Who Owns Berkshire Hathaway: The Largest Shareholders Overview

Berkshire Hathaway Inc. (BRK.A, BRK.B) is a conglomerate of companies active in many industries. The company’s CEO and chairman is famous investor Warren Buffett. The main segments are insurance, transportation, energy, and manufacturing. It also invests its vast insurance reserves in publicly traded companies like Coca-Cola or Apple. Let’s look at who owns Berkshire Hathaway and who controls it.

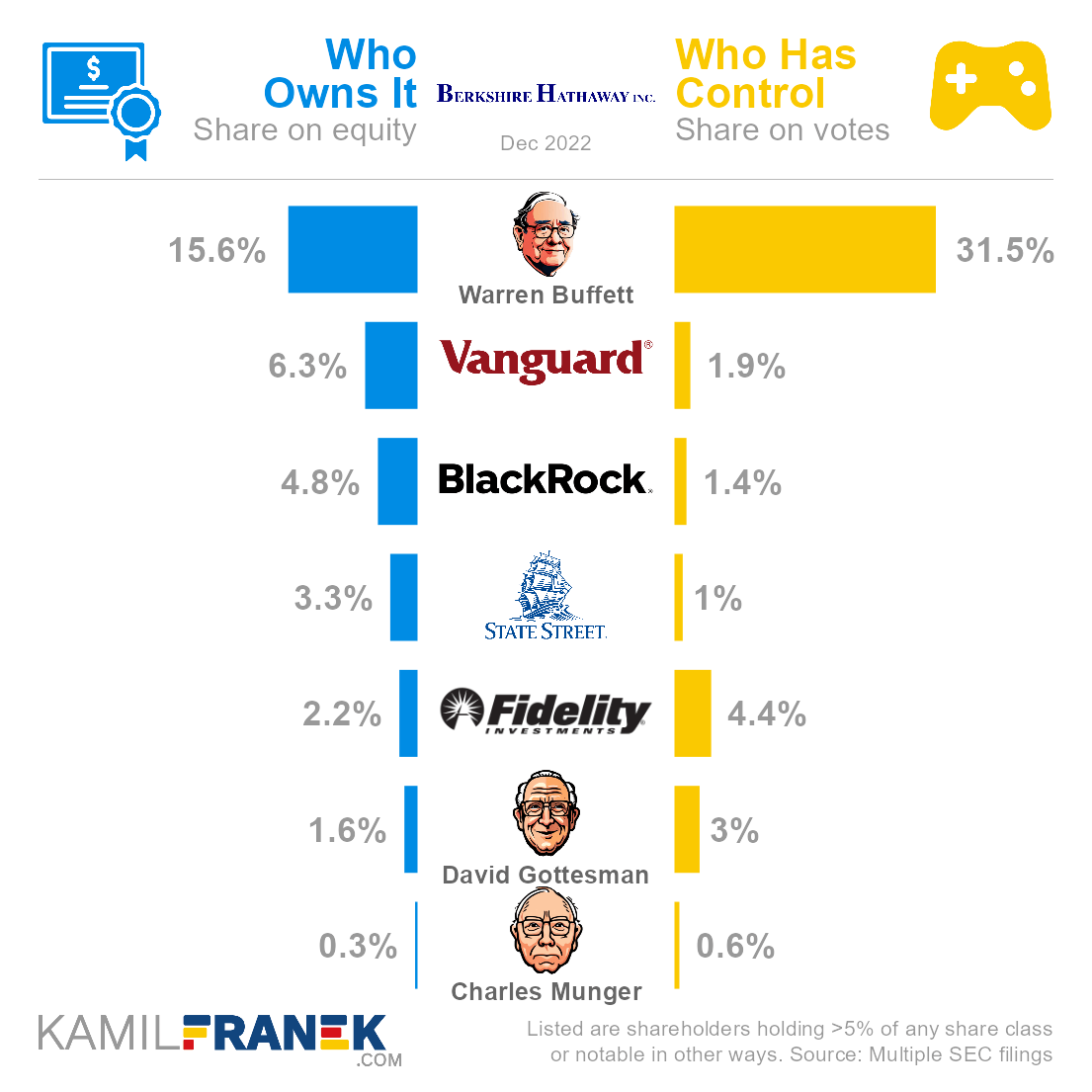

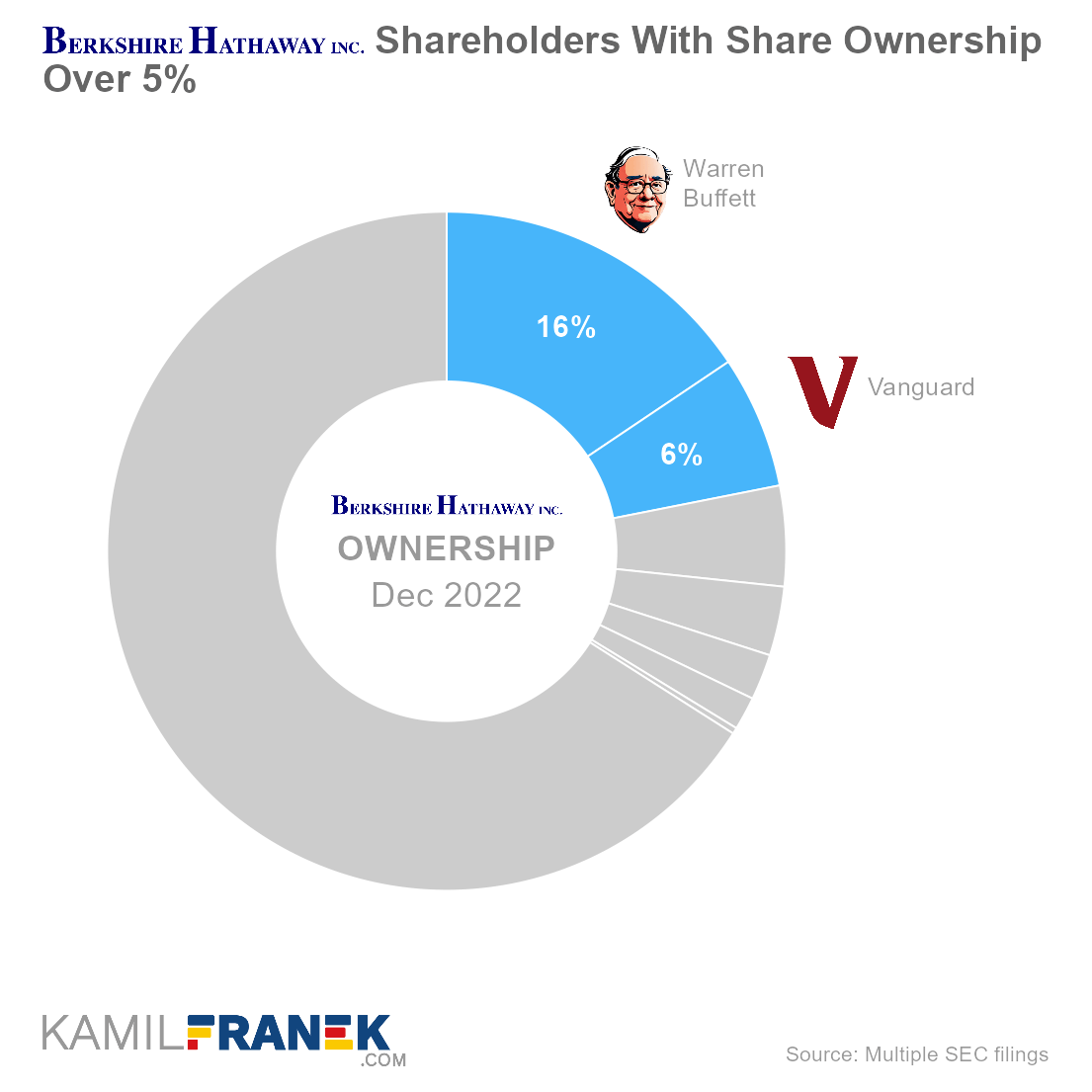

Berkshire Hathaway’s largest shareholders are its chairman and CEO Warren Buffett, who owns 15.6% of the company, followed by asset managers Vanguard (6.3%), BlackRock (4.8%), and State Street (3.3%). However, Warren Buffett controls 31.5% of all votes thanks to holding Class A shares.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Warren Buffett | 15.6% | 31.5% | |

| Vanguard | 6.3% | 1.9% | |

| BlackRock | 4.8% | 1.4% | |

| State Street | 3.3% | 1.0% | |

| Fidelity | 2.2% | 4.4% | |

| David Gottesman | 1.6% | 3.0% | |

| Charles Munger | 0.3% | 0.6% | |

| Other | 66.0% | 56.1% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Berkshire Hathaway and who controls it. I will show you who Berkshire Hathaway’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore my other articles about who owns companies like Microsoft, Alphabet(Google), Apple, IBM, Coca-cola, and others.

📃 Who Owns Berkshire Hathaway?

Berkshire Hathaway is owned by its shareholders. The largest ones are chairman and CEO Warren Buffett, who owns 15.6% of the company, followed by asset manager giant Vanguard with 6.3% ownership share, and asset manager giant BlackRock with 4.8% ownership. Notable owner is also company vice-chairman Charles Munger (0.3%).

The largest owner of Berkshire Hathaway is chairman and CEO Warren Buffett, who owns 15.6% of the company.

- Warren Buffett is an iconic investor renowned for his common sense, value-based investment style.

