Who Owns Visa: The Largest Shareholders Overview

Visa Inc. (V) is a payment processing giant that makes money by processing transactions for its members. Its only relevant competitor is MasterCard, and they are rightfully referred to as the payments duopoly. Let’s now look at who owns Visa and who controls it.

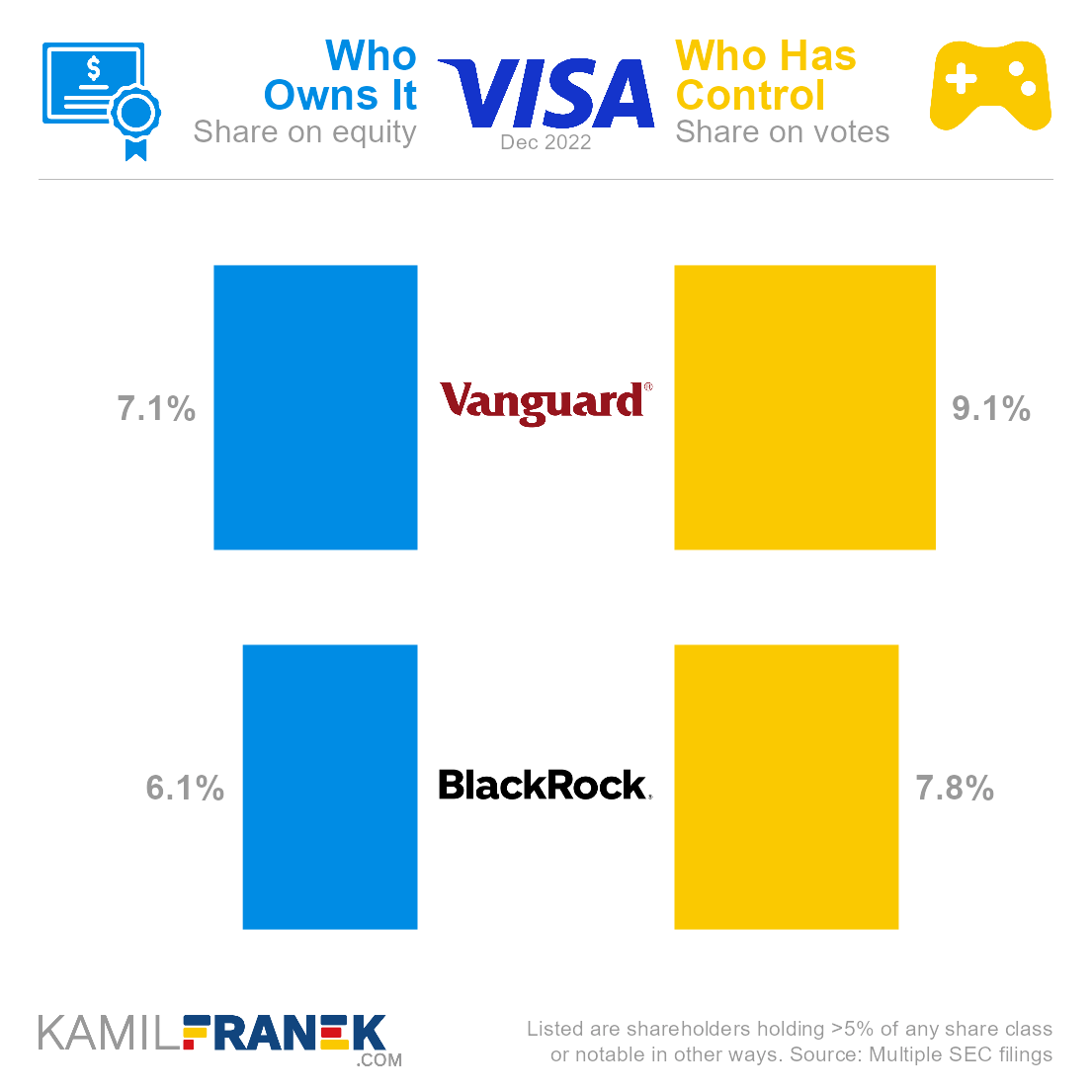

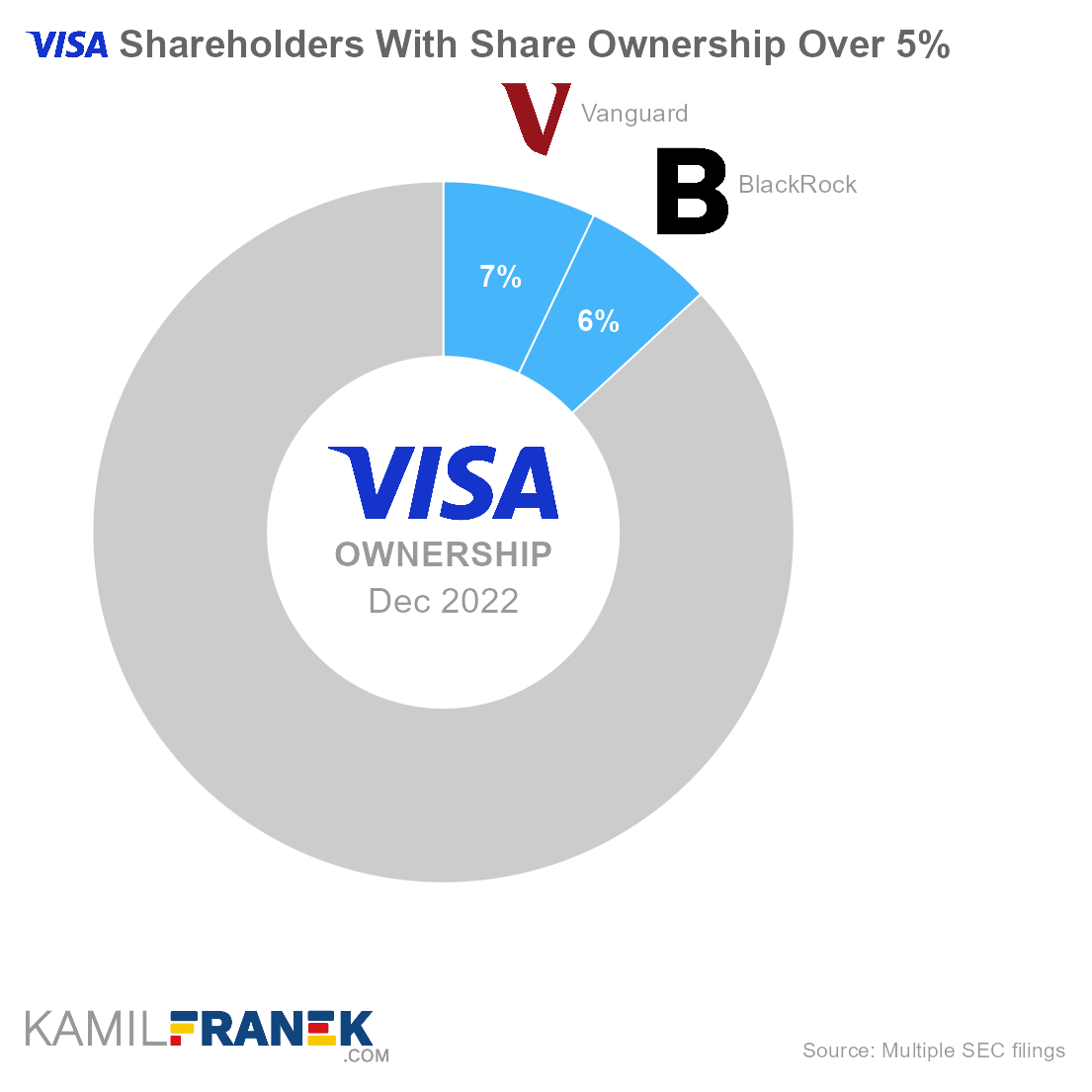

Visa’s largest shareholders are asset manager giant Vanguard, which owns a 7.1% share, followed by asset manager giant BlackRock with a 6.1% ownership share. No other shareholder holds more than 5% of the company.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 7.1% | 9.1% | |

| BlackRock | 6.1% | 7.8% | |

| Other | 86.9% | 83.2% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Visa and who controls it. I will show you who Visa’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Tesla, Apple, PayPal, Berkshire Hathaway, Starbucks, and others.

