Who Owns Cisco: The Largest Shareholders Overview

Cisco Systems, Inc. (CSCO) is one of the largest companies in the world, and in 2000 it even briefly was the largest in the world. It primarily makes money from its networking products that combine hardware with software. Let’s examine who owns Cisco and who controls it.

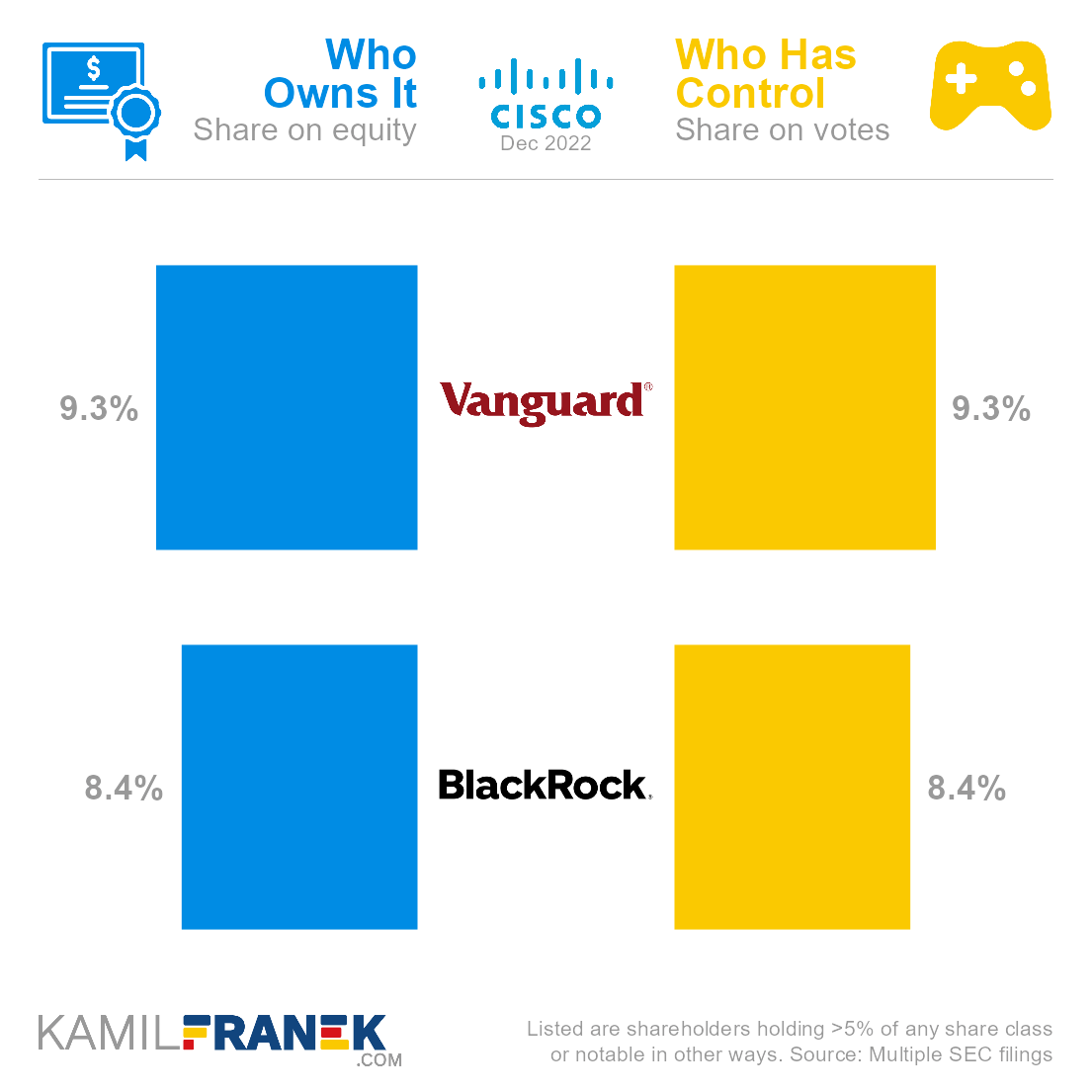