- He is not Berkshire Hathaway’s founder. The company was originally a textile manufacturer Buffett invested in during the 1960s. Buffed called it one of his worst investments. Today Berkshire is no longer active in the textile but in many other industries and especially insurance (GEICO, General Re)

- He controls a far bigger share of votes than his share on ownership because Class B shares he does not own have inferior voting rights compared to Class A shares that he holds.

- He is also the company CEO and chairman.

- Warren Buffett’s ownership and control of Berkshire Hathaway is slowly decreasing over the years as he, from time to time, donates part of his ownership to several foundations, especially Bill & Melinda Gates Foundation.

- He pledged to donate 99% of his wealth.

The rest of Berkshire Hathaway’s ownership is quite dispersed, and other large owners are large asset managers who invest money on behalf of their clients.

Sizable individual Berkshire Hathaway owner until his death in 2022 was David Gottesman, with a 1.6% stake.

- He was the founder of the investment firm First Manhattan

- Gottesman and Warren Buffett bonded in the 1960s and often discussed investments together.

- Gottesman was an early investor in Berkshire Hathaway and also a board director

The notable owner is also vice-chairman Charles Munger, which owns 0.3% of the company.

- Charlie Munger is a close partner and right-hand man of Warren Buffett.

- He serves as Berkshire Hathaway’s vice-chairman.

- He ran an investment partnership of his own before joining forces with Buffett.

- He is also a director (former chairman) of Daily Journal Corporation, a publisher with an investment portfolio that Munger manages.

Berkshire Hathaway was founded in 1839 by Oliver Chace, and it is a publicly listed company on NYSE (Ticker: BRK.A, BRK.B).

- The original business was textile manufacturing, but after Buffett fully acquired it in 1965, it grew into other businesses like insurance and later exited the textile business.

Berkshire Hathaway Inc. is incorporated in the State of Delaware (US), and its headquarters are in Omaha, Nebraska (US).