📃 Who Owns Visa?

Visa is owned by its shareholders. The largest ones are asset manager giant Vanguard, which owns 7.1% of the company, followed by another asset manager giant BlackRock with a 6.1% ownership share.

No shareholder has dominant ownership in the company. Visa’s ownership is dispersed, and the largest owners are asset managers who invest money on behalf of their clients.

It is not surprising to see Vanguard and BlackRock among top shareholders. They are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies.

Visa was founded in 1970 by Dee Hock and has been a publicly listed company since its initial public offering on NYSE in 2008 (Ticker: V).

- Although the corporation, now called VISA, was founded in 1970, its business started in 1958 as part of the Bank of America credit card program BankAmericard.

- In 1970, Dee Hock persuaded Bank of America to give up control over its BankAmericard program, and a new company, “National BankAmericard Inc.” was founded, and controlled by various BankAmericard issuer banks.

- The company started as a partnership of issuers. Today, it is a public company, and anybody can buy their shares. However, issuer banks still have important rights and can block potential acquisitions and mergers. The company certificate of incorporation also limits the maximum ownership any individual shareholder or competitor can own.

Visa Inc. is incorporated in the State of Delaware (US), and its headquarters are in San Francisco, California (US).

🎮 Who Controls Visa (V)?

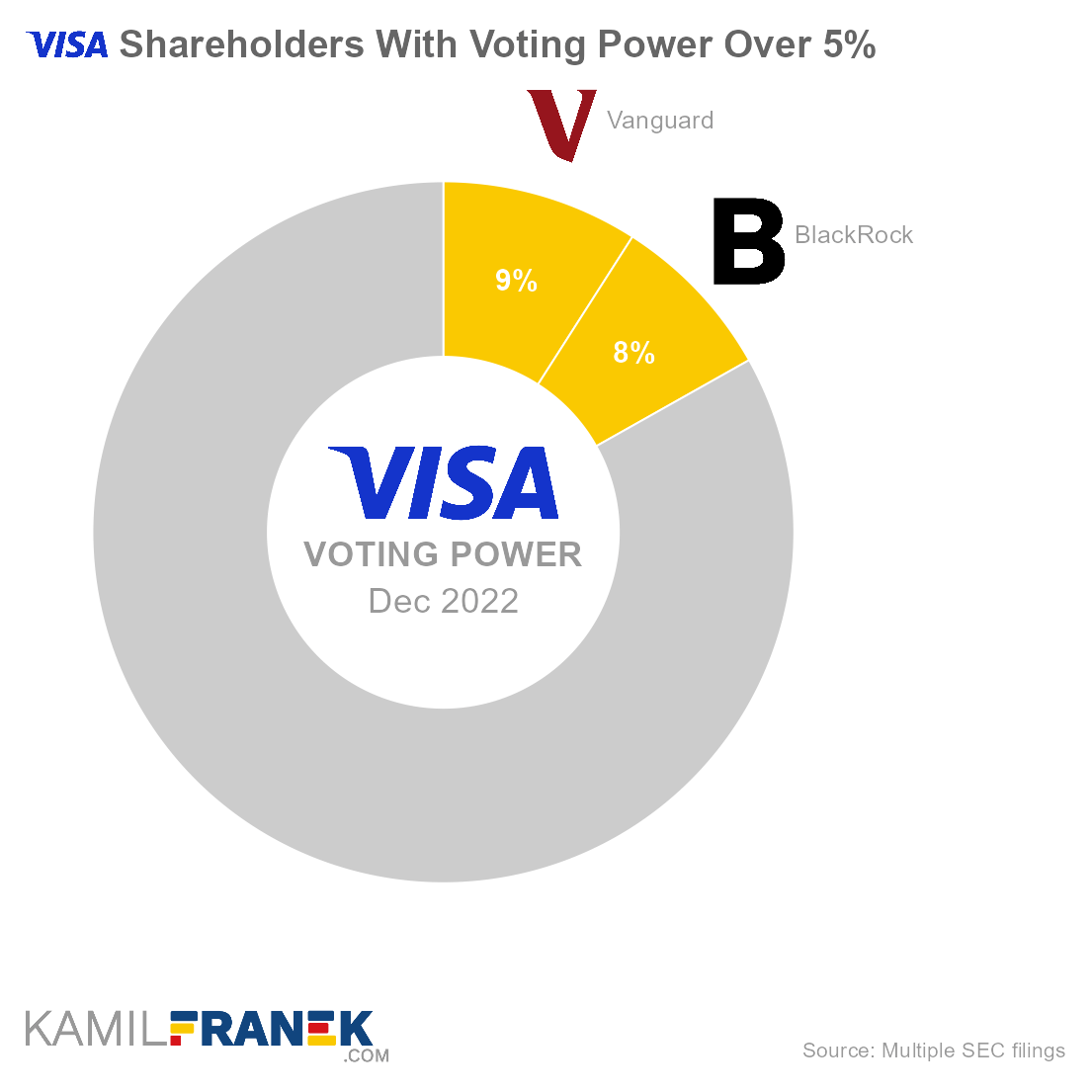

Visa’s shareholders with the largest voting power are asset manager giant Vanguard, which holds 9.1% of all votes, followed by asset manager giant BlackRock with 7.8% voting power.

Visa has several classes of shares, including preferred shares, outstanding. None of them except Class A shares have general voting power. Therefore there is a difference between the shareholder’s ownership and voting power. Class B, C, and preferred stocks do not have the same value of economic rights but are convertible to class A shares in various proportions.

- Class A: standard publicly traded shares that anybody can buy using the ticker “V.”

- Class B: special class in the hands of Visa member companies or their affiliates. Class B is linked to the escrow account held to cover the risk of several unresolved litigations with merchants. After are all the cases resolved, Class B should convert to Class A, and escrow funds will be merged with company funds. Until then, Class B shares are not transferrable.

- Class C: Those shares are in the hands of various Visa member companies or their affiliates. If they sell them or transfer them, they will automatically convert into Class A shares. If any Visa member or their affiliates buy Class A common stock, they will automatically convert to Class C, non-voting stocks.

