Who Owns Procter & Gamble: The Largest Shareholders Overview

The Procter & Gamble Company (PG) is a consumer goods giant selling its products under many brands. The company is active in various segments but makes money mainly from fabric care, home care, baby care, skin and personal care, hair care, family care, and oral care. Let’s now look at who owns Procter & Gamble and who controls it.

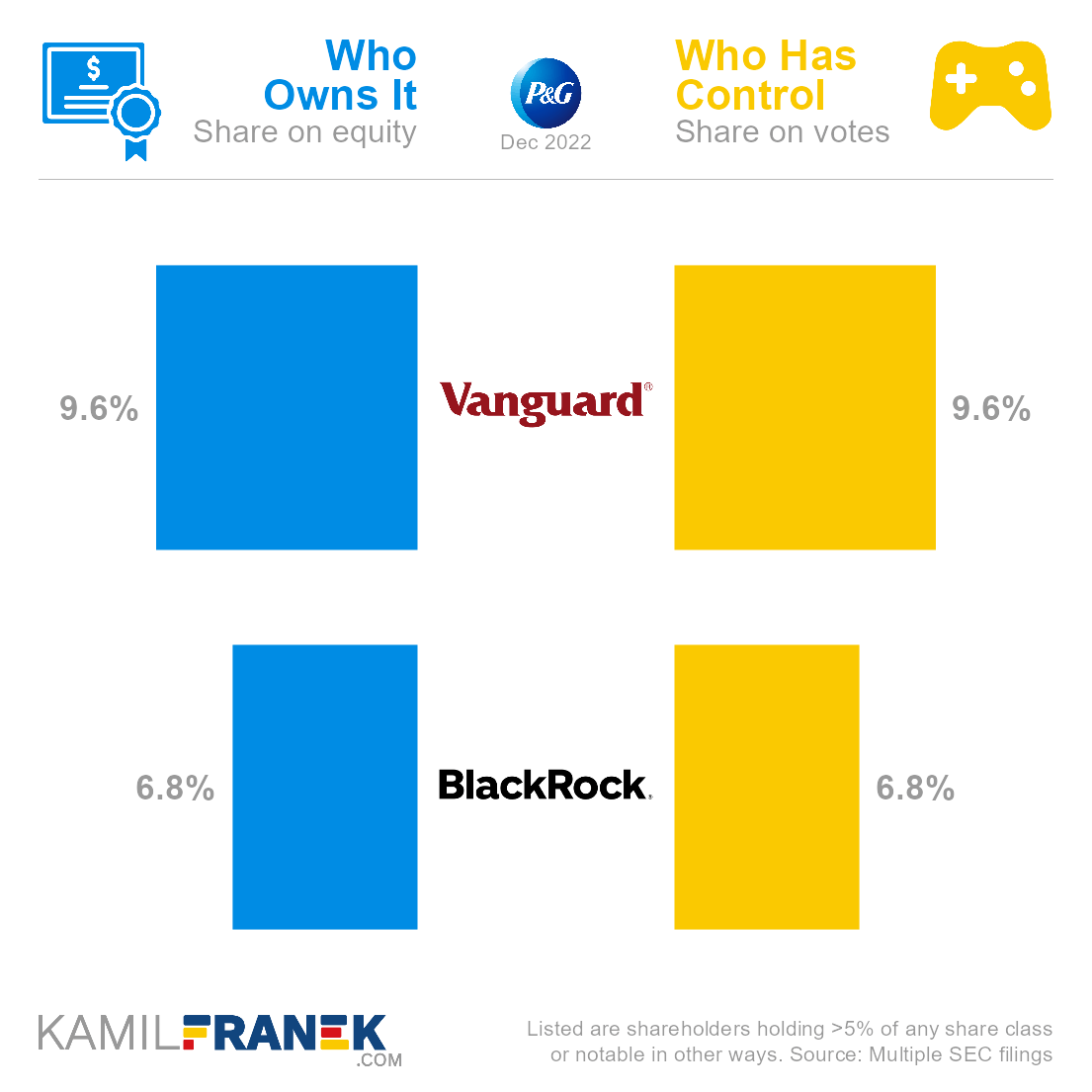

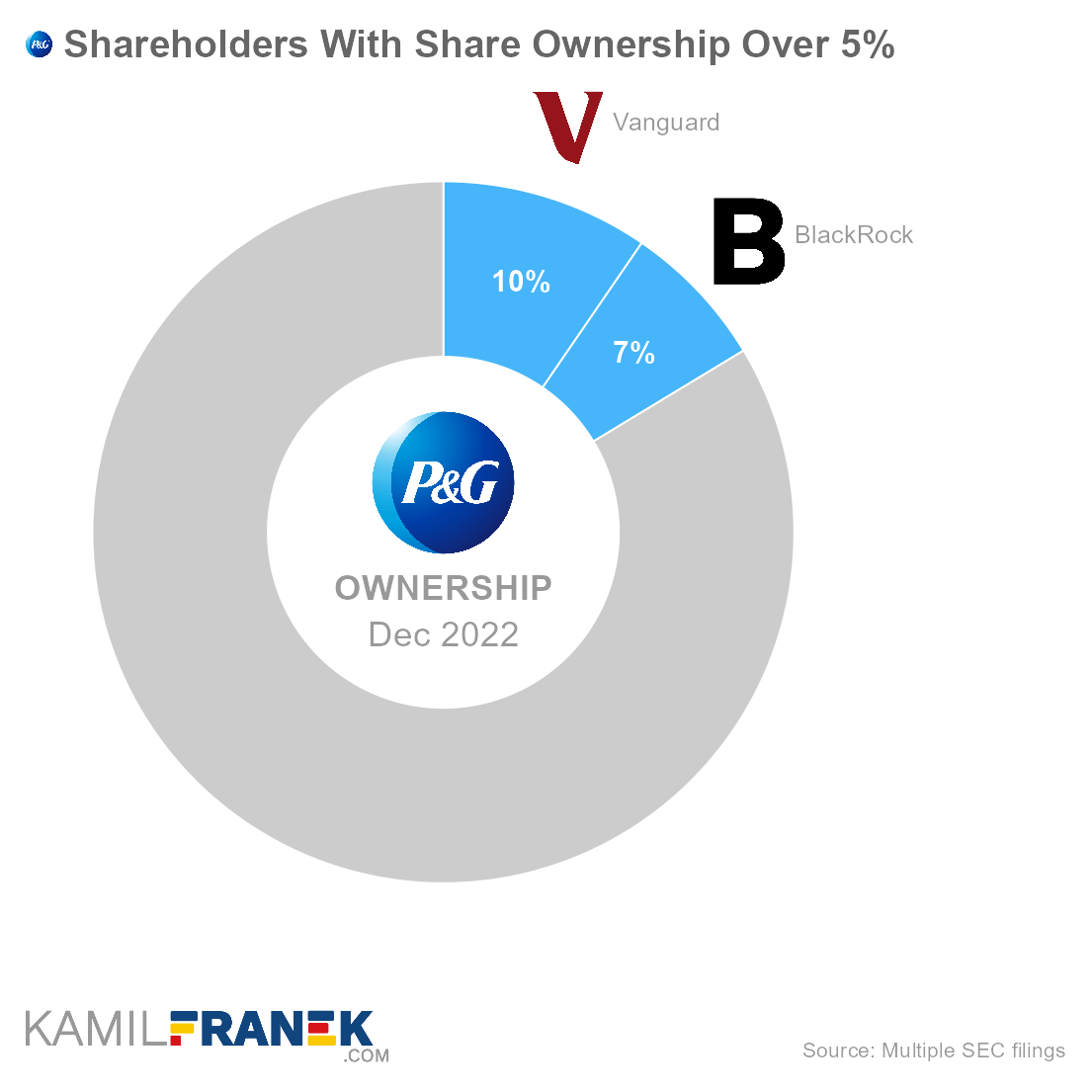

Procter & Gamble’s largest shareholders are asset managers giants Vanguard, which owns 9.6% share, and BlackRock, with 6.8% ownership. No other shareholder owns more than 5% of the company, and ownership is quite dispersed.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Vanguard | 9.6% | 9.6% | |

| BlackRock | 6.8% | 6.8% | |

| Other | 83.7% | 83.7% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Procter & Gamble and who controls it. I will show you who Procter & Gamble’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Johnson & Johnson, Tesla, Nestlé, and other articles in my “Who Owns Who” series.

