Who Owns Mastercard: The Largest Shareholders Overview

Mastercard Incorporated (MA) is a payment processing giant that makes money by processing transactions for its members. It makes money mainly from fees facilitating payment transactions but partly from other value-added services. Let’s now look at who owns Mastercard and who controls it.

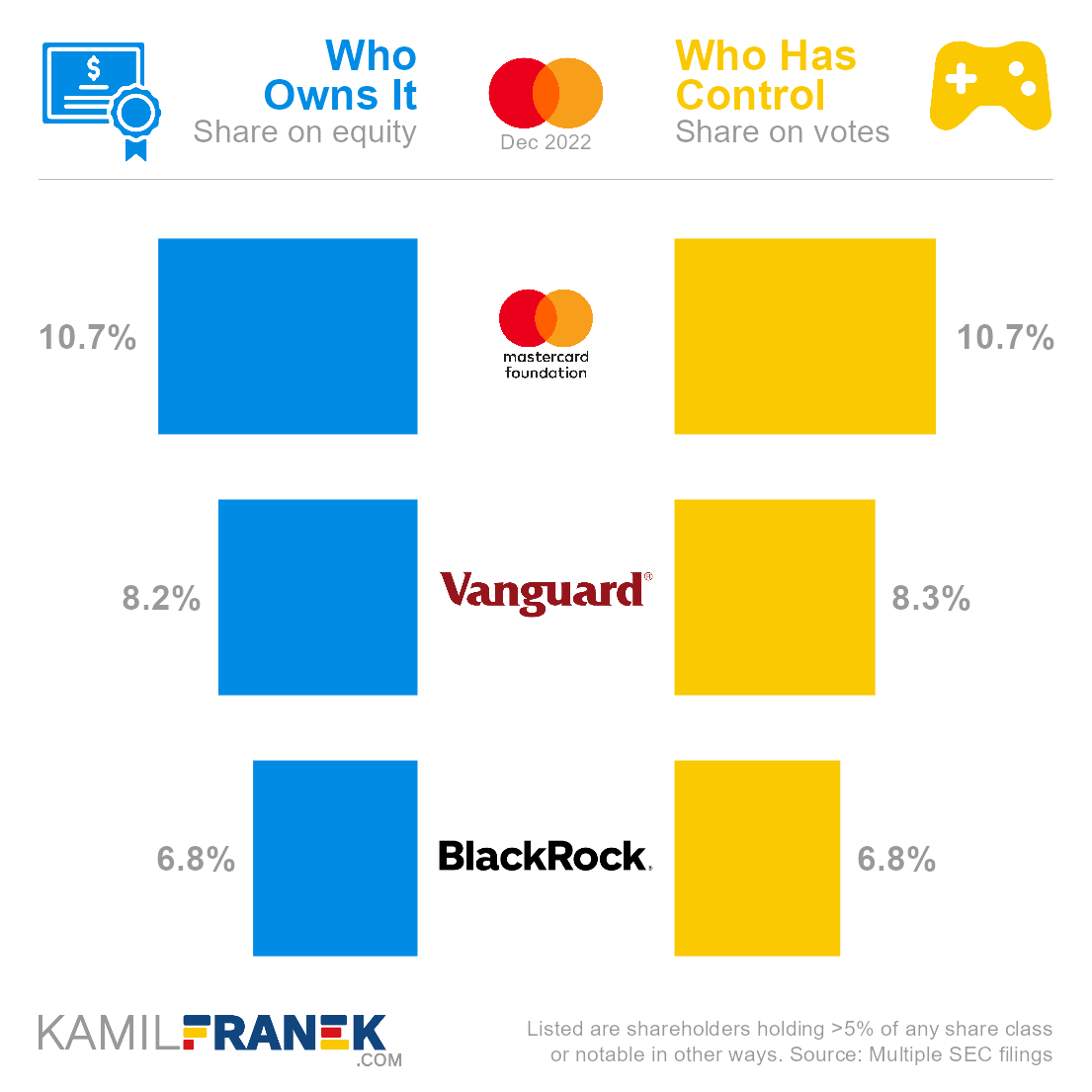

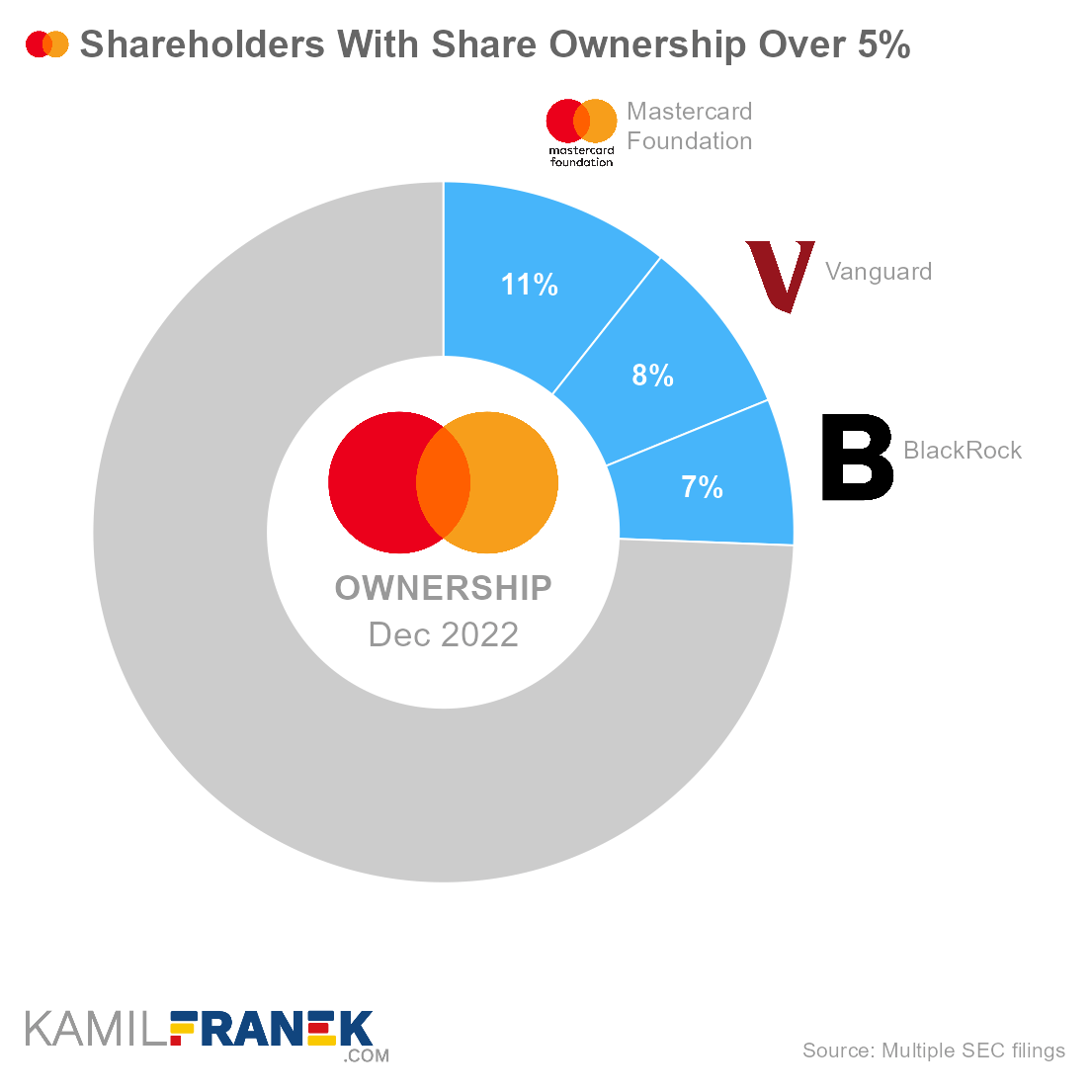

Mastercard’s largest shareholders are independently run Mastercard Foundation, which owns 10.7% share, followed by asset manager giant Vanguard (8.2%) and asset manager giant BlackRock (6.8%).

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Mastercard Foundation | 10.7% | 10.7% | |

| Vanguard | 8.2% | 8.3% | |

| BlackRock | 6.8% | 6.8% | |

| Other | 74.4% | 74.2% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||

In this article, I will dive more into who owns Mastercard and who controls it. I will show you who Mastercard’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like Visa, Alphabet (Google), Procter & Gamble, and other articles in my “Who Owns Who” series.

📃 Who Owns Mastercard?

Mastercard is owned by its shareholders. The largest ones are Mastercard Foundation, which owns 10.7% of the company, followed by asset manager giant Vanguard with 8.2% ownership share, and asset manager giant BlackRock with 6.8% ownership.

Let’s examine each top owner more closely, and I will share some additional interesting details about them.

The largest owner of Mastercard is the Mastercard Foundation, which owns 10.7% of the company.