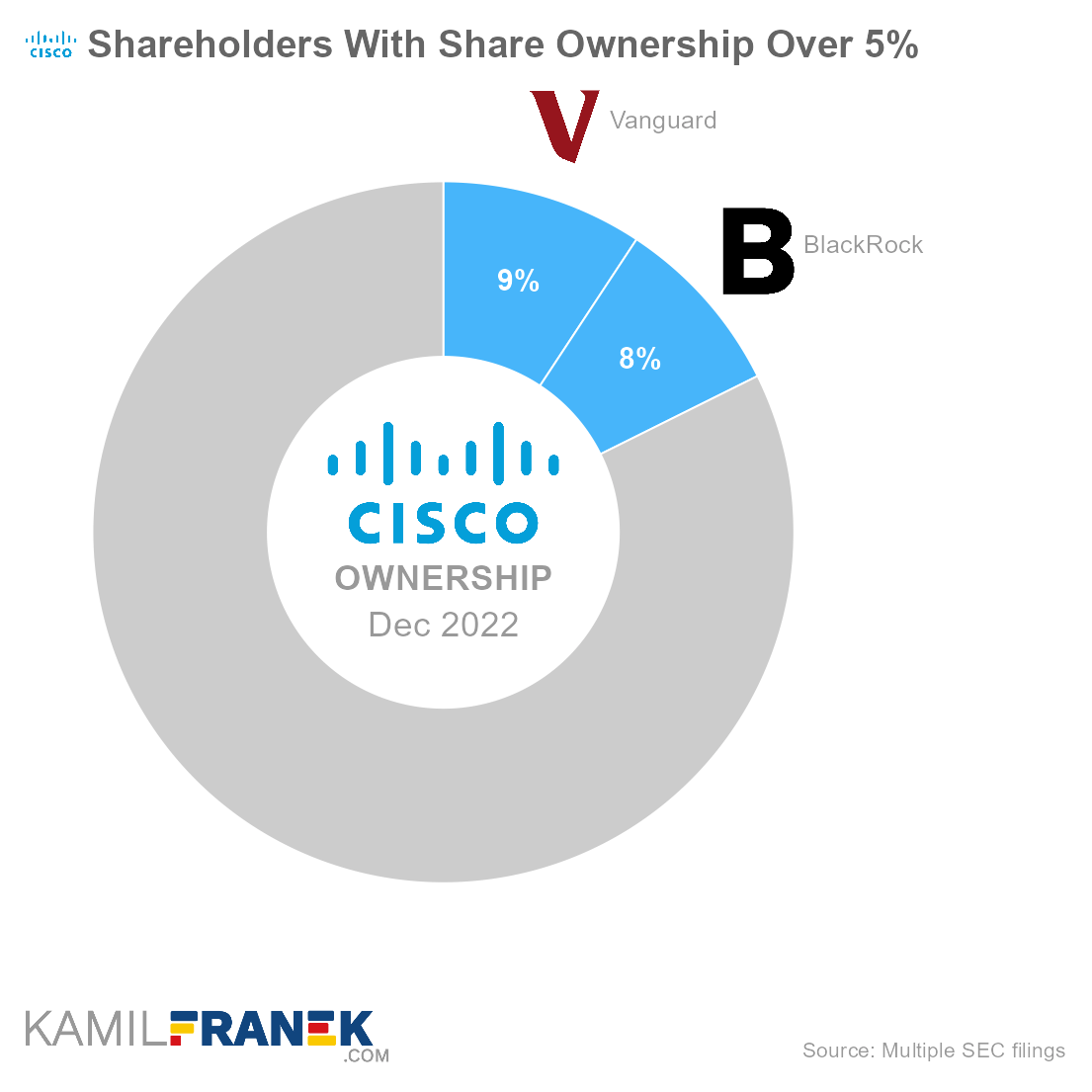

Cisco’s largest shareholders are asset manager giant Vanguard, which owns a 9.3% share, followed by another asset manager giant BlackRock, with an 8.4% ownership. No other shareholder holds more than 5% of the company.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 9.3% | 9.3% | |