📃 Who Owns Procter & Gamble?

Procter & Gamble is primarily owned by asset managers. The largest ones are Vanguard, which owns 9.6% of the company, followed by asset manager giant BlackRock with a 6.8% ownership share. No other shareholders own over 5% of the company.

- Procter & Gamble’s ownership is dispersed, and no shareholder has dominant ownership in the company.

- The largest owners of Procter & Gamble are asset managers who are not ultimate owners but invest money on behalf of their clients.

- Vanguard and BlackRock are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies with dispersed ownership.

- Vanguard and BlackRock portfolios are so huge that even if they spread it out across thousands of companies, they still belong to the main shareholders in many of them.

Between 2005 and 2016, Procter & Gamble had another famous shareholder. Warren Buffett’s company Berkshire Hathaway had a sizable stake in those years but exchanged its stake in 2016 for ownership of Duracell.

- Interestingly, although Berkshire Hathaway has owned P&G since 2005, it did not purchase it outright. Its stake resulted from Gillette’s acquisition by Procter & Gamble. Berkshire Hathaway was a sizable shareholder of Gillette at the time.

- Gillette’s acquisition was paid in stocks, so Berkshire Hathaway ended up owning a stake in Procter & Gamble since then.

- In 2016, P&G sold Duracell to Berkshire Hathaway in exchange for P&G shares that Berkshire owned. The sale was the result of P&G’s attempt to streamline its operations and focus only on the most important brands.

Procter & Gamble was founded in 1837 by William Procter and James Gamble and has been a public company since 1890. It is currently traded on NYSE under ticker ticker PG.

- The company started as a business making and selling soap and candles and grew into one of the world’s largest consumer goods companies renowned for household names like Tide, Pampers, and Crest.

- For a while, Procter & Gamble was a family-run company. Both son and grandson of co-founder William Procter served as company presidents, and the son of James Gamble served as vice president.

- Today, the founders’ descendants have no influence over the company.

The Procter & Gamble Company is incorporated in the State of Ohio, and its headquarters are in Cincinnati, Ohio (US).

🎮 Who Controls Procter & Gamble (PG)?

