Who Owns LVMH: The Largest Shareholders Overview

LVMH Moët Hennessy Louis Vuitton SE (PA: MC) is a French conglomerate selling luxury products across several segments and brands. It is active in several segments but makes money mainly from its “Fashion and Leather Goods”. Let’s now look at who owns LVMH and who controls it.

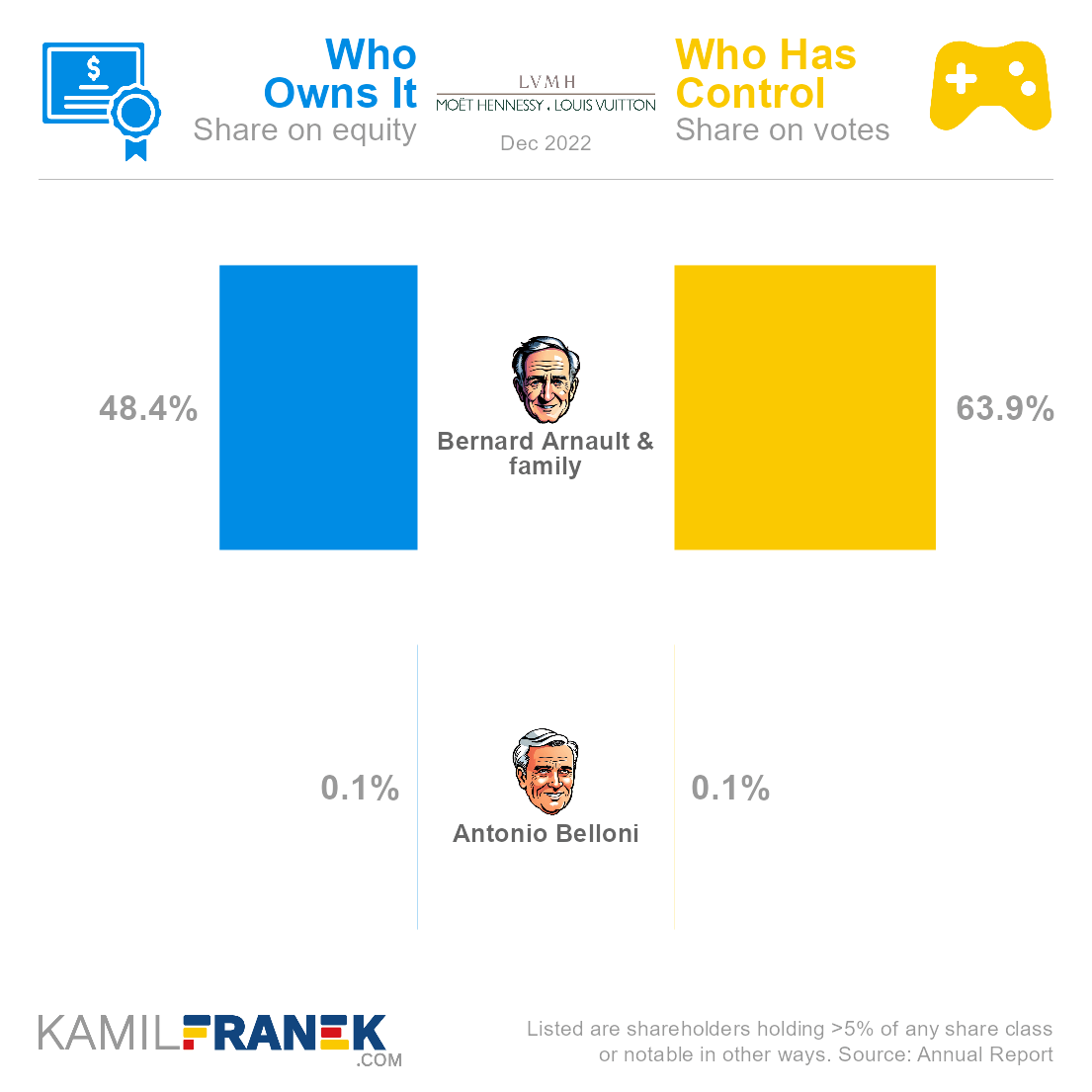

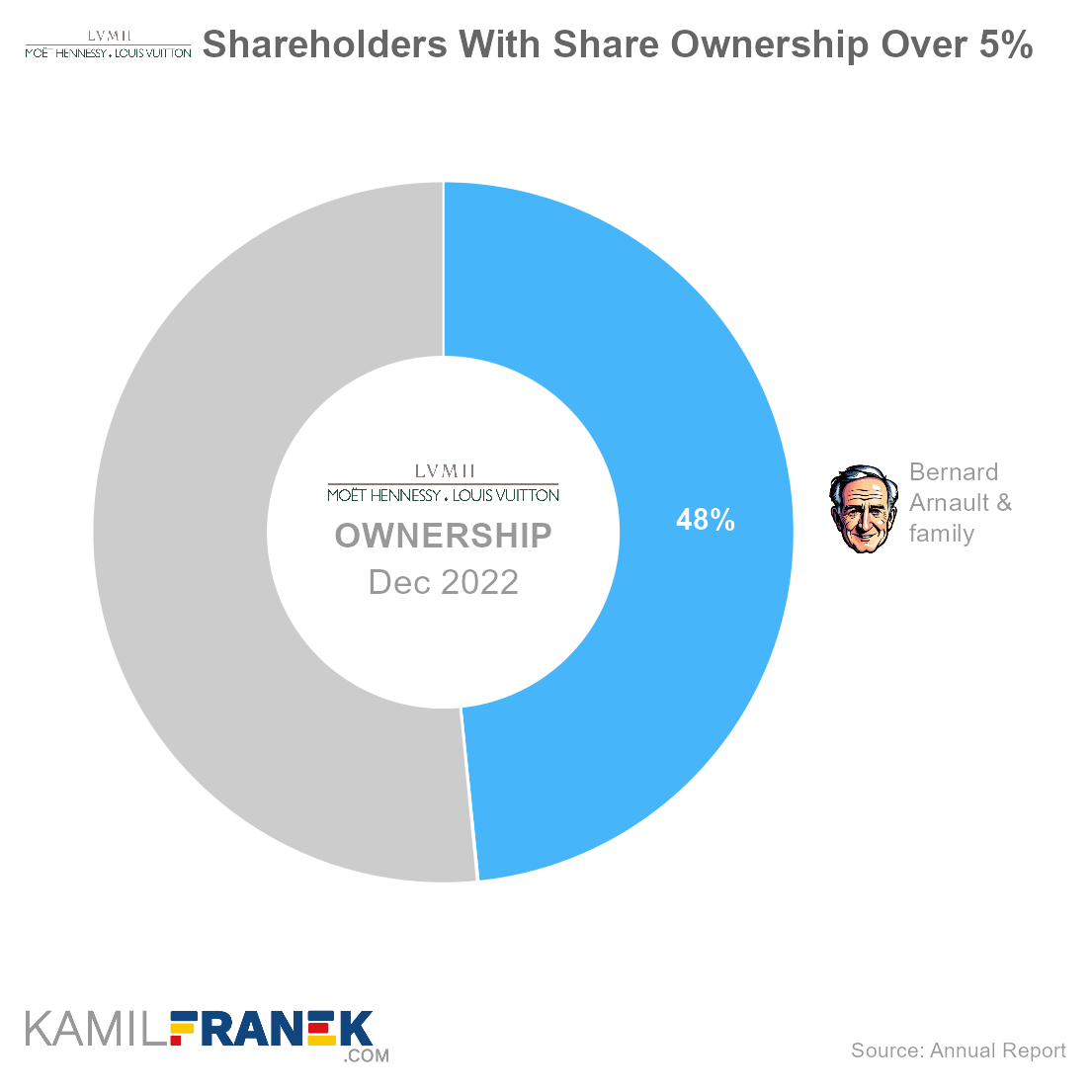

