Who Owns Johnson & Johnson: The Largest Shareholders Overview

Johnson & Johnson (JNJ) is a giant healthcare company focusing on pharmaceuticals and medical technology. It makes money mainly from pharmaceuticals representing the majority of revenues and profits, especially oncology and immunology drugs. It used to have also a consumer health segment, but it was spun off in 2023. Let’s look at who owns Johnson & Johnson and who controls it.

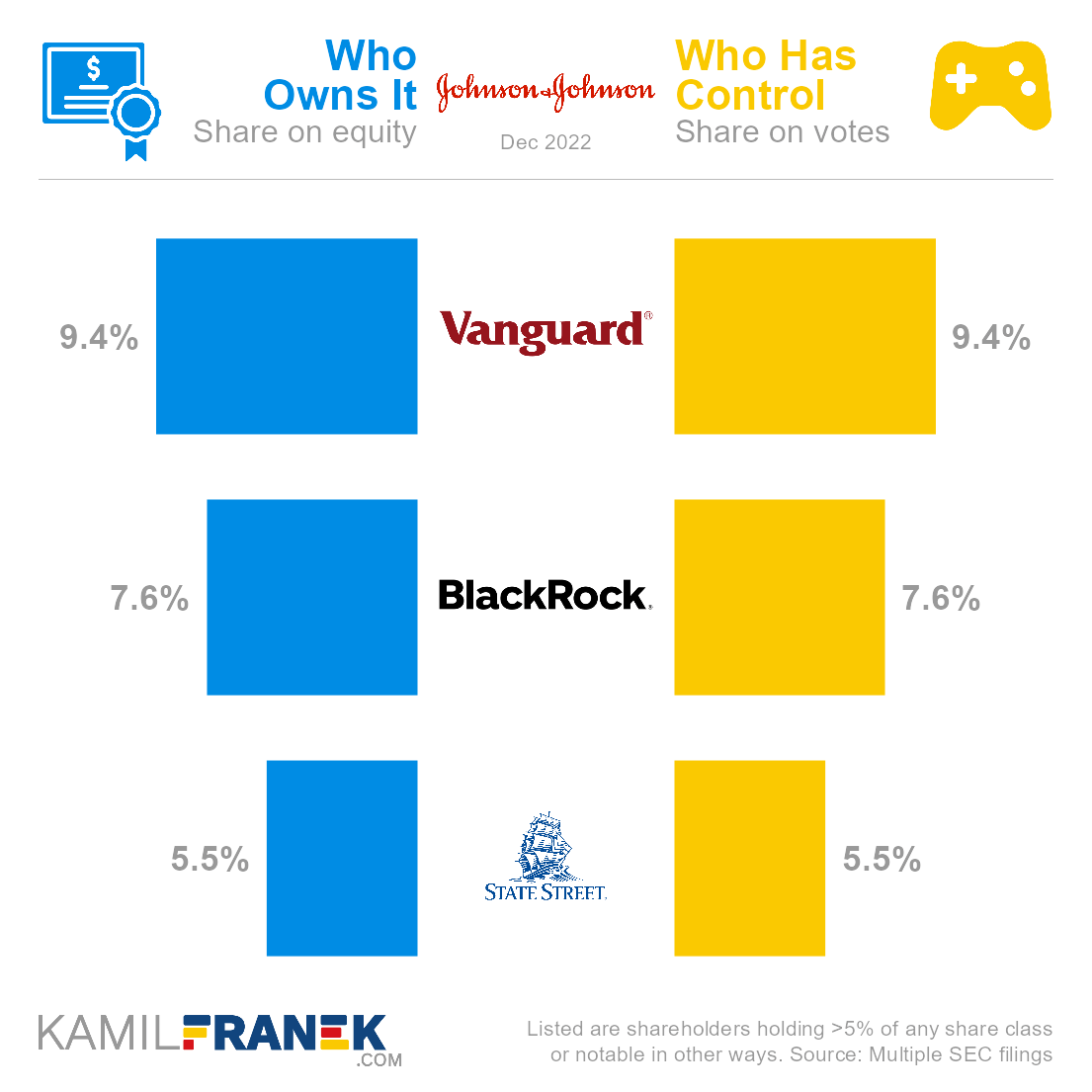

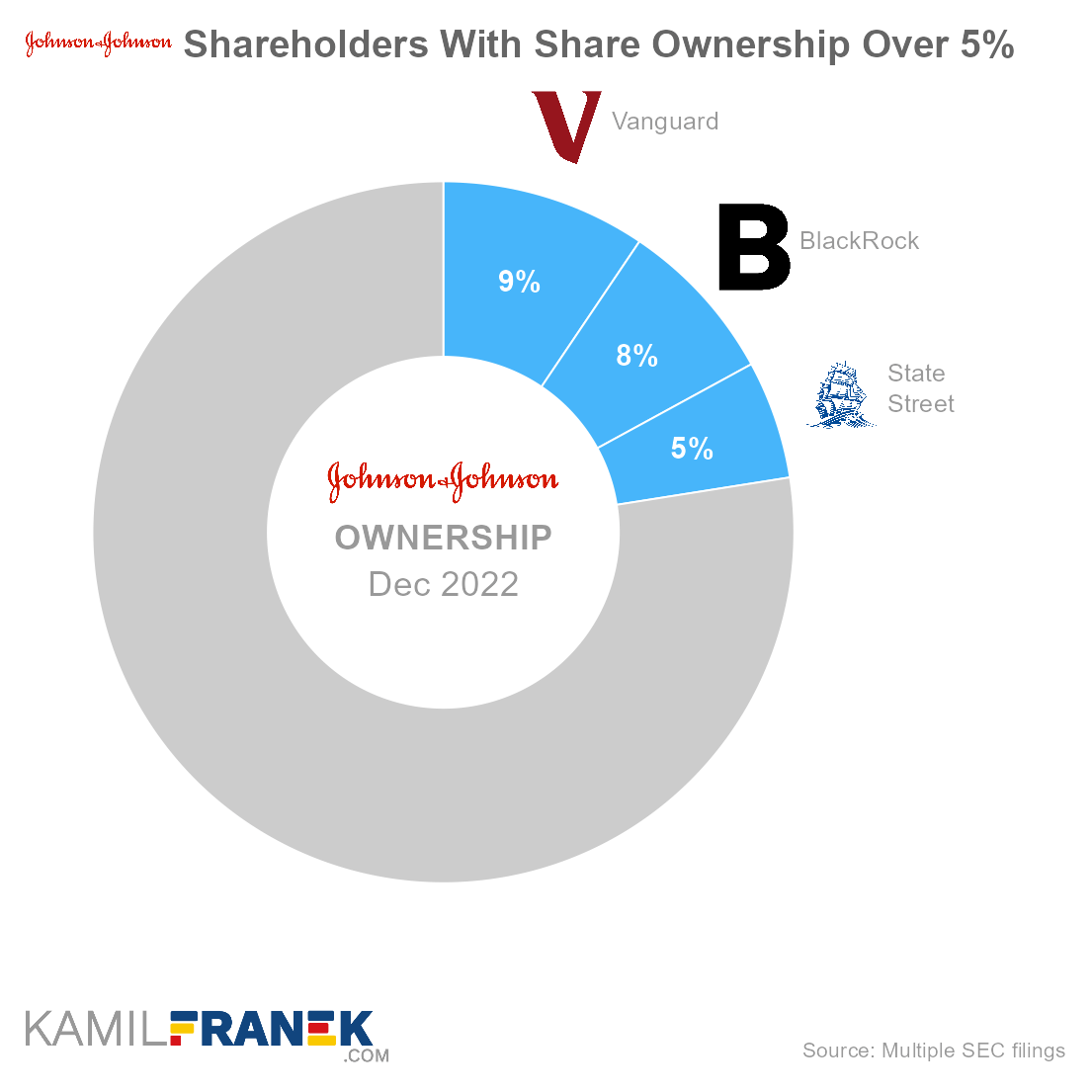

Johnson & Johnson’s largest shareholders are asset manager giant Vanguard, which owns a 9.4% share, followed by asset manager giant BlackRock (7.6%) and asset manager State Street (5.5%). No other shareholder owns more than 5% of the company.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 9.4% | 9.4% | |

| BlackRock | 7.6% | 7.6% | |

| State Street | 5.5% | 5.5% | |

| Other | 77.5% | 77.5% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Johnson & Johnson and who controls it. I will show you who Johnson & Johnson’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Eli Lilly, Amazon, UnitedHealth, and other articles in my “Who Owns Who” series.

📃 Who Owns Johnson & Johnson?

Johnson & Johnson is owned mainly by asset managers. The largest ones are asset manager giant Vanguard, which owns 9.4% of the company, followed by asset manager giant BlackRock with a 7.6% ownership share, and State Street with 5.5% ownership.

- No shareholder has dominant ownership in the company, and the company has no single sizable owner except asset managers.

- Johnson & Johnson’s ownership is dispersed, and the largest owners are asset managers who are not ultimate owners but invest money on behalf of their clients.

- Vanguard and BlackRock are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies with dispersed ownership. Their portfolio is so huge that even if they spread it out across thousands of companies, they still belong to the main shareholders in many of them.