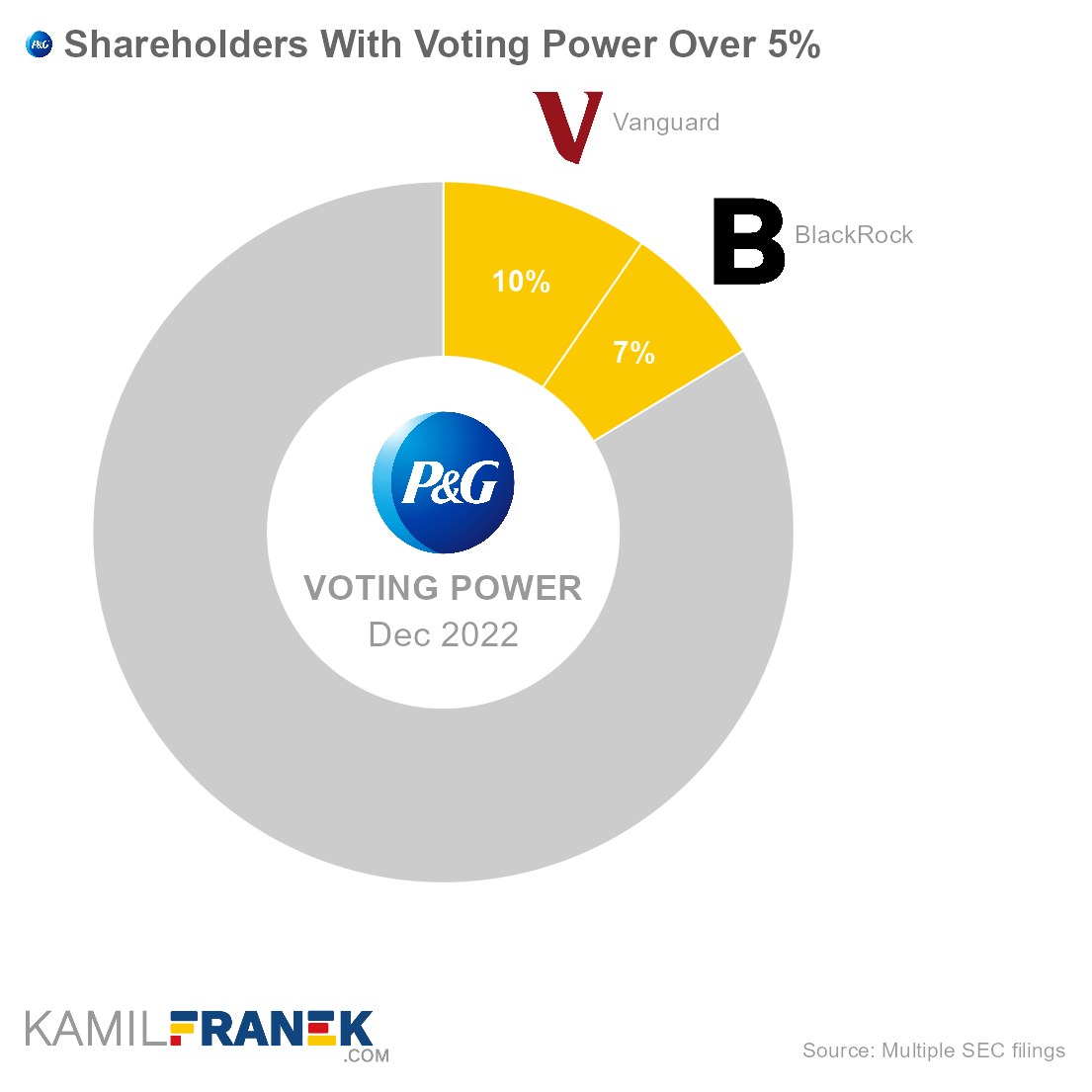

Procter & Gamble’s shareholders with the largest voting power are asset manager giant Vanguard, which holds 9.6% of all votes, followed by asset manager giant BlackRock with 6.8% voting power.

Procter & Gamble has only one class of outstanding shares, with one vote per share. Therefore, there is no difference between the shareholder’s ownership and voting power.

The ownership of The Procter & Gamble Company is quite dispersed, and the main shareholders are asset managers investing money on behalf of their clients.

- None of them control the company individually, but together they have a big influence.

- They are not ultimate owners of those shares but have significant voting power over a large part of the shares they hold.

- Voting power gives asset managers the influence to endorse or oppose resolutions and shape the company’s governance practices and decisions.

Procter & Gamble’s dispersed ownership structure dominated by asset managers creates conflicts of interest between Procter & Gamble’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent. In situations like these, insiders of the company hold significant power over it.

Procter & Gamble’s insiders that have influence over the company are CEO and chairman Jon Moeller and other board members and executives.

- Procter & Gamble has a 13-member board of directors reelected annually.

- The board of directors includes several CEOs of other large businesses. The director is, for example, Chris Kempczinski, CEO of McDonald’s, or Raj Subramaniam, CEO of FedEx.

- Jon Moeller became CEO only in 2021 when he replaced David Taylor.

- Nobody from the board of directors or executive officers holds more than 0.05% of Procter & Gamble’s shares. Even CEO’s ownership is very low relative to annual compensation.

- Despite CEO’s low ownership, the lack of other large shareholders, except asset managers, gives the CEO a large influence over the company.

- The usual majority of votes needed at the shareholder meeting is 50%+, but an 80% majority is needed in case of acquisition or divestment to anyone already holding 5% or more of the company. The 80% rule is not applied if 2/3 of the board approves the deal beforehand.