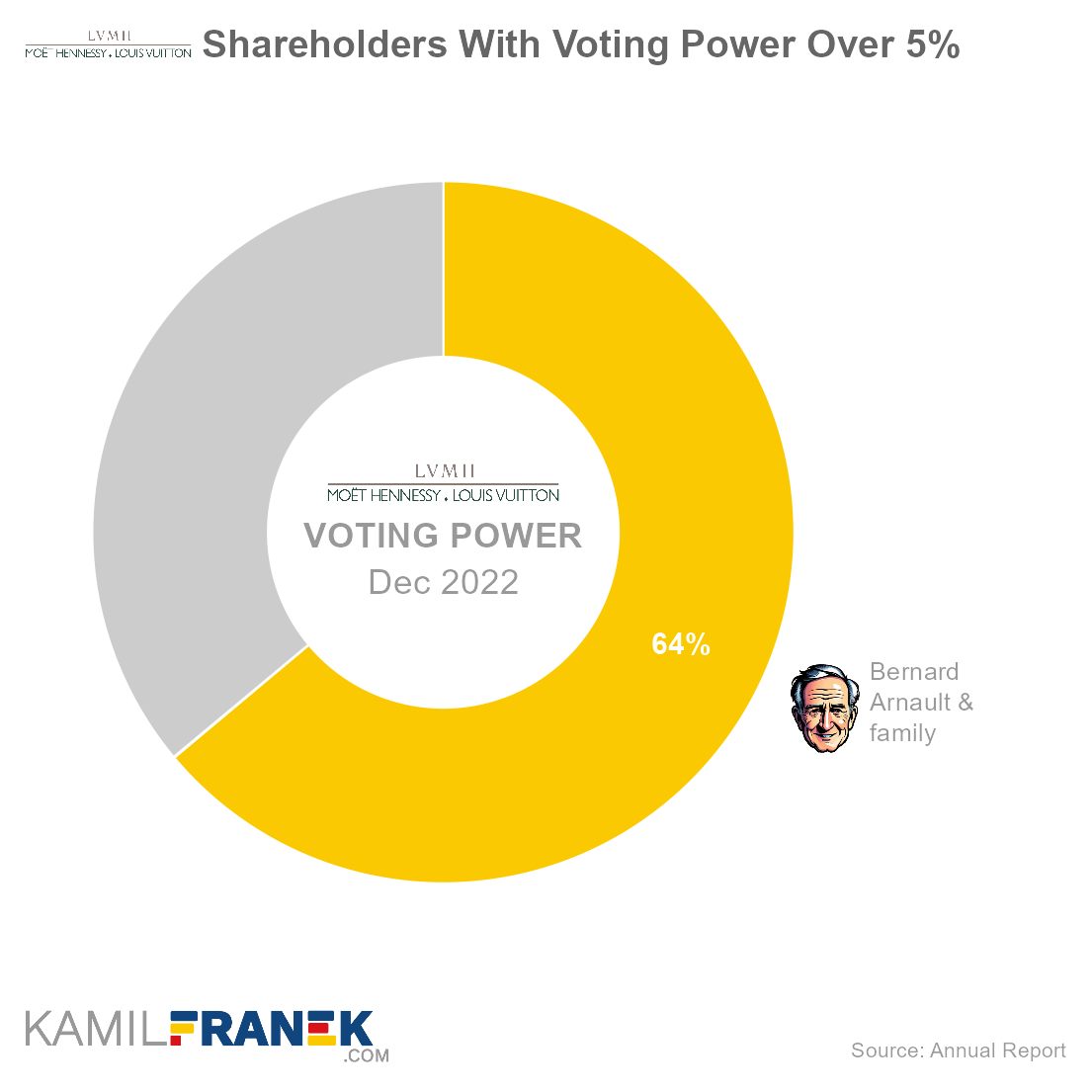

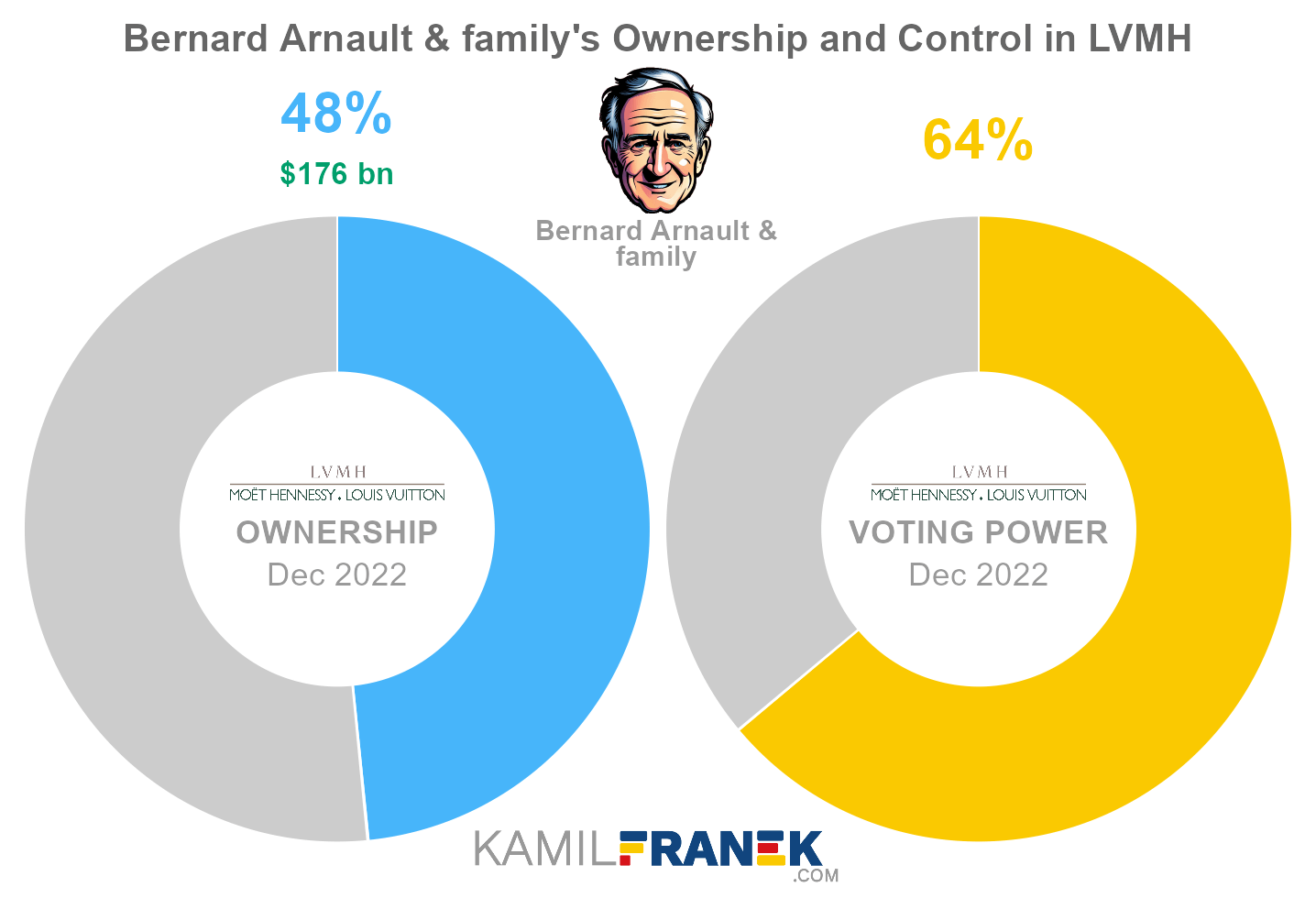

LVMH’s largest shareholder is mainly chairman and CEO Bernard Arnault and his family, who own 48.4% of the company. However, thanks to double voting rights, they hold 63.9% of all votes and fully control LVMH. The notable owner is also managing director Antonio Belloni with 0.1% ownership.

