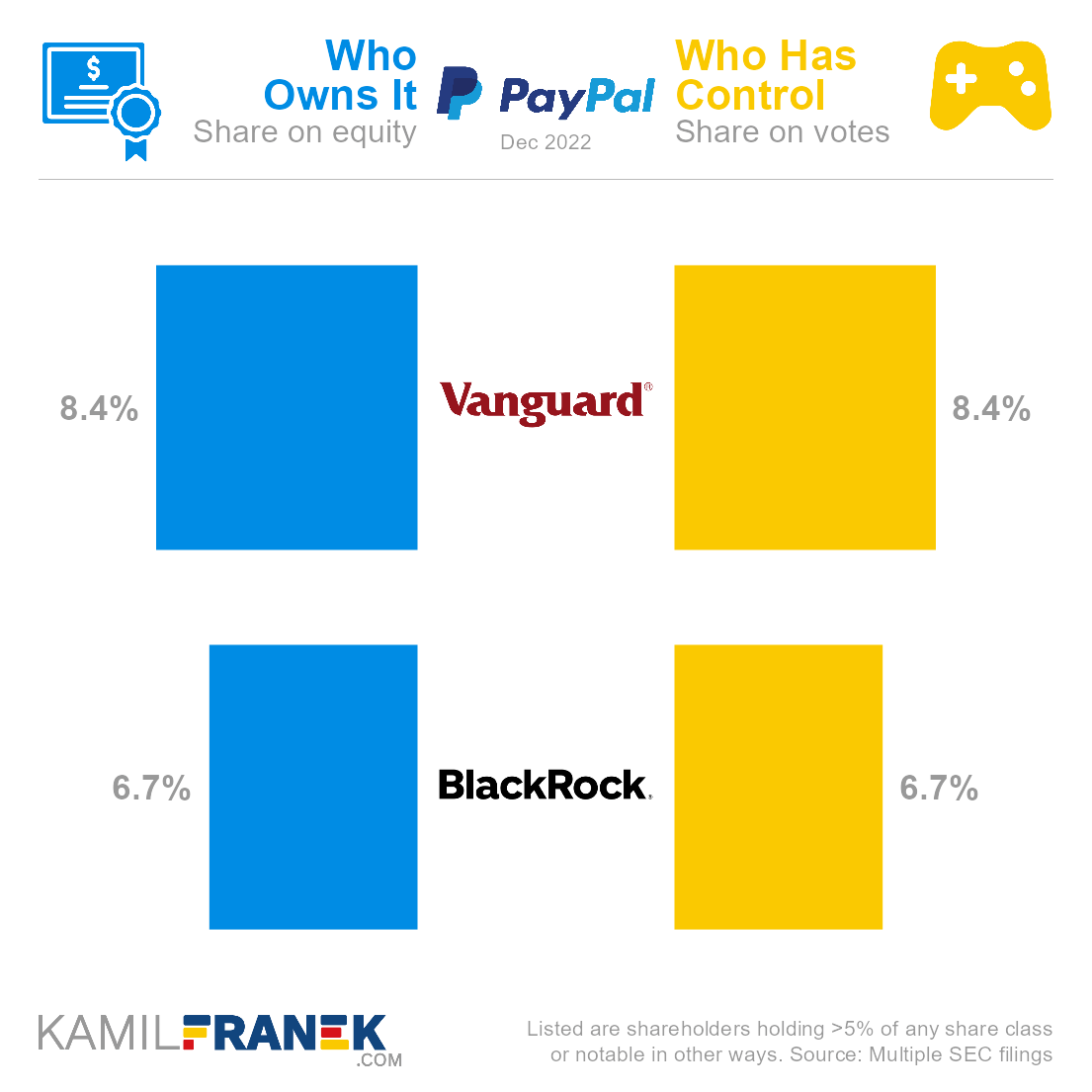

PayPal’s largest shareholders are asset manager Vanguard, which owns 8.4% share, and BlackRock, with 6.7% ownership. PayPal’s ownership is quite dispersed. None of its founders and once sizable shareholders, Elon Musk and Peter Thiel, own significant stakes anymore.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 8.4% | 8.4% | |

| BlackRock | 6.7% | 6.7% | |

| Other | 84.9% | 84.9% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns PayPal and who controls it. I will show you who PayPal’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Tesla, Apple, Alphabet(Google), eBay, or Meta.

📃 Who Owns PayPal?