- Mastercard Foundation shares the name with Mastercard but is an independently run, Canada-based foundation.

- Mastercard Foundation was established in 2006 through a donation of shares by the original shareholders of Mastercard before it went public.

- Although Mastercard Foundation is independent of Mastercard Inc., it owns Mastercard stock solely and cannot freely sell them until 2027, except to cover its operational needs.

The second and third largest Mastercard owners are asset management giants Vanguard, which owns an 8.2% stake, and BlackRock, with a 6.8% ownership share.

- Vanguard and BlackRock are the largest asset managers worldwide, and it is common to see them among top shareholders in large public companies, especially if they lack other direct shareholders.

- Asset managers invest on behalf of investors of their funds.

Warren Buffett’s company Berkshire Hathaway is also a shareholder of Mastercard, but its stake in Mastercard represents less than 1% of its investment portfolio.

- Berkshire Hathaway also owns a competitor Visa in a similar amount.

Mastercard was founded in 1966 by an alliance of several banks and regional bankcard associations and has been publicly listed since its initial public offering in 2006. It is currently traded on NYSE under ticker MA.

- Mastercard was founded in 1968 as Interbank Card Association (ICA), which would later change its name to Mastercard.

- Before the company went public, its main shareholders were banks: JPMorgan Chase & Co (10%), Citigroup (9%), Bank of America (6%), and HSBC Holdings (5%).