|

|

|||

| Shareholder | Ownership | Voting Power | |

|---|---|---|---|

| Bernard Arnault & family | 48.4% | 63.9% | |

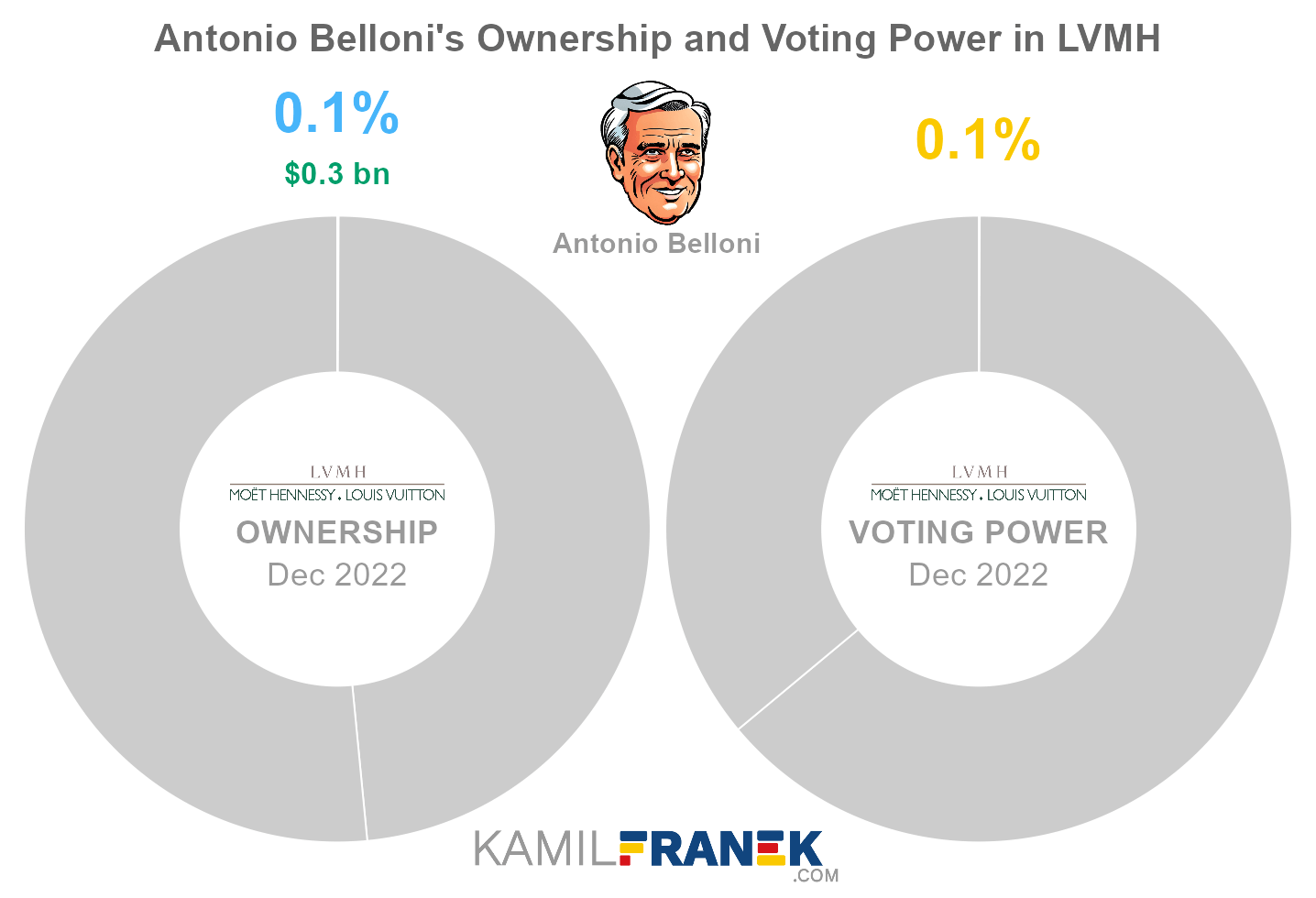

| Antonio Belloni | 0.1% | 0.1% | |

| Other | 51.5% | 36.1% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||

Source: Annual Report Source: Annual Report |

|||

In this article, I will dive more into who owns LVMH and who controls it. I will show you who LVMH’s largest shareholders are, how many shares and votes they have, and how much their stake is worth.

If you are interested, you can also explore who owns other companies like L’Oréal, Ferrari, Apple, and other articles in my Who Owns Who series of articles.

📃 Who Owns LVMH?

LVMH is owned mainly by Bernard Arnault and his family, who own 48.4% of the company. No other shareholders have a sizable stake in the company, and the rest of the ownership is dispersed. The notable owner is also LVMH managing director Antonio Belloni with a 0.1% ownership.

Let’s examine each top owner more closely, and I will share some additional interesting details about them.

The largest owner of LVMH is the Bernard Arnault & family, which owns 48.4% of the company.

- Arnault family is represented by Bernard Arnault, his wife, and his five children.

- Arnault family owns LVMH SE mainly through Christian Dior SE, which they nearly fully own. A smaller stake is owned directly by the family members and other entities under family control.

- Arnault family voting power is much higher than their ownership stake thanks to the French provision of double voting rights for long-term shareholders.

The notable owner is also LVMH managing director Antonio Belloni, which owns 0.1% of the company.

- Belloni’s stake is tiny when we look at it in percentages, but thanks to the company’s size, it is still worth hundreds of millions of USD.

- Belloni joined LVMH in 2001 after a long career at Procter & Gamble.

- His position is something like a “mini-CEO” of the company, although officially, it is called Group Managing Director.

LVMH was founded in 1987 by the merger of Moët Hennessy and Louis Vuitton and has been publicly listed since its initial public offering in 1990. It is currently traded on the Paris stock exchange under ticker PA: MC.

- Louis Vuitton was founded in 1854 by Louis Vuitton.

- Moët Hennessy was formed in 1971 through the merger of champagne producer Moët & Chandon (founded in 1743) and the cognac producer Hennessy (founded in 1765).

- However, LVMH, as we know it today, was born in 1987 through the merger of Louis Vuitton and Moët Hennessy.

- Bernard Arnault originally had only a small stake but was able just in a few years to take control of the company and merge it with the Christian Dior brand he had already acquired.

- A fun fact is that based on company ByLaws company should expire in the year 2115. This is a peculiarity of French law, where a company has to have an expiration date. But don’t worry since it can be prolonged.

LVMH Moët Hennessy Louis Vuitton SE is incorporated in France, and its headquarters are in Paris, France.