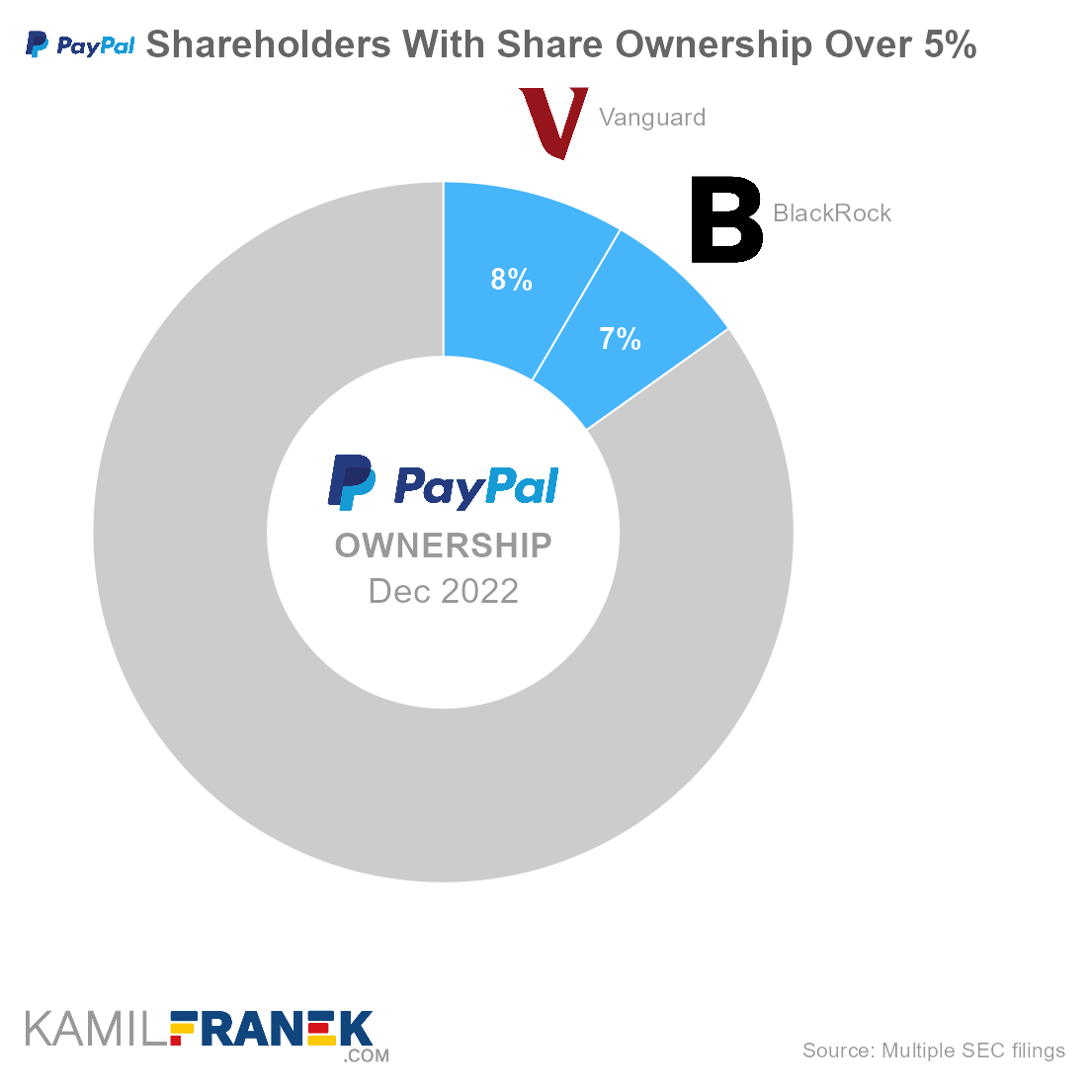

PayPal is owned by its shareholders. The largest ones are asset management giants Vanguard, which owns 8.4% of the company, and BlackRock, with a 6.7% ownership share. PayPal’s ownership is quite dispersed, and no other shareholder crossed the 5% ownership threshold.

No shareholder has a dominant stake in the company. PayPal ‘s largest shareholders are asset managers who invest money on behalf of their clients. It is not surprising to see Vanguard and BlackRock among top shareholders. They are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies.