Johnson & Johnson was founded in 1886 by brothers Robert Wood Johnson, James Wood Johnson and Edward Mead Johnson. It has been a publicly listed company since its initial public offering on NYSE in 1944 (Ticker: JNJ).

- After the company went public, the founding family lost control.

- Son of the founder Robert Wood Johnson II was the last family member heading the company. Philip B. Hofmann replaced him as CEO and chairman in 1963.

- Johnson family still belongs to the wealthiest families in the US but is no longer connected with Johnson & Johson company.

Johnson & Johnson is incorporated in the State of New Jersey (US), and its headquarters are in New Brunswick, New Jersey (US).

Until recently, Johnson & Johnson was active in three segments: Consumer Health, Pharmaceuticals, and MedTech. In 2023 the company spun off its Consumer Health business into a separate company called Kenvue, which is traded on NYSE under the trading ticker KVUE. Therefore, many brands that originally belonged to J&J, including “Johnson’s” brand, are no longer made and sold by J&J company.

🎮 Who Controls Johnson & Johnson (JNJ)?

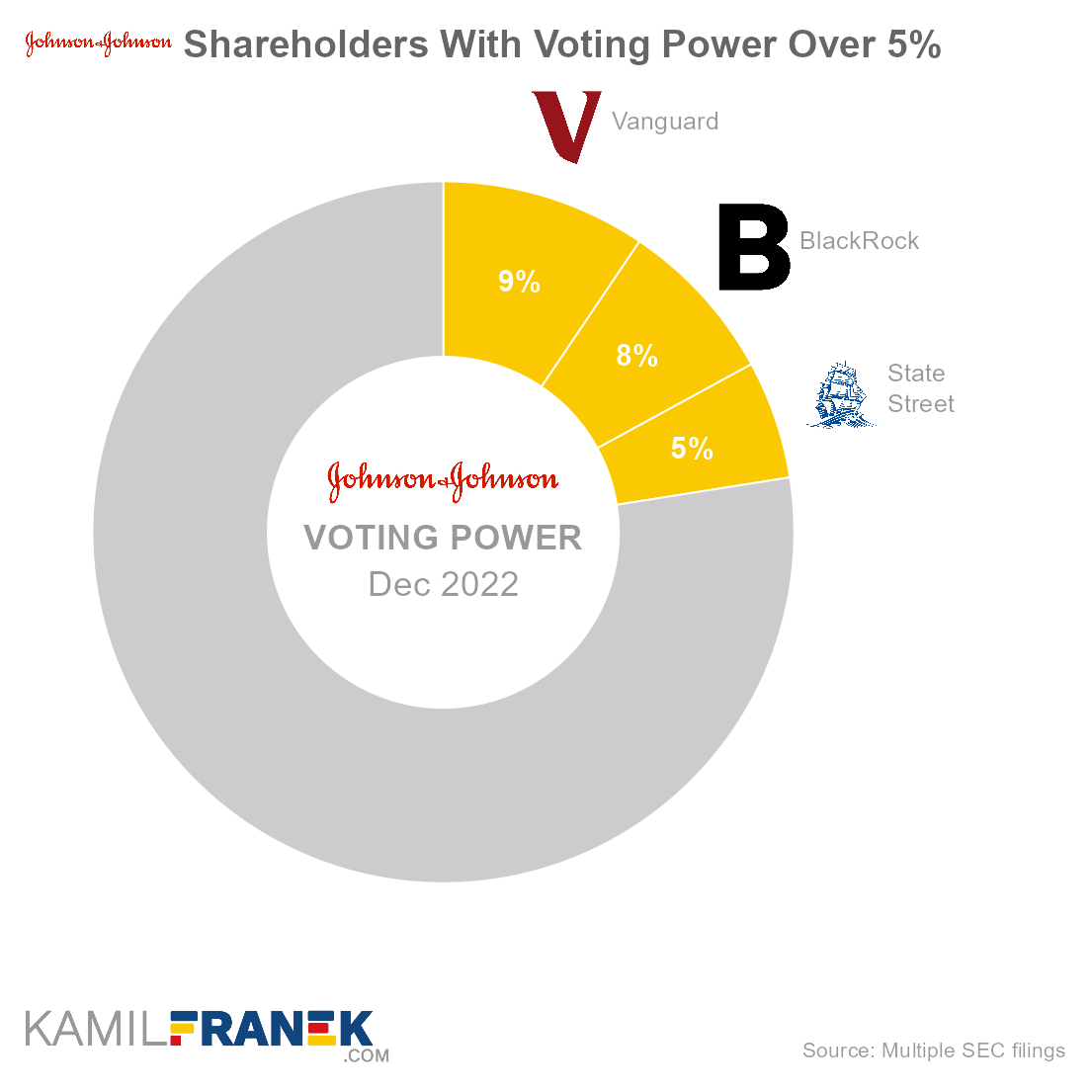

Johnson & Johnson’s shareholders with the largest voting power are asset manager giant Vanguard, which holds 9.4% of all votes, followed by asset manager giant BlackRock with 7.6% voting power, and asset manager State Street (5.5%).