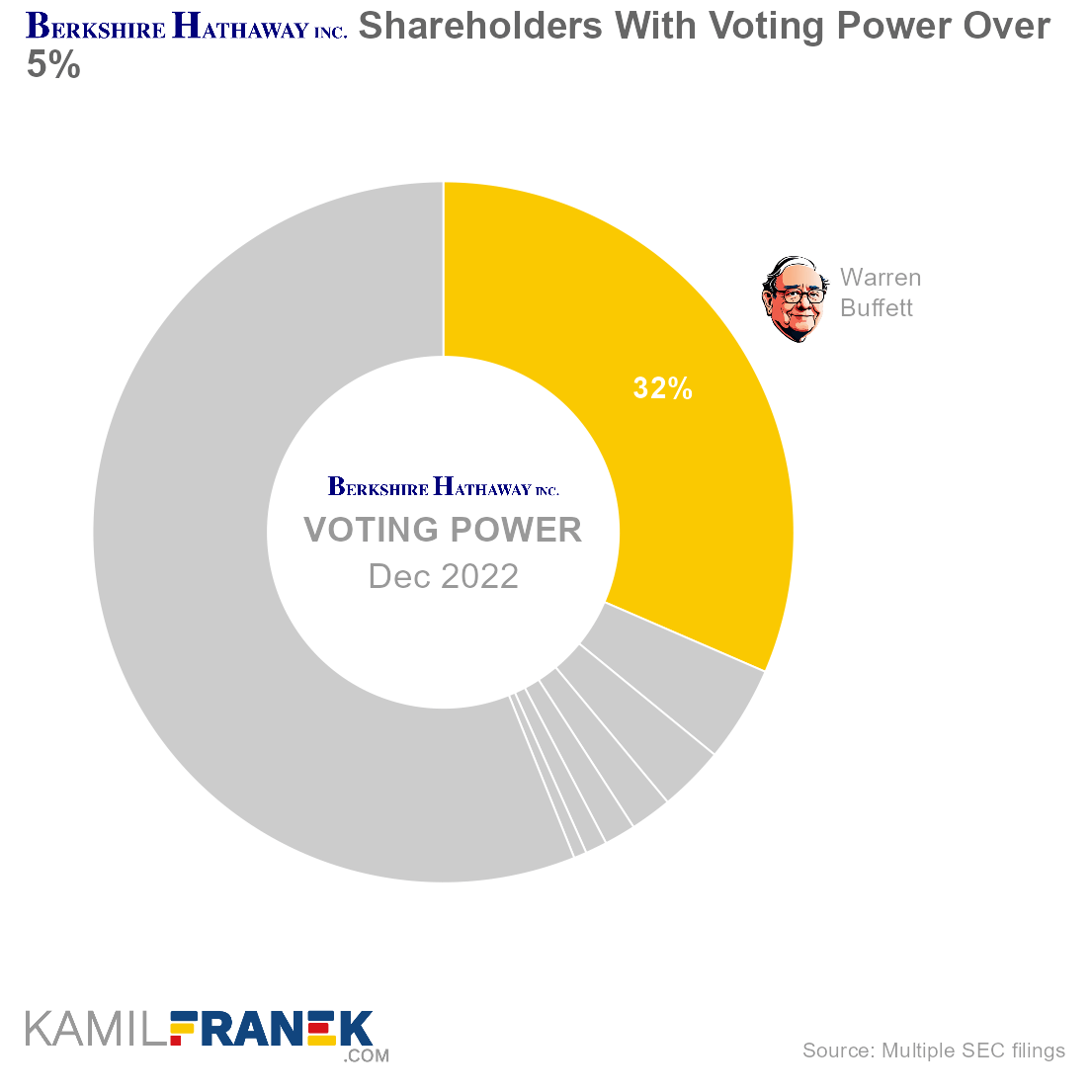

🎮 Who Controls Berkshire Hathaway (BRK.A, BRK.B)?

Berkshire Hathaway’s shareholders with the largest voting power are chairman and CEO Warren Buffett, who holds 31.5% of all votes, followed by asset manager Fidelity, with 4.4% voting power. Vice-chairman Charles Munger holds 0.6% voting power.

As you can see, the size of voting power is not equal to ownership. The reason why certain shareholders have outsized voting power compared to their ownership stake is that Berkshire Hathaway Inc. has two classes of outstanding shares, with different rights.

- Class A shares traded under the BRK.A ticker have one vote per share, and Class A shares are what shareholders Warren Buffett and Charlie Munger predominantly hold.

- One Class A share is worth around 500 thousand dollars because the shares never went through a stock split, unlike Class B shares.

- Class B shares are traded under the ticker BRK.B

- The difference to Class A shares is that they have lower economic rights. One Class B share is equal to 1/1000th of a Class A share. This makes shares more accessible for smaller investors.

- However, the more important difference is that Class B shares also have inferior voting rights, and one Class B share has only 1/10,000th of one vote. This inferior voting right for Class B shares makes Class A shares relatively super-voting shares, even though they have only one vote per share.

Owning Class A shares is equivalent to owning super-voting shares with approximately 6.67 votes per share, and that is why Warren Buffett still controls a sizable chunk of all votes.

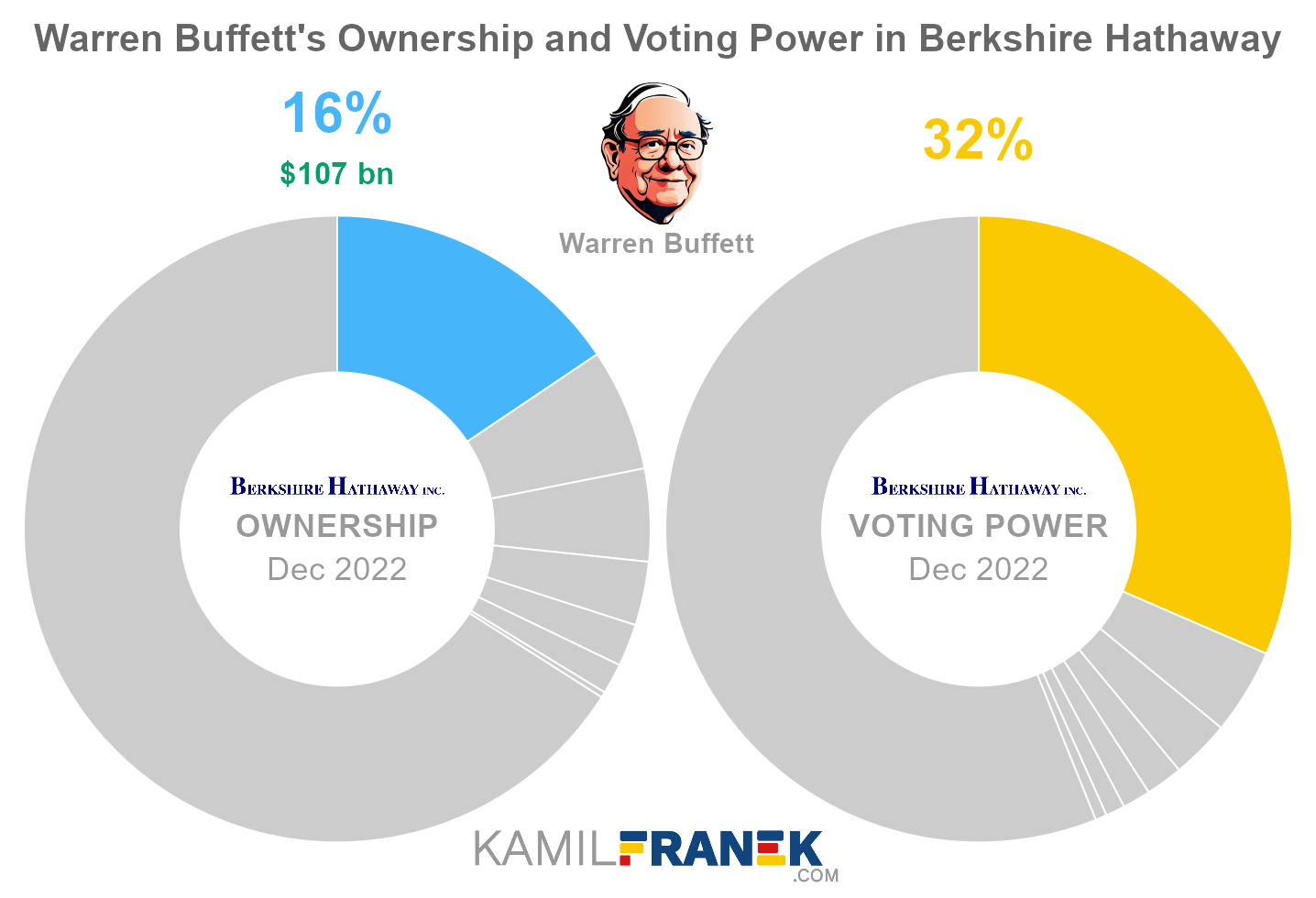

Berkshire Hathaway’s shareholder with the largest voting power is chairman and CEO Warren Buffett, who holds 31.5% of all votes. Warren Buffett owns just 15.6% of Berkshire Hathaway, and its voting power is boosted by owning Class A shares.

- Class A shares that Buffett owns have only one vote per share, but since many other shareholders hold Class B shares with inferior voting rights (1/10,000th), he has disproportionally high voting power.

- Buffett is also CEO and Chairman. If you take into account his credibility, then even though he does not have the majority of the votes, he is the one who calls the shots in Berkshire Hathaway.

Berkshire Hathaway’s shareholder with the second-largest voting power is asset manager Fidelity, holding 4.4% of all votes. Fidelity owns just 2.2% of Berkshire Hathaway, and its voting power is boosted by super-voting shares.