| BlackRock | 8.4% | 8.4% | |

| Other | 82.3% | 82.3% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Cisco and who controls it. I will show you who Cisco’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Microsoft, Alphabet(Google), Lenovo, IBM, Visa, and other articles about who owns who.

📃 Who Owns Cisco?

Cisco is owned mainly by asset managers. The largest ones are asset manager giant Vanguard, which owns 9.3% of the company, followed by asset manager giant BlackRock with an 8.4% ownership share.

No shareholder has dominant ownership in the company. Cisco’s ownership is dispersed, and the largest owners are asset managers who invest money on behalf of their clients.

- It is not surprising to see Vanguard and BlackRock among the top shareholders. They are the largest asset managers worldwide, and it is common to see them among the top shareholders of large public companies.

Cisco was founded in 1984 by Leonard Bosack and Sandy Lerner and has been a publicly listed company since its initial public offering on Nasdaq in 1990 (Ticker: CSCO).

- After Cisco was founded in 1984, both founders still worked at their jobs at Stanford University.

- Cisco’s first products were based on Standford designs and software without the university’s consent. Stanford forced some of the Cisco founders and employees to resign from their university jobs and contemplated legal actions.

- Both founders left the company in 1990, soon after Cisco’s IPO, and reportedly sold their shares. They no longer have any sizable stake in Cisco.

- Because Cisco does not make consumer-facing products, the company is sometimes forgotten when we talk about technology giants. But the fact is it is one of the largest technology companies in the world, and for a short time during the dot-com boom in 2000, it was even the largest company in the world.

Cisco Systems, Inc. is incorporated in the State of Delaware (US), and its headquarters are in San Jose, California (US).

🎮 Who Controls Cisco (CSCO)?