🎮 Who Controls LVMH (PA: MC)?

LVMH is controlled by its CEO Bernard Arnault and his family, which together hold 63.9% of all votes. Nobody else has a sizable voting power in the company.

As you can see, the size of voting power is not equal to ownership. The reason why certain shareholders, especially the Arnault family, have outsized voting power compared to their ownership stake is the French law that awards an extra vote per share for long-term shareholders.

- Although this double-voting provision is supposed to promote long-term shareholding, the reality is that these act as anti-takeover clauses.

- To gain double voting shares, one shareholder has to hold registered shares for 3 years. Transfer by inheritance does not reset the timer.

- This applies to all French companies unless they opt out of it in their bylaws/articles of incorporation.

LVMH’s shareholder with the largest voting power is Bernard Arnault and his family, which hold 63.9% of all votes. They own just 48.4% of the LVMH, but their voting power is boosted by default double-voting provision from French companies.

- Despite fully controlling the company thanks to double-voting rights, the Arnault family would be able to control the company even without it.

- Their stake would be enough to have a majority during shareholder meetings since not all votes are usually present.

LVMH’s insiders that have influence over the company is mainly CEO and chairman Bernard Arnault and to a lesser extent other board members and executives.

- LVMH has a 16-member board elected for a 3-year term, which is a common anti-takeover defense tactic.

- Shareholders select part of the Board of Director members, and the Group Works Council appoints part.

- Interestingly, each director, except for the employee nominated, has to own at least 500 shares throughout their term. If they do not own a minimum amount for 6 months, it means automatic resignation.

- The company has a 75 maximum age limit for the chairman and an 80 age limit for the CEO.

- Although Bernard Arnault is CEO, Antonio Belloni as Group Managing Director is something like a “mini” CEO position.

- Members of the board are also CEO’s son Antoine Arnault and his daughter Delphine Arnault.

- 2/3rd majority is needed to change company ByLaws, and it can be done only during extraordinary shareholder meetings.

🗳️ Breakdown of LVMH’s Outstanding Shares and Votes by Top Shareholders

LVMH Moët Hennessy Louis Vuitton SE had a total of 501 million outstanding shares as of December 2022. The following table shows how many shares each LVMH’s large shareholder holds.

|

|

|||||

| In millions of shares as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Bernard Arnault & family | 17.0 | 225.5 | 242.5 | 48.4% | |

| Antonio Belloni | 0.4 | - | 0.4 | 0.1% | |

| Other | 252.4 | 5.8 | 258.2 | 51.5% | |

| Total (# millions) | 269.8 | 231.3 | 501.1 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Annual Report Source: Annual Report |

|||||

There were 732 million votes distributed among shareholders of LVMH Moët Hennessy Louis Vuitton SE. The table below shows the total number of votes for each large shareholder.

|

|

|||||

| In millions of votes as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Bernard Arnault & family | 17.0 | 451.0 | 468.0 | 63.9% | |

| Antonio Belloni | 0.4 | - | 0.4 | 0.1% | |

| Other | 252.4 | 11.6 | 264.0 | 36.1% | |

| Total (# millions) | 269.8 | 462.6 | 732.4 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Annual Report Source: Annual Report |

|||||

💵 Breakdown of LVMH’s Market Value by Shareholder

The following table summarizes how much is each shareholder’s stake in LVMH Moët Hennessy Louis Vuitton SE worth.

However, keep in mind that a stake in LVMH could be just one part of their portfolio, and their total worth could be bigger, thanks to other investments. It could also be lower if they have debts.

|

|

|||||

| Market value in billions $ as of December 2022 | |||||

| Shareholder | Class A | Class B | Total | % Share | |

|---|---|---|---|---|---|

| Bernard Arnault & family | $12.3 | $163.5 | $175.8 | 48.4% | |

| Antonio Belloni | $0.3 | - | $0.3 | 0.1% | |

| Other | $183.0 | $4.2 | $187.2 | 51.5% | |

| Total ($ billions) | $195.5 | $167.7 | $363.2 | 100.0% | |

| Listed are shareholders holding >5% of any share class or notable in other ways | |||||

Source: Annual Report Source: Annual Report |

|||||

Let’s now look at each LVMH shareholder individually.

📒 Who Are LVMH’s Largest Shareholders?

Let’s now go through the list of the largest shareholders of LVMH Moët Hennessy Louis Vuitton SE one by one and look at who they are, how many shares they own, what is their voting power, and how much is their stake in LVMH worth.