🗳️ Breakdown of Procter & Gamble’s Outstanding Shares and Votes by Top Shareholders

The Procter & Gamble Company had a total of 2,359 million outstanding shares as of December 2022. The following table shows how many shares each Procter & Gamble’s large shareholder holds.

|

|

||||

| In millions of shares as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 226 | 226 | 9.6% | |

| BlackRock | 160 | 160 | 6.8% | |

| Other | 1,974 | 1,974 | 83.7% | |

| Total (# millions) | 2,359 | 2,359 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

There were 2,359 million votes distributed among shareholders of The Procter & Gamble Company. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | 226 | 226 | 9.6% | |

| BlackRock | 160 | 160 | 6.8% | |

| Other | 1,974 | 1,974 | 83.7% | |

| Total (# millions) | 2,359 | 2,359 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Procter & Gamble’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in The Procter & Gamble Company worth.

However, keep in mind that a stake in Procter & Gamble could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

||||

| Market value in billions $ as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Vanguard | $34.2 | $34.2 | 9.6% | |

| BlackRock | $24.2 | $24.2 | 6.8% | |

| Other | $299.1 | $299.1 | 83.7% | |

| Total ($ billions) | $357.6 | $357.6 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

Let’s now look at each Procter & Gamble shareholder individually.

📒 Who Are Procter & Gamble’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of The Procter & Gamble Company one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Procter & Gamble worth.

#1 Vanguard (9.6%)