- Preferred Shares: Represented by several series of preferred shares with no voting rights but preferential treatment in case of liquidation. Owners of Preferred shares can also block (each of 3 series individually) potential mergers or acquisitions.

The ownership of Visa Inc. is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients. None of them control the company individually, but together they have a big influence.

Visa’s dispersed ownership creates conflicts of interest between Visa’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

Visa has quite aggressive clauses in its certificate of incorporation that limit shareholder rights in case of ownership over a certain threshold. Member banks no longer own it, but all those clauses and rights of certain share classes to block mergers or acquisitions mean that member banks clearly don’t want anybody to take control of Visa.

- For example, there is a limitation of ownership over 5% for competitors.

- There is a 15% limit on ownership for anybody.

- If somebody acquires shares over that limit, those shares will not have any rights. (voting rights, dividend rights)

- These limitations are not applied, for example, to asset managers that hold shares for the benefit of other customers.

- Articles of incorporation also include a clause that requires 80% of votes in case Visa would want to exit its core payment business (operating debit/credit payments)

Visa’s insiders that have influence over the company are CEO Ryan McInerney, chairman of the board Alfred Kelly, and other board members and executives.

- Visa currently has an 11-member board of directors.

- Nobody from the board of directors or executive officers holds more than 0.05% share of Visa’s stocks when not taking into account options.

- At least 58% of the board is required to be independent directors.

- Ryan McInerney became CEO in 2023, and until then, Alfred F. Kelly was both CEO and Chairman.

🗳️ Breakdown of Visa’s Outstanding Shares and Votes by Top Shareholders

Visa Inc. had a total of 2,087 million outstanding shares as of December 2022. The following table shows how many shares each Visa’s large shareholder holds.

|

|

|||||||

| In millions of shares as of December 2022 | |||||||

| Shareholder | Class A | Class B | Class C | Class P | Total | % Share | |

|---|---|---|---|---|---|---|---|

| Vanguard | 147 | - | - | - | 147 | 7.1% | |

| BlackRock | 126 | - | - | - | 126 | 6.1% | |

| Other | 1,352 | 392 | 40 | 29 | 1,813 | 86.9% | |

| Total (# millions) | 1,626 | 392 | 40 | 29 | 2,087 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||||

Please note that the number of Class B, Class C, and preferred shares in the table above is already adjusted to Class A equivalents to make sure it makes sense to add them up.