Johnson & Johnson has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of Johnson & Johnson is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients.

- None of them control the company individually, but together they have a big influence.

- They are not ultimate owners of those shares but have significant voting power over a large part of the shares they hold.

- Voting power gives asset managers the influence to endorse or oppose resolutions and shape the company’s governance practices and decisions.

Johnson & Johnson’s dispersed ownership structure dominated by asset managers creates conflicts of interest between Johnson & Johnson’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the company hold significant power over it.

Johnson & Johnson’s insiders that have influence over the company are CEO and chairman Joaquin Duato and other board members and executives.

- Johnson & Johnson has a 12-member board of directors reelected annually.

- Nobody from the board of directors or executive officers holds more than 0.05% of Johnson & Johnson’s shares. Despite that, the lack of other large shareholders, except asset managers, gives the CEO a large influence.

🗳️ Breakdown of Johnson & Johnson’s Outstanding Shares and Votes by Top Shareholders

Johnson & Johnson had a total of 2,614 million outstanding shares as of December 2022. The following table shows how many shares each Johnson & Johnson’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 247 | 247 | 9.4% | |

| BlackRock | 199 | 199 | 7.6% | |

| State Street | 142 | 142 | 5.5% | |

| Other | 2,026 | 2,026 | 77.5% | |

| Total (# millions) | 2,614 | 2,614 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 2,614 million votes distributed among shareholders of Johnson & Johnson. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 247 | 247 | 9.4% | |

| BlackRock | 199 | 199 | 7.6% | |

| State Street | 142 | 142 | 5.5% | |

| Other | 2,026 | 2,026 | 77.5% | |

| Total (# millions) | 2,614 | 2,614 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Johnson & Johnson’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Johnson & Johnson worth.

However, keep in mind that a stake in Johnson & Johnson could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $43.6 | $43.6 | 9.4% | |

| BlackRock | $35.1 | $35.1 | 7.6% | |

| State Street | $25.2 | $25.2 | 5.5% | |

| Other | $357.8 | $357.8 | 77.5% | |

| Total ($ billions) | $461.7 | $461.7 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Johnson & Johnson shareholder individually.

📒 Who Are Johnson & Johnson’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Johnson & Johnson one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Johnson & Johnson worth.

#1 Vanguard (9.4%)

Vanguard is the largest shareholder of Johnson & Johnson, owning 9.4% of its shares. As of December 2022, the market value of Vanguard’s stake in Johnson & Johnson was $43.6 billion.

Vanguard owned 247 million shares in Johnson & Johnson and controlled 247 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