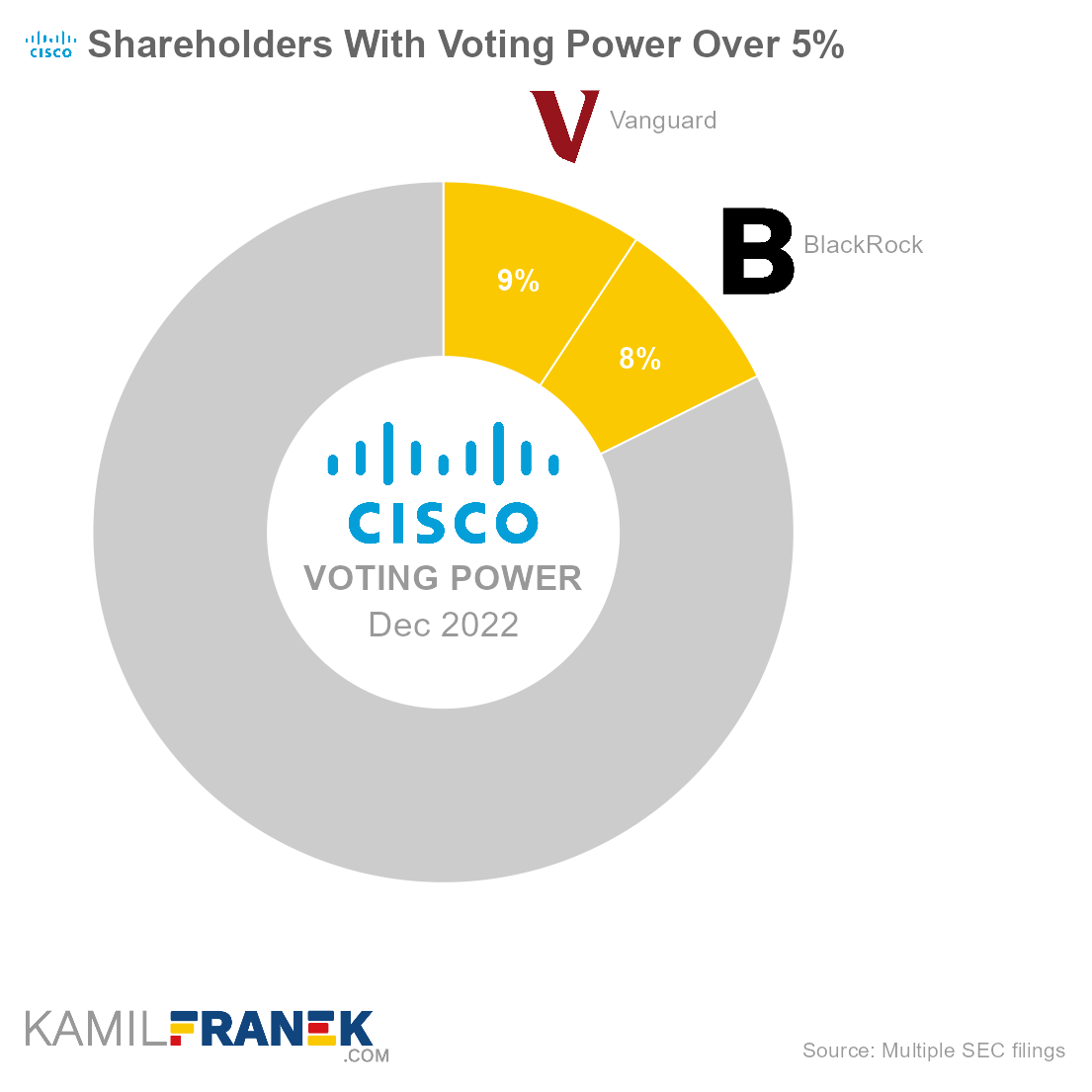

Cisco’s shareholders with the largest voting power are asset manager giant Vanguard, which holds 9.3% of all votes, followed by asset manager giant BlackRock with 8.4% voting power.

Cisco has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of Cisco Systems, Inc. is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients. None of them control the company individually, but together they have a big influence.

Cisco’s dispersed ownership creates conflicts of interest between Cisco’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the large asset manager shareholders and insiders of the company hold significant power over it.

Despite being incorporated in Delaware, Cisco prizes itself for not having any “poisonous pills” or anti-takeover clauses in its bylaws and certificate of incorporation.

- It even opted out of Delaware Section 203 of General Corporation Law, which makes it harder to make hostile takeover offers.

- For any Delaware company that does not specifically opt out of Section 203, these clauses are valid.

Cisco’s insiders that have influence over the company are CEO and chairman Charles Robbins and other board members and executives.

- Cisco currently has an 11-member board of directors, reelected annually.

- Nobody from the board of directors or executive officers holds more than 0.05% share of Cisco’s stocks.

🗳️ Breakdown of Cisco’s Outstanding Shares and Votes by Top Shareholders

Cisco Systems, Inc. had a total of 4,100 million outstanding shares as of December 2022. The following table shows how many shares each Cisco’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 381 | 381 | 9.3% | |

| BlackRock | 343 | 343 | 8.4% | |

| Other | 3,376 | 3,376 | 82.3% | |

| Total (# millions) | 4,100 | 4,100 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 4,100 million votes distributed among shareholders of Cisco Systems, Inc.. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 381 | 381 | 9.3% | |

| BlackRock | 343 | 343 | 8.4% | |

| Other | 3,376 | 3,376 | 82.3% | |

| Total (# millions) | 4,100 | 4,100 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Cisco’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Cisco Systems, Inc. worth.