PayPal was founded by merging two startups, Confinity and X.com, in 2000 and it had its initial public offering on Nasdaq in 2002. PayPal, however, only stayed a listed company for a short time because eBay acquired it in the same year. Later in 2015, eBay spun off PayPal, and it became a listed company again. (Ticker: PYPL)

- After PayPal’s initial IPO, the largest individual investors were Elon Musk (co-founder of X.com), with an 11.9% share, and Peter Thiel (co-founder of Confinity), whose stake at the time was 4.6%.

- You won’t find Elon Musk or Peter Thiel among current large PayPal investors because they sold their stakes long ago.

- Small stakes do not need to be disclosed, so it is possible that they still might have a smaller stake, but it seems improbable.

PayPal Holdings, Inc. is incorporated in the State of Delaware (US), but its headquarters are in San Jose, California (US).

🎮 Who Controls PayPal (PYPL)?

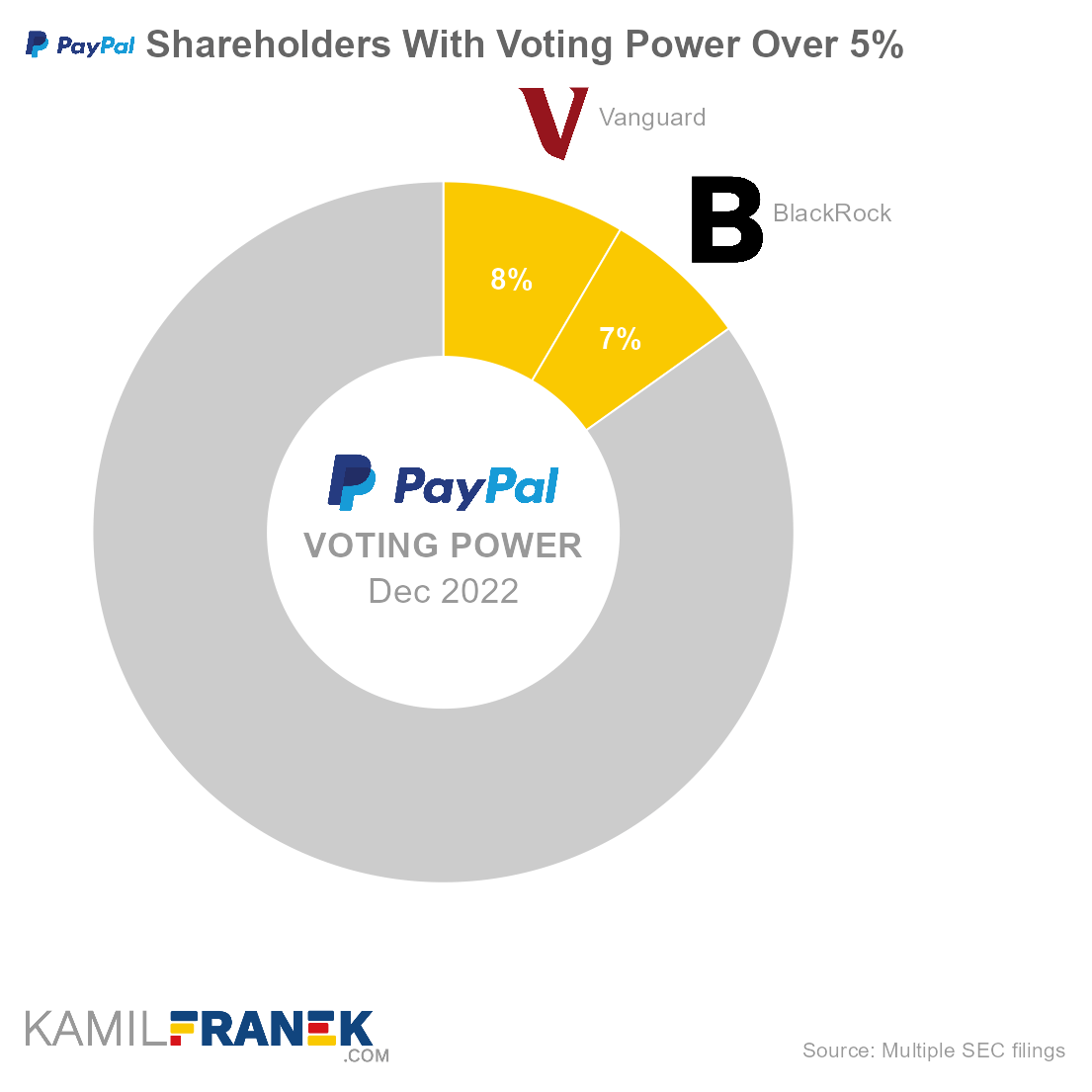

PayPal’s shareholders with the largest voting power are asset managers Vanguard, which holds 8.4% of all votes, and BlackRock with 6.7% voting power.