There were 1,626 million votes distributed among shareholders of Visa Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 147 | 147 | 9.1% | |

| BlackRock | 126 | 126 | 7.8% | |

| Other | 1,352 | 1,352 | 83.2% | |

| Total (# millions) | 1,626 | 1,626 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Visa’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Visa Inc. worth.

However, keep in mind that a stake in Visa could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||||

| Market value in billions $ as of December 2022 | |||||||

| Shareholder | Class A | Class B | Class C | Class P | Total | % Share | |

|---|---|---|---|---|---|---|---|

| Vanguard | $30.6 | - | - | - | $30.6 | 7.1% | |

| BlackRock | $26.3 | - | - | - | $26.3 | 6.1% | |

| Other | $280.9 | $81.4 | $8.3 | $6.0 | $376.7 | 86.9% | |

| Total ($ billions) | $337.8 | $81.4 | $8.3 | $6.0 | $433.5 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||||

Let’s now look at each Visa shareholder individually.

📒 Who Are Visa’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Visa Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Visa worth.

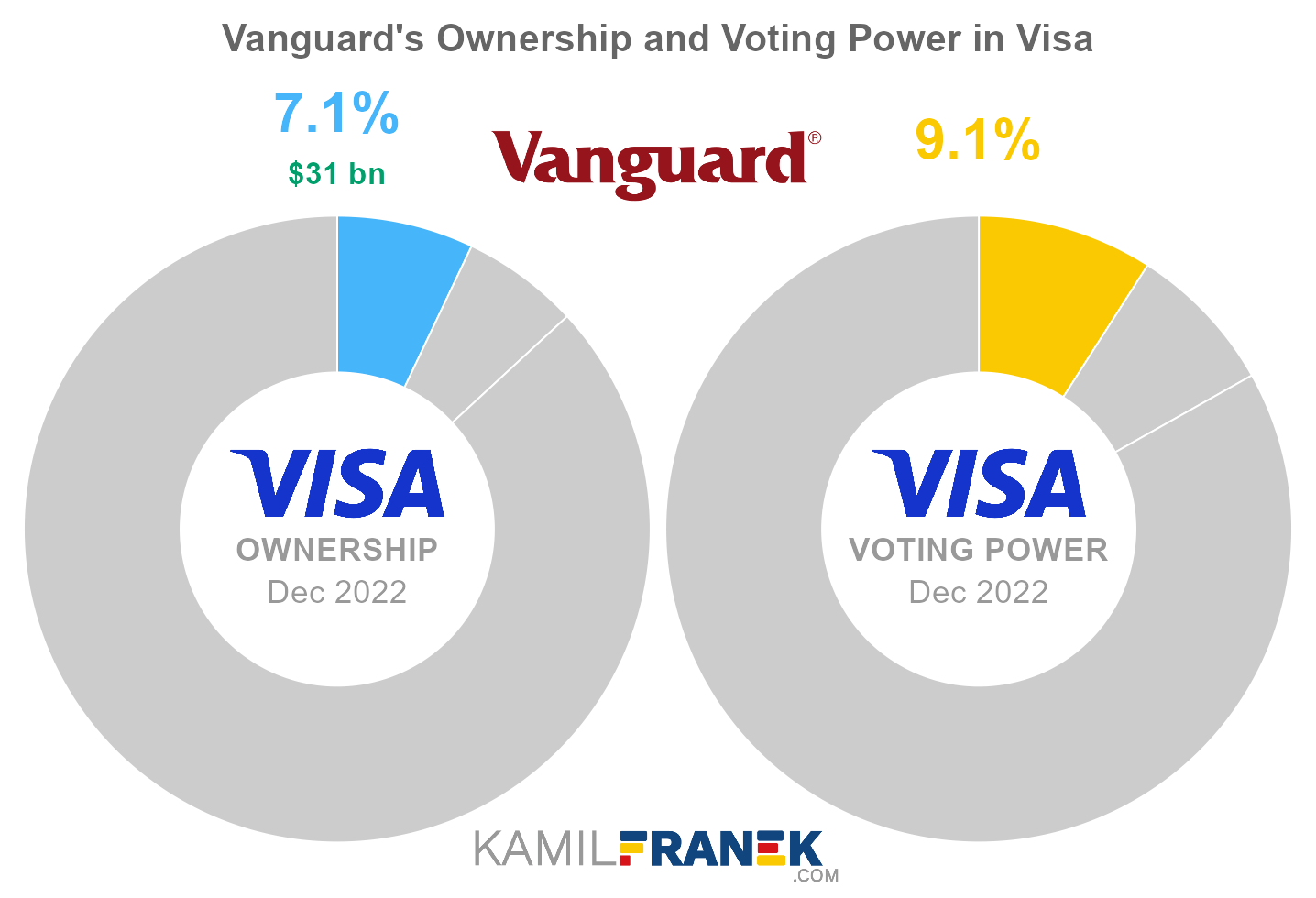

#1 Vanguard (7.1%)

Vanguard is the largest shareholder of Visa, owning 7.1% of its shares. However, Vanguard controls 9.1% of all votes thanks to the existence of non-voting shares owned by other investors. As of December 2022, the market value of Vanguard’s stake in Visa was $30.6 billion.

Vanguard owned 147 million shares in Visa and controlled 147 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