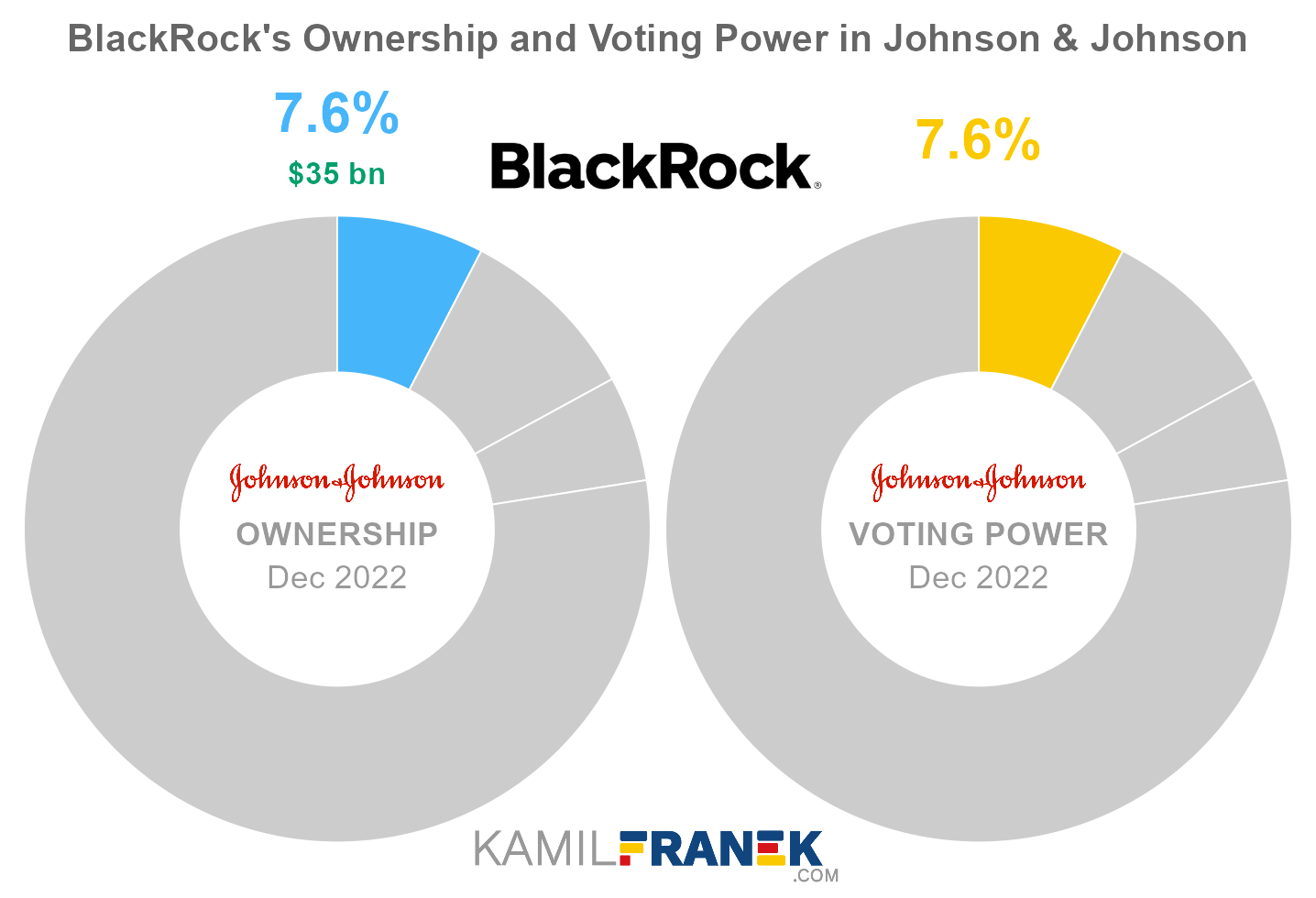

#2 BlackRock (7.6%)

BlackRock is the second-largest shareholder of Johnson & Johnson, owning 7.6% of its shares. As of December 2022, the market value of BlackRock’s stake in Johnson & Johnson was $35.1 billion.

BlackRock owned 199 million shares in Johnson & Johnson and controlled 199 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