- At the time of Mastercard’s initial public offering, a significant amount of shares was donated to the newly established Mastercard Foundation.

- Proceeds from the IPO were also used to buy back shares of original shareholders (banks).

- Mastercard International Inc. is a subsidiary of Mastercard Inc.

Mastercard Incorporated is incorporated in the State of Delaware (US), and its headquarters are in Purchase, New York (US).

🎮 Who Controls Mastercard (MA)?

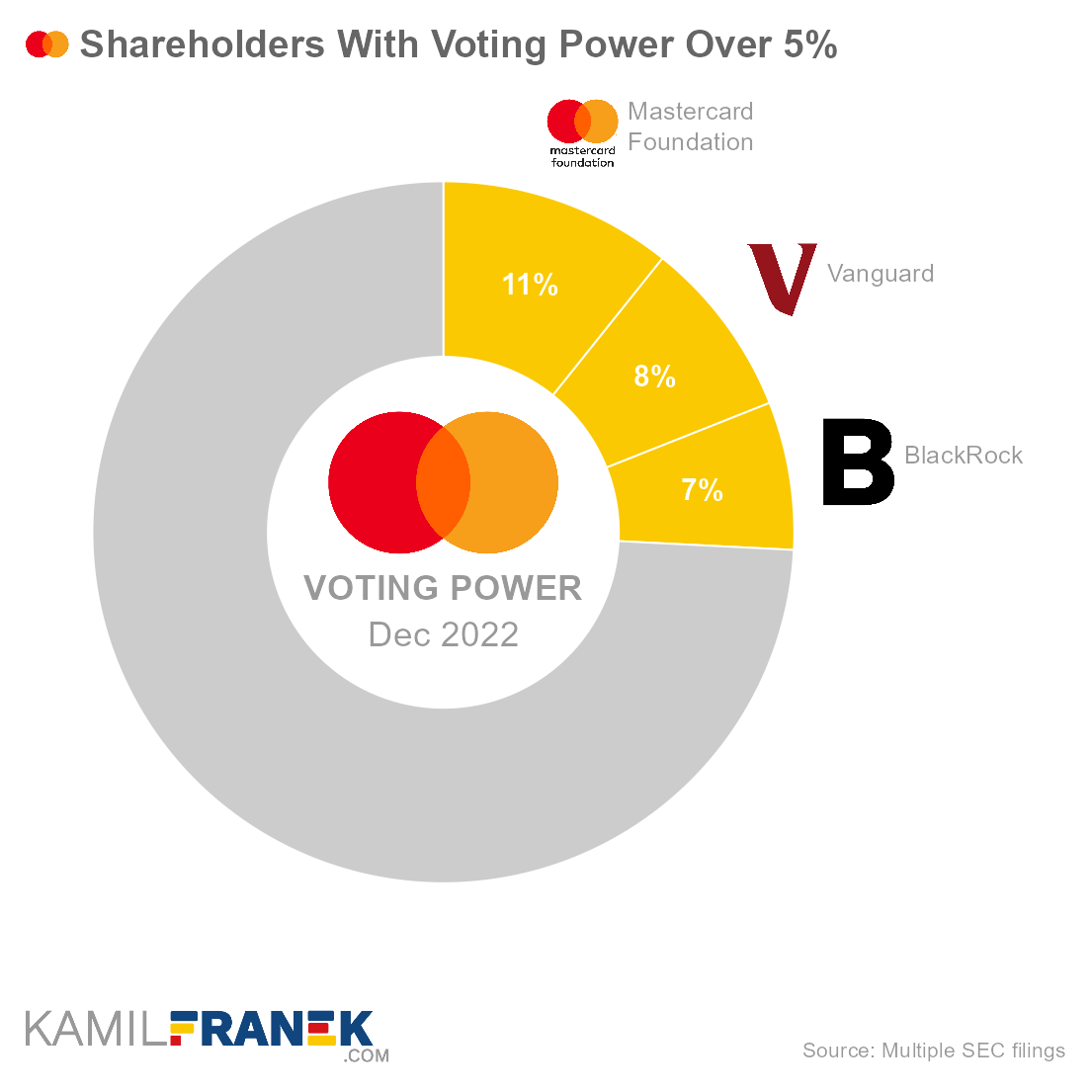

Mastercard’s shareholders with the largest voting power are Mastercard Foundation, which holds 10.7% of all votes, followed by asset manager giant Vanguard with 8.3% voting power, and asset manager giant BlackRock (6.8%).

The size of voting power is not fully equal to ownership because of the small amount of non-voting Class B shares that Mastercard has outstanding. However, the amount of Class B shares is so small that this difference is not significant.

- Class A shares are publicly traded under the MA ticker and have one vote per share. Anybody except Mastercard members or affiliate members can own them.

- Class B shares are not publicly traded and can be owned only by Mastercard members and affiliate members. Class B shares have the same economic rights as Class A shares, but they do not have voting rights.