- Unlike other asset managers that own Berkshire, Fidelity owns Class A shares, which have relatively higher voting power than Class B shares.

Berkshire Hathaway’s insiders that have influence over the company are CEO and chairman Warren Buffett and other board members and executives.

- Berkshire Hathaway currently has a 15-member board of directors.

- Aside from Charles Munger, members of the board of directors are also Buffett’s children, Susan Buffett and Howard Buffett, who are each in charge of their foundations.

- Buffett’s children also report sizable ownership in Berkshire Hathaway through their foundations, but they disclaim beneficial ownership.

🗳️ Breakdown of Berkshire Hathaway’s Outstanding Shares and Votes by Top Shareholders

Berkshire Hathaway Inc. had a total of 1 million outstanding shares as of December 2022. The following table shows how many shares each Berkshire Hathaway’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Warren Buffett | 0.227 | 0.000 | 0.227 | 15.6% | |

| Vanguard | - | 0.092 | 0.092 | 6.3% | |

| BlackRock | - | 0.070 | 0.070 | 4.8% | |

| State Street | - | 0.048 | 0.048 | 3.3% | |

| Fidelity | 0.032 | - | 0.032 | 2.2% | |

| David Gottesman | 0.022 | 0.001 | 0.023 | 1.6% | |

| Charles Munger | 0.004 | 0.000 | 0.004 | 0.3% | |

| Other | 0.306 | 0.657 | 0.963 | 66.0% | |

| Total (# millions) | 0.592 | 0.868 | 1.460 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Please note that the number of Class B shares in the table above is already adjusted to Class A equivalents to make sure it makes sense to add them up. It means they are divided by 1,500 because that is the difference in economic rights of one Class A share vs. a Class B share.

There were 1 million votes distributed among shareholders of Berkshire Hathaway Inc.. The table below shows the total number of votes for each large shareholder.

|

|

|||||

| In millions of votes as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Warren Buffett | 0.227 | 0.000 | 0.227 | 31.5% | |

| Fidelity | 0.032 | - | 0.032 | 4.4% | |

| David Gottesman | 0.022 | 0.000 | 0.022 | 3.0% | |

| Vanguard | - | 0.014 | 0.014 | 1.9% | |

| BlackRock | - | 0.010 | 0.010 | 1.4% | |

| State Street | - | 0.007 | 0.007 | 1.0% | |

| Charles Munger | 0.004 | 0.000 | 0.004 | 0.6% | |

| Other | 0.306 | 0.099 | 0.405 | 56.1% | |

| Total (# millions) | 0.592 | 0.130 | 0.722 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

💵 Breakdown of Berkshire Hathaway’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Berkshire Hathaway Inc. worth.

However, keep in mind that a stake in Berkshire Hathaway could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Warren Buffett | $106.6 | $0.0 | $106.6 | 15.7% | |

| Vanguard | - | $42.7 | $42.7 | 6.3% | |

| BlackRock | - | $32.3 | $32.3 | 4.8% | |

| State Street | - | $22.2 | $22.2 | 3.3% | |

| Fidelity | $15.0 | - | $15.0 | 2.2% | |

| David Gottesman | $10.1 | $0.7 | $10.8 | 1.6% | |

| Charles Munger | $2.0 | $0.0 | $2.0 | 0.3% | |

| Other | $143.6 | $304.4 | $447.9 | 65.9% | |

| Total ($ billions) | $277.3 | $402.3 | $679.5 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Let’s now look at each Berkshire Hathaway shareholder individually.

📒 Who Are Berkshire Hathaway’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Berkshire Hathaway Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Berkshire Hathaway worth.

#1 Warren Buffett (15.6%)

Warren Buffett is the largest shareholder of Berkshire Hathaway, owning 15.6% of its shares. However, Warren Buffett controls 31.5% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Warren Buffett’s stake in Berkshire Hathaway was $106.6 billion.

Warren Buffett owned 0.227 million shares in Berkshire Hathaway and controlled 0.227 million shareholder votes as of December 2022.

Warren Buffett is a legendary investor, CEO, and chairman of Berkshire Hathaway. He turned Berkshire from a textile manufacturer into the parent company of his conglomerate of different businesses.

Buffett was involved in investments since he was a kid and later ran an investment partnership.

Warren Buffett became the majority shareholder of Berkshire Hathaway in 1965 and has since transformed the company into a diversified conglomerate with interests in a wide range of industries. He has a long-term track record of beating the S&P500 index, which earned him the nickname “Oracle of Omaha.”

Berkshire Hathaway’s annual meetings were nicknamed “Woodstock for Capitalists.”

Even after large philanthropic donations, he is still one of the world’s wealthiest people. He promised to donate 99% of his wealth to philanthropy. A large part of it is a Bill & Melinda Gates Foundation donation.