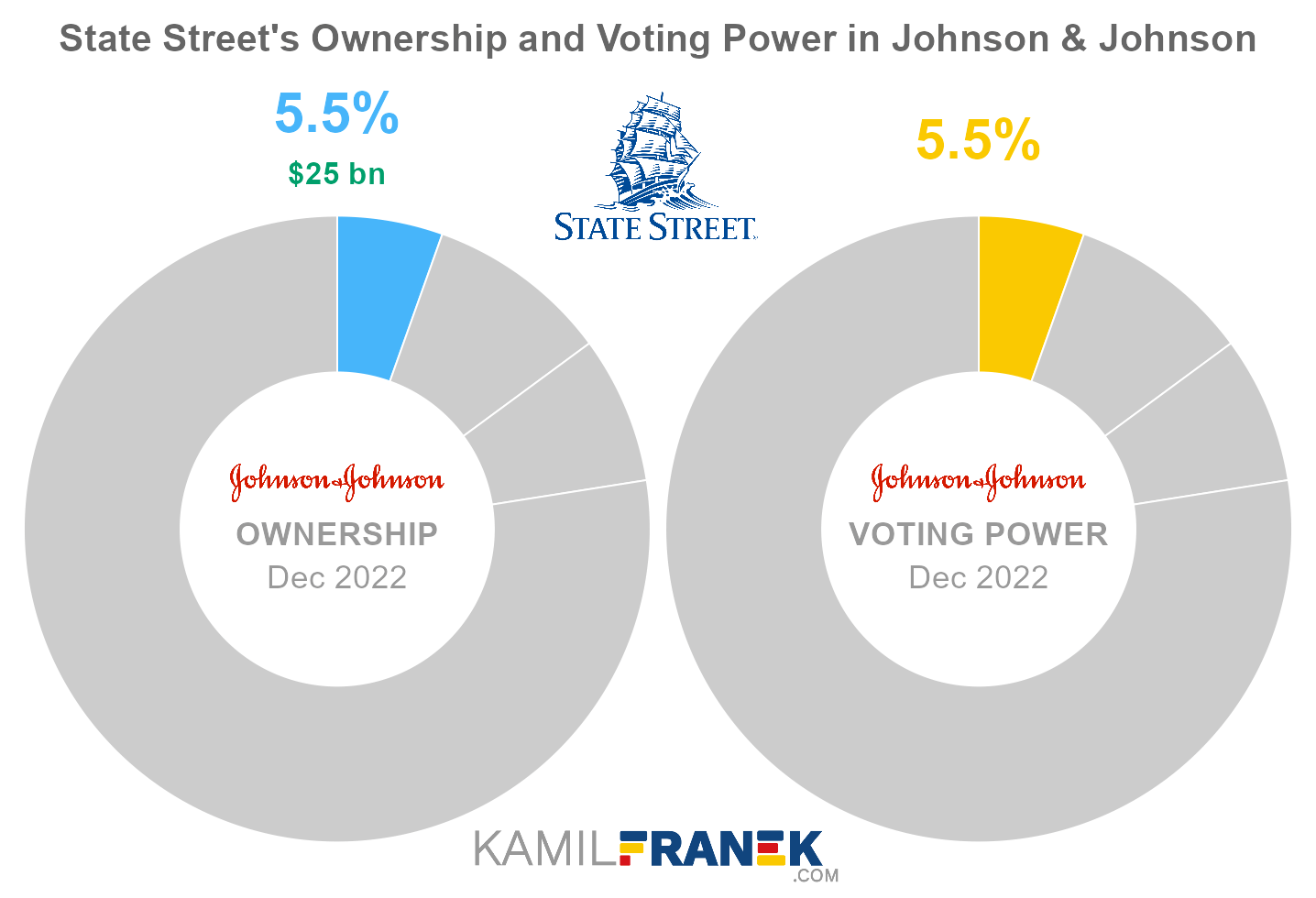

#3 State Street (5.5%)

State Street is the third-largest shareholder of Johnson & Johnson, owning 5.5% of its shares. As of December 2022, the market value of State Street’s stake in Johnson & Johnson was $25.2 billion.

State Street owned 142 million shares in Johnson & Johnson and controlled 142 million shareholder votes as of December 2022.

State Street Corporation is one of the largest asset managers in the world, with 4 trillion assets under management. It makes money mainly from servicing and management fees.

In 1993 company introduced the SPDR S&P 500 Trust ETF (traded under ticker SPY). It was the first exchange-traded fund, and State Street is now one of the largest ETF providers in the world.

State Street is a publicly traded company, and its largest shareholders are, ironically, its competitors, Vanguard and Blackrock. One of its largest shareholders is even State Street itself. Not directly but through their passive and active funds.

This circular ownership between State Street, Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies where they usually belong to the most significant shareholders.

🧱 Who and When Founded Johnson & Johnson?

Johnson & Johnson was founded in 1886 by three brothers, Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson. Today, Johnson & Johnson is one of the largest healthcare companies in the world, with a global network of subsidiaries.

Johnson & Johnson, one of the world’s leading healthcare conglomerates, has a rich and fascinating history that spans over a century.

It was in 1861 when Robert Wood Johnson embarked on his pharmaceutical journey as an apprentice at Wood & Tittamer’s pharmacy in Poughkeepsie, guided by his uncle, James Wood. Little did he know that this apprenticeship would sow the seeds of an extraordinary legacy.

By 1864, Johnson found himself in the bustling city of New York, working as a drug product salesman. Fate intervened when he crossed paths with George Seabury, a man who would play a crucial role in his future endeavors. Their collaboration led to the co-founding of Seabury & Johnson in 1873, a venture dedicated to the production of medicated plasters.

The company prospered, drawing the involvement of Johnson’s brothers. Yet, disagreements arose between the founders, and Johnson sold his stake in Seabury & Johnson in 1885.

In 1886, alongside his brothers James Wood Johnson and Edward Mead Johnson, Robert Wood Johnson laid the foundation of a new enterprise that would later dominate the healthcare industry, Johnson & Johnson.

The early years of Johnson & Johnson witnessed remarkable achievements. From manufacturing sterile surgical supplies to household products and medical guides. They introduced the world to the first sterile surgical products, including sutures, absorbent cotton, and gauze.

In 1910 when Robert Wood Johnson, the visionary founder, passed away, the reins of the company were passed to his brother, James Wood Johnson.

Over the years, the baton of leadership passed from one generation to another, with Robert Wood Johnson II, son of the founder, assuming the role of president in 1932 and chairman in 1938.

The year 1944 witnessed a significant turning point in the history of Johnson & Johnson. With their initial public offering, the company’s destiny and the destiny of the Johson family started to diverge.

In 1963, Philip B. Hofmann took the helm as Chairman and CEO, becoming the first non-Johnson family member to assume the esteemed position.

Despite the family’s departure from involvement in the company, the Johnson family still belongs among the most wealthy families in the US.

For example, Woody and Christopher Johnson, the great-grandsons of the founder, now hold ownership of the New York Jets.