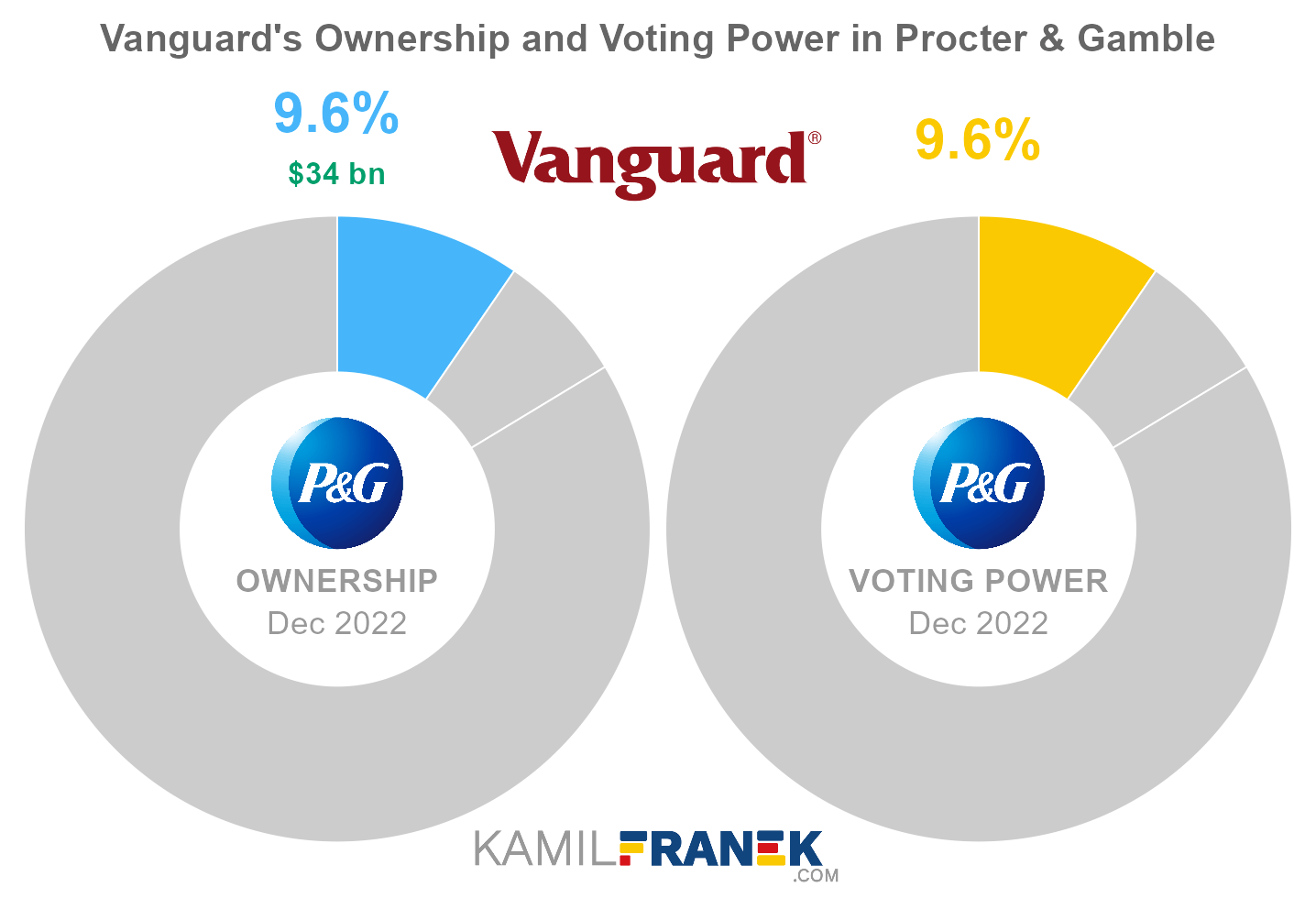

Vanguard is the largest shareholder of Procter & Gamble, owning 9.6% of its shares. As of December 2022, the market value of Vanguard’s stake in Procter & Gamble was $34.2 billion.

Vanguard owned 226 million shares in Procter & Gamble and controlled 226 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