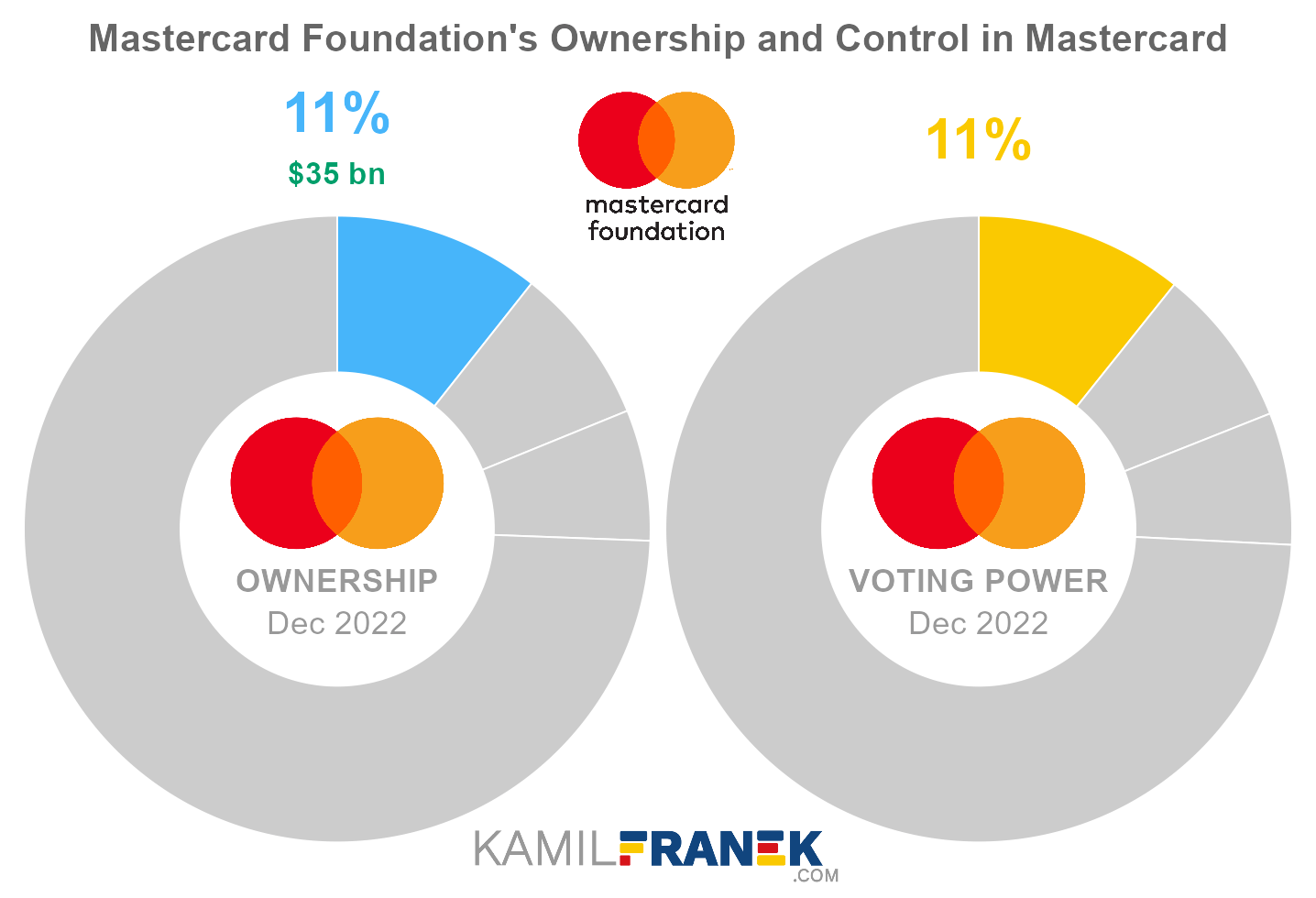

Mastercard’s shareholder with the largest voting power is the Mastercard Foundation which holds 10.7% of all votes.

- Mastercard Foundation is an independent organization but is expected to be supportive of Mastercard’s management proposal, weakening the influence of other shareholders.

- Foundation has its whole portfolio tied in Mastercard stocks until 2027.