However, keep in mind that a stake in Cisco could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $18.1 | $18.1 | 9.3% | |

| BlackRock | $16.4 | $16.4 | 8.4% | |

| Other | $160.8 | $160.8 | 82.3% | |

| Total ($ billions) | $195.3 | $195.3 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Cisco shareholder individually.

📒 Who Are Cisco’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Cisco Systems, Inc. one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Cisco worth.

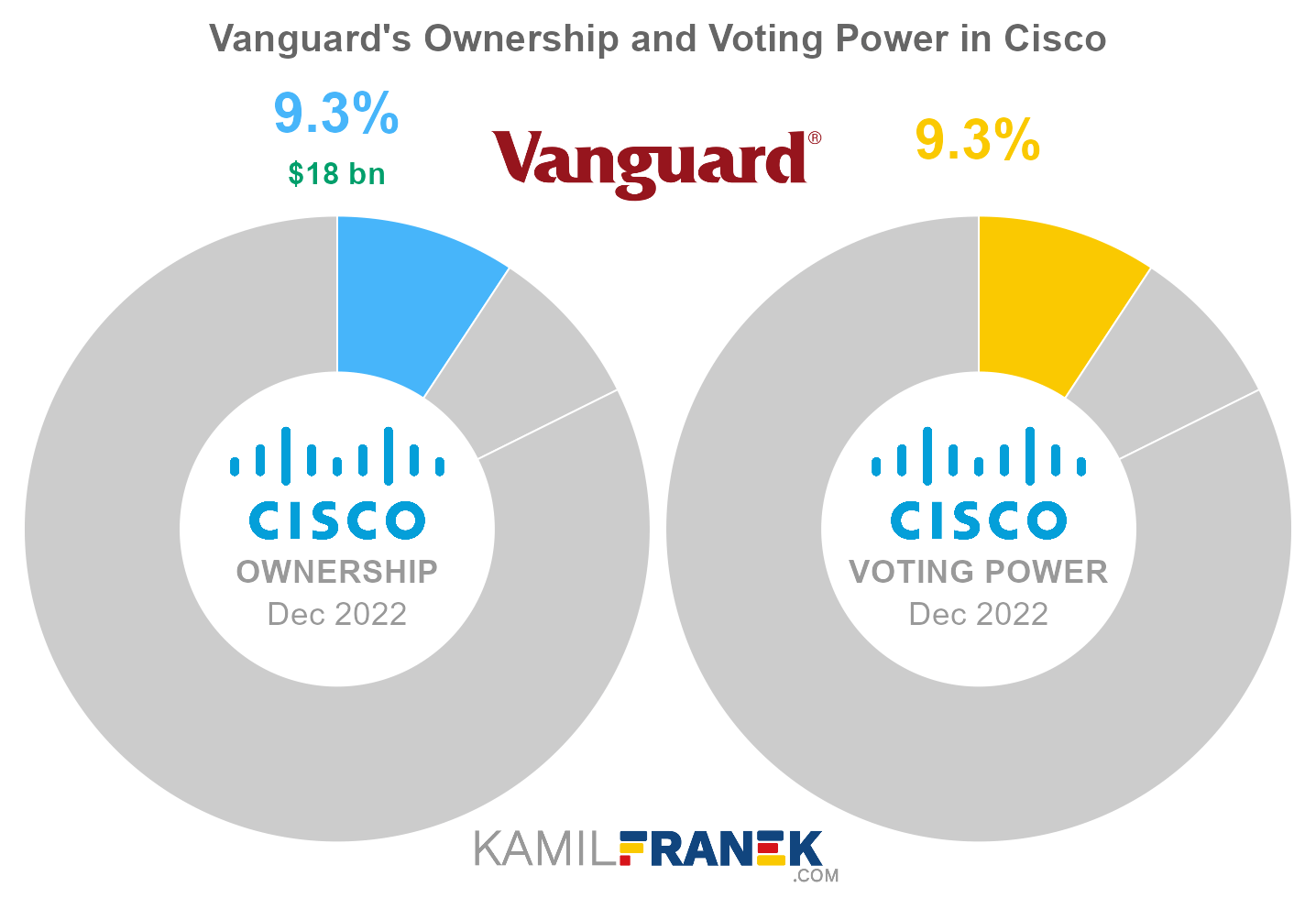

#1 Vanguard (9.3%)

Vanguard is the largest shareholder of Cisco, owning 9.3% of its shares. As of December 2022, the market value of Vanguard’s stake in Cisco was $18.1 billion.