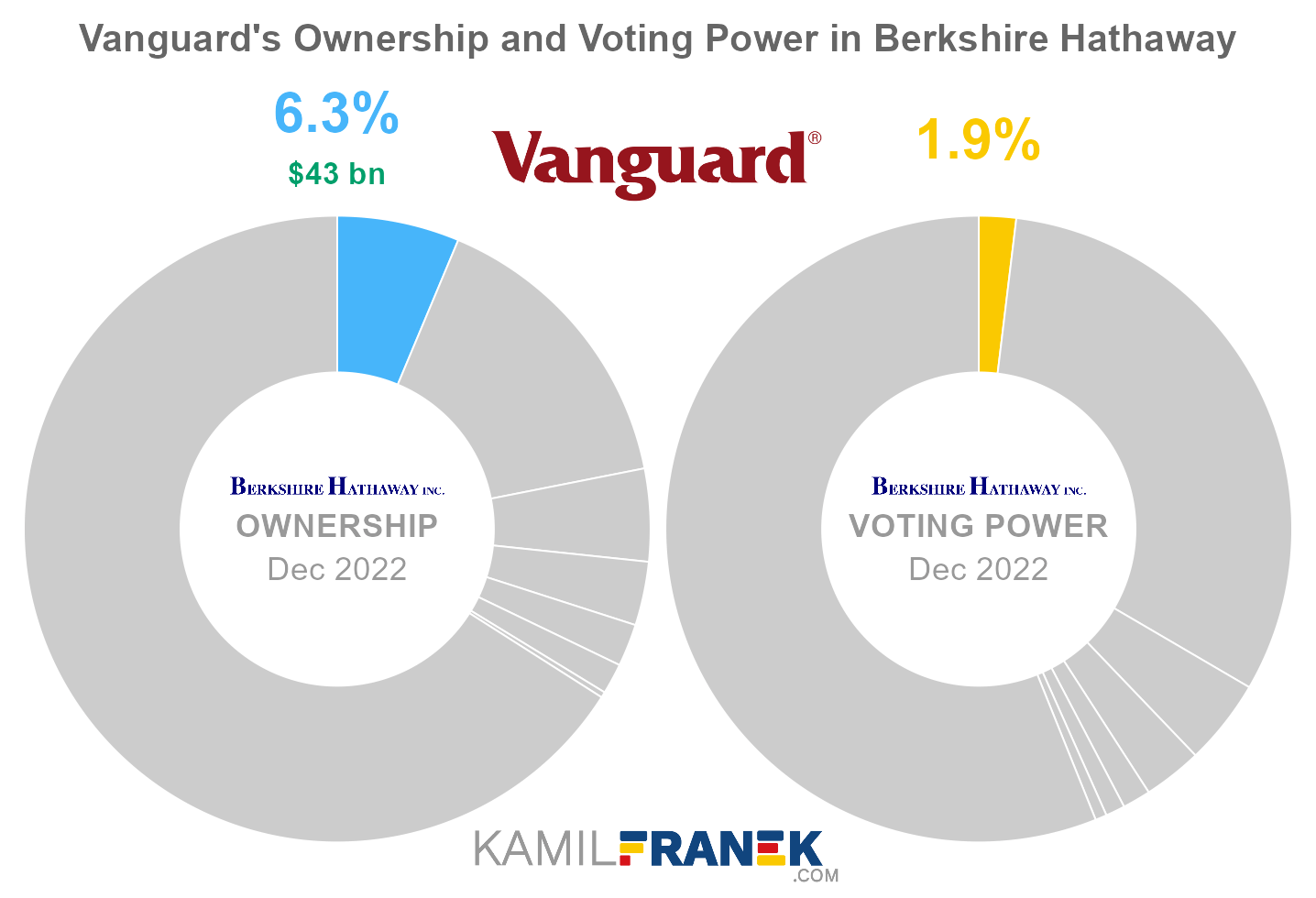

#2 Vanguard (6.3%)

Vanguard is the second-largest shareholder of Berkshire Hathaway, owning 6.3% of its shares. However, because other shareholders hold super-voting shares, Vanguard’s voting power is only 1.9%. As of December 2022, the market value of Vanguard’s stake in Berkshire Hathaway was $42.7 billion.

Vanguard owned 0.092 million shares in Berkshire Hathaway and controlled 0.014 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

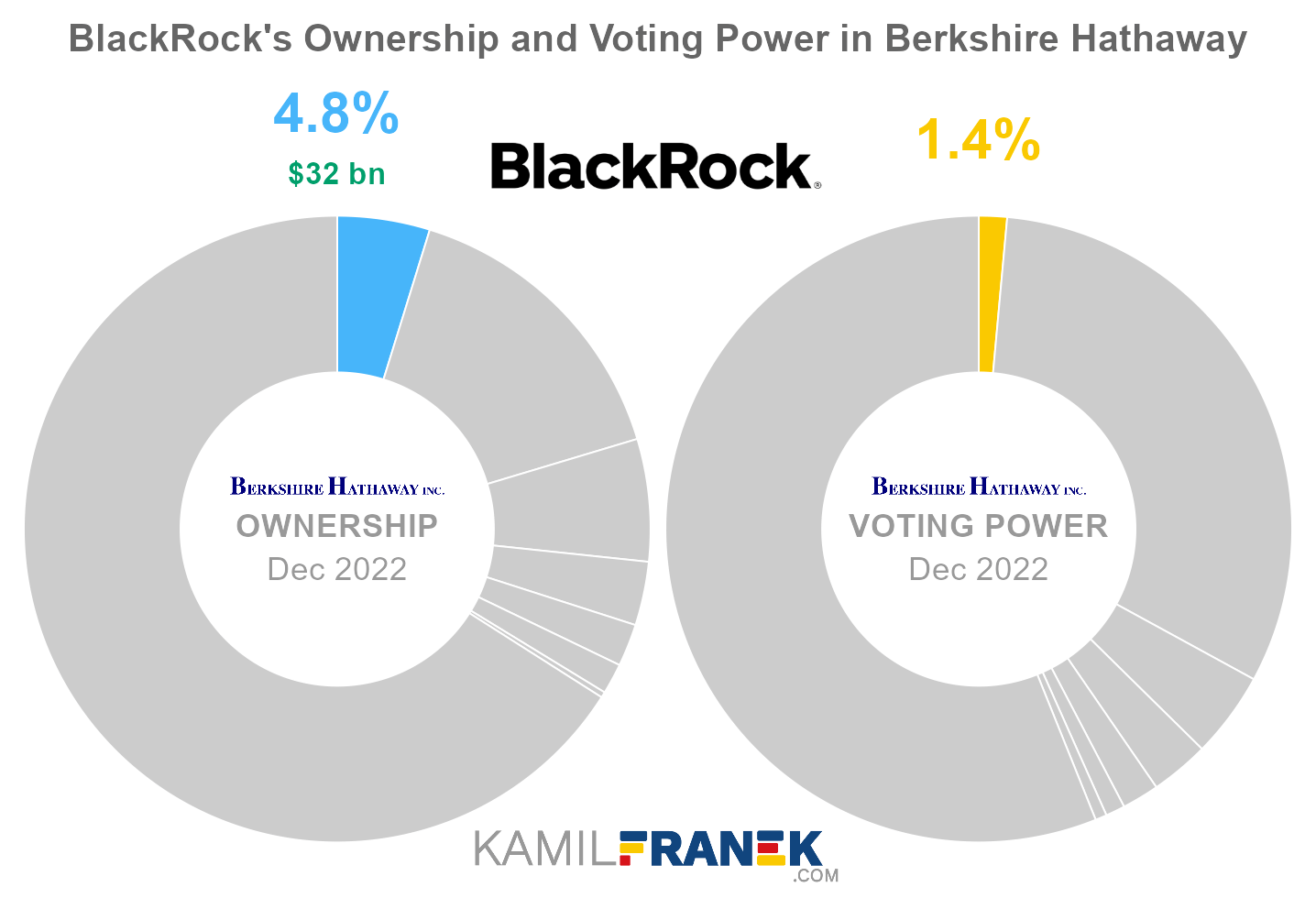

#3 BlackRock (4.8%)

BlackRock is the third-largest shareholder of Berkshire Hathaway, owning 4.8% of its shares. However, because other shareholders hold super-voting shares, BlackRock’s voting power is only 1.4%. As of December 2022, the market value of BlackRock’s stake in Berkshire Hathaway was $32.3 billion.