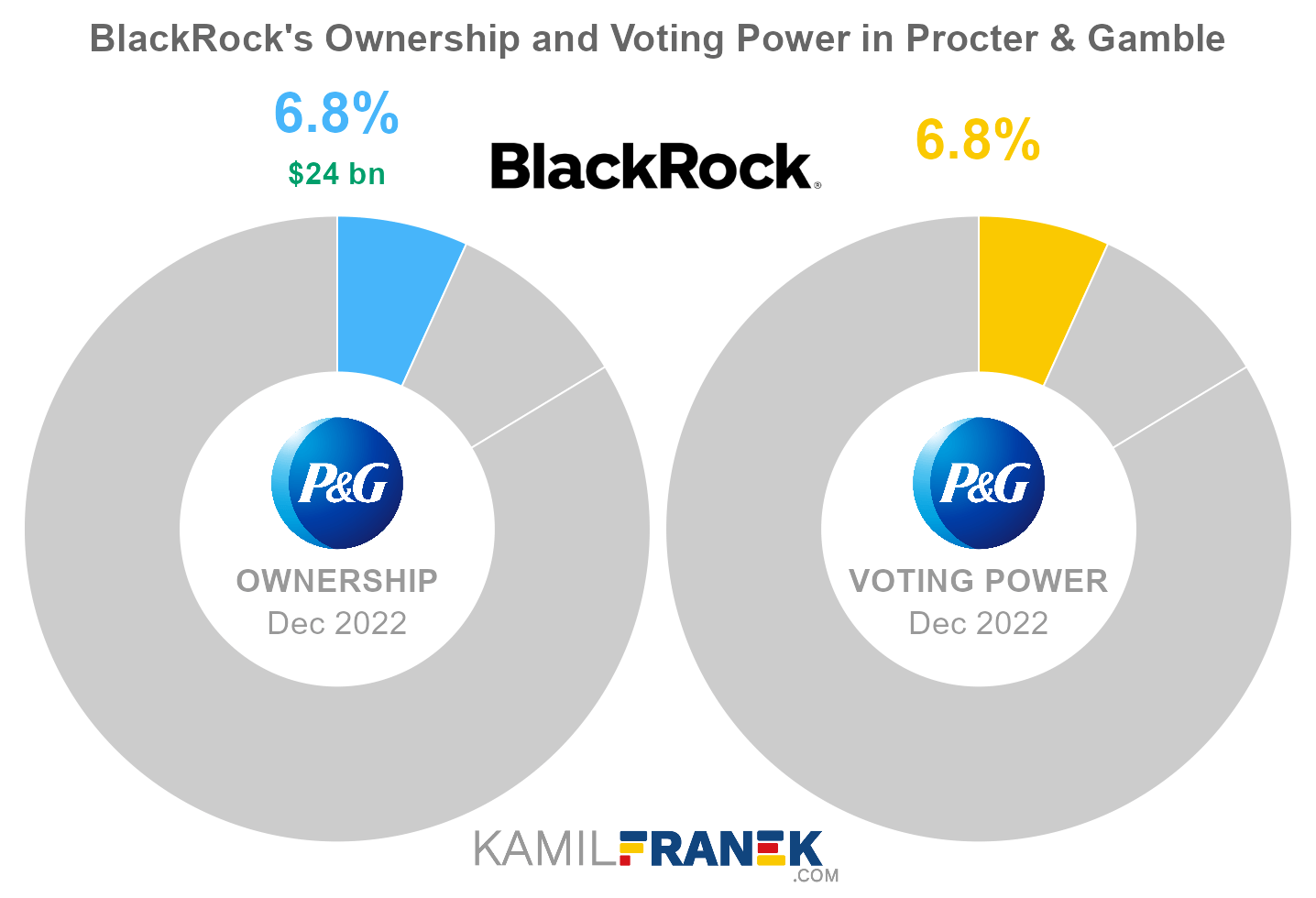

#2 BlackRock (6.8%)

BlackRock is the second-largest shareholder of Procter & Gamble, owning 6.8% of its shares. As of December 2022, the market value of BlackRock’s stake in Procter & Gamble was $24.2 billion.

BlackRock owned 160 million shares in Procter & Gamble and controlled 160 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

🧱 Who and When Founded Procter & Gamble?

Procter & Gamble was founded in 1837 by William Procter and James Gamble as a business with soap and candles. Still, it grew into one of the world’s largest consumer goods companies renowned for household names like Tide, Pampers, and Crest.

The two co-founders had different backgrounds, Procter was a skilled candle maker, and Gamble was a soap maker. They joined their forces at the suggestion of their father-in-law, Alexander Norris.

In 1879, James Norris Gamble, son of co-founder James Gamble, achieved a breakthrough with the creation of Ivory Soap, a single bar that revolutionized the realms of laundry and bathing.

In 1890, the company inaugurated its first laboratory at the Ivorydale facility, employing a talented team of young men and women.

Leadership transitions continued to shape Procter & Gamble’s evolution. In 1890, William Alexander Procter assumed the role of president, while his son, William Cooper Procter, took charge as the general manager.

Under the stewardship of William Cooper Procter, who ascended to the presidency in 1907, Procter & Gamble solidified its status as an industry titan.

Over time, the descendants of the founders ceded ownership and control of Procter & Gamble. While many proud descendants of the company founders are alive today, their influence has diminished.

This was recently highlighted when descendants sent an open letter expressing concerns about the company’s environmental impact. Their request for a meeting with the CEO was declined, underscoring that their influence on the company is no different than that of any other person.

📅 Procter & Gamble’s History Timeline

These are selected events from Procter & Gamble’s history:

1820s-1890s

- 1828: James Gamble manufactured soap on his own.

- 1830: Procter arrives in the United States and begins to manufacture candles in New York City.

- 1833: William Procter marries Olivia Norris after his first wife died a year earlier, and James Gamble married her sister Elizabeth. Gamble and Procter became brothers-in-law.

- 1833: William Alexander Proctor, son of founder William Procter was born.

- 1837: Brothers-in-law William Procter and James Gamble established the Procter & Gamble Company at the suggestion of his father-in-law Alexander Norris.

- 1862: William Cooper Procter, grandson of the company founder, was born.

- 1879: James Norris Gamble, son of founder James Gamble creates an innovative single bar of soap that works for both laundry and bathing purposes, named Ivory Soap.

- 1883: William Cooper Procter started to work at Procter & Gamble.

- 1884: Co-founder William Procter dies.

- 1890 Company was established as a New Jersey corporation.

- 1890: R&D quickly becomes a critical function at P&G, and our first lab is added to the Ivorydale facility, employing a staff of several hundred young men and women.

- 1890: William Alexander Procter became president of Procter & Gamble, and his son William Cooper Procter became general manager.

- 1891: Co-founder James Gamble died.

1900s

- 1907: The company re-incorporated in Ohio.

- 1907: William Cooper Procter became the president of Procter & Gamble.

1910s

- 1911: Procter & Gamble began producing Crisco, a shortening made of vegetable oils instead of animal fats.

1920s

- 1924: D. Paul “Doc” Smelser, a Ph.D. economist from Johns Hopkins University, collects statistical data breaking out consumers by income and background, making us the first company to conduct deliberate, data-based market research with consumers.