Vanguard owned 381 million shares in Cisco and controlled 381 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

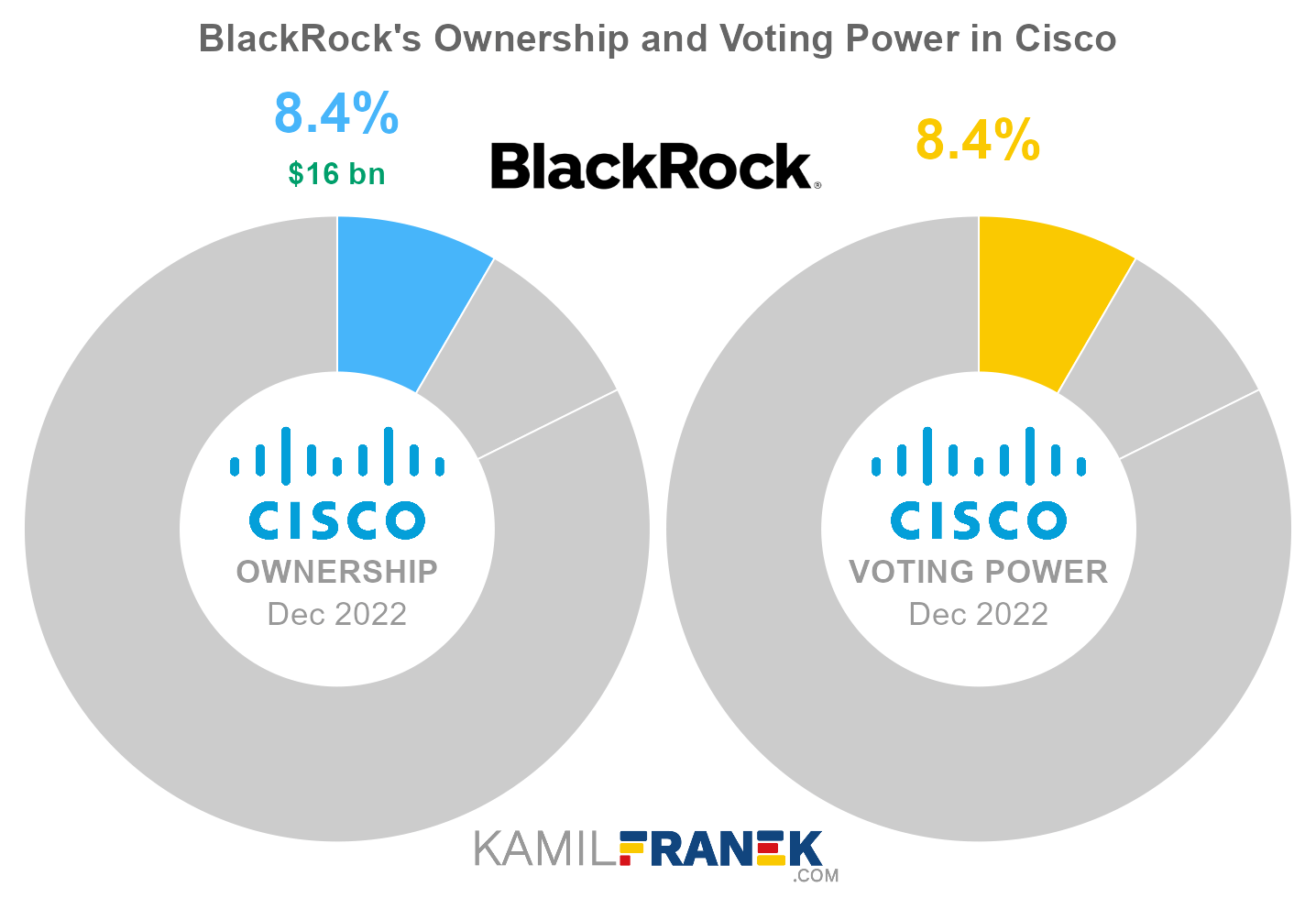

#2 BlackRock (8.4%)