BlackRock owned 0.070 million shares in Berkshire Hathaway and controlled 0.010 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

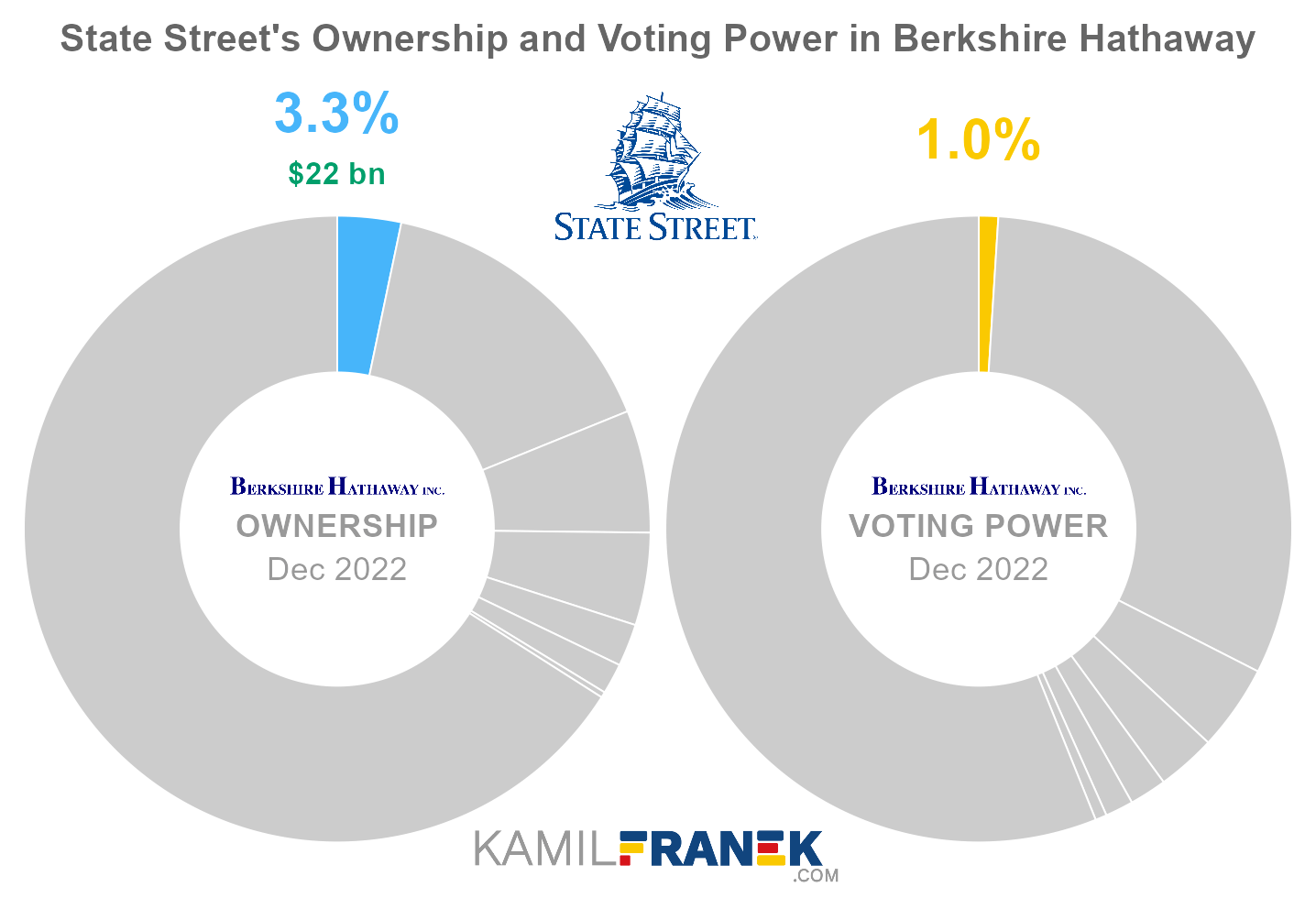

#4 State Street (3.3%)

State Street owns 3.3% of Berkshire Hathaway’s shares. However, because other shareholders hold super-voting shares, State Street’s voting power is only 1.0%. As of December 2022, the market value of State Street’s stake in Berkshire Hathaway was $22.2 billion.

State Street owned 0.048 million shares in Berkshire Hathaway and controlled 0.007 million shareholder votes as of December 2022.

State Street Corporation is one of the largest asset managers in the world, with 4 trillion assets under management. It makes money mainly from servicing and management fees.

In 1993 company introduced the SPDR S&P 500 Trust ETF (traded under ticker SPY). It was the first exchange-traded fund, and State Street is now one of the largest ETF providers in the world.

State Street is a publicly traded company, and its largest shareholders are, ironically, its competitors, Vanguard and Blackrock. One of its largest shareholders is even State Street itself. Not directly but through their passive and active funds.

This circular ownership between State Street, Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies where they usually belong to the most significant shareholders.

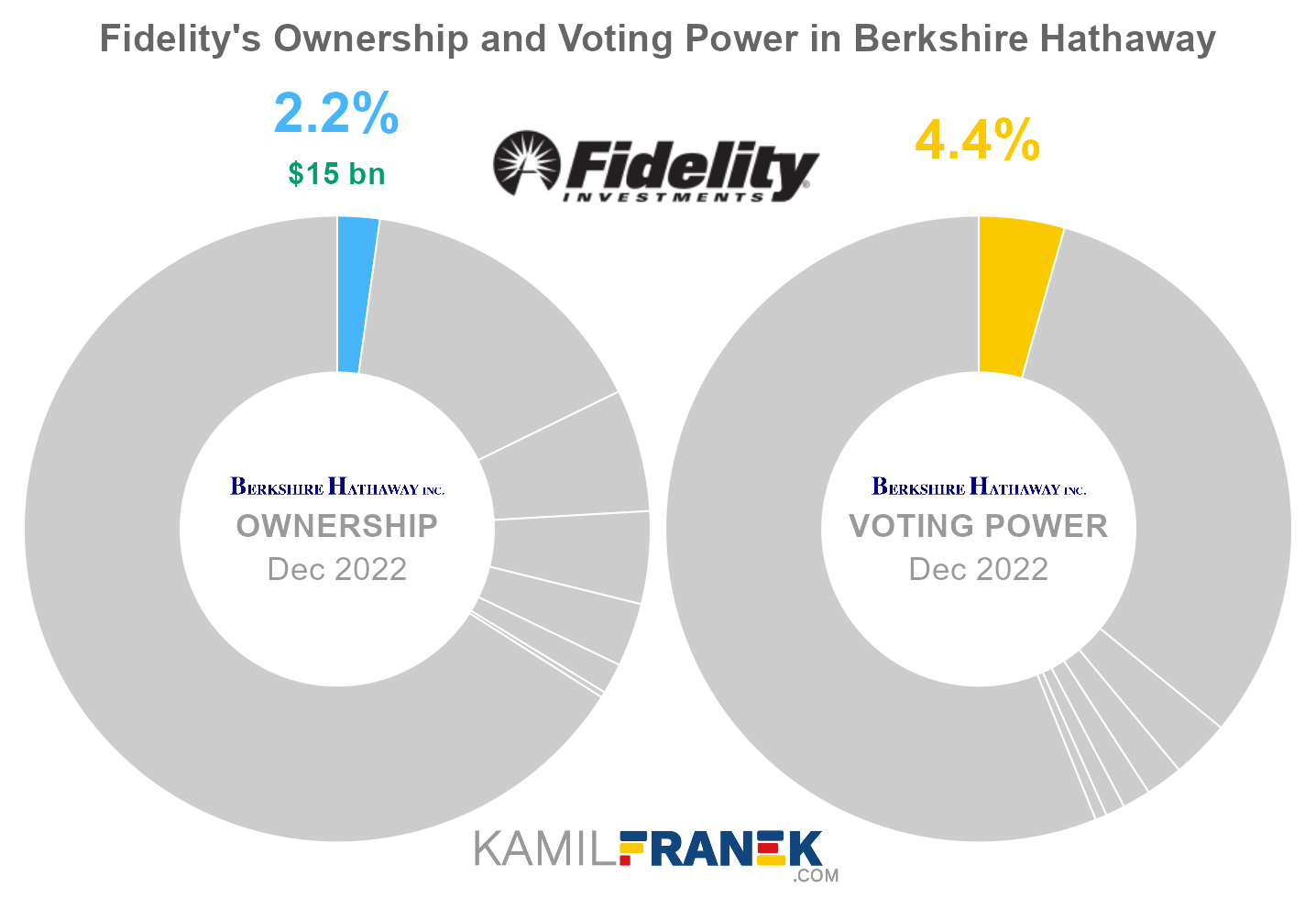

#5 Fidelity (2.2%)