PayPal has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of PayPal Holdings, Inc. is quite dispersed, and the main shareholders are only asset managers investing money on behalf of their clients. None of them control the company.

PayPal ‘s dispersed ownership might create conflicts of interest between PayPal ‘s management and its investors, which are represented by asset managers, another management layer. In situations like these, where ownership is dispersed, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

In the case of PayPal, insiders that influence the company are mainly CEO Dan Schulman, board chair John Donahoe, and other board members and executives.

- PayPal currently has a 12-member board of directors.

- Nobody from the board of directors or executive officers holds more than 0.05% share of PayPal ‘s stocks.

- Chairman John Donahoe serves as the CEO of Nike and previously was CEO of eBay.

- There are not any extraordinary protection measures within PayPal bylaws and certificate of incorporation. The board can be replaced annually, and decisions are made with a majority of votes. The exception is when there is a decision about business combinations when a two-thirds majority is required.

🗳️ Breakdown of PayPal’s Outstanding Shares and Votes by Top Shareholders

PayPal Holdings, Inc. had a total of 1,136 million outstanding shares as of December 2022. The following table shows how many shares each PayPal’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 96 | 96 | 8.4% | |

| BlackRock | 76 | 76 | 6.7% | |

| Other | 964 | 964 | 84.9% | |

| Total (# millions) | 1,136 | 1,136 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 1,136 million votes distributed among shareholders of PayPal Holdings, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 96 | 96 | 8.4% | |

| BlackRock | 76 | 76 | 6.7% | |

| Other | 964 | 964 | 84.9% | |

| Total (# millions) | 1,136 | 1,136 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of PayPal’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in PayPal Holdings, Inc. worth.

However, keep in mind that a stake in PayPal could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $6.8 | $6.8 | 8.4% | |

| BlackRock | $5.4 | $5.4 | 6.7% | |

| Other | $68.7 | $68.7 | 84.9% | |

| Total ($ billions) | $80.9 | $80.9 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each PayPal shareholder individually.

📒 Who Are PayPal’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of PayPal Holdings, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in PayPal worth.