📅 Johnson & Johnson’s History Timeline

These are selected events from Johnson & Johnson’s history:

1860s

- 1861: Robert Wood Johnson begins his pharmaceutical apprenticeship at Wood & Tittamer’s pharmacy in Poughkeepsie. It was offered to him by his uncle James Wood.

- 1864: Johnson works as a drug product salesman in New York City, where he meets George Seabury.

1870s

- 1873: Johnson co-founded Seabury & Johnson with George Seabury, producing medicated plasters. Johnson’s brothers later worked for the company.

1880s

- 1982: The Chicago Tylenol murders occurred, resulting in J&J making one of the first major recalls in American history and leading to reforms in the packaging of over-the-counter substances and federal anti-tampering laws.

- 1885: After some disagreements, Johnson sold his stake in Seabury & Johnson to Seabury.

- 1886: Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson started Johnson & Johnson, manufacturing sterile surgical supplies, household products, and medical guides

- 1887: Johnson & Johnson registered the Red Cross as a U.S. trademark for “medicinal and surgical plasters”and has used the design since 1887.

- 1888: Johnson & Johnson publishes Modern Methods of Antiseptic Wound Treatment, teaching doctors how to use sterile surgical supplies

1890s

- 1894: Johnson & Johnson introduced the world’s first maternity kit to aid at-home births.

1900s-1950s

- 1910: Founder Robert Wood Johnson died, and the company management was taken over by his brother James Wood Johnson.

- 1920: Earle Dickson combined two Johnson & Johnson products, adhesive tape and gauze, to create the first commercial adhesive bandage. Band-Aid Brand Adhesive Bandages began sales the following year.

- 1932: Robert Wood Johnson II (son of the founder) became president after his uncle James Wood Johnson died.

-

1938: Robert Wood Johnson II also became chairman of the board.

- 1944: Johnson & Johnson began to sell shares to the public, ending the company’s family control.

1960s

- 1963: Philip B. Hofmann succeeded Robert Wood Johnson (son of the founder) as Chairman and CEO. He was the first non-Johnson family member to become chief executive. Hofmann also helped found the Robert Wood Johnson Foundation.

- 1965: Johnson & Johnson acquired Codman & Shurtleff. The acquired company produced neurovascular devices and neurosurgery technologies.

- 1968: Robert Wood Johnson II died.

- 1969: Ortho Diagnostics, a company subsidiary, launched the Sickledex Tube Test for detecting anemia.

- 1969: The FDA approved the Johnson & Johnson arterial graft.

1970s

- 1971: Johnson & Johnson launched Hapindex Diagnostic Test, a rapid Hepatitis B test for blood donors.

- 1971: Internal documents showed that J&J knew about asbestos contamination in its baby powder since at least 1971 and spent decades finding ways to hide the evidence from the public.

- 1973: Richard Sellars became Chairman and CEO of Johnson & Johnson.

- 1976: James E. Burke became the company’s Chairman and CEO.

1980s

- 1982: The Chicago Tylenol murders occurred, resulting in J&J making one of the first major recalls in American history and leading to reforms in the packaging of over-the-counter substances and to federal anti-tampering laws.

- 1983: J. Seward Johnson Sr.’s estate battle over $402,824,971.59 ended in a settlement where his principal heir agreed to pay $160 million to Mr. Johnson’s children.

- 1985: Johnson & Johnson opened operating companies in China and Egypt.

- 1987: Acuvue contact lenses became the first disposable contact lenses available to consumers. The lenses lasted up to one week, reducing the cost of contact lenses.

- 1989: Ralph S. Larsen was appointed Chairman and CEO of the company.

1990s

- 1991: After the Dissolution of the Soviet Union, Johnson & Johnson expanded into Eastern Europe. By the end of 1991, the company had operations in Hungary, Russia, the Czech Republic, and Poland.

- 1996: Johnson & Johnson opened an operating company in Israel.

- 1997: Johnson & Johnson acquired Biosense Webster.

- 1998: DePuy was acquired by Johnson & Johnson and was rolled into the Medtech business group.

2000s

- 2002: William C. Weldon was appointed Chairman and CEO of the company.

- 2003: Johnson & Johnson and Boston Scientific have both claimed that the other had infringed on their patents covering heart stent medical devices.

- 2003: Jamie Johnson, grandson of J. Seward Johnson Sr., released a documentary called “Born Rich” which was shown at the Hamptons Film Festival and broadcast on HBO.

- 2006: Johnson & Johnson acquired Pfizer’s consumer healthcare business and merged it with its consumer healthcare business group. The acquisition added brands like Listerine, Bengay, and Neosporin to the company’s portfolio.

- 2006: Johnson & Johnson’s Janssen Pharmaceuticals, launched Prezista, a protease inhibitor for patients with failed previous HIV therapies.