1930s

- 1930: Procter & Gamble acquired Thomas Hedley Co., based in Newcastle upon Tyne, England, becoming an international corporation.

- 1932: Procter & Gamble introduced “The Puddle Family Radio Show,” the first “soap opera,” so called because of the sponsor.

- 1932: James Norris Gamble died.

- 1934: William Cooper Procter died.

1940s

- 1946: The lead researcher secretly works on the product in his spare time for 7 years. By 1946, he had created Tide, which was introduced as “The Washday Miracle” and cleans better than anything on the market.

- 1947: Procter & Gamble introduced Prell shampoo.

- 1949: California dentist invents Oral-B toothbrushes using soft nylon bristles out of concern for his patients’ gums. Oral-B has grown to become one of the largest global brush brands.

- 1949: Procter & Gamble introduced Joy, the first liquid synthetic detergent.

1950s

- 1955: Procter & Gamble began selling the first toothpaste to contain fluoride, known as Crest.

- 1957: Procter & Gamble purchased Charmin paper mills and began manufacturing toilet paper and other tissue paper products.

1960s

- 1960: Procter & Gamble began making Downy fabric softener.

- 1961: Procter & Gamble scientists discovered Pyrithione Zinc, an ingredient that reduces dandruff, leading to the introduction of Head & Shoulders, that quickly became one of P&G’s biggest brands.

- 1961: A P&G researcher developed a better and more affordable disposable diaper, leading to the advancement of Pampers, moving from pins to tapes, becoming thinner and more cloth-like, and designed for babies at every stage of development.

1970s

- 1973: P&G acquires Bounce technology to deliver fabric softener in the form of dryer sheets as a fresh alternative to liquid fabric softeners.

1980s

- 1980: Procter & Gamble voluntarily recalled its Rely brand of tampons from the market due to its association with toxic shock syndrome

1990s

- 1994: Procter & Gamble made headlines for big losses resulting from leveraged positions in interest rate derivatives and subsequently sued Bankers Trust for fraud.

2000s

- 2002: P&G was sued for suggesting that the drug Prilosec could cure heartburn in a day

- 2005: Procter & Gamble acquired Gillette for $57 billion in stocks, forming the largest consumer goods company and placing Unilever in second place. Berkshire Hathaway, a shareholder of Gillette, becomes a shareholder of Procter & Gamble.

- 2009: Warner Chilcott bought P&G’s prescription-drug business.

2010s

- 2011: P&G was fined €211.2 million by the European Commission for establishing a price-fixing cartel for washing powder in Europe

- 2013: P&G was found by a World Intellectual Property Organization panel to have engaged in reverse domain hijacking in an attempt to obtain the domain name “swash.com”

- 2014: Procter & Gamble sold its Iams pet food business to Mars, Inc. for $2.9 billion.

- 2014: Procter & Gamble announced it was streamlining the company, dropping around 100 brands and concentrating on the remaining 65, which were producing 95% of the company’s profits.

- 2015: Procter & Gamble announced the sale of 43 of its beauty brands to Coty, a beauty-product manufacturer, in a US$13 billion deal.

- 2016: Procter & Gamble completed the transfer of Duracell to Berkshire Hathaway through an exchange of its own shares Berkshire Hathaway held.

- 2018: Procter & Gamble completed the acquisition of the consumer health division of Merck Group for €3.4 billion ($4.2 billion) and renamed it Procter & Gamble Health Limited in May 2019.

- 2019: Procter & Gamble unveiled a simpler corporate structure with six business units.

📚 Recommended Articles & Other Resources

Who Owns Tesla: The Largest Shareholders Overview

Overview of who owns Tesla and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Eli Lilly: The Largest Shareholders Overview

Overview of who owns Eli Lilly and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Netflix: The Largest Shareholders Overview

Overview of who owns Netflix and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Lenovo: The Largest Shareholders Overview

Visual overview of who owns Lenovo and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Johnson & Johnson: The Largest Shareholders Overview

Overview of who owns Johnson & Johnson and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Procter & Gamble’s Annual Financials Statements (K-10)

- Procter & Gamble’s Proxy Statement

- Procter & Gamble’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.