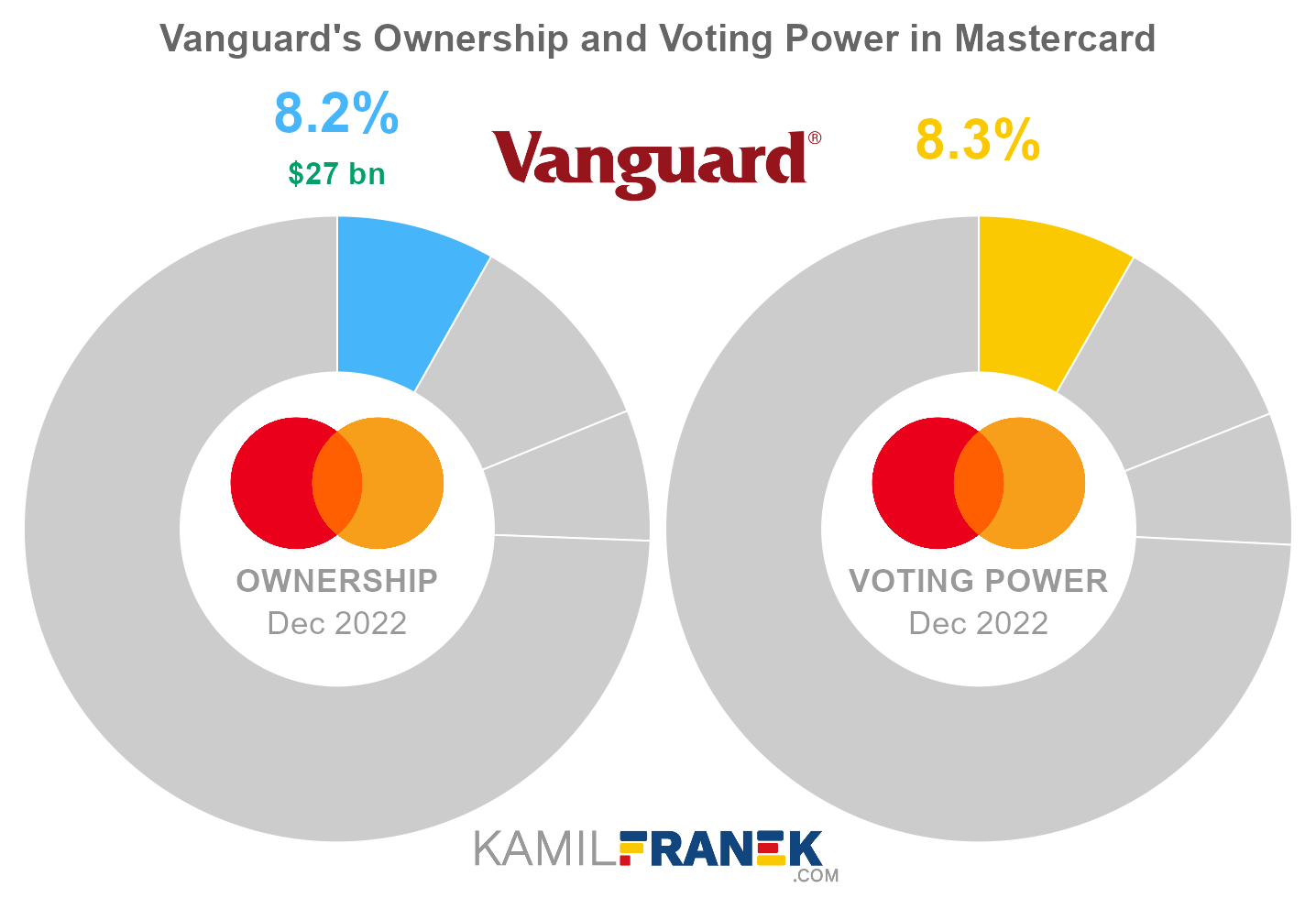

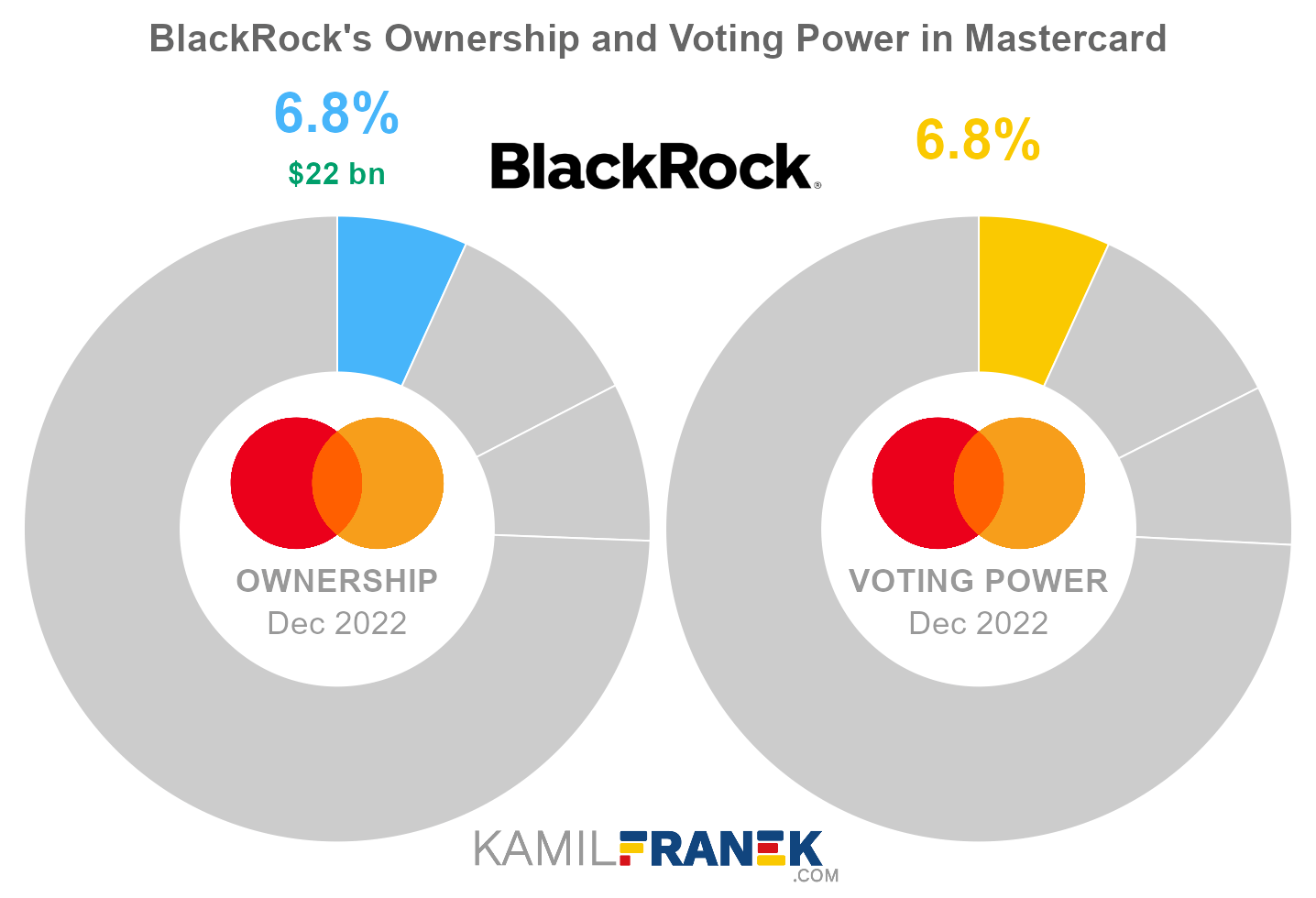

Mastercard’s shareholders with the second and third largest voting power are Vanguard (8.3%) and BlackRock (6.8%), which together hold 15.1% of all votes.

- They are not ultimate owners of those shares but have voting power over a large part of the shares they hold.

- Voting power gives asset managers the influence to endorse or oppose resolutions and shape the company’s governance practices and decisions.

- Significant ownership by large asset managers that usually support management proposals creates conflicts of interest between Mastercard’s management, asset manager’s management, and the ultimate underlying investors that asset managers represent.

None of the top shareholders has individual control over the company. The top three shareholders together represent 25.8% of the voting power.

- All of the top shareholders have in common that they will probably act in line with the company insiders and support their proposals.

Mastercard’s articles of incorporation and bylaws are full of protective clauses, making it harder for anyone to take over the company.

- For example, nobody can own more than 15% of the company.

- The company is incorporated in Delaware that has “default” anti-takeover measures implemented by law. Mastercard opted out of these measures but implemented similar measures directly in its articles of incorporation.

Mastercard’s insiders that have influence over the company are CEO Michael Miebach, chairman of the board Merit Janow, and other board members and executives.

- Mastercard has a 13-member board of directors reelected annually, but until 2013 had board split into 3 groups with a three-year term.

- Nobody from the board of directors or executive officers holds more than 0.05% of Mastercard’s shares. Despite that, the lack of other large shareholders, except asset managers and Mastercard Foundation, gives insiders a large influence over the company.

🗳️ Breakdown of Mastercard’s Outstanding Shares and Votes by Top Shareholders