BlackRock is the second-largest shareholder of Cisco, owning 8.4% of its shares. As of December 2022, the market value of BlackRock’s stake in Cisco was $16.4 billion.

BlackRock owned 343 million shares in Cisco and controlled 343 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

🧱 Who and When Founded Cisco?

Cisco Systems, Inc. was founded in 1984 by Leonard Bosack and his wife, Sandra Lerner. They both worked at Stanford University, where they met as students.

Lerner worked as director of computer facilities at Stanford Business School, and Bosack was in charge of computers at the university science department. In the beginning, they kept their jobs at Stanford while building Cisco. Cisco’s name came from the “San Francisco” name.

The company’s first products were based on a multiprotocol router called “Blue Box” that was invented at Standford by another researcher, and Cisco founders used it as a foundation for their Cisco IOS without university consent.

One might consider it theft and even Stanford University did for some time. Bosack and another Cisco employee, Kirk Lougheed, were forced to resign from Stanford in 1986. However, in 1987 Standford decided to license its software and other technology to Cisco.

Founders Leonard and Sandra brought in financial partners, including Sequoia Capital. This also led to installing John Morgridge as CEO in 1988. His relationship with the founders, especially Sandra, was not good.

After Cisco went public in 1990, Sandra Lerner was forced out of the company, and Leonard Bosack left too in solidarity. They sold their shares soon after that.

📅 Cisco’s History Timeline

These are selected events from Cisco’s history:

- 1984: Cisco was founded by Leonard Bosack and his wife, Sandra Lerner.

- 1986: Bosack and early employee Lougheed were forced to resign from their jobs at Standford, and the university contemplated criminal complaints against Cisco and its founders because of intellectual property theft.

- 1987: Standford University licensed its software and some other intellectual property to Cisco

- 1987: Sequoia Capital was brought in as an investor.

- 1988: John Morgridge became CEO

- 1990: Cisco’s initial public offering (IPO)

- 1990: Founder Sandra Lerner was ousted from Cisco, and founder Leonard Bosack left too.

- 1995: John Chambers replaced Morgridge as CEO of Cisco

- 1998: Acquisition of Selsius Systems (VoIP)

- 2005: Acquisition of set-top box company Scientifica Atlanta. Cisco was interested mainly in streaming technology and later got rid of the set-top box business.

- 2013: Cisco acquired security firm Sourcefire

- 2015: Cisco acquires OpenDNS

- 2015: Chuck Robbins replaces John Chambers as CEO

- 2016: Cisco acquired Jasper

- 2017: Cisco announced the acquisition of AppDynamics

- 2017: Cisco announced the acquisition of Broadsoft

- 2018: Acquisition of Duo Security

- 2021: Acquisition of Acacia Communications

📚 Recommended Articles & Other Resources

Who Owns Visa: The Largest Shareholders Overview

Overview of who owns Visa and who controls it. With a list of the largest shareholders and how much is each of their stake worth..

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Kahoot!: The Largest Shareholders Overview

Overview of who owns Kahoot! and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns IBM: The Largest Shareholders Overview

Overview of who owns IBM and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lenovo: The Largest Shareholders Overview

Visual overview of who owns Lenovo and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Shell: The Largest Shareholders Overview

Overview of who owns Shell and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Cisco’s Annual Financials Statements (K-10)

- Cisco’s Proxy Statement

- Cisco’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.