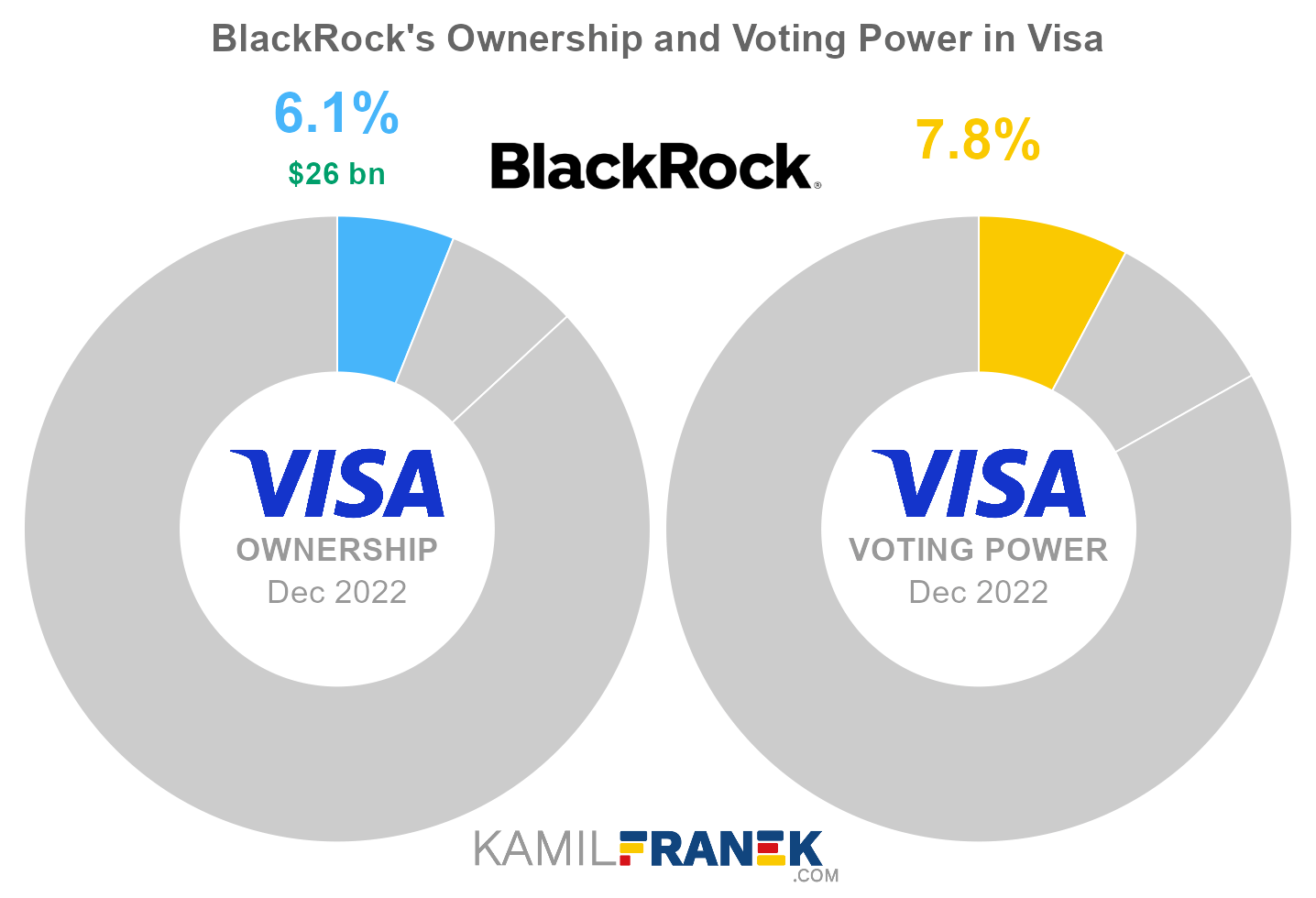

#2 BlackRock (6.1%)

BlackRock is the second-largest shareholder of Visa, owning 6.1% of its shares. However, BlackRock controls 7.8%of all votes thanks to the existence of non-voting shares owned by other investors. As of December 2022, the market value of BlackRock’s stake in Visa was $26.3 billion.

BlackRock owned 126 million shares in Visa and controlled 126 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

❔ Are Visa and MasterCard the same company?

No, Visa and MasterCard are two separate companies, but they are the two largest payment processing networks worldwide and control the market.

Because they have such dominance over payment processing, they are considered to be a duopoly and are involved in several active litigations, being accused of anticompetitive conduct.

They both started as consortiums of banks coming together to form a credit card network. Today, both companies are publicly traded.

🧱 Who and When Founded Visa:

Technically, Visa Inc., or more precisely National BankAmericard Inc, was formed in 1970. The founders of the company were card issuer banks with the help of Dee Hock, who persuaded Bank of America to give up control of their BankAmericard program.

So if I was asked when the company started, I would say in 1970. But If you ask me who and when founded the underlying business, then it clearly was Bank of America in 1958 when they started their BankAmericard credit card program.

As with any bold move, it did not start with an outright success. After Bank of America dropped unsolicited credit cards into people’s mailboxes, it resulted in massive losses from fraud. However, Bank of America stuck with the program, adjusted it, and became profitable over time.