Mastercard Incorporated had a total of 956 million outstanding shares as of December 2022. The following table shows how many shares each Mastercard’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Mastercard Foundation | 101.9 | - | 101.9 | 10.7% | |

| Vanguard | 78.2 | - | 78.2 | 8.2% | |

| BlackRock | 64.6 | - | 64.6 | 6.8% | |

| Other | 703.7 | 7.6 | 711.3 | 74.4% | |

| Total (# millions) | 948.4 | 7.6 | 956.0 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

There were 948 million votes distributed among shareholders of Mastercard Incorporated. The table below shows the total number of votes for each large shareholder.

|

|

||||

| In millions of votes as of December 2022 | ||||

| Shareholder | Class A | Total | % Share | |

|---|---|---|---|---|

| Mastercard Foundation | 101.9 | 101.9 | 10.7% | |

| Vanguard | 78.2 | 78.2 | 8.3% | |

| BlackRock | 64.6 | 64.6 | 6.8% | |

| Other | 703.7 | 703.7 | 74.2% | |

| Total (# millions) | 948.4 | 948.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | ||||

Source: Multiple SEC filings Source: Multiple SEC filings |

||||

💵 Breakdown of Mastercard’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in Mastercard Incorporated worth.

However, keep in mind that a stake in Mastercard could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Mastercard Foundation | $35.4 | - | $35.4 | 10.7% | |

| Vanguard | $27.2 | - | $27.2 | 8.2% | |

| BlackRock | $22.5 | - | $22.5 | 6.8% | |

| Other | $244.7 | $2.6 | $247.3 | 74.4% | |

| Total ($ billions) | $329.8 | $2.6 | $332.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Multiple SEC filings Source: Multiple SEC filings |

|||||

Let’s now look at each Mastercard shareholder individually.

📒 Who Are Mastercard’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of Mastercard Incorporated one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in Mastercard worth.

#1 Mastercard Foundation (10.7%)

Mastercard Foundation is the largest shareholder of Mastercard, owning 10.7% of its shares. As of December 2022, the market value of Mastercard Foundation’s stake in Mastercard was $35.4 billion.

Mastercard Foundation owned 102 million shares in Mastercard and controlled 102 million shareholder votes as of December 2022.