Fidelity owns 2.2% of Berkshire Hathaway’s shares. However, Fidelity controls 4.4% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Fidelity’s stake in Berkshire Hathaway was $15.0 billion.

Fidelity owned 0.032 million shares in Berkshire Hathaway and controlled 0.032 million shareholder votes as of December 2022.

Fidelity (FMR LLC) is one of the four largest asset managers in the world, together with BlackRock, Vanguard, and State Street. Fidelity is controlled by the Jonhson family, holding 49% of the voting power.

Fidelity is currently managed by Abigail Johnson after her father, Edward Johnson III, died in 2022.

An interesting fact is that in 2004 Abigail pulled a pretty bold move on her further when she tried to oust him from the company. The attempt was unsuccessful then, but she holds the reins now.

Like other large asset managers, Fidelity is not free from potential conflicts of interest.

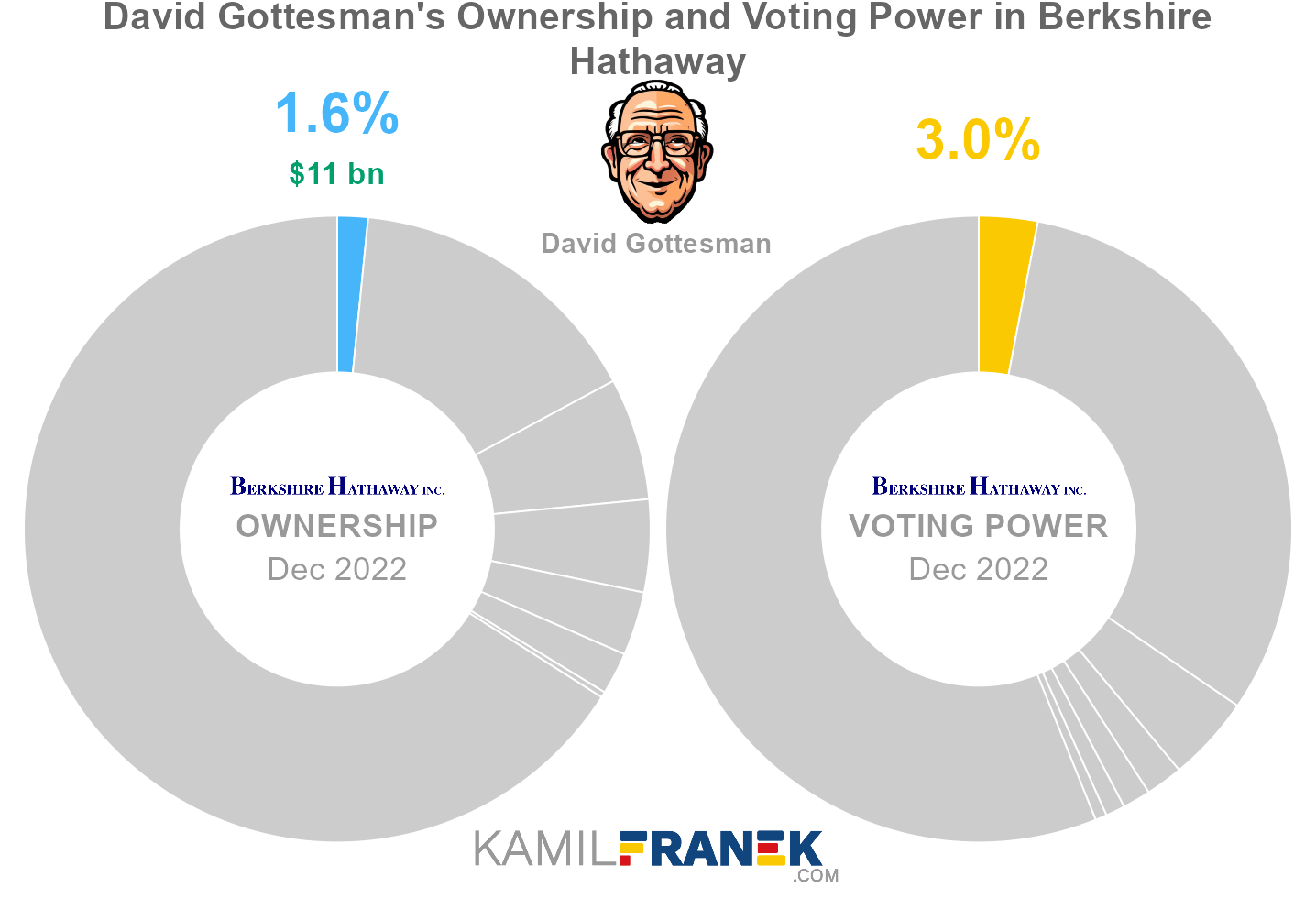

#6 David Gottesman (1.6%)

David Gottesman owns 1.6% of Berkshire Hathaway’s shares. However, David Gottesman controls 3.0% of all votes thanks to owning super-voting shares. As of December 2022, the market value of David Gottesman’s stake in Berkshire Hathaway was $10.8 billion.

David Gottesman owned 0.023 million shares in Berkshire Hathaway and controlled 0.022 million shareholder votes as of December 2022.

David Gottesman was a founder of the First Manhattan advisory firm and an early investor in Berkshire Hathaway. He was Warren Buffett’s long-time friend, and the two often discussed investment ideas with each other. He died in September 2022.