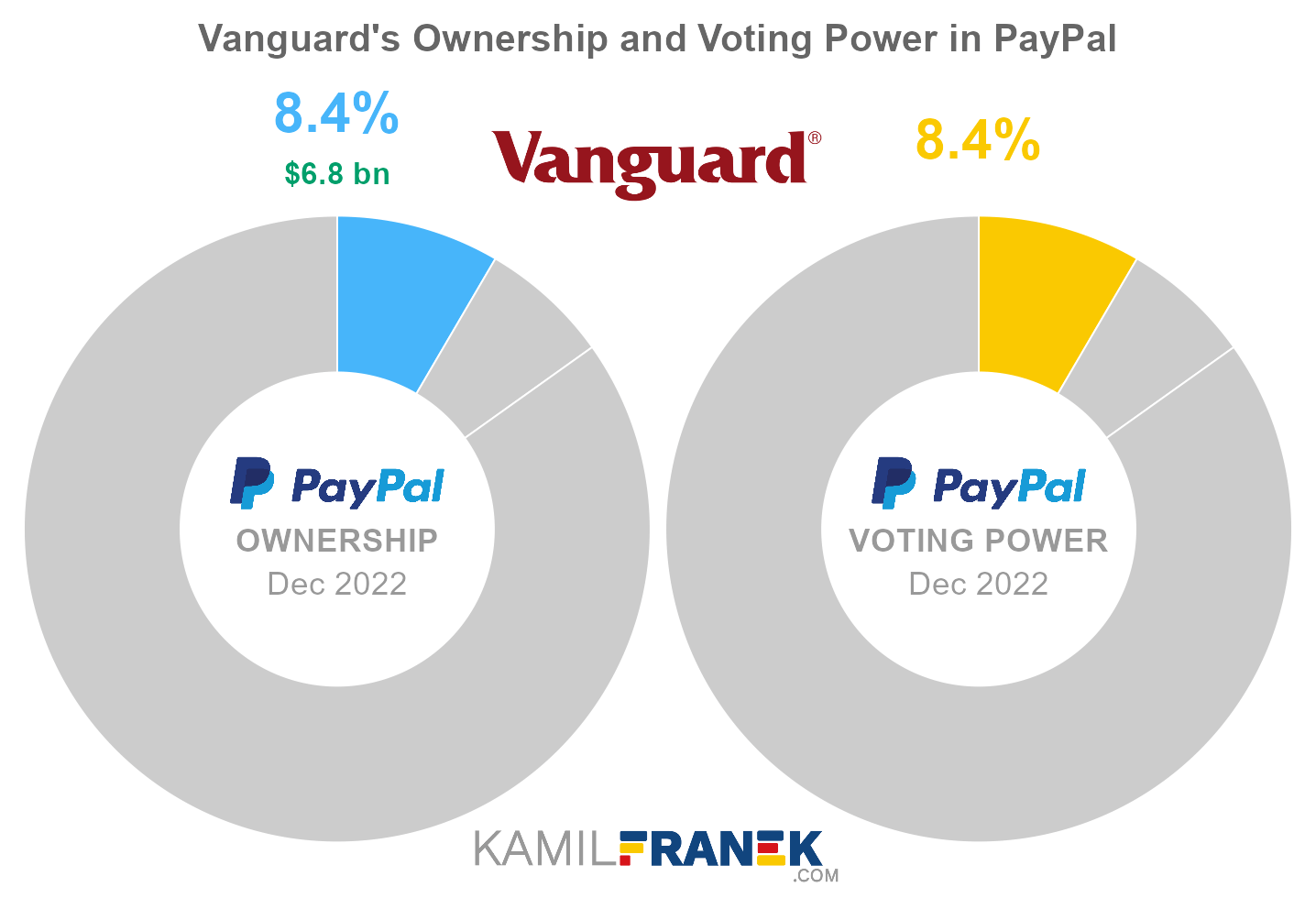

#1 Vanguard (8.4%)

Vanguard is the largest shareholder of PayPal, owning 8.4% of its shares. As of December 2022, the market value of Vanguard’s stake in PayPal was $6.8 billion.

Vanguard owned 96 million shares in PayPal and controlled 96 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