The Mastercard Foundation was established in 2006 through a donation of shares by the original shareholders of Mastercard before it went public.

The Mastercard Foundation is based in Canada, and its focus is enabling young people in Africa and in Indigenous communities in Canada to access dignified and fulfilling work.

Mastercard Foundation operates independently from Mastercard but is still ompany’s largest shareholder.

#2 Vanguard (8.2%)

Vanguard is the second-largest shareholder of Mastercard, owning 8.2% of its shares. As of December 2022, the market value of Vanguard’s stake in Mastercard was $27.2 billion.

Vanguard owned 78 million shares in Mastercard and controlled 78 million shareholder votes as of December 2022.

Vanguard (The Vanguard Group) is one of the largest asset managers in the world. It manages other people’s money through its mutual funds and exchange-traded funds and also offers other related investing and financial planning services.

Vanguard differs from other large asset managers by having no actual “owner .” Officially Vanguard says that its investors own it since its funds own it, and Vanguard fund investors own those funds.

However, the actual decision power is in the hands of Vanguard’s insiders since the ownership is diluted over millions of investors worldwide.

Vanguard has significant influence over the largest public companies. Thanks to its size, Vanguard usually belongs to the largest shareholders in those companies and has considerable power at their shareholder meetings. This is especially true if ownership is diluted.

- Several terms were coined to describe this issue. Some call it asset manager capitalism, and popular is also the power of twelve. Financial Times even put together who exactly those twelve people might be.

- Evidence shows that big asset managers usually vote together with management.

#3 BlackRock (6.8%)

BlackRock is the third-largest shareholder of Mastercard, owning 6.8% of its shares. As of December 2022, the market value of BlackRock’s stake in Mastercard was $22.5 billion.

BlackRock owned 65 million shares in Mastercard and controlled 65 million shareholder votes as of December 2022.

BlackRock, Inc. is the world’s largest asset manager, with assets under management of $10 trillion. BlackRock is not only an asset manager, but it also provides other asset managers and corporations with its Aladdin portfolio management software.

BlackRock is a publicly traded company, and its largest shareholders are its competitors, including BlackRock itself. Not directly but through their passive and active funds. The largest shareholder is Vanguard.

A similar situation is also true in the opposite direction because BlackRock is a significant shareholder in many of its publicly traded competitors and other large institutions, making the whole thing even more eyebrow-raising.

This circular ownership between Vanguard, BlackRock, and other large asset managers, amplifies the issue often raised about the power of these large asset managers over public companies since they usually belong to the most significant shareholders with large voting power.

-

In the case of Blackrock, this influence is personified in the form of its CEO Larry Fink, who is a powerful figure with close ties to the FED and the US government.

-

Adding to these concerns is evidence that BlackRock and other asset managers usually vote in favor of management proposals.

❔ Who Owns Mastercard Foundation?

Nobody really owns Mastercard Foundation. It is an independent private foundation governed by its board of directors.

Mastercard Foundation was created when Mastercard Inc. went public in 2006 when the original Mastercard shareholder donated part of the capital raised during IPO to the Mastercard Foundation.

The thing that still links Mastercard Inc. and Mastercard Foundation, besides the name, is ownership of Mastercard stocks. Mastercard Foundation is the largest shareholder of Mastercard Inc., and its portfolio is concentrated only in Mastercard stocks.

This ownership is not by choice. The foundation cannot freely sell Mastercard shares until 2027. Until then, it can only sell a small amount each year to cover its operational and funding needs.

❔ Is Mastercard Owned by Banks?

Banks has some small ownership of Mastercard, but they are not significant shareholder since the company went public in 2006.

However, before 2006, banks were the main Mastercard shareholders. The largest stakes belonged to JPMorgan Chase & Co (10%) and Citigroup (9%).

🧱 Who and When Founded Mastercard?

Mastercard was founded in 1968 as a response to the emergence of BankAmericard issued by the Bank of America. A group of banks joined forces to establish the Interbank Card Association (ICA), which would later become known as Mastercard.

The collaborative efforts of these financial institutions laid the foundation for what would become one of the leading global payment networks.

Over the years, Mastercard has evolved and gained prominence in the payment business. In 1979, the Interbank Card Association underwent a rebranding and adopted the name “MasterCard International.

Presently, Mastercard and its main competitor, Visa, are viewed as a duopoly, jointly controlling a dominant share of the payment market.

However, their dominance has not been without scrutiny. Various regulatory actions and legal battles have shed light on market power abuse by both Visa and Mastercard. Settled and lost cases throughout the years have provided evidence of the misuse of their influential positions within the industry.

📅 Mastercard’s History Timeline

These are selected events from Mastercard’s history:

1950s

- 1958: Bank of America started its BankAmericard credit card program.

1960s

- 1966: Interbank Card Association (ICA) was formed by a group of banks to compete with Bank of America’s BankAmericard (Visa).

- 1968: ICA formed an association with Banco Nacional in Mexico. Later that year, they formed an alliance in Europe with Eurocard.

1970s

- 1970: Competing BankAmericard became independent of Bank of America, and National BankAmericard Inc. was formed (later renamed to VISA).

- 1973: ICA establishes a centralized computer network that links merchants with financial institutions for credit card authorizations.