📅 Visa’s History Timeline

These are selected events from Visa’s history:

-

1958: Bank of America started its BankAmericard credit card program.

-

1966: Bank of America started licensing its BankAmericard program to other institutions. The main reason was that, at the time, US banks were not allowed to offer services outside their home states.

-

1970: BankAmericard became independent of Bank of America. National BankAmericard Inc. was formed and controlled by issuer banks. Its first CEO was Dee Hock, the man who persuaded Bank of America to give up control of their BAnkAmericard program.

- 1974: Independently, the International Bankcard Company (IBANCO) was formed to manage the BankAmericard program outside the US.

-

1975: Debit card introduced

-

1976: The company was renamed to Visa USA (The international entity was named Visa International)

-

2007: Different Visa companies worldwide partially merged into Visa Inc. Visa Europe stayed as a separate company owned by its member banks, but Visa Europe had a stake in Visa Inc.

-

2008: Visa’s initial public offering (IPO)

- 2016: Visa acquired Visa Europe.

📚 Recommended Articles & Other Resources

Who Really Owns Google (Alphabet) and Who Controls It

Overview of who owns Alphabet (Google) and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Paypal: The Largest Shareholders Overview

Overview of who owns PayPal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Ferrari: The Largest Shareholders Overview

Overview of who owns Ferrari and who controls it. With a list of the largest shareholders and how much is each of their stake worth

Other Resources

- Visa’s Annual Financials Statements (K-10)

- Visa’s Proxy Statement

- Visa’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.