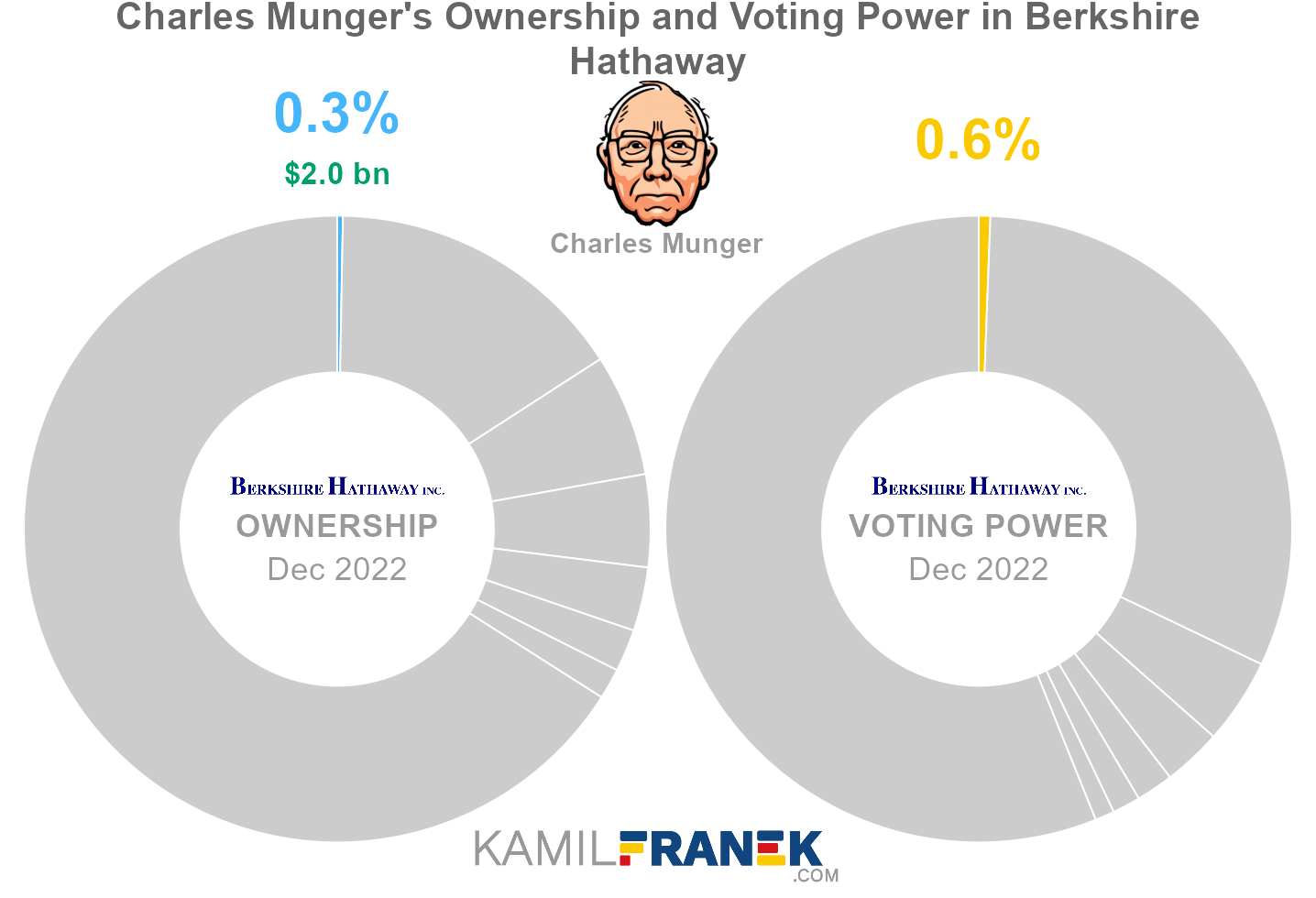

#7 Charles Munger (0.3%)

Charles Munger owns 0.3% of Berkshire Hathaway’s shares. However, Charles Munger controls 0.6% of all votes thanks to owning super-voting shares. As of December 2022, the market value of Charles Munger’s stake in Berkshire Hathaway was $2.0 billion.

Charles Munger owned 0.004 million shares in Berkshire Hathaway and controlled 0.004 million shareholder votes as of December 2022.

Munger is the Vice Chairman of Berkshire Hathaway and has been a close business partner and “right-hand” man of Buffett for decades. He is also known for his colorful, witty commentaries at Berkshire Hathaway’s annual shareholder meetings.

Before partnering with Warren Buffet, he successfully ran his own investment partnership. He is also still a director of Daily Journal Corporation, where he was previously chairman and reportedly still manages the Daily Journal investment portfolio.

❔ Does Bill Gates own Berkshire Hathaway?

Bill Gates might have part of his portfolio invested in Berkshire Hathaway shares, but since his stake is less than 5%, the honest answer is that we don’t know.

You may see that different articles show breakdowns of Bill Gates’s portfolio, including Berkshire Hathaway. However, those investments are taken from the public report of the Bill & Melinda Gates Foundation, not Bill’s personal portfolio.

Bill & Melinda Gates Foundation had and still has Berkshire Hathaway stocks in its portfolio. These are the results of donations made by Warren Buffet and are slowly being spent on the foundation projects.

As if the end of 2022 Bill & Melinda Gates Foundation owned 24.7 million Class B shares of Berkshire Hathaway, worth $9.4bn, representing under 2% of Berkshire’s equity.

🧱 Who and When Founded Berkshire Hathaway?

Berkshire Hathaway Inc. was founded in 1839 by Oliver Chace as the Valley Falls Company. It was originally a textile company.

Berkshire Hathaway started to turn into Berkshire Hathaway conglomerate as we know it today only after Warren Buffet purchased it in 1965 and turned into the parent company of his conglomerate and started acquiring insurance and other companies through it.

Buffett has been the company chairman since 1970, and Charlie Munger has been vice-chairman since 1978. They are both iconic faces that represent Berkshire Hathaway, especially during the famous Berkshire Hathaway annual shareholder meetings.

Berkshire’s annual shareholder meetings are nicknamed “Woodstock for Capitalists.” It is one of Omaha’s largest events.

📅 Berkshire Hathaway’s History Timeline

These are selected events from Berkshire Hathaway’s history:

-

1839: The company was founded as the Valley Falls Company, a textile manufacturer, by Oliver Chace

-

1929: The company merged with the Berkshire Cotton Manufacturing Company, founded in 1889. The combined company was known as Berkshire Fine Spinning Associates.

-

1955: The company merged with the Hathaway Manufacturing Company, which had been founded in 1888

-

1962: Warren Buffett started buying Berkshire Hathaway’s stocks. It was initially just one of his many investments.

-

1964: Warren Buffett agreed to sell his stake in Berkshire to the company CEO at the time. However, when the price of the paperwork he received was lower than the agreed price, he got angry. Later, he bought more stock, took control, and fired the former CEO.

- 1965: Waren Buffet’s investment group took control of Berkshire Hathaway (Buffett called it one of his biggest investment mistakes)

- 1967: Expansion into the insurance industry and other investments.

- 1978: Charlie Munger became vice chairman of the company

- 1996: Berkshire fully acquired GEICO

- 1998: Acquisition of reinsurer General Re.

- 2010: Acquisition ($26bn) of railroad company Burlington Northern Santa Fe

📚 Recommended Articles & Other Resources

Who Owns Coca-Cola: The Largest Shareholders Overview

Overview of who owns the Coca-Cola Company and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Nike: The Largest Shareholders Overview

Overview of who owns Nike and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Netflix: The Largest Shareholders Overview

Overview of who owns Netflix and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Berkshire Hathaway’s Annual Financials Statements (K-10)

- Berkshire Hathaway’s Proxy Statement

- Berkshire Hathaway’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.