- 1974: ICA introduces a magnetic strip on the back of cards to increase authorization efficiency and reduce fraud.

- 1979: ICA is renamed to MasterCard International, and Master Charge is renamed MasterCard.

1980s

- 1983: Mastercard becomes the first bank to use holograms as part of their card security.

- 1985: Mastercard acquires the Cirrus ATM network

- 1987: The first MasterCard card was issued in the People’s Republic of China.

- 1988: The first MasterCard card was issued in the Soviet Union.

1990s

- 1991: MasterCard partners with Europay International to introduce Maestro, a global online point-of-sale debit network.

- 1996: Merchants sued Mastercard and VISA in federal court for using their dominance in the credit card market to exact excessive fees when customers use debit cards. Merchants were demanding multi-billion dollars in damages. Mastercard settled this case in 2003.

- 1997: Mastercard takes over the Access card, and the Access brand is then retired.

- 1997: Mastercard was the main sponsor of the Mastercard Lola Formula One team, which withdrew from the 1997 Formula One season after its first race due to financial problems.

- 1997: MasterCard launches award-winning “Priceless” advertising campaign.

- 1998: The Department of Justice sues Mastercard and VISA over rules prohibiting their issuing banks from doing business with American Express or Discover. The Department of Justice won in 2001, and the verdict withstood appeal.

2000s

- 2001: MasterCard introduces MasterCard Advisors, offering professional advisory services to its members.

- 2002: Mastercard merged with Europay International and converted from a membership association to a private share corporation.

- 2003: Reserve Bank of Australia required that interchange fees be dramatically reduced from about 0.95% of the transaction to approximately 0.5%. Australia also prohibited the no-surcharge rule, a policy established by credit card networks.

- 2004: Mastercard Inc. paid damages to American Express due to anticompetitive practices that prevented American Express from issuing cards through U.S. banks and paid $1.8 billion for settlement.

- 2006: The company has an initial public offering.

- 2006: Mastercard shareholders gift company shares to create the Mastercard Foundation.

- 2006: MasterCard International changed its name to MasterCard Worldwide to suggest a more global scale.

- 2009: Mastercard agreed to reduce swipe fees to 0.2-0.3 percent to avoid regulatory actions by the European Union.

2010s

- 2010: Mastercard expands its e-commerce offering with the acquisition of DataCash, a UK-based payment processing and fraud/risk management provider.

- 2010: Mastercard and Visa reached a settlement with the U.S. Justice Department in another antitrust case.

- 2010: Mastercard and Visa blocked all payments to the whistleblowing platform WikiLeaks due to claims that they engaged in illegal activity. As a response, WikiLeaks backers hit MasterCard and Visa by cyber strike.

- 2012: Mastercard announces the expansion of its mobile contactless payments program, including markets across the Middle East.

- 2012: A class-action lawsuit was filed against Mastercard and Visa for alleged price-fixing practices employed by Mastercard and Visa.

- 2013: Mastercard was under investigation by the European Union for the high fees it charged merchants to accept cards issued outside the EU.

- 2014: Mastercard acquires Australia’s leading rewards program manager company Pinpoint.

- 2016: Mastercard introduced its new rebranding along with a new corporate logo. In addition, they changed their service name from “MasterCard” to “Mastercard.”

- 2017: Mastercard acquires Brighterion, a company with a portfolio of intellectual property in the areas of artificial intelligence and machine learning.

- 2018: Google reportedly bought access to Mastercard users’ credit card data and used it to track online advertisements to physical store sales.

- 2019: The European Commission imposed an antitrust fine of €570 million on Mastercard for “obstructing merchants’ access to cross-border card payment services.”

- 2019: A settlement of 5.54-$6.24 billion got preliminary approval for a class-action lawsuit against Mastercard and Visa for alleged price-fixing practices.

- 2019: Mastercard removed its name from its logo, leaving just the overlapping discs.

2020s

- 2021: Following an investigation by the British Payment Systems Regulator, Mastercard admitted liability for breaching competition rules in relation to pre-paid cards.

- 2021: The Reserve Bank of India (RBI) indefinitely barred Mastercard from issuing new debit or credit cards to domestic Indian customers for violating data localization and storage rules. Restrictions were lifted in 2022.

- 2022: Mastercard complies with United States sanctions and bans cards from being issued or used in Russia, including foreign cards from other countries. Mastercard suspended all business operations in Russia, which had accounted for 4% of their revenue.

📚 Recommended Articles & Other Resources

Who Owns Apple: The Largest Shareholders Overview

Overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Microsoft: The Largest Shareholders Overview

Overview of who owns Microsoft and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Amazon: The Largest Shareholders Overview

Overview of who owns Amazon.com, Inc. and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Johnson & Johnson: The Largest Shareholders Overview

Overview of who owns Johnson & Johnson and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns L’Oréal: The Largest Shareholders Overview

Overview of who owns L’Oréal and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns NVIDIA: The Largest Shareholders Overview

Overview of who owns NVIDIA and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

- Mastercard’s Annual Financials Statements (K-10)

- Mastercard’s Proxy Statement

- Mastercard’s Certificate of Incorporation

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.