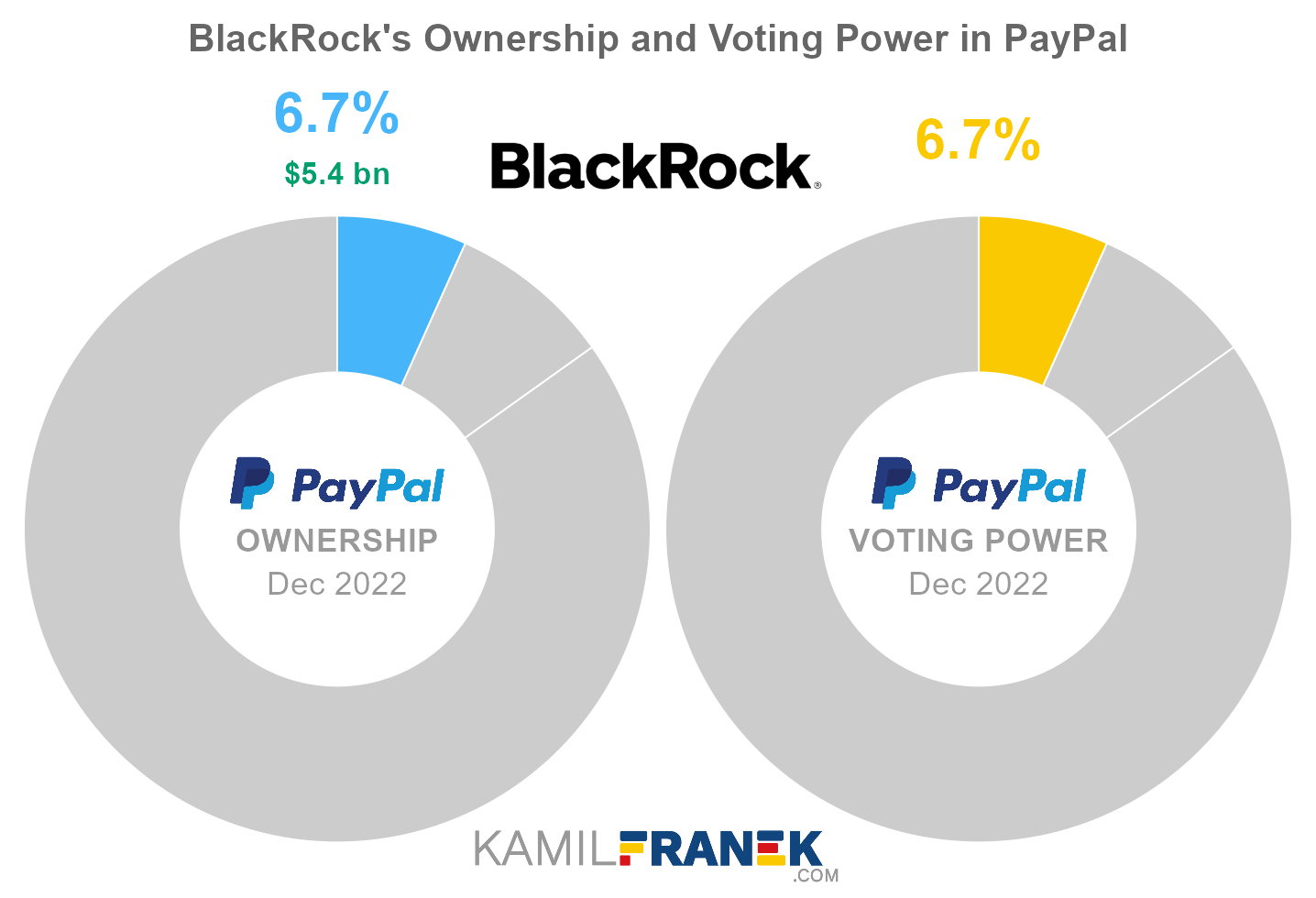

#2 BlackRock (6.7%)

BlackRock is the second-largest shareholder of PayPal, owning 6.7% of its shares. As of December 2022, the market value of BlackRock’s stake in PayPal was $5.4 billion.

BlackRock owned 76 million shares in PayPal and controlled 76 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

❔ Is PayPal Still Owned by eBay?

PayPal is currently not owned by eBay. eBay acquired PayPal shortly after PayPal’s initial IPO in 2002. However, in 2015, PayPal was spun off and became a separate entity again.

This spinoff was the result of investor pressure on eBay’s management. Investors were led by Carl Icahn, an iconic activist shareholder.

Later in 2018, eBay even dropped Paypal as its primary payment processing partner, so the separation was complete.

❔ Who Were PayPal’s Largest Shareholders after Its IPO in 2002?

PayPal’s initial public offering happed in 2002. Just after the IPO, Elon Musk was the largest PayPal shareholder, with an 11.9% share. Peter Thiel’s stake at the time was 4.6%.

List of the largest post-IPO shareholders from PayPal’s prospectus:

- Elon Musk (11.9%)

- Sequoia Capital (8.9%)

- Nokia Ventures, L.P. (8%)

- Clearstone Venture Partners (5.7%)

- Madison Dearborn Partners (4.6%)

- Peter Thiel (4,6%)

🧱 Who and When Founded PayPal

PayPal started in 2000 as a merger of two startups. The first was Confinity, founded by Max Levchin, Peter Thiel, and Luke Nosek in 1998. The second was X.com,, founded in 1999 by Elon Musk, Harris Fricker, Christopher Payne, and Ed Ho.

The merged company was first called X.com, and CEO was named Elon Musk. Musk and Thiel had diverging visions for the company. It reportedly culminated when Musk was on a trip with his wife, and Peter Thiel managed to persuade the board to oust Musk as CEO, and he became CEO.

📅 PayPal’s History Timeline

These are selected events from PayPal’s history:

- 1998: Confinity was founded by Max Levchin, Peter Thiel, and Luke Nosek.

- 1999: X.com was founded in 1999 by Elon Musk, Harris Fricker, Christopher Payne, and Ed Ho.

- 2000: Confinity and X.com merged into one company. Initially, it was called X.com.

- 2001: The company was renamed from X.com to PayPal

- 2002: PayPal went public and, soon after that, was acquired by eBay for $1.4bn

- 2015: eBay spun off PayPal as a separate listed company

- 2018: EBay drops PayPal as primary payment processing partner.

📚 Recommended Articles & Other Resources

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Twitter: The Largest Shareholders Overview

Overview of who owns Twitter and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Meta (Facebook): The Largest Shareholders Overview

Overview of who owns Meta Platforms and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns eBay: The Largest Shareholders Overview

Overview of who owns eBay and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- PayPal’s Annual Financials Statements (K-10)

- PayPal’s Proxy Statement

- PayPal’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.