- 2007: Johnson & Johnson sued Abbott Laboratories over the development and sale of the arthritis drug Humira.

- 2008: Johnson & Johnson acquired Mentor Corporation for $1 billion and merged its operations into Ethicon.

- 2009: The company acquired HealthMedia, later renamed Health & Wellness Solutions, and the Human Performance Institute.

2010s

- 2010: Shareholders sued the board for allegedly failing to take action to prevent serious failings and illegalities since the 1990s, including manufacturing problems, bribing officials, covering up adverse effects, and misleading marketing for unapproved uses.

- 2010-2011: J&J acquired Crucell for $2.4 billion. The subsidiary is the center for vaccines within Johnson & Johnson pharmaceuticals business group.

- 2011: J&J settled litigation brought by the US Securities and Exchange Commission under the Foreign Corrupt Practices Act and paid around $70M in disgorgement and fines.

- 2012: Alex Gorsky became Chairman and CEO of Johnson & Johnson.

- 2012: Johnson and Johnson proposed a settlement with the shareholders.

- 2013: Johnson & Johnson was ordered to pay more than $8.3 million in damages to a Montana man in the first of more than 10,000 lawsuits pending against the company in connection with the now-recalled DePuy hip.

- 2013: J&J was accused of illegally marketing Risperdal through Omnicare, and it agreed to pay a penalty of around $2.2 billion.

- 2016: Johnson & Johnson reached a settlement with 41 states and the District of Columbia, with no admission of liability, in a suit alleging deceptive marketing of transvaginal surgical-mesh devices.

- 2017: Johnson & Johnson acquired Actelion in a $30 billion deal, the largest-ever purchase by the company. After the purchase, Johnson & Johnson spun off Actelion’s research and development unit, into a separate legal entity.

- 2017: Johnson & Johnson acquired Abbott Medical Optics from Abbott Laboratories for $4.325 billion, adding the new division into Johnson & Johnson Vision Care, Inc. in 2017.

- 2017: J&J reached an agreement to pay $33 million to several states to settle consumer fraud allegations in some of the company’s over-the-counter drugs.

- 2017: Johnson & Johnson Vision Care, Inc acquired TearScience.

- 2017: The company acquired subscription-based contact lens startup Sightbox.

- 2017: Johnson & Johnson Medical GmbH acquired Emerging Implant Technologies GmbH, a manufacturer of 3D-printed titanium interbody implants for spinal fusion surgery.

- 2018: A St. Louis jury awarded nearly $4.7 billion in damages to 22 women and their families in 2018 after they claimed that asbestos in Johnson & Johnson talcum powder caused their ovarian cancer.

- 2018: J&J removed several chemicals from baby powder products and re-engineered them to make consumers more confident that products were safer for children.

- 2019: Johnson & Johnson announced the release of photochromic contact lenses.

- 2019: J&J was ordered by an Oklahoma judge to pay $572 million for their part in the opioid crisis.

- 2019: The FDA approved esketamine for the treatment of severe depression, which is marketed as Spravato by Janssen Pharmaceuticals.

2020s

- 2020: J&J announced it would discontinue the sale of talc-based baby powder in the United States and Canada in 2020, but would continue to sell it in other markets.

- 2020: Johnson & Johnson acquired Momenta Pharmaceuticals for $6.5 billion.

- 2021: J&J subsidiary LTL Management LLC, using a process called a Texas divisional merger, filed for Chapter 11 bankruptcy in North Carolina.

- 2022 Johnson & Johnson agreed to contribute $5bn from the total of $26bn to settle several thousand lawsuits claiming that J&J and other companies fueled the opioid crisis.

- 2022: Joaquin Duato became CEO of Johnson & Johnson.

- 2022: Johnson & Johnson announced that it would acquire Abiomed Inc for $16.6 billion.

- 2023: J&J announced that it would stop making talc-based powder by 2023 and replace it with cornstarch-based powders.

- 2023: J&J span off the J&J consumer segment into a separate company called Kenvue. It is listed under the ticker KVUE on NYSE. J&J retained only a minority stake.

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns JPMorgan Chase: The Largest Shareholders Overview

Overview of who owns JPMorgan Chase and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Eli Lilly: The Largest Shareholders Overview

Overview of who owns Eli Lilly and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Nike: The Largest Shareholders Overview

Overview of who owns Nike and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Volkswagen: The Largest Shareholders Overview

Overview of who owns Volkswagen and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns NVIDIA: The Largest Shareholders Overview

Overview of who owns NVIDIA and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Johnson & Johnson’s Annual Financials Statements (K-10)

- Johnson & Johnson’s Proxy Statement

- Johnson & Johnson’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.