#1 Bernard Arnault & family (48.4%)

Bernard Arnault & family is the largest shareholder of LVMH, owning 48.4% of its shares. However, Bernard Arnault & family controls 63.9% of all votes thanks to owning double-voting shares. As of December 2022, the market value of Bernard Arnault & family’s stake in LVMH was $175.8 billion.

Bernard Arnault & family owned 242 million shares in LVMH and controlled 468 million shareholder votes as of December 2022.

Bernard Arnault is the CEO and Chairman of LVMH Moët Hennessy Louis Vuitton, the world’s largest luxury goods company.

His vast wealth places him among the wealthiest person on earth. It is worth noting that although he controls the empire he built, his five children also hold stakes within it, and are expected to inherit it.

Beyond LVMH, Mr. Arnault is also President of the Board of Directors at Groupe Arnault S.E., his family’s holding company.

He also invested in various other companies outside LVMH, such as a diverse range of web companies, including Netflix, back in 1999.

#2 Antonio Belloni (0.1%)

Antonio Belloni is the second-largest shareholder of LVMH, owning 0.08% of its shares. However, because other shareholders hold super-voting shares, Antonio Belloni’s voting power is only 0.05%. As of December 2022, the market value of Antonio Belloni’s stake in LVMH was $0.3 billion.

Antonio Belloni owned 0.4 million shares in LVMH and controlled 0.4 million shareholder votes as of December 2022.

Antonio Belloni is a seasoned executive and serves as Group Managing Director of LVMH.

He has spent a large part of his career also at Procter & Gamble across various continents, and in 1999, he ascended to the position of President of Procter & Gamble Europe. He joined LVMH in 2001.

🧱 Who and When Founded LVMH?

LVMH was founded in 1987 through the merger of two renowned brands, Louis Vuitton and Moët Hennessy. It is now recognized as the global leader in luxury products. The histories of these companies, however, trace back to much earlier times.

Louis Vuitton, founded by the visionary Frenchman Louis Vuitton in 1854, revolutionized the world of luggage design. His creation of flat, stackable cases that were easily transportable by train or ship earned the brand’s popularity. The distinctive LV monogram became synonymous with luxury and sophistication.

Moët Hennessy, on the other hand, was established in 1743 by Claude Moët, a prominent French wine merchant. Over the years, the company acquired various wine and spirits brands, including the renowned Hennessy cognac, which was founded in 1765.

Both Louis Vuitton and Moët Hennessy thrived in their respective industries, garnering widespread acclaim.

The two companies decided to merge in 1987, forging a partnership that would shape the luxury market.

During this time, Bernard Arnault also played a role. Arnault had already made his mark by purchasing Boussac Saint-Frères in 1984, a bankrupt textile company that owned the esteemed fashion house of Christian Dior. Arnault propelled the ailing Dior brand to new heights with a calculated restructuring plan.

Arnault’s involvement continued as he aided Alain Chevalier, CEO of Moët Hennessy, and Henry Racamier, president of Louis Vuitton, in their merger efforts. Although initially a minor shareholder in LVMH, Arnault’s influence in LVMH changed rapidly. In 1988, during an internal disagreement between Chevalie and Racamier, he formed a joint venture with Guinness that eventually acquired a 24 percent stake in LVMH.

Arnault’s ambitions did not stop there. In 1989, he successfully executed a takeover bid, elevating his share to 43.5 percent and assuming the roles of CEO and chairman of LVMH. Under his leadership, LVMH flourished, expanding its portfolio through a series of strategic acquisitions throughout the 1990s.

📅 LVMH’s History Timeline

These are selected events from LVMH’s history:

1970s

- 1971: Arnault graduated from École Polytechnique and began working for his father’s company, Ferret-Savinel.

- 1978-1984: Arnault was president of Ferret-Savinel.

1980s

- 1984: Bernard Arnault purchased Boussac Saint-Frères, a bankrupt textile company that owned the fashion house of Christian Dior, for $65 million with funds from his family ($15 mil) and financing from Lazard Freres. He later renamed the company Financière Agache.

- 1986: Within two years of acquiring Boussac, Arnault laid off 9,000 workers and sold off the disposable-diaper division and most of its textile operations for $500 million to push the company into developing the ailing Dior brand.

- 1987: Moët Hennessy and Louis Vuitton merge and create LVMH, the world leader in luxury products. Bernard Arnault reportedly was involved in helping Alain Chevalier, CEO of Moët Hennessy, and Henry Racamier, president of Louis Vuitton, with the merger and had a minor stake in the company. He was supposedly brought on board by Chevalier as his ally against Racamier.

- 1988: Bernard changed sides and joined sides with Racamier, who probably helped him to negotiate deal with Guinness. Arnault’s Financière Agache formed a joint venture with Guinness, with Arache controlling 60% of it. The venture acquired a 24% stake in LVMH.

- 1989: Arnault made a successful takeover bid to increase its share to 43.5% of LVMH’s shares. Since then, he has become the head of the company.

1990s

- 1990: LVMH offered its shares publicly in its IPO.

- 1993: LVMH acquired Berluti, a menswear and men’s shoes and leather goods brand, which was founded in 1895 by Alessandro Berluti.

- 1993: LVMH acquired Kenzo, a womenswear and menswear brand founded in 1970, for $80 million.

- 1994: LVMH acquired Guerlain, the French perfume, cosmetics, and skincare brand, which was owned and managed by members of the Guerlain family until then. Guerlain created 1889, the first fragrance in the world to use synthetic raw ingredients in its composition.

- 1996: LVMH acquired Celine for 2.7 billion French francs to add another Paris-based brand known for its ready-to-wear items, leather goods, shoes, and accessories.

- 1996: LVMH acquired Loewe, a Spanish company established in 1846 that originally specialized in high-quality leather work but now offers leather goods and ready-to-wear.

- 1997: LVMH acquired Marc Jacobs and Sephora.

- 1998: Arnault purchased Château Cheval Blanc in a personal capacity with businessman Albert Frère for a reported €155m.

- 1999: LVMH establishes its Watches & Jewelry division, and Sephora launches sephora.com, one of the very first online shopping sites.

- 1999: LVMH opens its headquarters in New York, in a building designed by the architect Christian de Portzamparc, winner of the Pritzker prize.

- 1999: LVMH acquires Make Up For Ever, which was established in 1984.

2000s

- 2008: LVMH buys 50% stake in Château Cheval Blanc from their boss Bernard Arnault

2010s

- 2011 LVMH acquired family-owned shares of Bulgari and made a tender offer for the rest, which was publicly owned.

- 2013: Arnault abandoned his application for Belgian citizenship due to concerns about tax evasion and its potential misinterpretation.

- 2014: Arnault entered into a joint venture with the Italian fashion brand Marco De Vincenzo, taking a minority 45% stake in the firm.

- 2016: Founded in Cologne in 1898, trunk and leather goods maker RIMOWA is the first German Maison to join the LVMH Group.

- 2016: LVMH sold DKNY to G-III Apparel Group.

- 2017: LVMH acquired Christian Dior Haute Couture, which integrated the entire Christian Dior brand within LVMH.

- 2019: LVMH announced plan to acquire Tiffany & Co. for approximately US $16.2 billion.

2020s

- 2020: After Tiffany & Co shareholders approved the acquisition by LVMH, LVMH tried to get out of the deal. Tiffany filed suit against LVMH.

- 2020-10: Tiffany and LVMH agreed to the original takeover plan, though at a slightly reduced price of nearly $16 billion.

- 2021: LVMH completes the purchase of Tiffany.

- 2022: LVMH acquires a minority stake in New York-based label Aimé Leon Dore for an undisclosed sum.

- 2022: LVMH announces the closure of its 120+ stores in Russia due to the Russo-Ukrainian War.

- 2022: LVMH acquires the Piedmont-based jewelry maker Pedemonte Group.

- 2022 Forbes estimated Bernard Arnault’s fortune and family to be $158 billion in 2022, positioning him ahead of Bill Gates and making him the richest person in the world.

- 2023-04-24: LVMH becomes the first European company to reach a $500 billion valuation.

📚 Recommended Articles & Other Resources

Who Owns Meta: The Largest Shareholders Overview

Overview of who owns Meta Platforms and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Apple: The Largest Shareholders Overview

Visual overview of who owns Apple and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Mastercard: The Largest Shareholders Overview

Overview of who owns Mastercard and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns NVIDIA: The Largest Shareholders Overview

Overview of who owns NVIDIA and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Johnson & Johnson: The Largest Shareholders Overview

Overview of who owns Johnson & Johnson and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Who Owns Procter & Gamble: The Largest Shareholders Overview

Overview of who owns Procter & Gamble and who controls it. With a list of the largest shareholders and how much is each of their stake worth.

Other Resources

Disclaimer: Although I use third-party trademarks and logos in this article and its visuals, kamilfranek.com is an independent site, and there is no relationship, sponsorship, or endorsement between this site and the owners of those trademarks.